In your 30s, building a solid financial plan is crucial for long-term stability and success. But where do you start? How do you navigate the complex world of personal finance and make the right decisions for your future? Fear not, because in this blog article, we will guide you through the process of building a solid financial plan in your 30s. From setting clear goals to managing debt, investing wisely, and securing your financial future, we’ve got you covered. So, let’s dive in and explore how to build a solid financial plan in your 30s, step by step.

How to Build a Solid Financial Plan in Your 30s

Introduction

Entering your 30s is a significant milestone in your life, both personally and financially. It’s a time when you may be settling into a more stable career, starting a family, or considering homeownership. Building a solid financial plan during this decade can set you up for long-term success and help you achieve your financial goals.

In this article, we will explore the key steps you can take to build a solid financial plan in your 30s. From managing debt and budgeting effectively to investing for the future, we’ll cover everything you need to know to pave the way for a secure financial future.

1. Assess Your Current Financial Situation

Before you can build a solid financial plan, it’s crucial to have a clear understanding of your current financial situation. Here are some essential steps to assess your finances:

- Calculate your net worth by subtracting your liabilities from your assets. This will give you an overall picture of your financial health.

- Review your income and expenses to determine your cash flow. Identify areas where you can cut back on unnecessary expenses and allocate more funds towards savings and investments.

- Check your credit score and review your credit report for any errors or discrepancies. A good credit score is essential for accessing favorable interest rates on loans and credit cards.

2. Set Clear Financial Goals

Setting clear financial goals is the foundation of any solid financial plan. During your 30s, you may have a variety of short-term and long-term goals, such as:

- Building an emergency fund to cover unexpected expenses.

- Paying off high-interest debts, such as credit cards or student loans.

- Saving for a down payment on a home or a new car.

- Investing for retirement.

- Saving for your children’s education.

By identifying your priorities and setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, you can stay focused and motivated on your financial journey.

3. Create a Budget and Stick to It

Creating a budget is essential for managing your finances effectively. It helps you track your income and expenses, identify areas where you can cut back, and allocate funds towards your financial goals. Here are some steps to create and follow a budget:

- Track your income: Calculate your total monthly income, including salary, bonuses, and any other sources of income.

- List your expenses: Categorize your expenses into essential (e.g., housing, utilities, groceries) and non-essential (e.g., dining out, entertainment) categories.

- Set savings goals: Allocate a portion of your income towards savings and investments. Aim to save at least 10-20% of your income.

- Monitor and adjust: Regularly review your budget to ensure you’re staying on track. Make adjustments as needed, especially when your financial situation or goals change.

Remember, a budget is not meant to restrict your spending but rather to give you control over your financial decisions and help you achieve your goals.

4. Build an Emergency Fund

Life is full of unexpected events, and having a robust emergency fund can provide you with peace of mind and financial security. Here’s how you can build an emergency fund:

- Set a target: Aim to save at least three to six months’ worth of living expenses in your emergency fund.

- Automate savings: Set up automatic transfers from your checking account to a separate savings account dedicated to emergencies.

- Save windfalls: Whenever you receive unexpected money, such as a tax refund or a work bonus, allocate a portion towards your emergency fund.

Having an emergency fund can prevent you from relying on credit cards or loans during unexpected financial hardships, saving you from unnecessary debt.

5. Manage Debt Wisely

Debt can hinder your financial progress, so it’s crucial to manage it wisely. Here are some tips to handle your debt effectively:

- Pay off high-interest debt first: Focus on paying down debts with high-interest rates, such as credit card debt or personal loans.

- Consider refinancing: If you have high-interest loans, explore options to refinance them at a lower interest rate.

- Avoid taking on new debt: Limit your use of credit cards and try to pay for expenses with cash whenever possible.

- Seek professional advice: If you’re struggling with debt, consider consulting a financial advisor or credit counseling service for guidance.

By managing your debt effectively, you can free up more financial resources to invest and achieve your long-term goals.

