Are you struggling to navigate the complex world of filing taxes for cryptocurrency gains? Look no further! In this guide, we will provide you with a straightforward solution to ensure you are well-equipped to handle this often confusing aspect of cryptocurrency investments. Whether you’re a seasoned crypto trader or new to the game, understanding how to properly file taxes for your crypto gains is essential. So, let’s dive in and demystify the process of filing taxes for cryptocurrency gains.

Guide to Filing Taxes for Cryptocurrency Gains

Cryptocurrency has gained significant popularity in recent years, with many individuals investing and trading in various digital coins. However, one aspect that crypto enthusiasts often overlook is the tax implications of their cryptocurrency transactions. Filing taxes for cryptocurrency gains can be complex and confusing, but it is crucial to ensure compliance with tax regulations. In this comprehensive guide, we will walk you through the process of filing taxes for your cryptocurrency gains, covering important topics such as determining taxable events, calculating gains and losses, record-keeping requirements, and more.

Determining Taxable Events

One of the first steps in filing taxes for cryptocurrency gains is identifying the taxable events. Taxable events occur whenever you make a transaction involving cryptocurrency, such as:

1. Selling cryptocurrency for fiat currency (e.g. US dollars)

2. Trading one cryptocurrency for another (e.g. Bitcoin for Ethereum)

3. Using cryptocurrency to purchase goods or services

4. Receiving cryptocurrency as income (e.g. mining or staking rewards)

It is important to note that even if you haven’t converted your cryptocurrency into fiat currency, the above transactions still trigger tax obligations. Each taxable event may have different tax implications, so it is crucial to understand the rules specific to your jurisdiction.

Calculating Gains and Losses

Once you have identified your taxable events, the next step is to calculate your gains and losses. The most common method for calculating gains and losses in cryptocurrency transactions is the “FIFO” (First-In-First-Out) method. According to the FIFO method, the first cryptocurrency you acquired is considered the first one you sell or trade.

Here’s a step-by-step process for calculating gains and losses using the FIFO method:

1. Determine the cost basis: The cost basis is the original purchase price of the cryptocurrency you sold or traded. If you mined or received the cryptocurrency as income, the cost basis is the fair market value at the time of receipt.

2. Calculate the proceeds: The proceeds are the amount you received in exchange for your cryptocurrency, whether it was fiat currency or another cryptocurrency. If you used the cryptocurrency to purchase goods or services, the proceeds would be the fair market value of the goods or services at the time of the transaction.

3. Calculate the gain or loss: Subtract the cost basis from the proceeds to determine the capital gain or loss. If the result is positive, you have a capital gain. If it’s negative, you have a capital loss.

4. Repeat the process for each taxable event: Calculate the gains and losses for each transaction using the FIFO method. Keep in mind that you may have different cost bases for each acquisition of cryptocurrency, especially if you acquired it at different times or prices.

Record-Keeping Requirements

Maintaining accurate records of your cryptocurrency transactions is crucial for filing taxes correctly and minimizing the risk of an audit. Here are some record-keeping requirements to consider:

1. Transaction details: Keep track of the date, time, and value of each transaction. Include information such as the type of transaction (buying, selling, trading, etc.), the parties involved, and any fees or commissions paid.

2. Cost basis documentation: Retain documentation that supports the cost basis of your cryptocurrency, such as receipts from purchases, mining income records, or exchange statements.

3. Wallet addresses: Record the wallet addresses associated with your cryptocurrency transactions. This information can be crucial for proving ownership and tracking the flow of funds.

4. Exchange statements: If you trade cryptocurrency on multiple exchanges, keep copies of your exchange statements. These statements provide a comprehensive overview of all your transactions on the platform.

By keeping detailed and accurate records, you can easily report your cryptocurrency gains and losses when tax season arrives. It also ensures that you have the necessary documentation to support your tax filings in case of an audit.

Reporting Cryptocurrency Gains and Losses

Now that you have calculated your gains and losses and maintained proper records, it’s time to report your cryptocurrency transactions on your tax return. The specific forms and requirements vary depending on your jurisdiction, so it’s essential to consult with a tax professional or refer to the tax authority’s guidelines.

