Are you looking for tips on how to build a solid financial legacy? Look no further! Building a financial legacy is not just about accumulating wealth; it’s about taking deliberate steps to ensure that your hard-earned money lasts for generations to come. In this article, we will delve into actionable tips for building a financial legacy that will set you and your family up for long-term financial security and prosperity. So, let’s get started on this journey towards creating a lasting financial legacy that you can be proud of.

Tips for Building a Financial Legacy

Introduction

Building a strong financial legacy is a goal that many individuals strive to achieve. It involves creating a solid foundation for future generations, ensuring financial stability, and leaving a lasting impact. However, it requires careful planning, discipline, and smart decision-making. In this article, we will explore a range of tips and strategies to help you build a successful financial legacy and secure a bright future for yourself and your family.

1. Establish Clear Financial Goals

Before embarking on your journey to build a financial legacy, it is crucial to establish clear and realistic financial goals. These goals will act as a roadmap, guiding your decisions and actions. Consider what you want to achieve in terms of wealth accumulation, investments, debt reduction, education funds, and charitable contributions.

- Write down your goals in detail.

- Set specific targets and a timeline for achieving them.

- Ensure your goals align with your values and priorities.

2. Create a Solid Financial Plan

To build a financial legacy, a well-designed and comprehensive financial plan is essential. A financial plan serves as a blueprint for managing your money effectively and achieving your long-term goals. Here are some key steps to create a solid financial plan:

- Assess your current financial situation: Calculate your net worth, analyze your income and expenses, and evaluate your overall financial health.

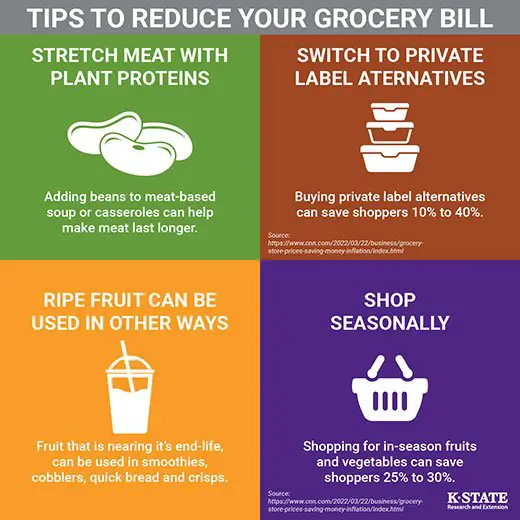

- Set a budget: Create a realistic budget that aligns with your financial goals. Track your expenses and find areas where you can cut back and save.

- Build an emergency fund: Set aside a portion of your income as an emergency fund to cover unexpected expenses.

