Personal loan interest rates can be confusing, but understanding them is key to making informed financial decisions. So, let’s dive into the world of personal loan interest rates and uncover the secrets behind this crucial aspect of borrowing money. Why does the interest rate matter? How can it affect your monthly payments and total loan amount? Stay tuned as we unravel the mysteries behind understanding personal loan interest rates and empower you to make smart choices when it comes to borrowing money. Look no further for clear, concise answers to all your questions!

Understanding Personal Loan Interest Rates

When it comes to personal loans, one of the most important factors to consider is the interest rate. The interest rate determines how much you’ll end up paying in addition to the principal amount borrowed. It’s crucial to understand the intricacies of personal loan interest rates to make informed borrowing decisions. In this article, we will delve into the details of personal loan interest rates, exploring what they are, how they are calculated, factors that influence them, and strategies to get the best interest rates available.

What Are Personal Loan Interest Rates?

Personal loan interest rates are the additional charges that lenders impose on the amount borrowed. It is calculated as a percentage of the principal loan amount and dictates the overall cost of borrowing. The interest rate is agreed upon by the lender and the borrower at the beginning of the loan term.

How Are Personal Loan Interest Rates Calculated?

Understanding how personal loan interest rates are calculated is essential to grasp their impact on your finances. Typically, interest rates are calculated using two methods: the reducing balance method and the flat interest rate method.

The reducing balance method is more common for personal loans. Under this method, interest is charged on the remaining principal amount after deducting the portion of your installment payment that goes towards the interest. As you continue to make payments, the interest component decreases, resulting in lower overall interest payments.

On the other hand, the flat interest rate method charges interest on the total loan amount throughout the loan tenure, regardless of the amount you have repaid. This method can make loans appear cheaper initially, but the overall interest cost is higher compared to the reducing balance method.

Factors That Influence Personal Loan Interest Rates

Several factors influence personal loan interest rates. Understanding these factors can help you negotiate better terms or choose the right loan for your financial needs. Here are the key factors to consider:

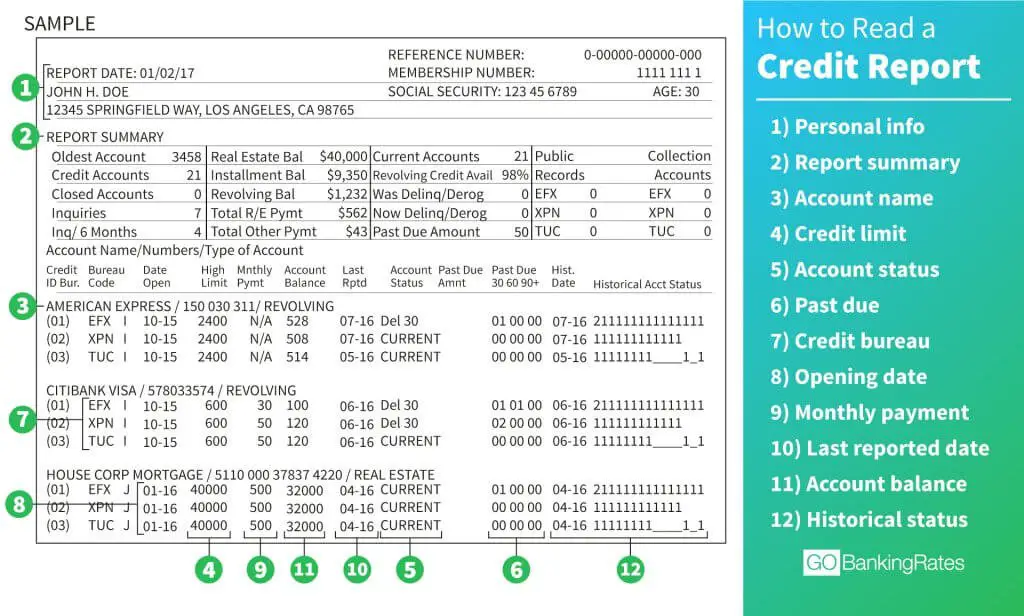

1. Credit Score: Your credit score plays a significant role in determining the interest rate you qualify for. A higher credit score indicates lower default risk, enabling you to secure a loan at a lower interest rate.

2. Income Level: Lenders often consider your income level to assess your repayment capacity. If you have a stable and high income, you may be offered a more favorable interest rate.

3. Loan Amount: The loan amount you apply for can impact the interest rate. Higher loan amounts might attract slightly higher interest rates compared to smaller loans.

4. Loan Tenure: The loan tenure, or the duration for which you borrow the funds, can influence the interest rate. Longer tenures may have higher interest rates compared to shorter tenures.

5. Employment History: Lenders consider your employment history to determine your job stability. If you have a consistent employment record, you may be eligible for better interest rates.

6. Relationship with Lender: Existing customers with a good repayment history and a long-term relationship with a lender may receive preferential interest rates.

7. Market Conditions: The prevailing market conditions, such as the RBI’s monetary policy, inflation rates, and demand for loans, can impact interest rates. During times of economic slowdown, interest rates may be lower to encourage borrowing and stimulate economic growth.

