Looking to manage your finances while on a career break? Wondering how to stay financially stable during this time? Well, you’re in luck! In this blog article, we will explore effective strategies to help you navigate your financial journey while taking a break from your career. From budgeting wisely to exploring alternative income sources, we’ve got you covered. So, let’s dive in and discover how to manage finances while on a career break.

How to Manage Finances While on a Career Break

Taking a career break can be an exciting and fulfilling decision. Whether you’re planning to travel, pursue further education, or explore new opportunities, it’s essential to have a solid financial plan in place. Managing your finances effectively during this time will allow you to make the most of your break without worrying about money. In this article, we will discuss various strategies and tips to help you manage your finances while on a career break.

Create a Budget

One of the first steps in managing your finances during a career break is to create a budget. A budget will give you a clear picture of your income, expenses, and savings goals. It’s crucial to assess your financial situation realistically and identify areas where you can cut back on expenses. Here’s how to create an effective budget:

- List your sources of income during the career break.

- Track your expenses from the past few months to identify spending patterns.

- Categorize your expenses, including essentials (rent, utilities, groceries), discretionary spending (entertainment, dining out), and savings.

- Set realistic goals for each category based on your income and priorities.

- Regularly track your expenses and adjust your budget as needed.

Save Before Taking the Career Break

Saving a sufficient amount of money before taking a career break is essential for financial security during that period. Here are a few strategies to boost your savings:

- Reduce discretionary spending: Cut back on non-essential expenses, such as dining out, entertainment, and shopping.

- Automate savings: Set up automatic transfers from your paycheck or checking account to a dedicated savings account.

- Consider a side hustle: Take on part-time work or freelancing opportunities to increase your income and save more.

- Revisit your budget: Continually review your budget to identify additional areas where you can save money.

Explore Income Generating Opportunities

While on a career break, it may be beneficial to explore income generating opportunities to supplement your savings. Here are a few ideas to consider:

- Freelancing or consulting: Leverage your skills and expertise to offer freelance or consulting services on a project basis.

- Rent out your space: If you have an extra room or property, consider renting it out on platforms like Airbnb or through long-term rentals.

- Part-time or temporary work: Look for temporary or part-time job opportunities that align with your interests and skills.

- Create passive income streams: Explore passive income options such as investing in stocks, real estate, or creating an online course.

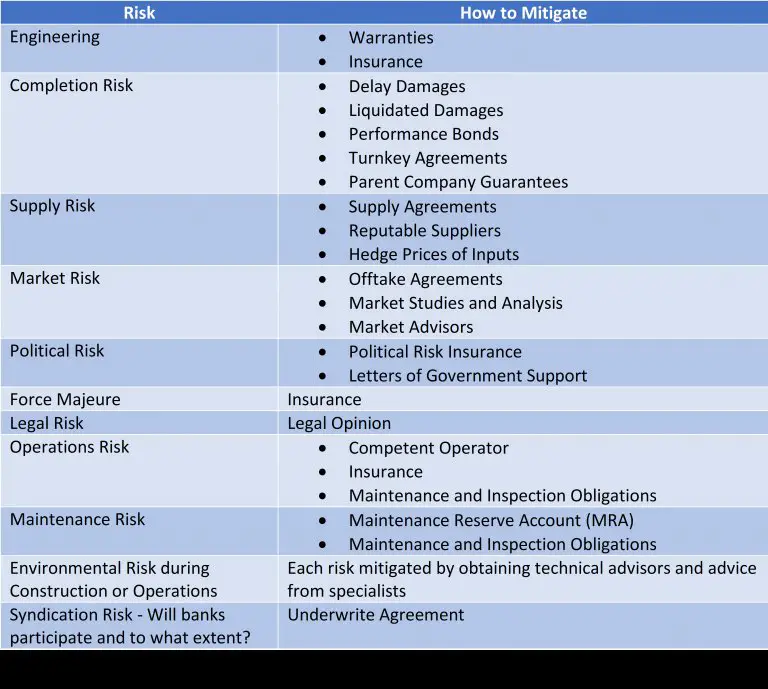

Manage Existing Debt

If you have existing debt, such as student loans or credit card debt, it’s crucial to manage it effectively during your career break. Here are a few strategies to consider:

- Review your debt repayment plan: Assess your repayment plan and consider adjusting it based on your current financial situation.

