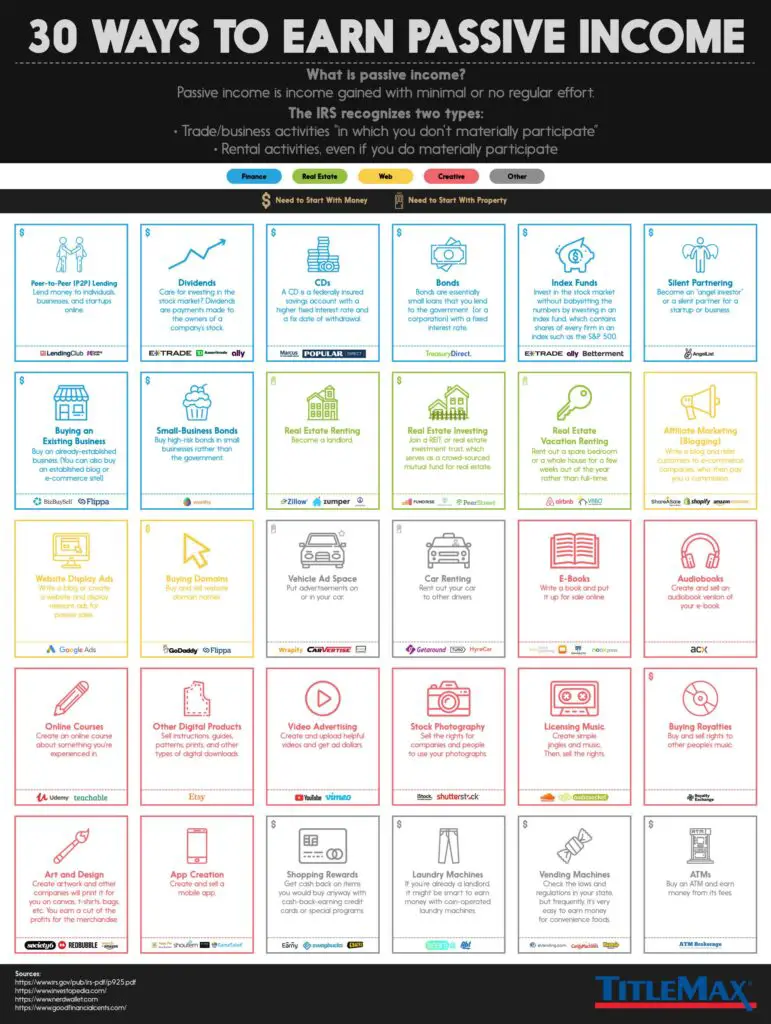

Looking for the best ways to earn passive income streams? You’ve come to the right place! In today’s fast-paced world, finding ways to increase your income and create financial stability has become more important than ever. Whether you’re looking to supplement your current income or have dreams of achieving financial freedom, there are numerous opportunities available to help you reach your goals. So, grab a cup of coffee and get ready to explore some exciting possibilities that can potentially change your financial future. Let’s dive in!

Best Ways to Earn Passive Income Streams

Welcome to our comprehensive guide on the best ways to earn passive income streams. In this article, we will explore various strategies and opportunities that can help you generate passive income, allowing you to earn money even while you sleep. From real estate investments to online businesses, we will cover a wide range of options to suit different interests and financial goals. Let’s dive in!

Understanding Passive Income

Before we delve into the strategies, let’s first understand what passive income actually means. Passive income refers to the money you earn with minimal effort or ongoing work. Unlike active income, which requires continuous time and effort, passive income allows you to earn money on a recurring basis without significant daily involvement.

While generating passive income often requires initial effort and investment, once the system is set up, it can provide a steady stream of income without consuming much of your time. This financial freedom can allow you to pursue other interests, spend more time with loved ones, or even create multiple streams of passive income to increase your earnings.

Now that we’ve covered the basics, let’s explore some of the best ways to earn passive income streams.

1. Real Estate Investments

Real estate has long been a popular choice for those seeking passive income. Whether it’s through rental properties or real estate investment trusts (REITs), owning property can provide a steady stream of passive income. Here are a few avenues to consider:

- Rental Properties: Purchasing residential or commercial properties and renting them out can be a lucrative way to earn passive income. While it requires initial investment and active management, rental properties can generate regular cash flow.

- REITs: Real Estate Investment Trusts allow you to invest in a portfolio of income-generating properties without the need to directly own or manage them. REITs often distribute a significant portion of their rental income as dividends to investors.

- Crowdfunded Real Estate: Crowdfunding platforms allow individuals to pool their resources and invest in real estate projects. This option provides the opportunity to invest in properties with lower capital requirements and diversify across different projects.

2. Dividend Stocks

Investing in dividend stocks is another popular way to generate passive income. Dividend stocks are shares of companies that distribute a portion of their profits to shareholders on a regular basis. Here’s how you can earn passive income through dividend stocks:

- Dividend-Paying Companies: Look for established companies that have a history of consistently paying dividends. These dividends can provide a reliable source of passive income over time.

- Dividend ETFs: Exchange-traded funds (ETFs) that focus on dividend-paying stocks can offer diversification and reduce the risk associated with investing in individual stocks.

