Looking for a convenient way to save money on healthcare expenses while enjoying tax advantages? Look no further! A Health Savings Account (HSA) could be the answer you’ve been searching for. So, what are the benefits of a health savings account? Let’s dive right in. With an HSA, you have the power to save pre-tax dollars, which can be used to cover a wide range of medical costs. Plus, the funds in your HSA roll over year after year, allowing you to build a robust safety net for future healthcare expenses. Discover how an HSA can elevate your savings game and streamline your healthcare finances.

What are the Benefits of a Health Savings Account?

A Health Savings Account (HSA) is a powerful tool that can help individuals and families take control of their healthcare expenses. With rising healthcare costs, an HSA offers a range of benefits that make it an attractive option for many people. From tax advantages to flexibility in spending, let’s explore the numerous advantages of having a health savings account.

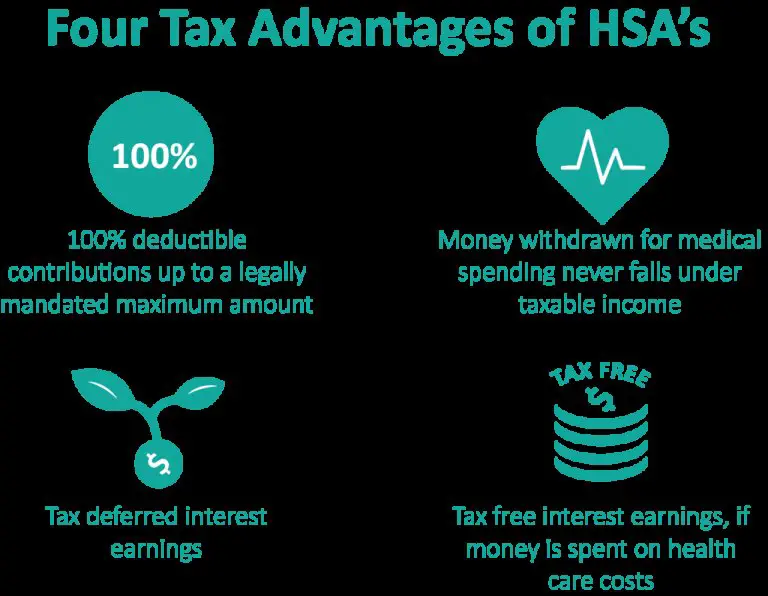

1. Triple Tax Advantage

One of the most significant benefits of an HSA is its triple tax advantage. This means that contributions made to the account, any interest or investment growth, and qualified withdrawals are all tax-free. Let’s break down each aspect:

Contributions:

When you contribute to your HSA, the money is deducted from your taxable income. This reduces your tax liability, helping you save money upfront.

Interest and Investment Growth:

Unlike a traditional savings account, the funds in your HSA can be invested in various financial instruments such as mutual funds or stocks. Any interest or investment gains made within the account are tax-free as well. This enables your contributions to grow over time and potentially accumulate significant funds for future healthcare expenses.

Qualified Withdrawals:

When you use your HSA funds for qualified medical expenses, such as doctor visits, prescription medications, or medical procedures, the withdrawals are also tax-free. This provides a substantial advantage compared to using post-tax dollars to pay for healthcare costs.

2. Pre-Tax Contributions

Contributions made to an HSA are made on a pre-tax basis. This means that the money you contribute is deducted from your taxable income, reducing your overall tax liability. By contributing pre-tax dollars, you effectively lower your taxable income, providing immediate tax savings.

For example, if you earn $50,000 a year and contribute $3,000 to your HSA, your taxable income is reduced to $47,000. This results in a lower tax bill and more money in your pocket.

3. Flexibility in Spending

One of the major advantages of an HSA is the flexibility it offers in spending the funds. Unlike a Flexible Spending Account (FSA), where funds may be forfeited if not used by the end of the year, an HSA allows you to carry over the funds from year to year. This means you don’t have to rush to spend the money and can save it for future healthcare needs.

