Are you tired of feeling overwhelmed by your finances? Maybe you’ve heard about financial minimalism and wondered if it could be the answer to your money-related stress. Well, look no further! Financial minimalism is a transformative approach that can help you take control of your financial situation and find peace in simplicity.

In this article, we will explore what financial minimalism is all about and how you can incorporate its principles into your life. So, if you’re ready to streamline your finances and embark on a journey towards financial freedom, keep reading!

Financial Minimalism: Simplifying Your Finances for a Better Life

Whether you’re struggling with debt, overwhelmed by financial responsibilities, or simply looking to live a more intentional and stress-free life, embracing financial minimalism can be a transformative step towards financial freedom.

By adopting minimalist principles and implementing them in your financial life, you can simplify, declutter, and optimize your finances, paving the way for a more secure and fulfilling future.

The Essence of Financial Minimalism

Financial minimalism is about focusing on what truly matters in your financial life and eliminating unnecessary distractions. It involves making conscious choices to reduce financial clutter, simplify your financial processes, and align your spending habits with your values and goals. By adopting this mindset, you can free yourself from the pressures of consumerism and find peace in living with less.

The Benefits of Financial Minimalism

Embracing financial minimalism offers numerous benefits that can positively impact both your financial and personal well-being. Some of the key advantages include:

1. Reduced Financial Stress: Simplifying your finances helps alleviate the stress associated with managing a complex financial life. By decluttering unnecessary financial commitments and focusing on what truly matters, you can gain a sense of control and minimize financial anxiety.

2. Increased Savings: Financial minimalism encourages you to examine your spending habits and identify areas where you can cut back. By consciously reducing unnecessary expenses, you can redirect those funds towards savings and investments, ultimately building a stronger financial foundation.

3. Debt Freedom: Many individuals find themselves buried under a mountain of debt, making it difficult to achieve their financial goals. Financial minimalism promotes a proactive approach to debt elimination by prioritizing debt repayment and avoiding unnecessary loans or credit card usage.

4. Enhanced Financial Awareness: By simplifying your finances, you gain a clearer understanding of your financial situation. This heightened awareness allows you to make better financial decisions, identify potential areas of improvement, and seize opportunities for growth.

5. Increased Focus on What Matters: Financial minimalism shifts your focus from accumulating material possessions to pursuing experiences and values that truly enrich your life. By aligning your financial choices with your values, you can find greater fulfillment and happiness.

Implementing Financial Minimalism in Your Life

To embrace financial minimalism, you’ll need to make intentional choices and implement changes that align with your financial goals. Here are some practical steps to get you started:

1. Assess Your Current Financial Situation

Take an honest look at your finances to understand your current situation and identify areas that need improvement. Consider factors such as income, expenses, debt, savings, and investments. This assessment will serve as a foundation for implementing your financial minimalism journey.

2. Define Your Financial Goals and Values

Determine your financial goals and values to gain clarity on what truly matters to you. Reflect on your short-term and long-term aspirations, whether it’s achieving debt freedom, saving for a dream vacation, or preparing for retirement. Defining your goals will help guide your financial decisions and align your spending with your values.

