Strategies for debt consolidation and payoff can be a lifesaver when it comes to getting your finances back on track. Are you grappling with multiple loans and credit card debts that seem never-ending? Don’t worry, I’ve got you covered! In this article, we will explore effective techniques to consolidate your debts and efficiently pay them off. By implementing these strategies, you can regain control of your financial situation and work towards a debt-free future. So, let’s dive in and uncover the secrets to conquering your debts once and for all!

Strategies for Debt Consolidation and Payoff

Dealing with multiple debts can be overwhelming and stressful. It’s not uncommon for individuals to find themselves juggling multiple loan payments, credit card bills, and other outstanding debts. However, there are effective strategies available to help consolidate and pay off debt. By implementing these strategies, you can regain control over your finances and work towards becoming debt-free. In this article, we will explore various strategies for debt consolidation and payoff, providing you with practical steps to tackle your debt head-on.

1. Create a Comprehensive Debt Repayment Plan

Before diving into any specific debt consolidation strategies, it’s essential to start by creating a comprehensive repayment plan. This plan should include all of your outstanding debts, their interest rates, minimum monthly payments, and due dates. By having a clear overview of your debts, you can prioritize them strategically and determine the best approach to tackle them.

Here are some steps to create an effective debt repayment plan:

- List all your debts, including credit cards, personal loans, student loans, and others.

- Make a note of the interest rates and minimum monthly payments for each debt.

- Identify any high-interest debts that require immediate attention.

- Consider your monthly budget and determine the amount you can allocate towards debt repayment.

- Decide on a debt payoff strategy that aligns with your financial goals and circumstances.

By having a well-structured plan in place, you’ll have a clear roadmap to follow and stay on track towards paying off your debts.

2. Debt Consolidation Loans

A popular strategy for simplifying debt repayment is to consolidate multiple debts into a single loan. Debt consolidation loans allow you to combine all your debts into one, making it easier to manage and potentially lowering your overall interest rate.

Here’s how a debt consolidation loan works:

- You apply for a loan that covers the total amount of your outstanding debts.

- If approved, you use the loan funds to pay off your existing debts.

- With just one loan to focus on, you no longer have to manage multiple payments.

- Make sure to research different lenders and compare interest rates and terms before choosing a consolidation loan.

It’s important to note that debt consolidation loans may not be suitable for everyone. Consider your financial situation, credit score, and overall debt amount before opting for this strategy. Additionally, it’s crucial to avoid accumulating new debt while repaying the consolidation loan to prevent falling back into a debt cycle.

3. Balance Transfer Credit Cards

Another option for consolidating and paying off debt is utilizing balance transfer credit cards. These credit cards allow you to transfer multiple high-interest credit card balances onto a single card with a low or 0% introductory interest rate. This can help you save money on interest payments and simplify your monthly payments.

Consider the following when using balance transfer credit cards:

- Look for balance transfer credit cards with a low or 0% introductory APR period.

- Calculate the balance transfer fees, if any, to ensure the cost doesn’t outweigh the benefits.

- Make a plan to pay off the balance before the introductory period ends and the regular interest rate applies.

- Avoid using the balance transfer card for additional purchases, as it can lead to more debt.

Balance transfer credit cards can be an effective strategy if used wisely and if you have a plan to pay off the transferred balance within the introductory period.

4. Debt Snowball Method

The debt snowball method is a debt repayment strategy that focuses on paying off debts one by one, starting with the smallest balance. This method provides a psychological boost as you see your debts being eliminated gradually, helping to build momentum and motivation.

Here’s how the debt snowball method works:

- List your debts from smallest balance to largest balance.

- Allocate the minimum payment for each debt from your budget.

- Determine the maximum amount you can afford to pay towards debt repayment.

- Put the maximum amount towards the debt with the smallest balance while paying the minimum for other debts.

- Once the smallest debt is paid off, move to the next smallest debt and repeat the process.

The debt snowball method is more focused on behavior change and motivation rather than the interest rates associated with each debt. While it may not be the most cost-effective strategy, it can be beneficial for individuals who need the psychological boost of seeing progress.

5. Debt Avalanche Method

Contrary to the debt snowball method, the debt avalanche method focuses on paying off debts based on their interest rates, starting with the highest interest rate first. This approach can save you more money in interest payments over the long run.

Here’s how the debt avalanche method works:

- List your debts from highest interest rate to lowest interest rate.

- Allocate the minimum payment for each debt from your budget.

- Determine the maximum amount you can afford to pay towards debt repayment.

- Put the maximum amount towards the debt with the highest interest rate while paying the minimum for other debts.

- Once the highest interest rate debt is paid off, move to the next highest interest rate debt and repeat the process.