In the United States, for example, the Internal Revenue Service (IRS) treats cryptocurrency as property, and you report your gains and losses on Form 8949 and Schedule D. On Form 8949, you provide a detailed breakdown of each cryptocurrency transaction, including the date acquired, date sold or traded, proceeds, and cost basis.

It’s important to accurately report your cryptocurrency gains and losses to avoid penalties or legal consequences. Failing to report can result in tax evasion charges, fines, and interest on unpaid taxes.

Seeking Professional Assistance

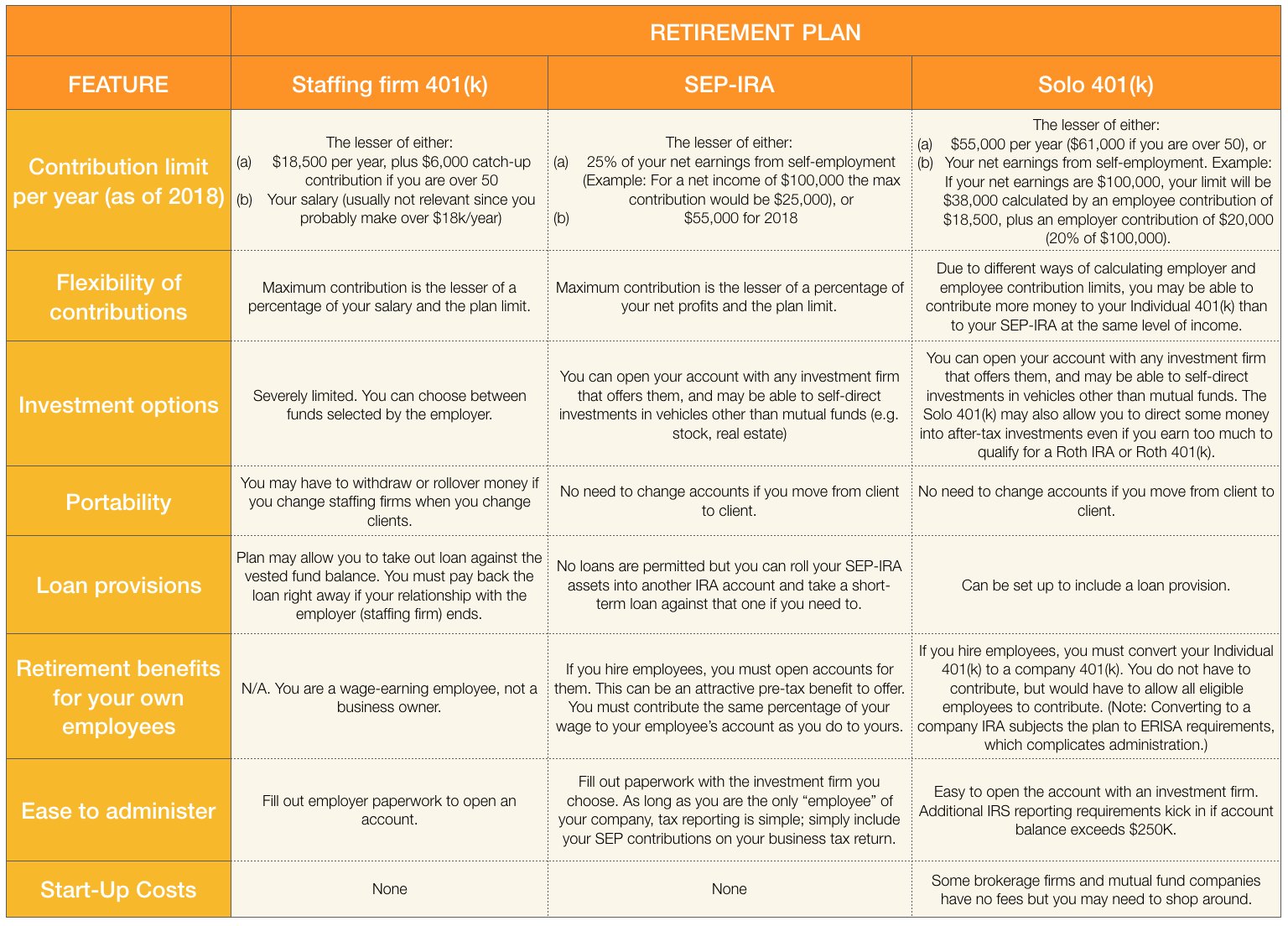

Filing taxes for cryptocurrency gains can be a complex process, especially if you have multiple transactions or are unsure about the specific tax regulations in your jurisdiction. Therefore, it is highly recommended to seek the assistance of a qualified tax professional who specializes in cryptocurrency taxation.