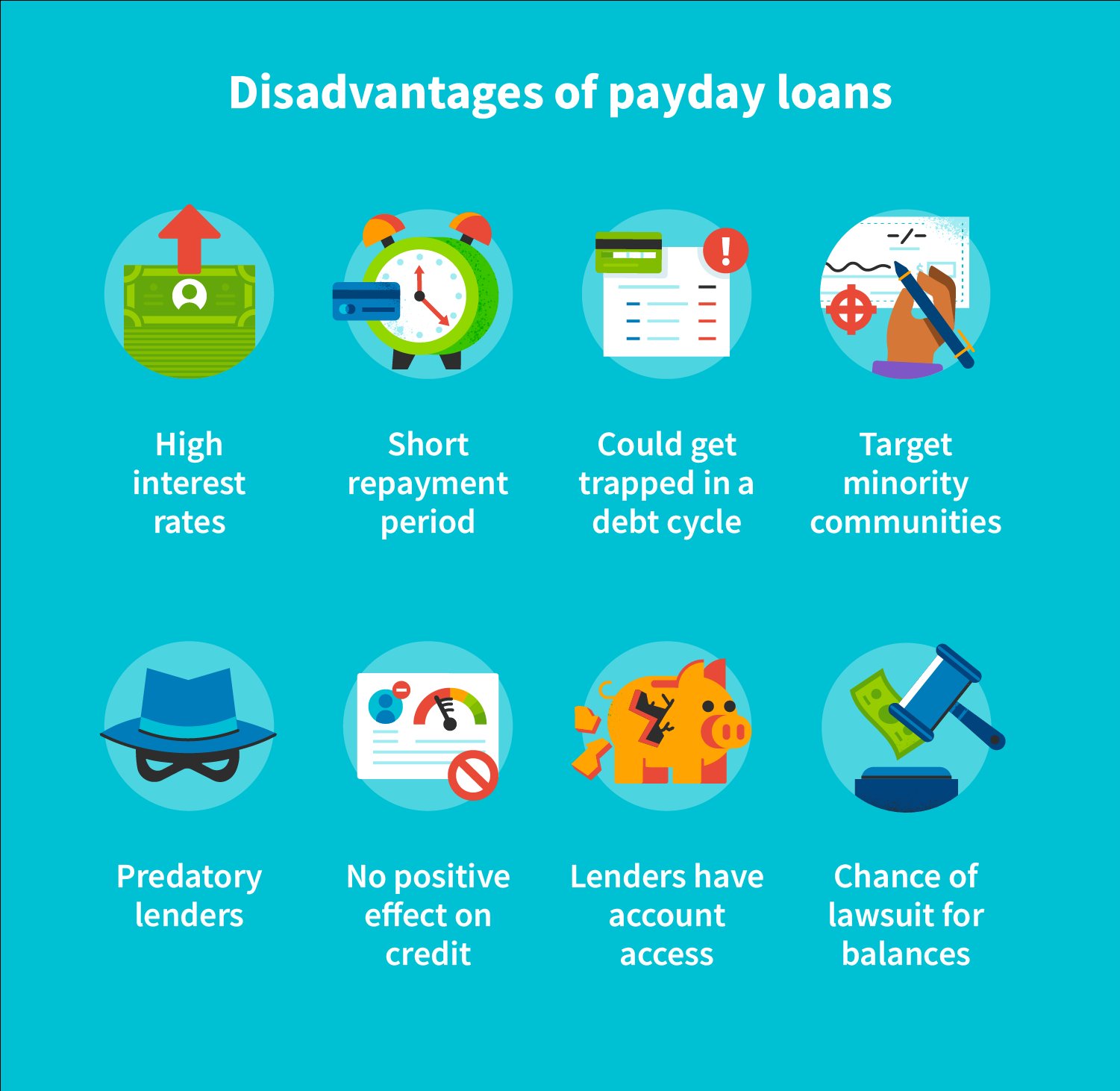

- Manage debt: Develop a strategy to pay off high-interest debt systematically. Prioritize debt repayment to avoid unnecessary interest payments.

