Investment portfolio rebalancing is a crucial aspect of maintaining a well-diversified and successful investment strategy. Wondering what it is and how it can benefit you? Look no further! This article will guide you through the world of investment portfolio rebalancing, explaining its purpose and importance. Whether you’re a seasoned investor or just starting out, understanding this concept is essential for maximizing returns and managing risk. So, let’s dive in and explore the ins and outs of what an investment portfolio rebalancing truly entails.

What is Investment Portfolio Rebalancing?

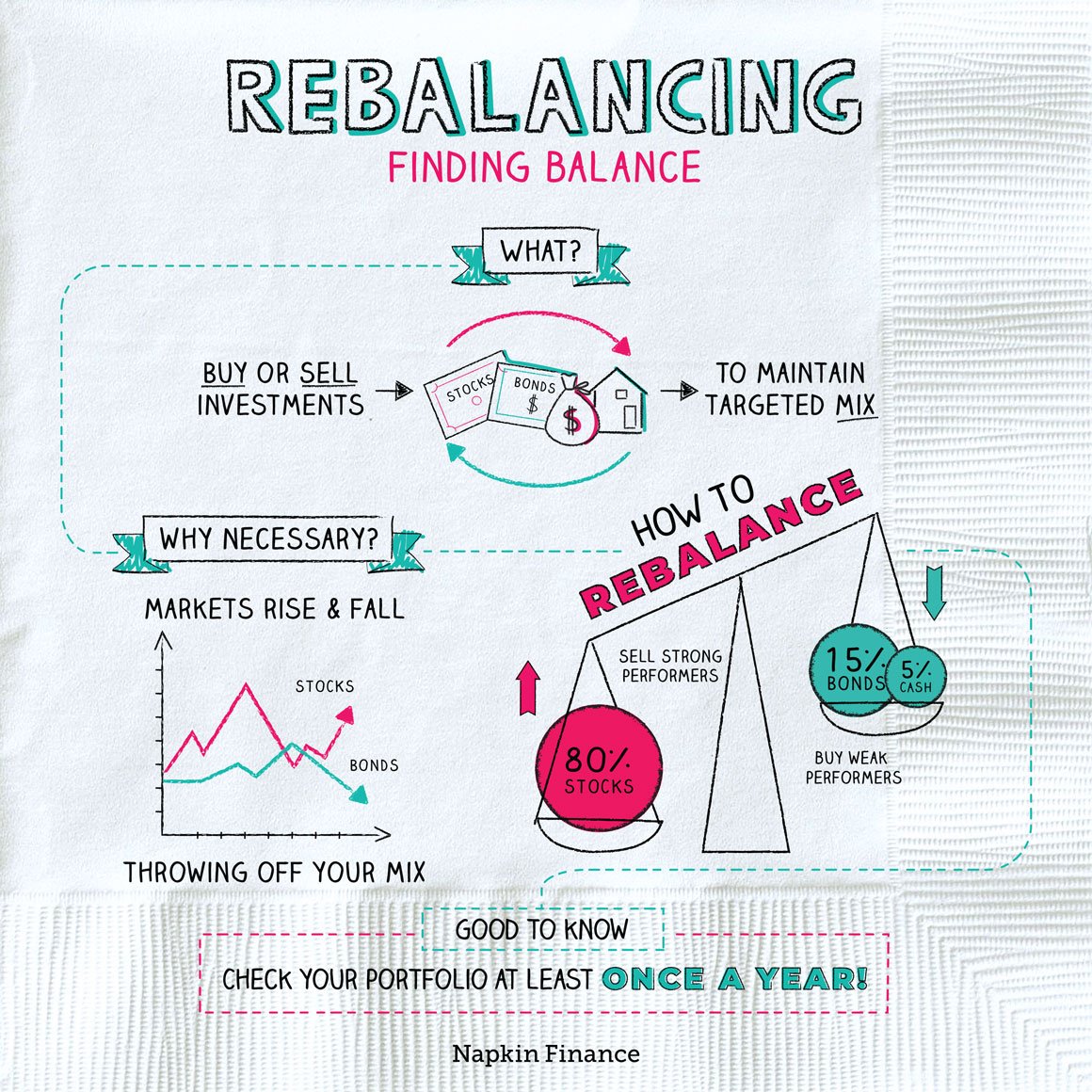

Investment portfolio rebalancing is a financial strategy used by investors to maintain their desired asset allocation over time. It involves periodically adjusting the proportions of different investments within a portfolio, ensuring that it aligns with the investor’s long-term goals and risk tolerance.

