Navigating finances during unemployment can be overwhelming, but it doesn’t have to be an insurmountable challenge. In this article, we’ll explore practical tips and strategies on how to effectively manage your finances during this difficult period. Whether you’ve recently lost your job or find yourself in between positions, it’s crucial to have a solid plan in place to ensure financial stability and peace of mind. So, if you’re wondering how to navigate finances during unemployment, you’ve come to the right place. Let’s dive in and explore some practical steps to help you maintain control over your finances during this transitional phase.

How to Navigate Finances During Unemployment

Losing a job can be a challenging and stressful situation, especially when it comes to managing your finances. It’s essential to have a plan in place to navigate this period and ensure your financial stability. In this article, we will discuss various strategies and tips to help you effectively manage your finances during unemployment.

Assessing Your Financial Situation

The first step in navigating finances during unemployment is assessing your current financial situation. Take a close look at your income, expenses, and savings to get a clear understanding of where you stand. Here are some key aspects to consider:

1. Income: Calculate the exact amount of income you have from all sources, including severance pay, unemployment benefits, and potential side gigs or freelance work. This will give you an idea of how much money you have coming in every month.

2. Expenses: Make a detailed list of your monthly expenses, including rent or mortgage payments, utilities, groceries, transportation, insurance, and any other regular bills. Identify areas where you can cut back and reduce expenses if necessary.

3. Savings: Evaluate the amount of savings you currently have. This includes emergency funds, investments, and any other financial assets that you can tap into during this period of unemployment.

4. Debts: Take stock of any outstanding debts you may have, such as credit card balances, student loans, or personal loans. It’s important to prioritize and manage your debts efficiently to avoid unnecessary financial stress.

Create a Budget

Once you have assessed your financial situation, creating a budget becomes crucial. A budget helps you allocate your limited resources effectively and ensures you can cover necessary expenses while saving for the future. Here’s how to create a budget during unemployment:

1. Track Your Expenses: Start by tracking every expense you make for a month. This will help you understand where your money is going and identify areas where you can cut back.

2. Prioritize Essential Expenses: Determine your essential expenses, such as housing, utilities, food, and healthcare. Make sure these are covered first in your budget.

3. Trim Non-Essential Spending: Look for ways to reduce discretionary expenses like dining out, entertainment, and unnecessary subscriptions. Cutting back on these expenses can free up more money for essential needs.

4. Set Realistic Goals: Assess your income and savings to set realistic financial goals. Aim to save a certain percentage of your monthly income and build an emergency fund to provide a safety net during unemployment.

5. Review and Adjust: Regularly review your budget and make necessary adjustments as your financial situation changes. Stay flexible and adapt to new circumstances.

Explore Government Assistance and Benefits

During unemployment, it’s essential to be aware of the government assistance and benefits available to you. These programs can provide financial support and help cover essential expenses. Here are some options to consider:

1. Unemployment Benefits: File for unemployment benefits as soon as possible. Each state has its own requirements and eligibility criteria, so make sure to check with your local unemployment office. These benefits can provide a temporary income stream while you search for a new job.

2. Government Assistance Programs: Research and explore other government assistance programs that you may qualify for. These can include food assistance, healthcare subsidies, housing assistance, and utility bill support. Check with your local government offices or online resources for more information.

3. Credit Card and Loan Relief: If you have outstanding credit card debt or loans, contact your creditors to explore options for temporary relief. Many financial institutions offer hardship programs that can lower interest rates, waive fees, or allow for deferred payments during challenging times.

Reduce Expenses and Increase Income

When facing unemployment, finding ways to reduce expenses and increase income becomes crucial to maintain financial stability. Consider the following strategies:

1. Review Insurance Coverage: Evaluate your insurance policies, such as health, auto, and home insurance. Shop around for better rates or consider adjusting your coverage to save on premiums without compromising essential protection.

2. Downsize and Declutter: Take advantage of this downtime to declutter your home and sell items you no longer need. Not only will this help you generate some extra cash, but it will also reduce the amount of stuff you have to move if you decide to relocate for a new job.

3. Explore Freelancing or Side Gigs: Consider taking on freelance work or side gigs to supplement your income. Look for opportunities in your field of expertise or explore online platforms that connect freelancers with clients in need of specific services.

4. Utilize Your Skills and Hobbies: Identify skills or hobbies that can be monetized. Whether it’s graphic design, writing, photography, or tutoring, you may find opportunities to offer your services and generate income.

5. Take Advantage of Community Resources: Look for local community resources that offer assistance during unemployment. This can include job placement services, career counseling, or workshops on financial management. These resources can provide valuable support and guidance during your job search.

Manage Debt and Protect Your Credit Score

During unemployment, managing debt becomes crucial to avoid long-term financial consequences. Here’s how you can protect your credit score and manage your debts effectively:

1. Communicate with Creditors: If you’re struggling to make debt payments, reach out to your creditors and explain your situation. Many creditors are willing to work with you and offer temporary relief options such as reduced payments or forbearance.

2. Monitor Your Credit: Regularly monitor your credit report to ensure there are no errors or fraudulent activities impacting your credit score. Several online platforms offer free credit monitoring services that can help you stay on top of any changes.

3. Explore Debt Consolidation: If you have multiple debts with high-interest rates, consider consolidating them into a single loan with a lower interest rate. This can simplify repayment and save you money on interest charges.

4. Avoid New Debt: Be cautious about taking on new debt during unemployment. Focus on managing existing debt and be mindful of your spending habits to avoid falling into further financial strain.