A tax professional can help you navigate the complexities of cryptocurrency tax reporting, ensure compliance with tax laws, and help you maximize your deductions and credits. They can also provide guidance on any upcoming regulatory changes or updates that may affect your tax obligations.

Filing taxes for cryptocurrency gains is an important step in ensuring compliance with tax regulations and avoiding potential penalties. By understanding the taxable events, calculating gains and losses using the FIFO method, maintaining proper records, and reporting accurately, you can fulfill your tax obligations as a responsible cryptocurrency investor.

Remember, it’s always best to consult with a tax professional who can provide personalized advice based on your specific circumstances. With their assistance, you can navigate the complexities of cryptocurrency taxation with confidence and peace of mind. Stay informed, stay organized, and stay compliant!

Crypto Tax Reporting (Made Easy!) – CryptoTrader.tax / CoinLedger.io – Full Review!

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is considered a cryptocurrency gain?

When it comes to taxes, a cryptocurrency gain refers to any profit made from buying, selling, or exchanging cryptocurrencies like Bitcoin, Ethereum, or Litecoin. It includes gains realized from trading, mining, or receiving cryptocurrency as payment.

Do I have to report my cryptocurrency gains on my tax return?

Yes, you are required to report your cryptocurrency gains on your tax return. The Internal Revenue Service (IRS) views cryptocurrencies as property, not currency, which means they are subject to capital gains tax rules. Failure to report your gains can result in penalties and interest.

How do I determine the value of my cryptocurrency for tax purposes?

The value of your cryptocurrency for tax purposes is generally based on its fair market value at the time of the transaction. You can use reputable cryptocurrency exchanges or websites that provide historical price data to determine the value of your cryptocurrency at the specific time of the transaction.

What tax forms do I need to file for my cryptocurrency gains?

For reporting cryptocurrency gains, you may need to file Form 8949, Sales and Other Dispositions of Capital Assets, along with Schedule D, Capital Gains and Losses. Additionally, you may also need to include Form 1040, the individual income tax return form.

Are there any tax deductions or credits available for cryptocurrency gains?

While there are no specific deductions or credits exclusive to cryptocurrency gains, you may be able to offset your gains with capital losses from other investments. It is advisable to consult with a tax professional to determine which deductions or credits may be applicable to your situation.

What if I have only held cryptocurrency and haven’t sold or traded it?

If you have only held cryptocurrency and haven’t sold or traded it, you generally don’t have any taxable events to report. However, you should still keep track of your holdings as the IRS requires accurate records for all cryptocurrency transactions.

What happens if I fail to report my cryptocurrency gains?

Failure to report your cryptocurrency gains can result in penalties and interest. The IRS has been actively pursuing cryptocurrency tax evasion cases and has taken steps to ensure compliance. It is important to accurately report all cryptocurrency gains to avoid potential legal consequences.

Can I amend a previously filed tax return to include cryptocurrency gains?

Yes, if you have previously filed a tax return without reporting your cryptocurrency gains, you can file an amended tax return using Form 1040X. Make sure to include the necessary forms, such as Form 8949 and Schedule D, to accurately report your cryptocurrency gains and pay any additional taxes owed.

Should I consult a tax professional for assistance with filing taxes for cryptocurrency gains?

While it is not mandatory, consulting a tax professional who is knowledgeable about cryptocurrency taxation can be highly beneficial. They can provide guidance specific to your situation, help with accurate reporting, and ensure compliance with tax laws and regulations.

Final Thoughts

Filing taxes for cryptocurrency gains can be a complex process, but with the right guidance, it becomes manageable. Start by accurately calculating your gains and losses from cryptocurrency transactions. Keep detailed records of your trades, including dates, transaction amounts, and prices. Understand the tax regulations specific to your country or jurisdiction, as they may vary. Seek the help of a professional tax advisor if needed. Ensure that you report your cryptocurrency gains correctly and on time to avoid any penalties or legal issues. By following this guide to filing taxes for cryptocurrency gains, you can fulfill your tax obligations while staying on the right side of the law.