Portfolio rebalancing helps investors manage risk and optimize returns by selling overperforming assets and buying underperforming ones. This process ensures that the portfolio’s risk exposure remains within the investor’s desired level, which is crucial for long-term financial success.

Why is Investment Portfolio Rebalancing Important?

Maintaining the right asset allocation is crucial for any investor. Over time, market fluctuations can cause the value of different investments within a portfolio to change. As a result, the portfolio’s asset allocation may deviate from the original plan.

Here’s why investment portfolio rebalancing is important:

1. Manage Risk: Rebalancing allows investors to manage their risk exposure. Without regular rebalancing, market changes can lead to an overexposure to certain assets, which may increase the portfolio’s vulnerability to market downturns.

2. Preserve Long-Term Goals: Rebalancing helps investors stay focused on their long-term goals. By periodically realigning the portfolio, investors can ensure that it stays in line with their overall investment strategy.

3. Optimize Returns: Through rebalancing, investors have an opportunity to optimize their returns. Selling overperforming assets allows them to lock in profits, while buying underperforming assets enables them to take advantage of potential future growth.

4. Avoid Emotional Decisions: Emotional decision-making can negatively impact investment performance. Rebalancing provides investors with a disciplined approach, reducing the likelihood of making impulsive decisions based on short-term market fluctuations.

How Does Investment Portfolio Rebalancing Work?

The process of investment portfolio rebalancing involves several steps. Let’s explore each step in detail:

1. Set an Asset Allocation Plan: Before starting the rebalancing process, investors need to establish their desired asset allocation. This plan outlines the target percentages for each asset class or investment type within the portfolio.

2. Monitor Asset Performance: Regularly monitoring the performance of different assets in the portfolio is crucial. This helps identify any significant deviations from the target allocation.

3. Identify Deviations: When monitoring asset performance, investors should identify assets that have deviated from their target allocation. These deviations can occur due to market movements and changes in asset values.

4. Determine Rebalancing Thresholds: Setting specific thresholds for rebalancing is important to avoid unnecessary adjustments caused by minor fluctuations. For example, an investor may decide to rebalance if an asset deviates by more than 5% from its target allocation.

5. Execute Rebalancing: Once deviations surpass the predetermined thresholds, it’s time to execute the rebalancing. Selling or buying assets according to the deviation helps bring the portfolio back in line with the target allocation.

6. Consider Transaction Costs and Taxes: It’s essential to carefully consider transaction costs and taxes associated with rebalancing. Selling and buying assets may incur fees, and capital gains taxes can apply to profitable transactions.

7. Repeat the Process: Rebalancing is not a one-time event; it’s an ongoing process. Investors should periodically reassess their portfolios, monitor asset performance, and rebalance when necessary.

Benefits of Investment Portfolio Rebalancing

Investment portfolio rebalancing offers several benefits for investors. Let’s take a closer look at the advantages:

1. Risk Control: Rebalancing helps investors control their risk exposure. By realigning the portfolio to the target asset allocation, they can ensure a more balanced and diversified portfolio, reducing the impact of market volatility.

2. Long-Term Focus: Rebalancing encourages a long-term investment perspective. Market fluctuations can cause temporary imbalances in a portfolio, but rebalancing keeps the focus on achieving long-term financial goals.

3. Discipline: Regularly rebalancing a portfolio instills discipline in the investment process. It helps investors avoid making hasty decisions based on short-term market movements, promoting a more strategic approach to investing.

4. Opportunity for Buying Low and Selling High: Rebalancing provides an opportunity to buy underperforming assets at a lower price and sell overperforming assets at a higher price. This strategy aligns with the basic principle of buying low and selling high, potentially increasing overall returns.

5. Flexibility: Rebalancing allows investors to adjust their portfolios based on changing market conditions or personal circumstances. It provides the flexibility to adapt to new opportunities or reassess risk tolerance.

Challenges and Considerations

While investment portfolio rebalancing offers numerous benefits, there are some challenges and considerations to keep in mind:

1. Transaction Costs: Rebalancing may incur transaction costs, such as brokerage fees and taxes. These costs can impact the overall returns and should be carefully evaluated.