The debt avalanche method allows you to save money on interest payments in the long run. However, it may take longer to see progress compared to the debt snowball method, as the debts with higher interest rates tend to have larger balances.

6. Debt Management Plans

If you feel overwhelmed managing your debt on your own or are struggling to negotiate lower interest rates, a debt management plan (DMP) can be a beneficial solution. DMPs are offered by nonprofit credit counseling agencies and can help you consolidate your debts into one monthly payment, often with reduced interest rates.

Consider the following when opting for a Debt Management Plan:

- Research and choose a reputable nonprofit credit counseling agency.

- Work with a credit counselor who will review your financial situation and negotiate with creditors on your behalf.

- Based on your budget, the credit counselor will determine an affordable monthly payment.

- You make a single monthly payment to the credit counseling agency, who distributes the funds to your creditors.

- Stick to the plan and make regular payments until your debts are paid off.

It’s important to choose a reputable credit counseling agency and understand any fees associated with the program. A DMP can be an effective way to simplify debt repayment and potentially lower interest rates.

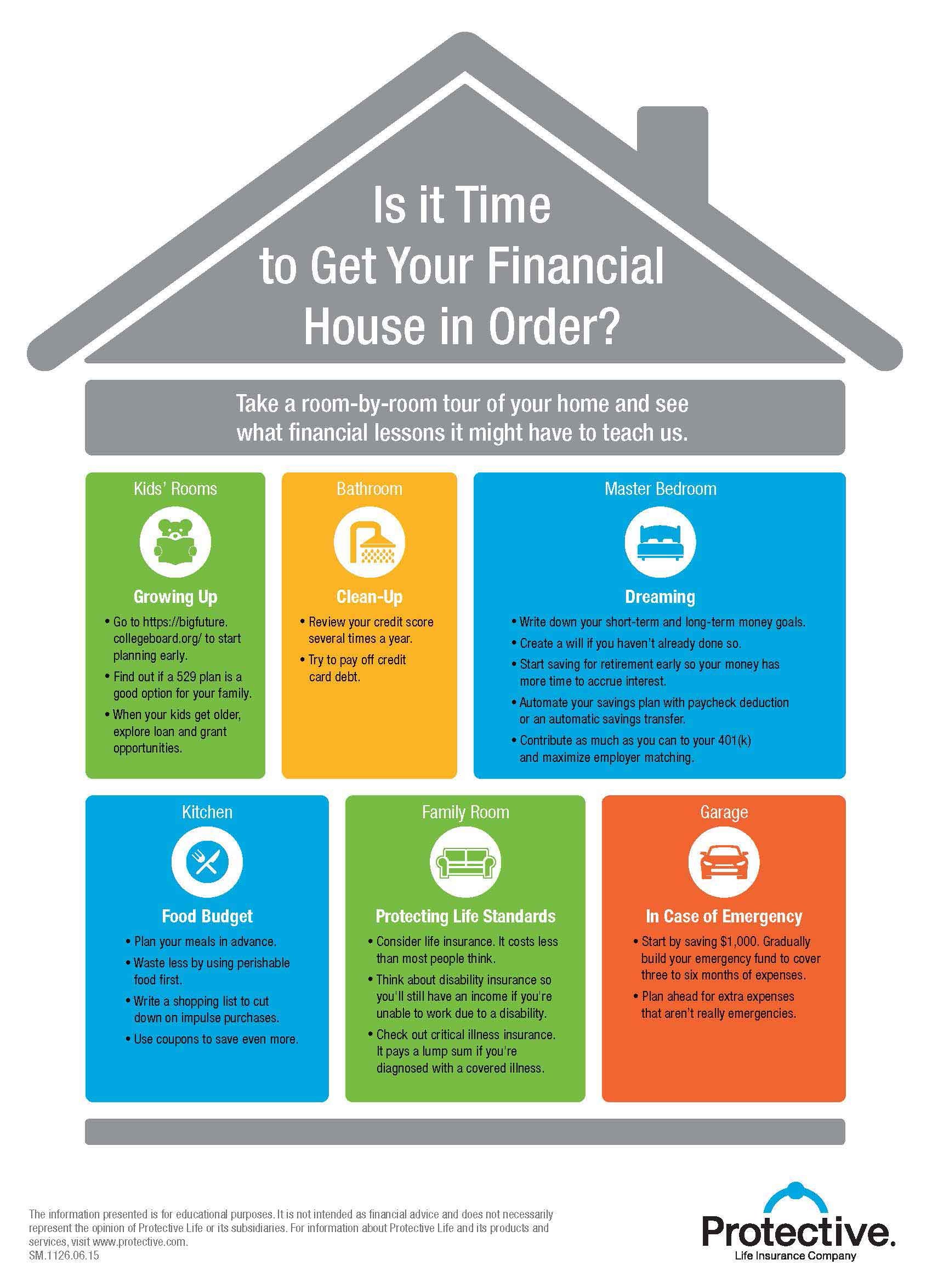

7. Increase Income and Reduce Expenses

To accelerate your debt payoff journey, consider increasing your income and reducing expenses. By doing so, you’ll have more funds available to allocate towards debt repayment, allowing you to pay off your debts more quickly.