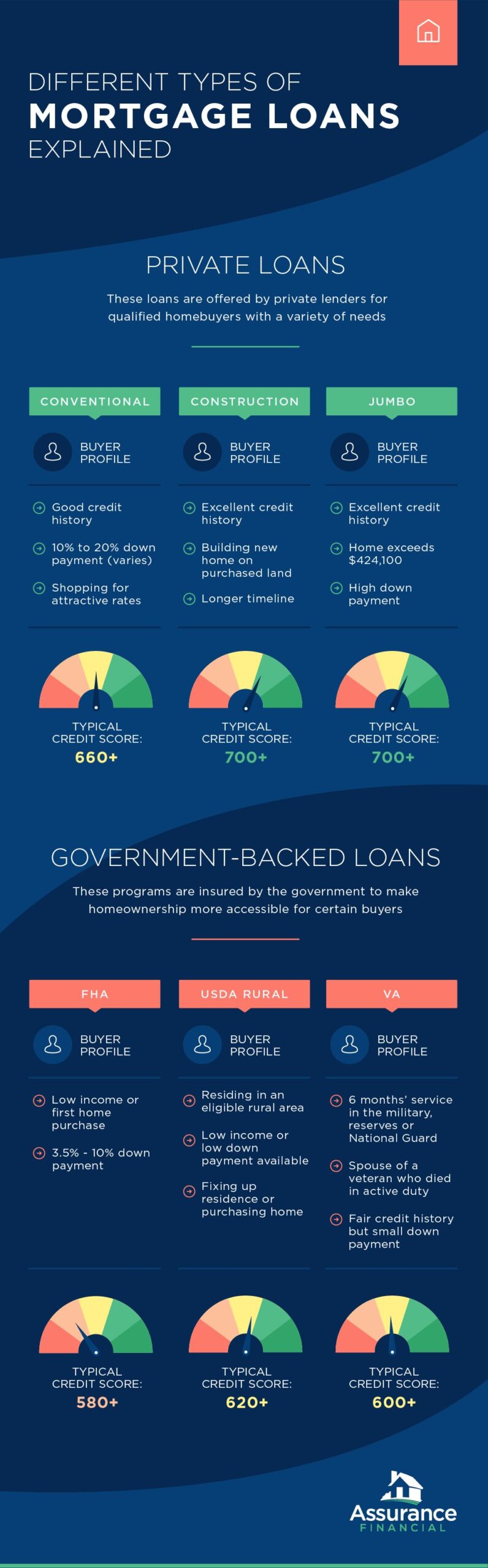

- Establish investment strategies: Determine the appropriate investment vehicles that suit your risk tolerance and long-term goals. Seek professional advice if needed.

- Review and adjust regularly: Revisit your financial plan periodically to ensure it remains relevant and aligned with your evolving circumstances.

3. Focus on Long-Term Investing

Investing is a powerful way to grow your wealth and leave a financial legacy. However, it is important to adopt a long-term perspective and avoid short-term market fluctuations. Here are some tips for successful long-term investing:

- Diversify your investments: Spread your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds, to minimize risk.

- Invest consistently: Set up a systematic investment plan and contribute regularly to your investment portfolio. This approach takes advantage of dollar-cost averaging and allows you to benefit from compounding returns over time.

- Stay informed: Keep up-to-date with market trends, economic news, and changes in investment landscapes. However, avoid making impulsive decisions based on short-term market volatility.

- Work with a financial advisor: Seek professional advice from a qualified financial advisor who can provide personalized guidance tailored to your risk tolerance, goals, and investment horizon.

4. Minimize Tax Liabilities

One of the keys to building a strong financial legacy is minimizing tax liabilities. Paying unnecessary taxes can erode your wealth over time. Consider the following strategies to optimize your tax situation:

- Take advantage of tax-efficient investment accounts: Maximize contributions to tax-advantaged accounts such as individual retirement accounts (IRAs) and 401(k) plans.

- Utilize tax-loss harvesting: Offset capital gains by selling investments with capital losses, reducing your overall tax liability.

- Consider charitable giving: Donate to qualified charities to receive tax deductions while supporting causes you care about.

- Consult with a tax professional: Work with a knowledgeable tax professional who can help you navigate complex tax laws and identify potential savings opportunities.

5. Educate and Empower Future Generations

A crucial aspect of building a financial legacy is ensuring that future generations are equipped with the knowledge and skills to manage wealth responsibly. Empower your children and grandchildren to make informed financial decisions by:

- Teaching financial literacy: Educate young family members about budgeting, saving, investing, and the importance of responsible money management.

- Introduce them to investing: Encourage the habit of investing early by setting up investment accounts for your children or contributing to their educational savings.

- Instill philanthropic values: Teach the importance of giving back to the community and involve younger family members in charitable activities.

- Establish trusts and inheritances: Work with an estate planning attorney to create trusts or set guidelines for inheritances that promote responsible wealth management.

6. Review Estate Planning and Protection

Estate planning is a critical element in building a financial legacy. It ensures that your assets are distributed according to your wishes and minimizes potential conflicts among beneficiaries. Consider these steps for effective estate planning:

- Create a will: Draft a legally binding will that clearly defines how your assets should be distributed upon your passing.

