Looking to minimize fees in your investment portfolio? We’ve got you covered. In this article, we’ll provide you with practical tips and strategies that can help you reduce expenses, ensuring that more of your hard-earned money is working for you. Say goodbye to unnecessary fees and hello to a more cost-effective and efficient investment approach. Whether you’re a seasoned investor or just starting out, learning how to minimize fees in your investment portfolio is a crucial step towards maximizing your returns. So, let’s dive in and explore the key ways to achieve this financial goal.

How to Minimize Fees in Your Investment Portfolio

Investing in the financial markets is an excellent way to grow your wealth over time. However, fees associated with your investment portfolio can eat into your returns and hinder your progress. Minimizing these fees is crucial to maximizing your investment potential. In this article, we will explore various strategies and tactics to help you reduce fees in your investment portfolio and increase your overall returns.

1. Understand Different Types of Investment Fees

Before we delve into minimizing fees, it’s essential to understand the different types of fees commonly associated with investment portfolios. Familiarizing yourself with these will empower you to make informed decisions and take necessary actions to minimize them effectively.

Management Fees

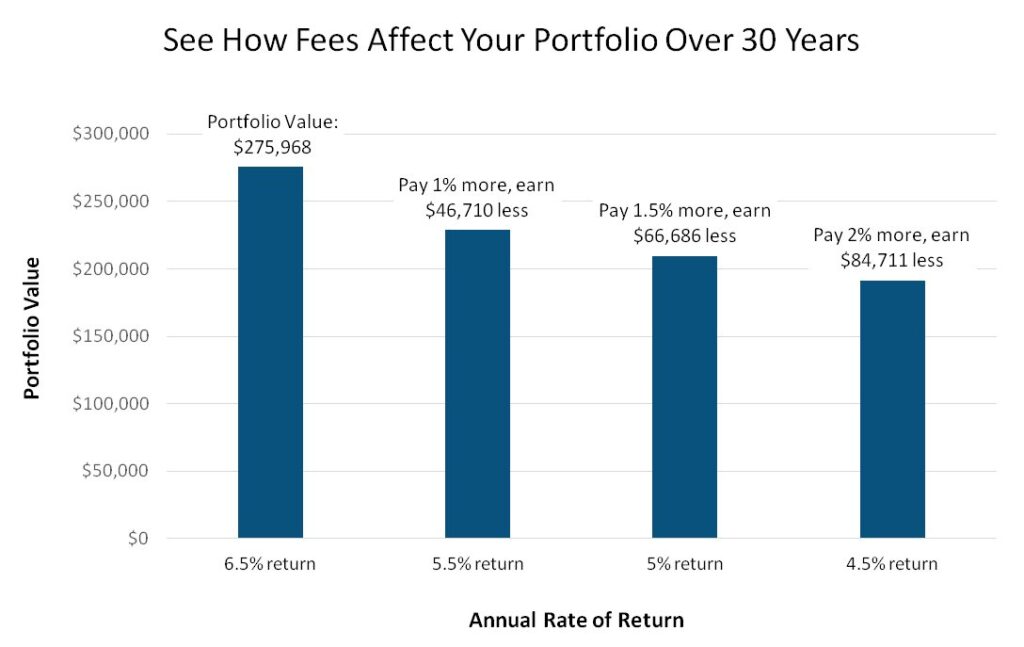

Management fees are the charges levied by the investment company or fund manager for managing your portfolio. These fees are typically expressed as a percentage of your total investment. They can range from less than 0.1% for passively managed index funds to over 2% for actively managed funds.

Expense Ratios

Expense ratios are another type of fee associated with mutual funds and exchange-traded funds (ETFs). These fees cover the operating expenses of the funds, including administrative costs, salaries, and marketing expenses. Expense ratios are expressed as a percentage of your investment and can vary widely depending on the fund.

Transaction Costs

Transaction costs include brokerage fees, commissions, and other charges associated with buying or selling securities in your portfolio. These costs can vary based on the brokerage firm and the type of investments you make.

Front-End and Back-End Loads

Front-end loads are sales charges applied when you buy mutual funds, typically expressed as a percentage of your investment. Conversely, back-end loads are charges incurred when you sell your mutual fund shares within a specific period. These loads can significantly impact your investment returns.

2. Choose Low-Cost Investment Vehicles

When constructing your investment portfolio, selecting low-cost investment vehicles is one of the most effective ways to minimize fees. Consider the following options to keep fees in check:

Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) are popular choices for cost-conscious investors. These investment vehicles often have lower expense ratios compared to actively managed mutual funds. Passive index funds track a specific market index, such as the S&P 500, while ETFs trade on exchanges like individual stocks.

No-Load Mutual Funds

No-load mutual funds are funds that don’t charge sales commissions or loads. By choosing no-load funds, you can avoid the upfront and back-end load charges associated with other mutual funds.

Diversified Portfolios

Building a diversified investment portfolio can also help minimize fees. By spreading your investments across different asset classes and geographical regions, you can reduce the reliance on expensive actively managed funds.

3. Compare Expense Ratios

When investing in mutual funds or ETFs, comparing expense ratios is crucial. Lower expense ratios mean a higher portion of your returns stays in your pocket. Conduct thorough research and compare expense ratios across different investment options before making your investment decisions.