3. Simplify Your Budget

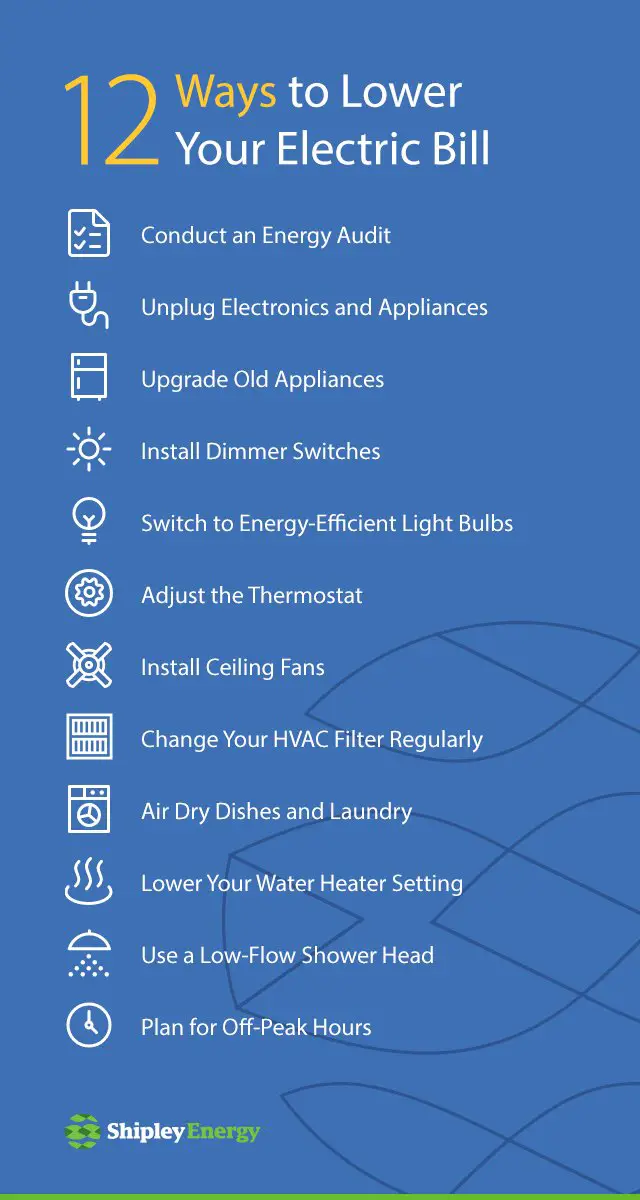

Streamline your budget by eliminating unnecessary expenses and focusing on key priorities. Consider non-essential spending areas where you can cut back without sacrificing your quality of life. Aim to create a budget that is realistic, flexible, and aligned with your financial goals.

