Are you wondering how to allocate assets in your retirement portfolio? Planning for retirement can be a complex task, but fear not! In this article, we will guide you through the process of strategically distributing your assets to ensure a comfortable and secure retirement. No need to search far and wide, as you’ve come to the right place for practical advice on this crucial matter. Let’s dive in and explore the best strategies for allocating assets in your retirement portfolio.

How to Allocate Assets in Your Retirement Portfolio

Introduction

As you plan for your retirement, one important aspect to consider is how to allocate your assets effectively in your retirement portfolio. Proper asset allocation can help you achieve a balance between risk and reward, ensuring that your investments align with your goals and financial situation. In this comprehensive guide, we will explore the key factors to consider and provide actionable tips to help you make informed decisions about asset allocation in your retirement portfolio.

Understanding Asset Allocation

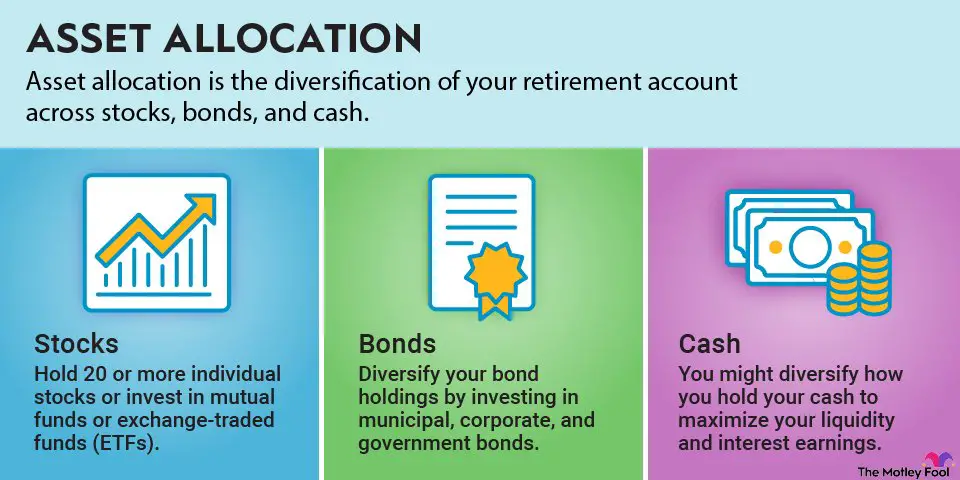

Asset allocation refers to the process of distributing your investment portfolio across different asset classes, such as stocks, bonds, cash, and real estate. The goal is to create a diversified portfolio that aligns with your risk tolerance, time horizon, and financial goals. Here are some key points to understand about asset allocation:

Diversification

Diversification is a crucial concept in asset allocation. It involves spreading your investments across different asset classes, industries, and geographical regions. By diversifying your portfolio, you reduce the risk of being heavily impacted by the performance of a single investment or asset class. Diversification can help enhance your portfolio’s stability and potential returns.

Risk Tolerance

Your risk tolerance is a crucial factor in determining your asset allocation. It refers to your ability and willingness to withstand fluctuations in the value of your investments. Generally, younger investors with a longer time horizon can afford to take higher risks, while those closer to retirement may prefer a more conservative approach. It’s important to consider your risk tolerance when deciding how much of your portfolio to allocate to different asset classes.

Factors to Consider in Asset Allocation

Time Horizon

Your time horizon, or the number of years until you plan to retire, is a vital consideration in asset allocation. The longer your time horizon, the more risk you can afford to take, as you have more time to recover from potential market downturns. A longer time horizon allows you to invest in growth-oriented assets, such as stocks, which historically offer higher returns but also come with higher volatility. As you approach retirement, it may be prudent to gradually shift towards more income-focused and stable investments, such as bonds.

Financial Goals

Your financial goals play a significant role in determining your asset allocation strategy. Are you aiming for long-term growth, wealth preservation, or a combination of both? Clearly defining your financial goals will help you determine the appropriate asset mix for your retirement portfolio. For example, if your main goal is preserving capital and generating income, a higher allocation to bonds and other fixed-income investments may be suitable. However, if you have a longer time horizon and are comfortable with higher volatility, you may opt for a higher allocation to stocks.

Income Needs

Consider your income needs during retirement when allocating assets. Do you have other sources of income, such as a pension or rental income? Understanding your expected cash flow requirements will guide your decision on how much to allocate to income-generating assets. For example, if you anticipate a significant income shortfall during retirement, you may need to allocate a larger portion of your portfolio to investments with the potential for higher income, such as dividend-paying stocks or real estate investment trusts (REITs).

Tax Implications

Tax efficiency is an often overlooked factor in asset allocation. Different types of investments are subject to varying tax treatments. For example, interest income from bonds is typically taxable, while qualified dividends and long-term capital gains may receive preferential tax rates. By considering the potential tax implications of different investments, you can optimize your asset allocation to minimize the tax burden on your retirement portfolio.