Investigate Healthcare and Insurance Options

Losing a job often means losing employer-sponsored health insurance. It’s crucial to understand your healthcare and insurance options during unemployment. Consider the following:

1. COBRA Insurance: If you qualify, COBRA insurance allows you to continue your employer-sponsored health insurance coverage for a limited time, but at your own expense. While it may be more expensive than other options, it ensures you maintain comprehensive coverage during the transition period.

2. Health Insurance Marketplace: Explore health insurance options available through the government’s Health Insurance Marketplace. Depending on your income, you may qualify for subsidies that can significantly reduce your monthly premium costs.

3. Medicaid: If your income falls below a certain threshold, you may be eligible for Medicaid, a government program that provides health coverage for low-income individuals and families. Check your eligibility and apply through your state’s Medicaid office.

Emotional Support and Self-Care

Unemployment can take a toll on your emotional well-being. It’s important to prioritize self-care and seek emotional support during this challenging time. Consider the following:

1. Reach Out to Support Networks: Lean on family, friends, and support networks for emotional support and encouragement. Share your concerns and feelings with them. Sometimes, talking about your worries can provide a sense of relief.

2. Take Care of Your Mental and Physical Health: Engage in activities that promote mental well-being, such as exercise, meditation, and hobbies. Take advantage of free or low-cost resources like community centers or online platforms that offer mental health support.

3. Stay Positive and Maintain a Routine: Establish a daily routine to maintain productivity and a sense of normalcy. Set goals for yourself and celebrate small victories along the way. Remember that unemployment is temporary, and with perseverance, you will find a new opportunity.

By implementing these strategies and tips, you can navigate your finances effectively during unemployment. Remember to stay proactive, seek support when needed, and remain optimistic about your future financial prospects.

Top mistakes people make when filing for unemployment benefits with EDD in California

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I navigate my finances during unemployment?

During unemployment, it is crucial to manage your finances wisely to ensure financial stability. Here are some steps you can take:

What should I do if I lose my job?

If you lose your job, there are a few immediate actions you should take:

Should I create a budget when I am unemployed?

Yes, creating a budget is essential when you are unemployed as it helps you track your expenses and manage your money effectively. Follow these steps to create a budget:

What are some ways to reduce expenses during unemployment?

To cut down on expenses during unemployment, consider the following strategies:

How can I handle my debt while I am unemployed?

Managing debt during unemployment can be challenging, but there are options available to help you cope:

What are some options for generating income while unemployed?

If you are unemployed and need to generate income, explore these potential avenues:

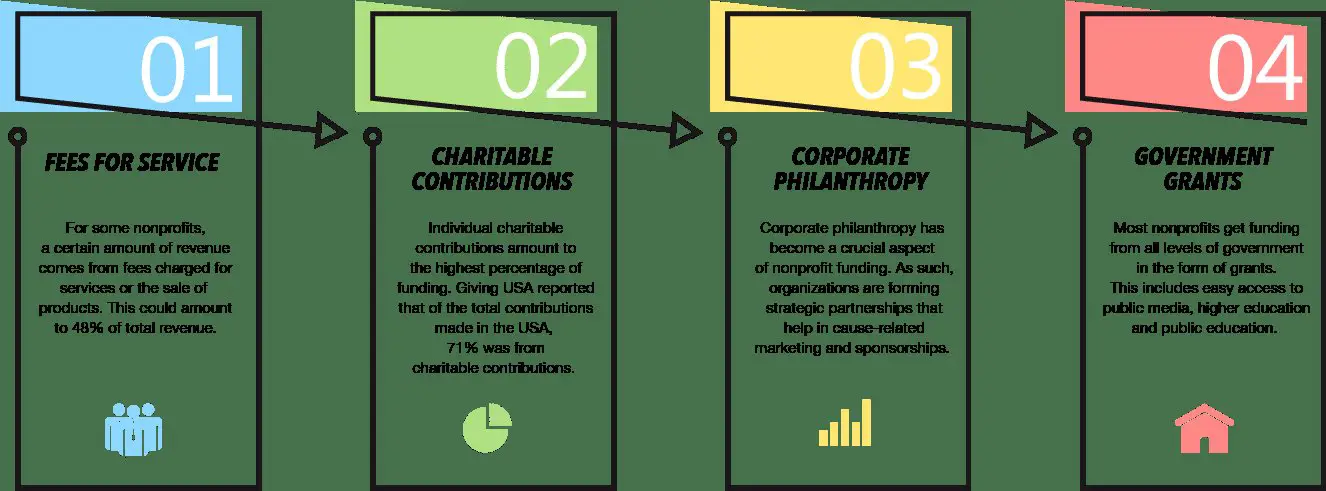

What financial assistance programs are available for the unemployed?

Various financial assistance programs exist to support those who are unemployed. Consider the following options:

How can I protect my credit score during unemployment?

Unemployment can impact your credit score, but you can take steps to protect it:

Final Thoughts

Navigating finances during unemployment can be a challenging task, but with careful planning and proactive steps, it is possible to manage this difficult period. Firstly, create a budget that reflects your new financial situation and prioritize essential expenses such as housing, utilities, and food. Remember to explore available government programs and resources that can provide temporary financial assistance. Additionally, consider ways to generate income through freelance work or part-time jobs. Finally, focus on building an emergency fund for future uncertainties. By taking these practical measures, you can successfully navigate finances during unemployment.