Consider the following strategies:

- Look for opportunities to increase your income, such as taking on a part-time job or freelancing.

- Create a budget and identify areas where you can cut back on unnecessary expenses.

- Reduce discretionary spending, such as dining out, entertainment, or shopping.

- Consider downsizing your living arrangements or finding ways to lower your housing costs.

- Automate savings and debt payments to ensure consistent progress.

By combining increased income and reduced expenses, you’ll have more financial resources to allocate towards debt repayment and achieve your goal of becoming debt-free sooner.

8. Seek Professional Help

If you’re struggling to manage your debt or feel overwhelmed, don’t hesitate to seek professional help. Financial advisors, credit counselors, and debt consolidation companies can provide valuable guidance tailored to your specific situation.

When seeking professional help:

- Research and choose reputable professionals or organizations.

- Ensure they have a good track record and positive reviews from previous clients.

- Understand any fees or costs involved before committing to any service.

- Ask questions and clarify any doubts regarding the process and potential outcomes.

Remember, professional help can be a valuable resource in developing a personalized debt consolidation and payoff strategy that aligns with your financial goals and circumstances.

Summary

Debt consolidation and payoff strategies provide individuals with practical ways to manage and eliminate debt. By creating a comprehensive debt repayment plan and considering strategies such as debt consolidation loans, balance transfer credit cards, the debt snowball or debt avalanche methods, debt management plans, increasing income, reducing expenses, and seeking professional help, you can regain control over your finances and work towards a debt-free future. Choose the strategies that best suit your needs and take consistent action towards achieving your financial goals.

The FASTEST Way To Pay Off Debt

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is debt consolidation and payoff?

Debt consolidation and payoff refers to a financial strategy where multiple debts are combined into a single loan or repayment plan. This allows individuals to simplify their debt management and potentially save money on interest.

Is debt consolidation a good strategy for managing debts?

Debt consolidation can be a beneficial strategy for managing debts, especially if it helps lower the overall interest rate or provides a more manageable repayment plan. However, it is important to carefully consider the terms and conditions of any consolidation program before opting for it.

What are the common strategies for debt consolidation?

Common strategies for debt consolidation include balance transfer credit cards, personal loans, home equity loans, and debt consolidation loans. Each strategy has its own advantages and considerations, so it’s important to choose the one that best suits your specific financial situation.

How does debt consolidation affect my credit score?

Debt consolidation itself does not directly impact your credit score. However, applying for new credit or closing old accounts during the consolidation process may have a temporary effect on your score. It is crucial to manage the new consolidation loan responsibly to maintain or improve your credit score in the long run.

Can debt consolidation help me pay off my debts faster?

Debt consolidation can potentially help you pay off your debts faster by combining them into one manageable payment. This enables you to focus on a single loan with a specific payoff timeline. However, it is important to maintain discipline and avoid accumulating new debts after consolidation.

Will debt consolidation reduce my monthly payments?

Debt consolidation can reduce your monthly payments in some cases. By combining multiple debts into one, you may secure a lower interest rate or extend the repayment term, resulting in lower monthly payments. However, it is crucial to consider the overall cost and potential savings before opting for consolidation.

What are the risks associated with debt consolidation?

Some of the risks associated with debt consolidation include obtaining a higher interest rate on the consolidated loan, incurring additional fees and charges, and potentially extending the overall repayment period. It is important to carefully compare the terms and conditions of different consolidation options to minimize these risks.

Can I consolidate all types of debts?

Debt consolidation can be used to consolidate various types of debts, including credit card debt, personal loans, medical bills, and more. However, not all debts are eligible for consolidation, such as student loans. It is advisable to consult with a financial advisor or debt consolidation expert for guidance specific to your situation.

Final Thoughts

Debt consolidation and payoff can be challenging, but with the right strategies, you can regain control of your finances. Start by assessing your debts and creating a budget to prioritize payments. Consider consolidating your debts into a single loan with a lower interest rate or exploring balance transfer options. Another effective strategy is to negotiate with creditors for lower interest rates or extended payment terms. Additionally, you can increase your income through side hustles or cutting back on expenses to free up more money for debt repayment. By implementing these strategies for debt consolidation and payoff, you can take significant steps towards achieving financial freedom.