Monitoring and Rebalancing

Once you have established your initial asset allocation, it’s essential to regularly monitor your portfolio’s performance and make adjustments as needed. Over time, certain assets may outperform or underperform, causing your asset allocation to deviate from your desired targets. Rebalancing involves realigning your portfolio to your original asset allocation by selling overperforming assets and buying underperforming ones. Regular monitoring and rebalancing ensure that your portfolio stays in line with your long-term goals and risk tolerance.

Asset Allocation Strategies

Age-Based Approaches

Age-based asset allocation strategies take into account the investor’s age and time horizon until retirement. These approaches generally recommend a higher allocation to equities for younger investors, gradually decreasing as they approach retirement. An example of an age-based approach is the “100 minus age” rule, where you subtract your age from 100 to determine the percentage you should allocate to stocks. The remaining percentage is allocated to bonds or other fixed-income investments.

Target-Date Funds

Target-date funds (TDFs) are investment funds designed for investors with a specific retirement date in mind. These funds automatically adjust their asset allocation over time, becoming more conservative as the target date approaches. TDFs offer a convenient and hands-off approach to asset allocation, particularly for those who prefer a set-it-and-forget-it strategy. However, it’s essential to review the fund’s prospectus and understand its underlying investments to ensure they align with your risk tolerance and goals.

Risk-Based Approaches

Risk-based asset allocation approaches focus on an investor’s risk tolerance rather than their age. These strategies aim to create a portfolio with the optimal level of risk for the individual investor. Risk-based approaches often involve assessing risk tolerance through questionnaires or risk profiling tools. Based on the results, the portfolio is allocated among different asset classes according to the investor’s risk tolerance. This approach allows for more customization and consideration of the investor’s preferences.

Allocating assets in your retirement portfolio requires careful consideration of various factors, such as your time horizon, risk tolerance, financial goals, income needs, and tax implications. A well-diversified portfolio tailored to your specific circumstances can help you achieve your retirement objectives while managing risk. Regular monitoring, rebalancing, and reviewing your asset allocation strategy are essential to ensure your investments align with your changing needs and market conditions. By taking the time to understand asset allocation principles and implementing a thoughtful strategy, you can increase your chances of building a resilient and successful retirement portfolio.

Portfolio Asset Allocation by Age – Beginners To Retirees

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I allocate assets in my retirement portfolio?

Allocating assets in your retirement portfolio requires careful consideration and planning. Here are some commonly asked questions regarding asset allocation:

1. What is asset allocation?

Asset allocation refers to the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash, to achieve a balance between risk and return.

2. Why is asset allocation important for retirement?

Asset allocation is crucial for retirement as it determines the potential return and risk of your investment portfolio. Proper allocation helps to diversify your investments and aligns them with your specific retirement goals and risk tolerance.

3. How do I determine my risk tolerance?

Determining your risk tolerance involves assessing your financial goals, time horizon, and comfort level with fluctuations in investment returns. It’s important to gauge how much risk you are willing to take in order to make informed asset allocation decisions.

4. How should I diversify my retirement portfolio?

A well-diversified retirement portfolio typically includes a mix of assets from different asset classes, sectors, and geographical regions. By diversifying, you spread the risk and increase the chances of achieving consistent returns over time.

5. What factors should I consider when allocating assets?

When allocating assets, consider factors such as your age, financial goals, risk tolerance, investment time horizon, and market conditions. These factors will help you determine how much to allocate to each asset class.

6. Should I adjust my asset allocation as I get closer to retirement?

Yes, it’s generally recommended to adjust your asset allocation as you approach retirement. As you become more risk-averse, you may want to shift your portfolio towards more conservative investments to protect your retirement savings.

7. How often should I review and rebalance my retirement portfolio?

It’s advisable to review your retirement portfolio at least once a year or when there is a significant change in your financial situation. Rebalancing should be done periodically to maintain your desired asset allocation proportions.

8. Should I seek professional advice for asset allocation in my retirement portfolio?

While it is not mandatory, seeking professional advice can provide valuable insights and help you make informed decisions about asset allocation. A financial advisor can assess your unique circumstances and provide personalized recommendations based on your retirement goals.

Final Thoughts

In conclusion, allocating assets in your retirement portfolio is crucial for ensuring financial success during your golden years. By diversifying your investments across different asset classes such as stocks, bonds, and real estate, you can mitigate risks and maximize potential returns. Additionally, regularly rebalancing your portfolio based on your risk tolerance and changing market conditions is essential. Remember to consider factors such as your age, financial goals, and time horizon when determining asset allocation. Seeking professional advice or using online tools can provide further assistance in creating a well-balanced retirement portfolio.