When it comes to managing your finances, having options is crucial. And that’s where a personal line of credit comes into the picture. So, what is a personal line of credit, you ask? Well, simply put, it’s a flexible borrowing tool that allows you to access funds when you need them, all within a predetermined credit limit. Unlike a traditional loan, where you receive a lump sum upfront, a personal line of credit offers you the freedom to withdraw funds as you go, making it an ideal solution for unexpected expenses and ongoing financial flexibility. Let’s delve deeper into the world of personal lines of credit and explore how they can benefit you.

What is a Personal Line of Credit?

A personal line of credit is a flexible form of borrowing that allows individuals to access funds as needed, providing financial flexibility and convenience. It functions like a credit card but typically comes with higher credit limits and lower interest rates. With a personal line of credit, you can withdraw money up to a certain limit set by the lender, and you only pay interest on the amount you borrow, not the entire credit limit.

How Does a Personal Line of Credit Work?

Personal lines of credit work differently from traditional loans or credit cards. Here’s how they typically operate:

1. Approval and Credit Limit: When applying for a personal line of credit, your lender will assess your creditworthiness based on factors such as credit history, income, and debt-to-income ratio. If approved, they will determine your credit limit, which is the maximum amount you can borrow.

2. Borrowing Flexibility: Unlike a loan that provides a lump sum upfront, a line of credit offers the flexibility to withdraw funds as needed. You can borrow a little or the full credit limit, depending on your requirements, and you can make multiple withdrawals as long as you stay within the credit limit.

3. Repayment: Once you withdraw funds from your line of credit, you’ll need to start repaying the borrowed amount. The repayment terms depend on the lender and can vary widely. Some may require interest-only payments, while others may require minimum monthly payments that include both principal and interest.

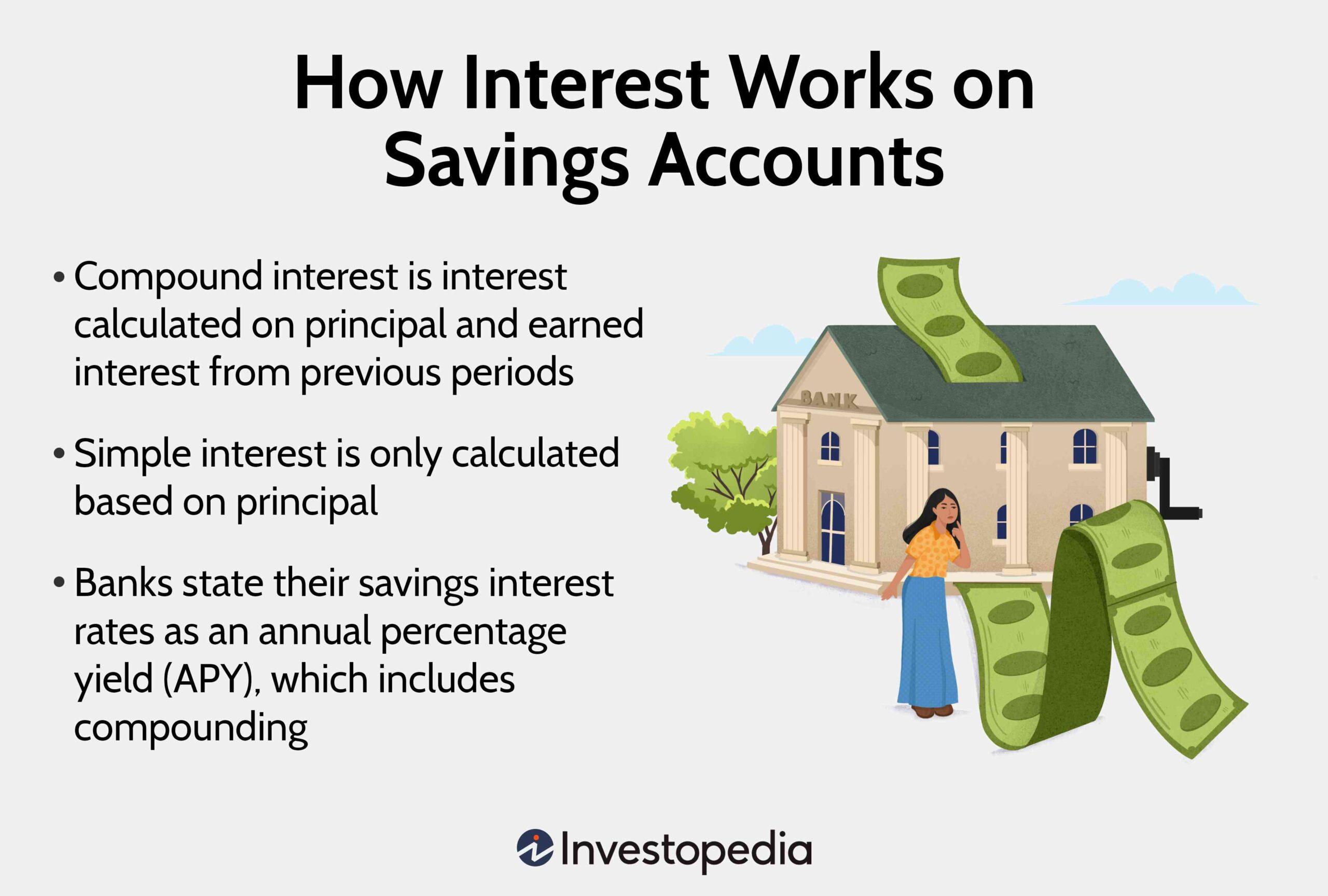

4. Interest and Fees: Interest rates for personal lines of credit are typically variable, meaning they can fluctuate over time based on market conditions. Additionally, lenders may charge annual fees, transaction fees, or other charges, so it’s essential to read the terms and conditions of the line of credit agreement.