Moreover, HSAs can be used to cover a wide range of qualified medical expenses. These include doctor visits, hospital stays, prescription medications, dental and vision care, mental health services, and even some alternative treatments like acupuncture or chiropractic care. This flexibility allows you to make decisions about your healthcare based on your individual needs and preferences.

4. Portability

Another advantage of an HSA is its portability. Unlike employer-sponsored health insurance plans, which may be tied to a specific job, an HSA belongs to you. It is not dependent on your employment status and can be carried with you from one job to another. This provides peace of mind and continuity in managing your healthcare expenses, even if you change jobs or become self-employed.

5. Long-Term Savings and Retirement

In addition to covering current medical expenses, an HSA can also serve as a valuable long-term savings and retirement tool. Since the funds in your HSA roll over from year to year and can be invested, you have the opportunity to accumulate a significant healthcare nest egg over time.

Once you turn 65, you can use your HSA funds for non-medical expenses without incurring a penalty. While these withdrawals will be subject to income tax, it essentially functions as a tax-deferred investment account. This makes an HSA a unique asset that can supplement your retirement savings and provide a buffer for healthcare costs during your golden years.

6. Control and Ownership

Having an HSA gives you greater control and ownership over your healthcare decisions. You have the freedom to choose how and where to spend your HSA funds, empowering you to make choices aligned with your healthcare needs and priorities. This control over your healthcare expenses can lead to more informed decisions, reduced costs, and a better overall healthcare experience.

7. Family Benefits

A health savings account is not limited to just individuals. Families can also reap the benefits of an HSA. With family coverage, contributions can be made on behalf of your spouse and dependents, allowing you to accumulate tax-free funds to cover their medical expenses.

Additionally, if you have adult children who are no longer dependents, you can still use your HSA funds to pay for their qualified medical expenses. This makes an HSA a versatile tool that can support your family’s healthcare needs beyond just your immediate household.

In conclusion, a health savings account offers numerous benefits that can help you take charge of your healthcare expenses. From the triple tax advantage to the flexibility in spending, an HSA provides significant financial advantages. Its portability, long-term savings potential, and control over healthcare decisions make it a valuable tool for individuals and families alike. Consider opening an HSA today to start enjoying the benefits it offers.

The Real TRUTH About An HSA – Health Savings Account Insane Benefits

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are the advantages of having a health savings account (HSA)?

A health savings account (HSA) offers various benefits:

- 1. Tax advantages: Contributions made to an HSA are tax-deductible, and withdrawals used for qualified medical expenses are tax-free.

- 2. Lower healthcare costs: HSAs typically have lower monthly premiums and higher deductibles compared to traditional health insurance plans.

- 3. Flexibility: HSA funds can be used for a wide range of medical expenses, including co-pays, prescriptions, and certain over-the-counter items.

- 4. Long-term savings: Unused HSA funds roll over from year to year, allowing the account to grow over time and be used for future healthcare expenses.

- 5. Portability: HSAs are not tied to a specific employer, so you can keep your account and contributions even if you change jobs or retire.

- 6. Investment potential: Some HSA providers offer investment options, allowing you to potentially grow your savings over time.

- 7. Control: With an HSA, you have more control over your healthcare decisions and how you allocate your funds.

- 8. Eligibility: Individuals with high-deductible health insurance plans are generally eligible to open an HSA.

Final Thoughts

In conclusion, the benefits of a health savings account (HSA) are numerous. Firstly, HSAs offer tax advantages as contributions are tax-deductible and withdrawals for qualified medical expenses are tax-free. Secondly, individuals have control over their HSA funds, allowing them to save and invest for future healthcare needs. Additionally, HSAs provide flexibility in choosing healthcare providers and treatments. Moreover, any unused funds roll over each year, creating a long-term savings opportunity. Lastly, HSAs can be used as retirement savings vehicles, offering even more financial security. For those seeking a comprehensive healthcare and financial solution, a health savings account is the way to go.