- Dividend Reinvestment Plans (DRIPs): Some companies offer DRIPs, which allow you to reinvest your dividends to purchase additional shares. This can help accelerate the growth of your passive income over time.

3. Peer-to-Peer Lending

Peer-to-peer lending platforms have gained popularity in recent years as a way for individuals to bypass traditional financial institutions and earn passive income by lending money directly to borrowers. Here’s how it works:

- Choose a P2P Lending Platform: Research and select a reputable peer-to-peer lending platform that aligns with your risk tolerance and investment goals.

- Diversify Your Investments: Spread your investment across multiple borrowers to reduce the risk of default. Most platforms allow you to invest small amounts in each loan.

- Monitor and Reinvest: Regularly review your investments and reinvest the repayments received to further grow your passive income.

4. Create an Online Business

Thanks to the internet, creating an online business has become increasingly accessible and can provide significant passive income opportunities. Here are a few online business ideas to consider:

- Affiliate Marketing: Promote products or services on your website or social media platforms and earn a commission for each sale generated through your affiliate links.

- Dropshipping: Set up an e-commerce store without the need to hold inventory. When a customer makes a purchase, the product is shipped directly from the supplier to the customer, and you earn a profit on the difference in price.

- Digital Products: Create and sell digital products such as e-books, online courses, or software. Once developed, these products can be sold repeatedly without the need for inventory or shipping.

5. High-Yield Savings Accounts and CDs

While interest rates on traditional savings accounts are typically low, high-yield savings accounts and certificates of deposit (CDs) offer better returns on your savings. While not as passive as some other options, they are relatively low risk and require minimal effort once the initial setup is complete.

6. Create and Monetize Digital Content

If you enjoy creating content, there are several ways to monetize your skills and generate passive income. Here are a few examples:

- YouTube Videos: Start a YouTube channel and earn money through ad revenue, sponsorships, and product placements.

- Podcasts: Launch a podcast and monetize it through sponsorships, advertisements, and affiliate marketing.

- Online Courses: Create and sell online courses on platforms like Udemy or Teachable. Once the course is developed, it can generate passive income with minimal ongoing effort.

7. Royalties from Intellectual Property

If you have creative talents or own intellectual property rights, such as music, books, or software, you can earn passive income through royalties. Here’s how:

- Music Royalties: License your music to streaming platforms, TV shows, movies, or advertisements and earn royalties whenever your music is played.

- Book Publishing: Self-publish your book or e-book on platforms like Amazon Kindle Direct Publishing and earn royalties on each sale.

- Software Licensing: Develop software or applications and license them to businesses or individuals, earning passive income through licensing fees.

8. Rental Income from Vehicles or Equipment

If you own vehicles or equipment that are not in constant use, renting them out can be an excellent source of passive income. Some examples include:

- Car Rental: Rent out your car through platforms like Turo when you’re not using it yourself.

- Camera or Equipment Rental: If you own high-quality camera gear, audio equipment, or other specialized equipment, rent it out to others in need.

- Storage Space Rental: If you have extra storage space, consider renting it out to individuals or businesses in need of storage solutions.

Earning passive income is an excellent way to achieve financial independence and enjoy the benefits of financial freedom. By diversifying your income streams and investing in opportunities that align with your goals and interests, you can create a steady stream of passive income that provides long-term financial stability. Remember, patience and persistence are key when it comes to building passive income streams, so start exploring your options and take the first steps toward a more secure financial future.

How I Built 5 Passive Income Streams That Earn $63,869/Mo

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are the best ways to earn passive income streams?

Earning passive income streams can provide financial stability and freedom. Here are some effective methods to generate passive income:

How can I earn passive income through investing?

Investing in stocks, bonds, real estate, or peer-to-peer lending platforms can generate passive income through dividends, interest payments, or rental income.

Can I earn passive income by creating and selling online courses?

Yes, creating and selling online courses on platforms like Udemy or Teachable can generate passive income. Once the course is created, you can earn money through course sales without active involvement.

What are the options to earn passive income through real estate?

Real estate investments offer various options for passive income, such as rental properties, real estate investment trusts (REITs), or crowdfunding platforms focusing on real estate projects.

Is affiliate marketing a viable way to earn passive income?

Affiliate marketing involves promoting other companies’ products or services and earning a commission for each sale made through your referral. It can be a profitable way to generate passive income.

Can I earn passive income through peer-to-peer lending?

Peer-to-peer lending platforms allow individuals to lend money to others and earn interest on the loans. By leveraging these platforms, you can generate passive income through interest payments.

What are the benefits of dividend stocks for passive income?

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders. Investing in dividend stocks can provide regular passive income through dividend payments.

How can I earn passive income by creating a mobile app?

Developing and monetizing a mobile app can be a lucrative way to generate passive income. Through in-app purchases, subscriptions, or ad revenue, your app can generate income while you sleep.

Final Thoughts

If you’re looking for the best ways to earn passive income streams, there are several options to consider. One lucrative approach is investing in dividend stocks, as they provide regular payments without requiring active involvement. Another method is creating and selling digital products, such as e-books or online courses, which can generate income long after the initial effort is put in. Rental properties can also be a great source of passive income, as tenants’ rent payments contribute to your earnings. Additionally, investing in index funds or peer-to-peer lending platforms can offer passive income opportunities. By exploring these strategies, you can establish reliable and sustainable passive income streams.