Looking to simplify your financial situation and manage your student loans more effectively? You’ve come to the right place! In this blog article, we’ll guide you through the steps for consolidating your student loans so you can breathe a little easier. Consolidating your student loans can be a game-changer, helping you simplify payments, potentially lower interest rates, and gain more control over your finances. So, let’s dive in and explore the straightforward process of consolidating your student loans.

Steps for Consolidating Your Student Loans

If you’re struggling to manage multiple student loans with varying interest rates and repayment terms, consolidating them into a single loan can simplify your finances and potentially save you money in the long run. Consolidation allows you to combine all your loans into one, with one monthly payment and a fixed interest rate. In this article, we will guide you through the steps for consolidating your student loans.

Step 1: Understand the Benefits and Considerations

Before you embark on the consolidation process, it’s important to understand the benefits and considerations involved. Here are some key points to consider:

- Lower monthly payments: Consolidating your loans can potentially lower your monthly payments by extending the repayment period.

- Simplified repayment: Managing a single loan makes it easier to keep track of your payments and stay organized.

- Fixed interest rate: Consolidation often offers a fixed interest rate, which provides stability compared to variable rates.

- Loss of benefits: Consolidating federal loans into a private loan can result in the loss of certain federal loan benefits such as income-driven repayment plans and loan forgiveness options.

- Potential longer repayment period: While lower monthly payments may seem appealing, extending the repayment period can result in paying more interest over time.

Considering these factors will help you make an informed decision about whether loan consolidation is the right choice for you.

Step 2: Evaluate Your Current Loan Situation

Before you proceed with consolidation, it’s essential to assess your current loan situation. Here’s what you need to do:

- Gather all your loan details: Collect information about each of your student loans, including the lender, outstanding balance, interest rate, and repayment terms.

- Review your budget: Understand your current financial situation by analyzing your income, expenses, and existing loan payments.

- Calculate your total debt: Add up the outstanding balances of all your loans to determine the total amount you’ll need to consolidate.

- Estimate your future income: Consider your future earnings potential and job stability to assess your ability to make consolidated loan payments.

Evaluating your current loan situation will help you determine if consolidation is a viable option and give you a clear understanding of your financial standing.

Step 3: Research and Compare Loan Consolidation Options

Once you’ve assessed your current loan situation, it’s time to research and compare different loan consolidation options. This step involves:

- Identifying lenders: Research and identify reputable lenders that offer student loan consolidation services.

- Compare interest rates: Look for lenders offering competitive interest rates that can save you money in the long run.

- Check for additional fees: Consider any fees associated with loan consolidation, such as origination fees or prepayment penalties.

- Read customer reviews: Look for feedback and reviews from other borrowers to gauge the lender’s reputation and customer service.

- Consider loan terms and benefits: Evaluate the terms and benefits offered by different lenders, such as repayment options, deferment, or forbearance.

By thoroughly researching and comparing your options, you can select a loan consolidation provider that best suits your needs and financial goals.

Step 4: Gather the Required Documents

Before you apply for loan consolidation, you’ll need to gather the necessary documents. These typically include:

- Loan statements: Collect your most recent statements from each of your existing loans.

- Identification documents: Prepare a copy of your driver’s license, Social Security card, or other identification documents required by the lender.

- Proof of income: Provide proof of income, such as pay stubs or tax returns, to demonstrate your ability to repay the consolidated loan.

- Employment information: Gather details about your current employer, including contact information and length of employment.

Having these documents readily available will streamline the application process and prevent delays.