6. Start Investing for the Future

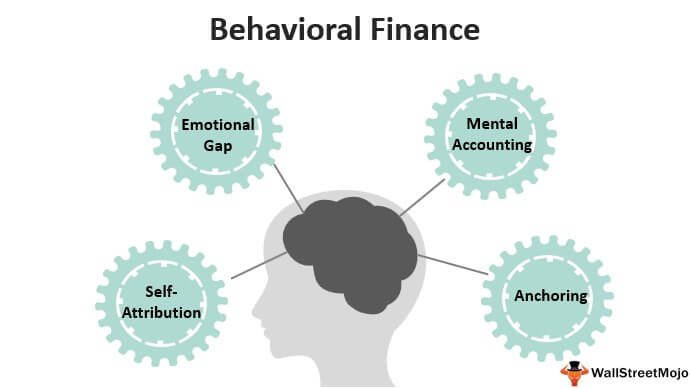

Investing is a crucial aspect of building wealth and securing your financial future. Here are some key considerations when starting to invest in your 30s:

- Understand your risk tolerance: Determine how much risk you are comfortable with when it comes to investing. This will guide your investment choices.

- Maximize tax-advantaged accounts: Take advantage of retirement accounts, such as a 401(k) or an IRA, which offer tax benefits and potential employer matching contributions.

- Diversify your investments: Spread your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk.

- Consider professional help: If you’re new to investing, it may be beneficial to seek guidance from a financial advisor to help you make informed investment decisions.

Remember, investing is a long-term strategy, so it’s essential to stay committed and avoid making impulsive investment decisions based on short-term market fluctuations.

7. Review and Adjust your Financial Plan Regularly

As your life circumstances change, it’s important to review and adjust your financial plan accordingly. Here are some instances when you should revisit your plan:

- Marriage or starting a family

- Changing careers or receiving a significant salary increase

- Buying a home or other significant purchases

- Approaching retirement

Regularly reassessing your financial plan ensures that it remains aligned with your goals and helps you make any necessary course corrections.

Building a solid financial plan in your 30s is crucial for setting yourself up for long-term financial success. By assessing your current financial situation, setting clear goals, creating a budget, building an emergency fund, managing debt, starting to invest, and reviewing your plan regularly, you can make significant progress towards achieving your financial aspirations. Remember, financial planning is a lifelong journey, so stay committed, adapt as needed, and seek professional advice when required. The actions you take today can pave the way for a financially secure future.

How To Develop A Financial Plan In Your 20's and 30's

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I build a solid financial plan in my 30s?

Building a solid financial plan in your 30s is crucial for securing your financial future. Here are some key steps to help you get started:

What should I consider when creating a financial plan in my 30s?

When creating a financial plan in your 30s, consider the following:

How much should I be saving for retirement in my 30s?

While the specific amount varies based on individual circumstances, a general rule of thumb is to save at least 15-20% of your income for retirement in your 30s.

What are some effective strategies for paying off debt in your 30s?

To effectively pay off debt in your 30s, consider the following strategies:

Is it necessary to work with a financial advisor in your 30s?

While working with a financial advisor is not mandatory, it can be beneficial in helping you navigate complex financial decisions and develop a solid financial plan tailored to your goals and circumstances.

How can I prioritize my financial goals in my 30s?

To prioritize your financial goals in your 30s, follow these steps:

What are some recommended investment options for building wealth in your 30s?

Consider the following investment options to build wealth in your 30s:

How can I protect my financial plan from unexpected emergencies in my 30s?

To protect your financial plan from unexpected emergencies in your 30s:

Please note that the specific details of your financial plan may vary based on your individual circumstances. It is recommended to consult with a financial professional to tailor your plan to your specific needs and goals.

Final Thoughts

In conclusion, building a solid financial plan in your 30s is crucial for securing your future financial stability. Start by setting clear and achievable goals, such as saving for retirement, paying off debts, and building an emergency fund. Take advantage of investment opportunities, diversify your portfolio, and seek professional advice when needed. Budgeting and tracking expenses will help you stay on top of your finances, while regularly reviewing and adjusting your plan will ensure it remains relevant to your changing circumstances. By prioritizing financial literacy and discipline, you can build a solid financial plan that will set you up for long-term success and peace of mind in your 30s and beyond.