2. Tax Implications: Selling profitable assets during the rebalancing process can trigger capital gains taxes. Investors should consider the tax implications and consult with a tax professional if needed.

3. Market Timing: Rebalancing involves selling assets that have performed well and buying assets that have underperformed. However, timing market movements correctly is challenging, and rebalancing decisions should not be based solely on short-term market trends.

4. Asset Liquidity: In some cases, it may be difficult to rebalance a portfolio due to illiquid assets. Illiquid investments can limit the ability to adjust the allocation precisely.

5. Personal Circumstances: Personal circumstances, such as changes in income, risk tolerance, or investment goals, may require adjustments to the target asset allocation. Regular evaluation of these factors is necessary to ensure the portfolio remains aligned with individual needs.

Investment portfolio rebalancing is an essential strategy for maintaining a well-diversified and risk-adjusted portfolio. By periodically realigning your investments, you can manage risk, optimize returns, and stay focused on your long-term financial goals. While rebalancing comes with certain challenges, the benefits far outweigh the potential drawbacks. Remember, successful investing is a disciplined and strategic journey, and rebalancing is a vital tool to navigate that path. So, take the time to review your portfolio regularly and rebalance when necessary to ensure your investments are working in harmony with your financial aspirations.

Portfolio Rebalancing – Stock Rebalancing Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is investment portfolio rebalancing?

Investment portfolio rebalancing is the process of adjusting the composition of your investment portfolio to maintain the desired asset allocation. It involves selling and buying assets within the portfolio to bring it back in line with your predetermined targets.

Why is investment portfolio rebalancing important?

Regularly rebalancing your investment portfolio is important to maintain your desired level of risk and return. Over time, the value of different investments within your portfolio can change, causing your asset allocation to deviate from your original goals. Rebalancing helps ensure that you do not become overexposed to certain assets or markets.

How often should I rebalance my investment portfolio?

The frequency of rebalancing depends on your investment strategy and personal preferences. Some investors rebalance on a set schedule, such as annually or semi-annually. Others may rebalance when the asset allocation deviates beyond a certain percentage threshold. It is generally recommended to rebalance at least once a year.

What factors should I consider when rebalancing my portfolio?

There are several factors to consider when rebalancing your investment portfolio. These include your target asset allocation, investment goals, time horizon, risk tolerance, and any changes in your financial circumstances. Additionally, you may want to assess the performance and outlook of the different asset classes within your portfolio.

How do I rebalance my investment portfolio?

To rebalance your investment portfolio, you need to review the current asset allocation, determine the desired allocation, and then execute trades to bring the portfolio in line with the targets. This may involve selling some assets that have increased in value and buying assets that have underperformed. The specific steps may vary depending on your brokerage platform or financial advisor.

What are the potential benefits of portfolio rebalancing?

Portfolio rebalancing offers several benefits, such as maintaining your desired risk tolerance, reducing the impact of market volatility, and potentially enhancing long-term returns. It helps to ensure that your portfolio stays aligned with your investment goals and prevents overexposure to a single asset class or market sector.

Are there any risks associated with portfolio rebalancing?

While portfolio rebalancing can be beneficial, it also carries some risks. One risk is the potential for transaction costs, including fees and taxes, when buying and selling assets. Additionally, rebalancing too frequently or based on short-term market movements may lead to unnecessary trading and potential underperformance.

Should I consider professional help for portfolio rebalancing?

The decision to seek professional help for portfolio rebalancing depends on your individual circumstances and comfort level. If you are unsure about the process or lack the time or expertise to rebalance your portfolio, consulting a financial advisor or investment professional can provide guidance and ensure that your portfolio is properly rebalanced based on your goals and risk tolerance.

Final Thoughts

Investment portfolio rebalancing is a crucial practice in maintaining a well-diversified and balanced investment strategy. It involves periodically reviewing and adjusting the composition of your investment portfolio. By rebalancing, you aim to bring your portfolio back to its original target allocation or adjust it based on your changing investment goals. This process ensures that your investments align with your risk tolerance and long-term objectives. By periodically realigning your portfolio, you minimize the risk of being overexposed to specific assets or asset classes. Investment portfolio rebalancing is a proactive approach to managing your investments and optimizing long-term returns.