Wondering about the tax implications of retirement withdrawals? Look no further! Understanding the tax implications of retirement withdrawals is an essential part of financial planning for your golden years. It’s important to navigate this financial aspect with confidence to make informed decisions about your retirement savings. In this article, we will delve into the intricacies of retirement withdrawals and shed light on the tax implications you need to consider. Let’s dive in and unravel the complexities of taxes in relation to your retirement nest egg.

Understanding the Tax Implications of Retirement Withdrawals

Retirement is a time to enjoy the fruits of your labor and relax after years of hard work. But before you embark on your retirement journey, it is crucial to have a clear understanding of the tax implications of your retirement withdrawals. Making informed decisions about your finances will ensure that you can maximize your retirement income and avoid any unexpected tax burdens. In this article, we will delve into the various aspects of understanding the tax implications of retirement withdrawals, including taxable income, tax brackets, early withdrawal penalties, and strategies to minimize taxes. So let’s dive in and explore the world of retirement withdrawals and taxes!

1. Taxable Income and Retirement Withdrawals

When you withdraw funds from your retirement accounts, such as 401(k)s, traditional IRAs, or pension plans, the amount you take out is generally considered taxable income. It is important to remember that these contributions were made on a pre-tax basis, meaning they were not subject to income tax when you earned them. However, when you withdraw this money during retirement, it becomes taxable.

1.1 Traditional IRAs and 401(k)s

Traditional IRAs and 401(k)s are subject to ordinary income tax rates. The amount of income tax you owe on your withdrawals depends on your tax bracket at the time of withdrawal. The funds you withdraw from these accounts will be added to your taxable income for the year, potentially pushing you into a higher tax bracket.

1.2 Roth IRAs and Roth 401(k)s

Unlike traditional IRAs and 401(k)s, Roth accounts are funded with after-tax contributions. This means that withdrawals from Roth accounts are generally tax-free, as long as you meet the required holding periods and age criteria. With Roth accounts, you pay taxes upfront, allowing you to enjoy tax-free growth and withdrawals in retirement.

2. Understanding Tax Brackets

Tax brackets play a crucial role in determining how much income tax you owe on your retirement withdrawals. The United States tax system is progressive, meaning that higher income is subject to higher tax rates. It is essential to understand the different tax brackets and how they impact your retirement income.

2.1 Marginal Tax Rates

The U.S. tax system follows a marginal tax rate structure, where different portions of your income are taxed at different rates. The tax rates increase as your income rises through the tax brackets. It is important to note that being in a higher tax bracket only affects the income within that bracket, not your entire income.

2.2 Capital Gains Tax Rates

If you have invested in stocks, bonds, or real estate throughout your working years, you may have capital gains to consider when making retirement withdrawals. Capital gains are the profits generated from the sale of investments or property. The tax rate on capital gains depends on your income and the holding period of the investment.

3. Early Withdrawal Penalties

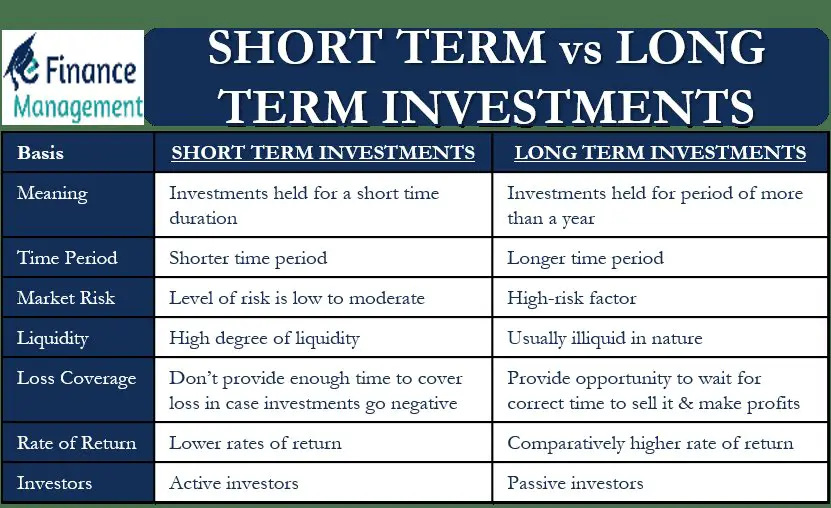

Retirement accounts are designed to encourage long-term savings and discourage early withdrawals. If you withdraw funds from your retirement accounts before reaching age 59 ½ (55 in some cases), you may be subject to early withdrawal penalties in addition to income tax.

3.1 401(k) Early Withdrawal Penalties

If you withdraw funds from your 401(k) before reaching age 59 ½, you may face a 10% early withdrawal penalty. This penalty is in addition to the income tax you owe on the withdrawal. However, there are some exceptions to this rule, such as financial hardship, disability, or certain qualified education expenses.

3.2 IRA Early Withdrawal Penalties

Similar to 401(k)s, traditional IRA withdrawals made before age 59 ½ may be subject to a 10% early withdrawal penalty. However, there are also exceptions to this rule, including first-time homebuyers, certain medical expenses, or higher education expenses.