How to Get the Best Personal Loan Interest Rates

Securing the best personal loan interest rates requires a combination of understanding your financial situation and taking proactive steps. Here are some strategies that can help you get the best interest rates available:

Improve Your Credit Score

Your credit score is a crucial factor in determining the interest rate you’ll receive. Taking steps to improve your credit score can significantly impact the loan terms. Here’s how you can improve your credit score:

- Pay your bills and debts on time.

- Keep your credit utilization ratio low.

- Avoid applying for multiple loans or credit cards simultaneously.

- Regularly check your credit report for errors and rectify them if necessary.

Compare Interest Rates

Before finalizing a personal loan, compare the interest rates offered by different lenders. This allows you to choose the most competitive rate available. Consider reaching out to online aggregators, checking with banks, and exploring credit unions to find the best interest rates.

Negotiate with Lenders

Don’t shy away from negotiating with lenders. If you have a good credit score, a stable income, or a long-standing relationship with a lender, use these factors to your advantage. Ask for a lower interest rate or negotiate other favorable terms.

Consider Secured Loans

Secured personal loans, backed by collateral such as property or fixed deposits, usually offer lower interest rates compared to unsecured loans. If you have assets to pledge, opting for a secured loan can help you secure a lower interest rate.

Shorten the Loan Tenure

Choosing a shorter loan tenure can lower the overall interest cost. While the monthly installments may be higher, you’ll save on the interest paid over the duration of the loan.

Pay Attention to Additional Charges

Apart from interest rates, consider other charges such as processing fees, prepayment penalties, and late payment fees. These charges can significantly impact the overall cost of the loan. Compare the total cost of borrowing, including all charges, to make an informed decision.

Understanding personal loan interest rates is crucial for responsible borrowing. By knowing how they are calculated and what factors influence them, you can make informed decisions and secure the best interest rates available. Remember to improve your credit score, compare rates, negotiate with lenders, consider secured loans, and pay attention to additional charges. With these strategies, you can navigate personal loan interest rates more effectively and save money in the long run.

About Interest Rates on Personal Loans

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a personal loan interest rate?

Personal loan interest rate refers to the cost of borrowing money from a lender. It is expressed as a percentage of the loan amount and determines the additional amount you will need to repay along with the principal loan amount.

How is the interest rate on a personal loan calculated?

The interest rate on a personal loan is calculated based on several factors, including your credit score, income, loan amount, repayment term, and the lender’s policies. Lenders use this information to assess their risk and determine the interest rate that best suits your financial profile.

What is the difference between fixed and variable interest rates on personal loans?

A fixed interest rate remains the same throughout the loan term, providing stability and predictability in your monthly installments. In contrast, a variable interest rate can fluctuate based on market conditions, potentially resulting in changes to your monthly payments.

How does my credit score affect personal loan interest rates?

Your credit score plays a crucial role in determining personal loan interest rates. A higher credit score usually results in lower interest rates, as it demonstrates your creditworthiness and ability to repay the loan. Conversely, a lower credit score may lead to higher interest rates due to perceived higher risk.

Is it possible to negotiate the interest rate on a personal loan?

Yes, it is often possible to negotiate the interest rate on a personal loan. Some lenders may be willing to lower the interest rate based on your creditworthiness, relationship with the bank, or if you can provide collateral. It’s always worth discussing your options with the lender to see if a better rate is available.

Can personal loan interest rates change over time?

If you have a personal loan with a variable interest rate, the interest rate can indeed change over time. This is because variable rates are typically tied to an underlying index, such as the prime rate or the LIBOR rate. Changes in the index will then impact the interest rate on your loan.

Are there any fees associated with personal loan interest rates?

In addition to the interest rate, personal loans may come with certain fees. Common fees include an origination fee (charged for processing the loan), prepayment penalties (if you repay the loan before the agreed-upon term), and late payment fees (for missed or late payments). It’s important to review the loan terms carefully to understand any associated fees.

Can I refinance my personal loan to get a lower interest rate?

Yes, refinancing your personal loan can be an option to obtain a lower interest rate. By refinancing, you essentially replace your existing loan with a new loan that has better terms, such as a lower interest rate. However, it’s important to consider any fees or potential impacts on your credit score before refinancing.

Final Thoughts

Understanding personal loan interest rates is essential when considering borrowing money. The interest rate determines the cost of borrowing and affects the monthly repayments. By comprehending how interest rates are calculated, individuals can make informed decisions regarding their financial obligations.

One key factor to consider is the difference between fixed and variable interest rates. While fixed rates remain unchanged throughout the loan term, variable rates can fluctuate based on market conditions. It is crucial to assess personal preferences and evaluate potential risks when choosing between the two.

Another aspect to understand is how personal loan interest rates vary based on credit scores. Lenders generally offer lower interest rates to borrowers with higher credit scores, as they are perceived as less risky. Therefore, maintaining a good credit score is vital to secure favorable interest rates.

Additionally, it is important to consider the impact of interest rates on the overall cost of the loan. Even a small percentage difference in interest rates can result in significant savings over the loan term. Therefore, individuals should compare different loan options and negotiate favorable interest rates whenever possible.

In conclusion, comprehending personal loan interest rates is crucial for making informed borrowing decisions. By understanding the difference between fixed and variable rates, the influence of credit scores, and the impact on overall loan cost, individuals can navigate the borrowing process more effectively. Taking the time to research and understand personal loan interest rates will ultimately help borrowers secure the best possible terms for their financial needs.