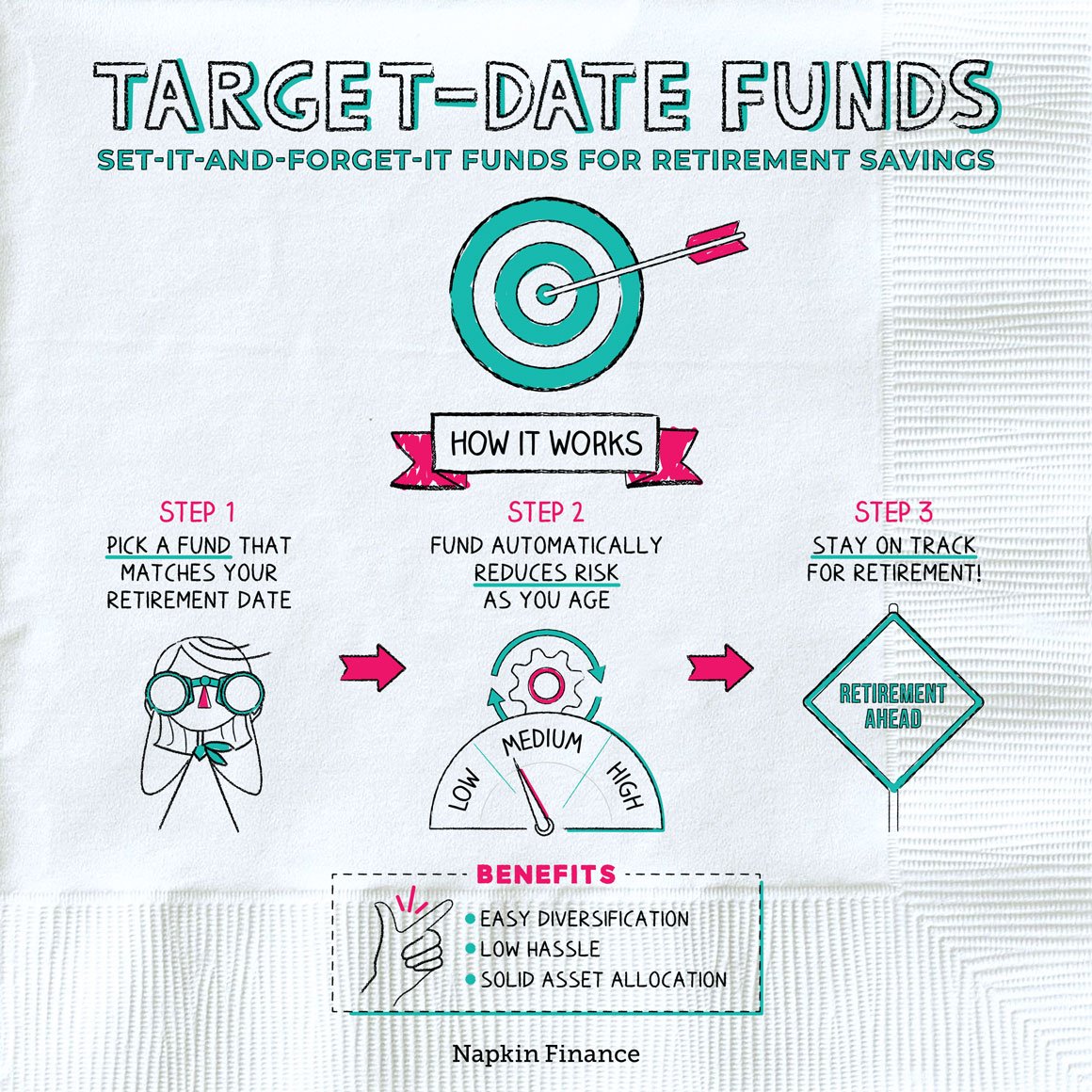

4. Automate and Consolidate Financial Processes

Simplify your financial life by automating bill payments and consolidating accounts. This will reduce the time and effort required to manage your finances, allowing you to focus on more meaningful aspects of your life. Automating processes also helps avoid late payment fees and ensures you stay on top of your financial obligations.

5. Minimize Debt

Prioritize debt repayment and develop a debt payoff strategy. Consider consolidating high-interest debts into a more manageable loan or credit card with a lower interest rate. Explore methods like the debt snowball or debt avalanche to efficiently pay off your debts and regain financial freedom.

6. Adopt Conscious Spending Habits

Practice mindful spending by carefully evaluating your purchases before making them. Ask yourself if the item aligns with your values and if it will contribute to your overall well-being. Avoid impulse buying and instead focus on experiences and purchases that bring long-term satisfaction.

7. Build an Emergency Fund

Establish an emergency fund to provide a safety net for unexpected expenses. Aim to save three to six months’ worth of living expenses in a separate account. Having an emergency fund ensures you’re prepared for unexpected financial challenges without relying on credit cards or loans.

8. Prioritize Quality Over Quantity

Adopt a mindset that emphasizes quality over quantity. Instead of accumulating a large volume of possessions, focus on acquiring durable and long-lasting items that serve your needs. This approach not only reduces clutter but also saves money in the long run.

9. Seek Financial Education

Continuously educate yourself about personal finance to empower your financial decisions. Read books, attend seminars, and follow reputable financial experts or blogs. Gaining knowledge and understanding will further enhance your ability to make informed choices that align with your financial goals.

The Challenges and Roadblocks

While financial minimalism offers many benefits, it’s important to acknowledge the challenges and potential roadblocks you may encounter along the way. Some common obstacles include:

1. Social Pressure and Influence

Living a minimalist and frugal lifestyle can sometimes conflict with societal norms and expectations. Friends and family may question or criticize your choices, making it challenging to stay committed to your financial goals. It’s essential to communicate your values and maintain confidence in your decisions.