4. Consider Tax Efficiency

Minimizing taxes on your investment returns can indirectly reduce the overall fees you pay. Consider the following tax-efficient strategies:

Hold Investments for the Long Term

By holding investments for longer periods, you can benefit from long-term capital gains tax rates, which are generally lower than short-term capital gains rates. Avoid frequent buying and selling, as it can trigger higher taxes and additional transaction costs.

Utilize Tax-Advantaged Accounts

Tax-advantaged accounts, such as individual retirement accounts (IRAs) and 401(k)s, offer tax benefits that can help you minimize taxes on your investments. Contributions to traditional IRAs and 401(k)s may be tax-deductible, and earnings grow tax-deferred until withdrawal.

5. Avoid Market Timing and Excessive Trading

Market timing refers to attempting to buy and sell investments based on predictions of future market movements. Engaging in market timing exposes investors to higher transaction costs and potential losses. Instead, focus on a long-term investment approach and avoid excessive trading, which incurs additional fees.

6. Negotiate Brokerage Fees

When selecting a brokerage firm, take the time to compare fees and consider negotiating them. Some brokerage firms are open to lowering their fees, especially if you have a substantial amount to invest or if you are a frequent trader. Don’t be afraid to ask for fee reductions or explore alternatives if your current broker is not accommodating.

7. Monitor Your Portfolio Regularly

Regularly reviewing and rebalancing your investment portfolio can help you minimize fees. Over time, the asset allocation of your portfolio may deviate from your original plan, leading to overweighting in certain investments and asset classes. By rebalancing, you can avoid unnecessary fees associated with skewed allocations and bring your portfolio back in line with your investment strategy.

8. Seek Professional Advice

If managing your own investment portfolio feels overwhelming or if you require more personalized guidance, seeking advice from a reputable financial advisor can be invaluable. A financial advisor can provide insights into minimizing fees, constructing a diversified portfolio, and optimizing tax efficiency based on your unique circumstances and goals.

9. Stay Informed and Educated

Lastly, staying informed and continuously educating yourself about investment strategies and best practices is essential. Attend seminars, read books, and follow reputable financial news sources to deepen your understanding of the investment landscape. The more knowledgeable you become, the better equipped you’ll be to navigate the complexities of investment fees and optimize your portfolio.

In conclusion, minimizing fees in your investment portfolio is crucial for maximizing your long-term returns. By understanding the various types of investment fees, choosing low-cost investment vehicles, comparing expense ratios, considering tax efficiency, avoiding market timing, negotiating brokerage fees, monitoring your portfolio regularly, seeking professional advice, and staying informed, you can take proactive steps to minimize fees and grow your wealth over time. Remember, every dollar saved on fees is an additional dollar working for your future financial goals.

The Five Simple Rules of Investing | Simple Steps for a Retirement Portfolio Course

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I minimize fees in my investment portfolio?

The following are some strategies you can employ to minimize fees in your investment portfolio:

1. Which types of fees should I be aware of?

In your investment portfolio, you should be aware of various types of fees such as management fees, expense ratios, transaction fees, and advisory fees. These fees can impact your overall investment returns.

2. What is the importance of comparing expense ratios?

Comparing expense ratios is crucial as it allows you to assess the cost of investing in different mutual funds or exchange-traded funds (ETFs). Lower expense ratios can significantly reduce the fees you pay over time.

3. How can I choose investments with lower expense ratios?

To choose investments with lower expense ratios, you can research and compare similar funds in the market. Look for funds that aim to provide competitive returns while keeping expenses low. Analyzing historical expense ratios can also give you valuable insights.

4. Are there any alternatives to actively managed funds?

Yes, there are alternatives to actively managed funds. Passive investing through index funds or ETFs can be a cost-effective option as they typically have lower expense ratios compared to actively managed funds.

5. Can I negotiate fees with my financial advisor?

Yes, you can negotiate fees with your financial advisor. Discuss your investment goals, portfolio size, and services provided. Some financial advisors may be willing to negotiate their fees depending on your circumstances.

6. What impact can frequent trading have on fees?

Frequent trading can lead to higher transaction fees and potentially increase your overall investment costs. It is important to assess your investment strategy and only make trades when necessary to avoid unnecessary fees.

7. Are there any tax implications related to minimizing fees?

Minimizing fees can potentially have tax implications. For example, if you hold investments in a taxable account, selling investments to switch to lower-fee options may trigger capital gains taxes. Consider consulting with a tax advisor to evaluate potential tax implications.

8. Should I consider a robo-advisor for lower fees?

Robo-advisors can be a cost-effective option as they typically charge lower fees compared to traditional financial advisors. However, it’s important to assess whether a robo-advisor’s services align with your investment goals and preferences before making a decision.

Final Thoughts

To minimize fees in your investment portfolio, start by understanding the different fees involved. Assess the expense ratios of mutual funds or ETFs you’re considering. Opt for low-cost index funds that track market performance rather than actively managed funds. Be mindful of transaction fees and avoid excessive trading. Consider the impact of taxes and opt for tax-efficient investments like tax-managed funds or tax-exempt municipal bonds. Regularly review and rebalance your portfolio to maintain a diversified and cost-effective approach. By being proactive and informed, you can effectively minimize fees in your investment portfolio.