- Designate beneficiaries: Ensure all your financial accounts and insurance policies have designated beneficiaries to avoid delays and legal complications.

- Establish a trust: Set up a trust, such as a revocable living trust, to protect your assets, avoid probate, and maintain privacy.

- Review and update regularly: Regularly review your estate plan to reflect any changes in your financial situation, family circumstances, or legal regulations.

- Consider life insurance: Determine if life insurance is necessary to provide for your loved ones and cover potential estate taxes.

7. Seek Professional Guidance

Building a financial legacy can be complex, and seeking professional guidance can provide invaluable support. Consider working with professionals such as:

- Financial advisors: Engage a certified financial planner (CFP) or wealth manager who can help you navigate investment strategies, retirement planning, and overall wealth management.

- Estate planning attorneys: Collaborate with experienced attorneys who specialize in estate planning to ensure your wishes are properly documented and legally binding.

- Tax professionals: Consult with tax professionals or certified public accountants (CPAs) who can optimize your tax planning strategies and ensure compliance with tax laws.

Building a financial legacy requires dedication, discipline, and a forward-thinking mindset. By implementing the tips outlined in this article, you can create a solid financial plan, invest wisely, minimize tax liabilities, educate future generations, and protect your assets through effective estate planning. Remember that building a financial legacy is a lifelong journey, so regularly review and adjust your strategies to stay on track. With careful planning and informed decision-making, you can build a lasting financial legacy for yourself and your loved ones.

You're Richer Than You Think!: A Step by Step Guide to building a lasting financial legacy

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Q: Why is building a financial legacy important?

A: Building a financial legacy is important because it allows you to leave a lasting impact on future generations. It provides financial security, stability, and opportunities for your loved ones after you’re gone.

Q: How can I start building a financial legacy?

A: To start building a financial legacy, you can begin by setting clear financial goals, creating a budget, saving and investing wisely, and educating yourself about personal finance strategies. Consistency and discipline are key.

Q: What are some tips for effective estate planning?

A: Effective estate planning is crucial for building a financial legacy. Here are some tips to consider: regularly review and update your will, establish a trust, appoint a reliable executor, consider life insurance policies, and consult with a professional estate planner.

Q: How can I ensure my financial legacy lasts for multiple generations?

A: To ensure your financial legacy lasts for multiple generations, it’s important to involve your family in your financial planning, provide financial education to younger generations, set up trusts or foundations, and choose appropriate investment strategies with long-term growth potential.

Q: What role does philanthropy play in building a financial legacy?

A: Philanthropy can be an integral part of building a financial legacy. By giving back to causes that align with your values, you not only make a positive impact on society but also create a lasting legacy that reflects your values and beliefs.

Q: Is it necessary to involve a financial advisor or planner in building a financial legacy?

A: While it’s not mandatory, involving a financial advisor or planner can be highly beneficial in building a financial legacy. They can provide expert guidance, assist in creating customized financial strategies, and help navigate complex financial decisions to maximize the effectiveness of your legacy planning.

Q: How can I ensure my financial legacy aligns with my values and goals?

A: To ensure your financial legacy aligns with your values and goals, take the time to clearly define and communicate them to your loved ones and financial advisors. Regularly review and update your plans to reflect any changes in your values, goals, or life circumstances.

Q: Are there any tax implications associated with building a financial legacy?

A: Yes, there can be tax implications related to building a financial legacy. It’s important to consult with a tax professional or accountant who can provide guidance on tax-efficient strategies, such as gifting, charitable contributions, and estate planning, to minimize tax burdens.

Final Thoughts

In conclusion, building a financial legacy requires careful planning and disciplined execution. Start by setting clear financial goals and creating a budget to achieve them. Saving consistently and investing wisely are key factors in growing your wealth over time. Diversify your investment portfolio and regularly review and adjust it as needed. Protect your assets through insurance and estate planning. Educate yourself about personal finance and seek professional advice when necessary. By following these tips for building a financial legacy, you can secure your future and leave a lasting financial impact for generations to come.