2. Temptation and Impulse Buying

In a world full of advertising and constant exposure to consumerism, resisting temptation can be difficult. Impulse buying can derail your financial minimalism efforts. To overcome this challenge, practice mindful spending and take time to reflect on the true value of your purchases before making them.

3. Emotional Attachment to Possessions

Letting go of sentimental or unnecessary possessions can be emotionally challenging. This emotional attachment can make it difficult to declutter and simplify your life. Adopt a gradual approach and start with small steps, gradually decluttering and detaching from possessions as you become more comfortable with the process.

4. Financial Inertia

If you’ve been stuck in a cycle of financial habits for a long time, breaking free from the inertia can be tough. Overcoming this challenge requires perseverance, commitment, and a strong desire for change. Celebrate small victories along the way to reinforce positive financial habits.

Embrace Financial Minimalism for a Better Future

Financial minimalism provides a path to simplifying your financial life, reducing stress, and achieving your long-term goals. By adopting minimalist principles, eliminating financial clutter, and aligning your spending habits with your values, you can embark on a journey towards financial freedom and a more fulfilling life. Start small, stay committed, and embrace the positive impact financial minimalism can have on your overall well-being.

How I’m Building Wealth as a Beginner | Financial Minimalism

Frequently Asked Questions (FAQs)

Financial minimalism is a lifestyle approach that emphasizes simplicity, mindfulness, and intentional decision-making when it comes to personal finances. It involves reducing unnecessary expenses, decluttering financial obligations, and focusing on financial goals that align with one’s values and priorities.

Financial minimalism can provide several benefits, including reduced financial stress, increased savings, greater financial freedom, and improved overall well-being. By focusing on what truly matters and eliminating excess, you can create a more intentional and fulfilling financial life.

While frugality and financial minimalism share some similarities, they are not the same. Frugality typically involves strict budgeting, cutting costs, and seeking the cheapest options. On the other hand, financial minimalism focuses on intentional spending, optimizing expenses, and aligning financial decisions with personal values.

Absolutely! Financial minimalism can be particularly helpful if you have debt. It encourages you to prioritize debt repayment, eliminate unnecessary expenses, and develop a strategic plan to become debt-free. By adopting minimalistic principles, you can accelerate your debt payoff journey and improve your financial situation.

No, financial minimalism does not require giving up all luxuries. It emphasizes conscious spending and aligning expenses with your values. It encourages you to evaluate your spending habits and prioritize what truly brings you joy and fulfillment. Financial minimalism is about finding a balance between enjoying the luxuries that matter to you and avoiding unnecessary clutter and excess.

To start practicing financial minimalism, you can begin by evaluating your current financial situation and identifying areas where you can simplify and reduce expenses. Create a budget that aligns with your values and goals, declutter unnecessary financial obligations, and establish clear financial priorities. It’s also important to continually reassess your spending habits and make intentional choices that support your financial well-being.

No, financial minimalism is for everyone, regardless of income level. While it’s true that high-income individuals may have more financial resources to allocate, financial minimalism focuses on intentional decision-making and optimizing expenses regardless of income. It is about prioritizing what truly matters to you and making mindful choices with your money.

Financial minimalism and financial independence often go hand in hand. By adopting a minimalistic approach to your finances, you can minimize unnecessary expenses, save and invest wisely, and ultimately work towards achieving financial independence. Financial minimalism helps you align your lifestyle choices with your long-term financial goals and paves the way for financial freedom.

Final Thoughts

Financial minimalism is a mindset and lifestyle that promotes simplicity and intentional decision-making when it comes to money. It emphasizes the importance of living within one’s means, reducing unnecessary expenses, and prioritizing financial well-being.

By consciously evaluating our spending habits and focusing on what truly matters, we can achieve greater financial freedom and peace of mind. Embracing financial minimalism allows us to align our values with our spending, avoid debt, and build a solid foundation for long-term financial security. So, let’s embrace financial minimalism and take control of our financial future.