Step 5: Apply for Loan Consolidation

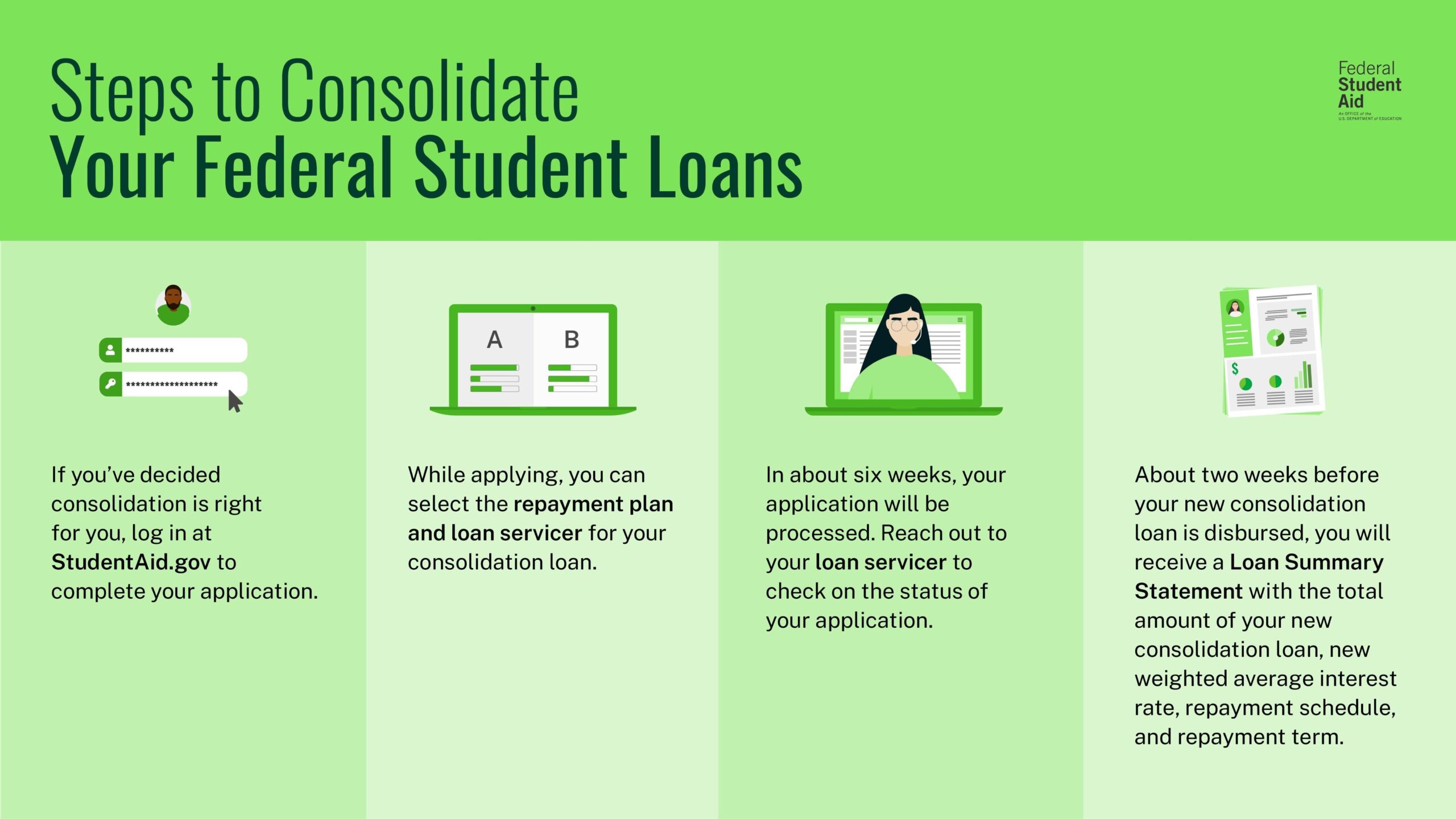

Once you’ve evaluated your options and gathered the necessary documents, it’s time to apply for loan consolidation. Here’s what you need to do:

- Contact your chosen lender: Get in touch with the lender you’ve selected and express your interest in consolidating your student loans.

- Submit your application: Complete the lender’s application form, providing accurate and truthful information.

- Review the terms and conditions: Carefully review the terms and conditions of the consolidation loan, including the interest rate, repayment period, and any associated fees.

- Sign the loan agreement: If you’re satisfied with the terms, sign the loan agreement and submit it to the lender.

- Follow up on the application: Stay in touch with the lender to ensure that your application is processed smoothly, providing any additional documentation if required.

Completing these steps will set the consolidation process in motion and bring you closer to achieving a more manageable loan repayment plan.

Step 6: Repay Your Consolidated Loan

Once your loan consolidation is approved and finalized, it’s important to stay on top of your repayment obligations. Follow these tips:

- Create a repayment plan: Assess your budget and create a repayment plan that aligns with your financial goals and capabilities.

- Set up automatic payments: Opt for automatic payments to ensure that you never miss a payment and incur late fees.

- Track your progress: Keep track of your payments and monitor your progress towards paying off your consolidated loan.

- Consider extra payments: If your financial situation allows, consider making extra payments to reduce your overall interest costs and repay the loan faster.

- Stay in contact with your lender: Maintain open communication with your lender and reach out if you encounter any financial difficulties.

By responsibly repaying your consolidated loan, you can successfully manage your debt and work towards financial stability.

Consolidating your student loans can be a smart financial move, simplifying your repayment process and potentially saving you money. By following these steps and carefully considering your options, you can consolidate your loans effectively and embark on a more secure financial future.

How & When To Consolidate Your Student Loans | Student Loan Planner

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are the steps for consolidating your student loans?

To consolidate your student loans, follow these steps:

Can I consolidate my federal and private student loans together?

Yes, it is possible to consolidate both federal and private student loans together.

What are the benefits of consolidating my student loans?

Consolidating your student loans can offer several benefits such as simplifying repayment by combining multiple loans into one, potentially lowering your monthly payment, and providing the option to choose a new repayment plan.

Will consolidating my student loans lower my interest rate?

Consolidating your student loans does not necessarily guarantee a lower interest rate. The new interest rate will be a weighted average of the rates on the loans being consolidated.

Can I consolidate my loans if I am in default?

Yes, it is possible to consolidate your defaulted loans through the federal loan consolidation program. However, specific conditions and requirements may apply.

Is there a fee to consolidate my student loans?

No, there are no application or origination fees associated with federal student loan consolidation. However, some private lenders may charge fees for loan consolidation.

Can I choose my repayment term when consolidating my student loans?

Yes, when consolidating your student loans, you typically have the flexibility to choose a new repayment term. This can help you align your monthly payments with your financial situation.

Will consolidating my loans affect my credit score?

Consolidating your student loans should not directly impact your credit score. However, it is important to make timely payments on your consolidated loan to maintain a good credit history.

Final Thoughts

Consolidating your student loans can be a beneficial step towards managing your debts more effectively. Firstly, gather all the necessary information and documents about your loans. Then, explore different consolidation options, comparing interest rates and repayment terms. Next, choose the best consolidation plan that aligns with your financial goals and needs. Submit your application and be prepared to provide any additional documentation required. Once your consolidation loan is approved, you will receive a new loan with a single monthly payment. By following these steps for consolidating your student loans, you can simplify your repayment process and potentially save money in the long run.