4. Strategies to Minimize Taxes on Retirement Withdrawals

While taxes are inevitable, there are strategies you can employ to minimize the impact of taxes on your retirement withdrawals. By utilizing these strategies, you can potentially keep more money in your pocket and make the most of your hard-earned savings.

4.1 Roth Conversions

Converting traditional retirement accounts, such as traditional IRAs or 401(k)s, into Roth accounts can be a wise move for some individuals. By doing so, you pay taxes on the converted funds upfront but enjoy tax-free withdrawals in retirement. This strategy can be particularly beneficial if you anticipate being in a higher tax bracket during retirement.

4.2 Timing of Withdrawals

Strategic timing of your retirement withdrawals can also help minimize taxes. For example, if you anticipate lower income in a particular year, you may consider withdrawing a larger amount from your retirement accounts to take advantage of the lower tax bracket. Conversely, if you expect higher income in a given year, you can choose to delay withdrawals to avoid entering a higher tax bracket.

4.3 Utilizing Tax-Efficient Investments

Investing in tax-efficient vehicles, such as index funds or ETFs, can help minimize taxes on your investments. These investment options typically generate fewer taxable events, such as capital gains distributions, compared to actively managed funds. By reducing taxable events, you can keep more of your investment returns and potentially lower your tax liability in retirement.

As you navigate the world of retirement withdrawals, understanding the tax implications is essential for making informed financial decisions. By comprehending the tax rules surrounding retirement accounts, tax brackets, and early withdrawal penalties, you can effectively plan your retirement income strategy and minimize taxes. Whether it’s taking advantage of tax-free Roth withdrawals or employing smart timing and investment strategies, being proactive and knowledgeable about taxes can help you make the most of your retirement savings. Now that you have a solid understanding of the tax implications of retirement withdrawals, you can embark on your retirement journey with confidence and financial peace of mind.

A Tax-Smart Strategy for Managing Retirement Withdrawals

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What are the tax implications of retirement withdrawals?

Retirement withdrawals can have tax implications, depending on the type of retirement account and the timing of the withdrawals. Generally, withdrawals from traditional retirement accounts, such as a 401(k) or traditional IRA, are considered taxable income and are subject to ordinary income tax rates. However, withdrawals from a Roth IRA may be tax-free if certain conditions are met.

2. How is the tax calculated on retirement withdrawals?

The tax on retirement withdrawals is calculated based on the individual’s tax bracket. Withdrawals count as taxable income and are added to other sources of income for the year. The tax rate applied to the withdrawals depends on the individual’s total taxable income and their corresponding tax bracket.

3. Are there any penalties for early retirement withdrawals?

Yes, there may be penalties for early retirement withdrawals. If you withdraw funds from a traditional retirement account before the age of 59 ½, you may be subject to an early withdrawal penalty of 10% in addition to the regular income tax. However, certain exceptions, such as disability or using the funds for qualified education expenses, may waive the penalty.

4. Can I minimize taxes on retirement withdrawals?

Yes, there are strategies to minimize taxes on retirement withdrawals. One approach is to consider a Roth conversion, where funds from a traditional retirement account are converted to a Roth IRA. This conversion can be done gradually over several years to spread out the tax liability. Another strategy is to carefully plan the timing and amount of withdrawals to stay within lower tax brackets.

5. Are Social Security benefits taxed when combined with retirement withdrawals?

Social Security benefits can be taxed when combined with retirement withdrawals. The taxability of Social Security benefits depends on the individual’s “provisional income,” which includes the sum of adjusted gross income, tax-exempt interest, and half of the Social Security benefits. If the provisional income exceeds certain thresholds, a portion of the Social Security benefits may be subject to taxation.

6. How can I estimate the tax impact of my retirement withdrawals?

To estimate the tax impact of retirement withdrawals, you can use tax calculators or consult a tax professional. These tools consider factors such as your income, filing status, deductions, and retirement account type to provide an estimate of the taxes owed on the withdrawals. It’s important to plan ahead and understand the potential tax implications.

7. Can I avoid taxes on retirement withdrawals by reinvesting the funds?

Generally, reinvesting the funds from retirement withdrawals does not have a direct impact on the taxes owed. The tax liability is determined by the withdrawal amount and the individual’s overall taxable income. However, reinvesting the funds wisely, such as in tax-efficient investments, may help optimize your overall tax situation in the long run.

8. Are there any tax benefits for charitable contributions from retirement withdrawals?

Yes, there may be tax benefits for charitable contributions made directly from retirement withdrawals. Individuals who are 70 ½ years old or older can make qualified charitable distributions (QCDs) from their traditional IRA. These QCDs can satisfy the required minimum distribution (RMD) while being excluded from taxable income. This can provide tax advantages for individuals who want to support charitable causes.

Final Thoughts

Understanding the tax implications of retirement withdrawals is an essential aspect of retirement planning. It is crucial to be aware of how different types of withdrawals can affect your tax liability. By understanding the tax rules governing retirement withdrawals, individuals can make informed decisions and optimize their retirement income. Proper tax planning can help retirees minimize tax obligations and maximize the benefits of their savings. Therefore, staying informed about the tax implications and seeking professional advice when necessary can ensure a smooth and financially secure retirement journey.