- Consolidate or refinance loans: Explore options to consolidate or refinance your loans to get better interest rates.

- Communicate with lenders: If you are struggling to make payments, reach out to your lenders and discuss possible options such as deferment or reduced payments.

- Create a repayment strategy: Prioritize your debts based on interest rates and pay off high-interest debts first while making minimum payments on others.

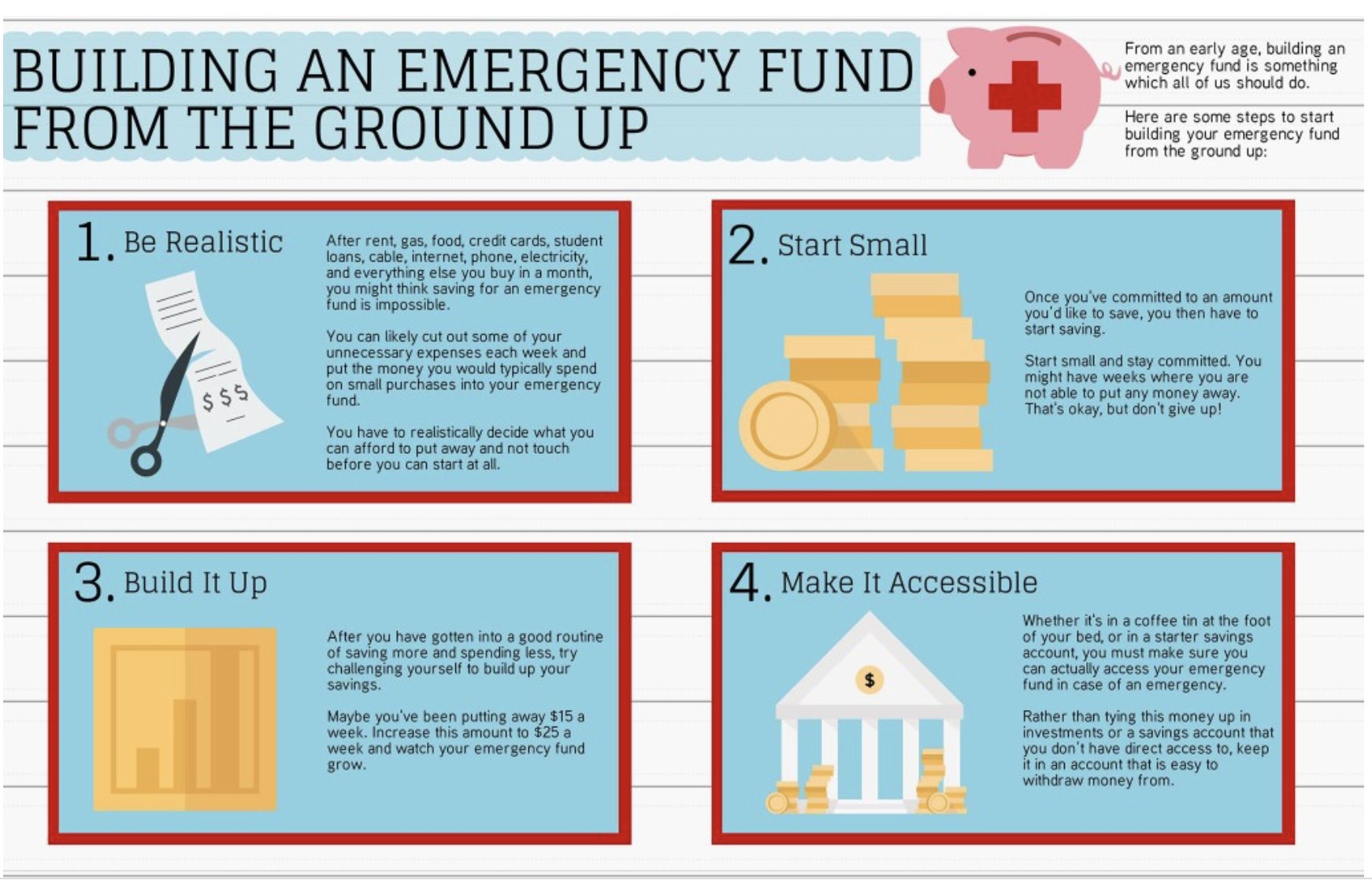

Consider Insurance and Emergency Funds

During a career break, it’s crucial to have adequate insurance coverage and emergency funds. Here’s what you should consider:

- Health insurance: Ensure that you have proper health insurance coverage, whether it’s through your previous employer, private insurance, or government programs.

- Travel insurance: If you plan to travel during your career break, consider purchasing travel insurance to protect yourself from unexpected costs.

- Emergency fund: Build an emergency fund that covers at least three to six months of living expenses in case of unforeseen circumstances like medical emergencies or job loss.

Monitor and Adjust Your Financial Plan

Once you have your budget, savings, income-generating strategies, and debt management plan in place, it’s essential to monitor and adjust your financial plan regularly. Here are a few tips:

- Track your expenses: Continually track your spending to ensure you’re sticking to your budget.

- Review your investments: Keep an eye on your investments and adjust them as needed based on market conditions or your financial goals.

- Reassess your budget: Revisit your budget periodically to reflect any changes in your income, expenses, or savings goals.

- Seek financial advice if needed: If you’re unsure about certain financial aspects, consider consulting a financial advisor for guidance tailored to your specific situation.

Remember, managing your finances while on a career break requires discipline, planning, and adaptability. By creating a budget, saving before taking the break, exploring income-generating opportunities, managing debt, having insurance and emergency funds, and monitoring your financial plan, you can enjoy your career break without unnecessary financial stress.

Sabbaticals: Time [off] well spent | Dennis DiDonna | TEDxEVHS

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Can I manage my finances while on a career break?

Yes, it is possible to manage your finances effectively while on a career break. With careful planning and budgeting, you can ensure your financial stability during this time.

How should I create a budget for my career break?

To create a budget for your career break, start by assessing your income, expenses, and financial goals. Determine your essential expenses and prioritize them accordingly. Cut back on non-essential expenses and allocate funds towards savings or emergency funds.

What steps can I take to save money during a career break?

To save money during a career break, consider reducing discretionary spending, finding cost-effective alternatives for entertainment, shopping, and travel. Additionally, explore ways to generate extra income through part-time work or freelancing opportunities.

Should I consider pausing or adjusting my savings and investments during a career break?

It is important to review your savings and investments during a career break. Consider adjusting your contributions or pausing certain investments if necessary. Consult with a financial advisor to ensure your long-term financial goals are not compromised.

How can I make the most of my existing savings during a career break?

To make the most of your existing savings during a career break, focus on smart spending. Prioritize necessary expenses, explore ways to reduce costs, and consider alternative options for major expenses such as housing or transportation.

What are some strategies to generate income while on a career break?

While on a career break, you can explore part-time work, freelance opportunities, or even starting your own small business. Look for flexible or remote work options that align with your skills and interests.

What financial safety nets should I have in place during a career break?

During a career break, it is crucial to have a safety net in place. This can include having an emergency fund to cover unexpected expenses, ensuring adequate health and life insurance coverage, and considering disability or income protection insurance.

How can I prepare financially for returning to work after a career break?

To prepare financially for returning to work after a career break, consider updating your skills through training or online courses. Review your resume and network with professionals in your industry. Plan for potential additional expenses such as childcare or transportation.

Note: The answers provided are general guidelines and may vary depending on individual circumstances. It is recommended to consult with a financial advisor for personalized advice.

Final Thoughts

When taking a career break, managing finances becomes essential to ensure stability and avoid any financial stress. Prioritizing a detailed budgeting plan is crucial in this situation, allowing you to track expenses and identify areas where you can cut back. It is important to explore options for supplementing income during the break, such as freelancing or part-time work. Additionally, reviewing and adjusting your investments and insurance policies can help optimize your financial situation. With careful planning and proactive measures, managing finances while on a career break can be successfully accomplished.