5. Revolving Credit: One of the significant advantages of a personal line of credit is that it is a revolving form of credit. This means that as you repay the borrowed amount, the credit becomes available again for you to borrow. This feature provides ongoing access to funds without the need to reapply for a new loan.

The Benefits of a Personal Line of Credit

A personal line of credit offers several benefits that make it an attractive financing option for individuals. These include:

1. Flexibility: Having access to a personal line of credit provides financial flexibility during unforeseen expenses or emergencies. It allows you to borrow funds when needed without the hassle of applying for a new loan each time.

2. Lower Interest Rates: Personal lines of credit often come with lower interest rates compared to credit cards or other forms of unsecured credit. This can result in significant savings over time, especially if you need to borrow larger amounts.

3. Customize Borrowing: With a personal line of credit, you can borrow the exact amount you need. Unlike a loan where you receive a lump sum, you only pay interest on the amount you withdraw, not the entire credit limit. This flexibility helps you save on interest charges.

4. Revolving Credit: The revolving nature of a personal line of credit is a valuable advantage. As you repay the borrowed amount, the credit becomes available again, allowing you to reuse the funds without going through the application process repeatedly.

5. Building Credit: Responsible use of a personal line of credit can help you establish or improve your credit history. Making timely payments and managing your credit limit effectively demonstrates financial responsibility to creditors and can boost your credit score.

Uses of a Personal Line of Credit

A personal line of credit can be used for a variety of purposes. Some common uses include:

1. Emergency Expenses: Unforeseen expenses such as medical bills, car repairs, or home repairs can arise at any time. Having a personal line of credit provides quick access to funds when emergencies occur.

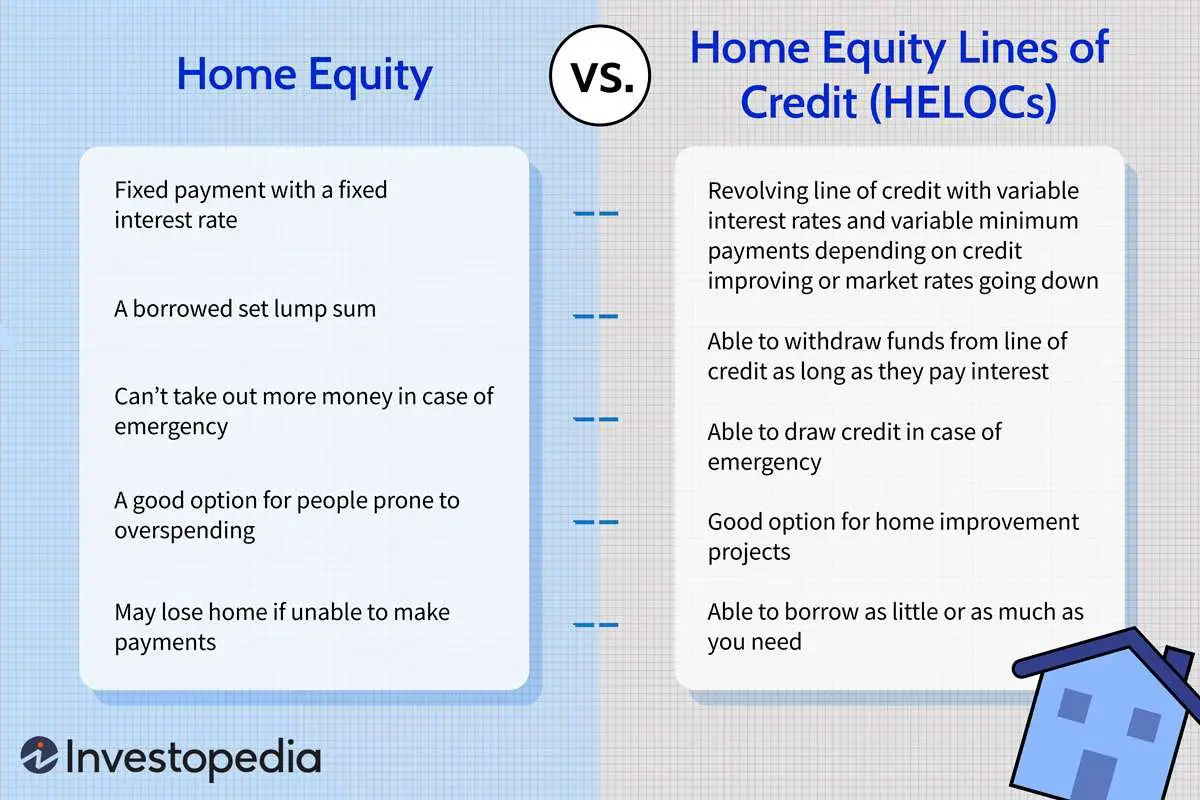

2. Home Improvements: If you’re planning renovations or upgrades to your home, a personal line of credit can be a convenient way to finance the project. It allows you to withdraw funds as needed and manage cash flow effectively.

3. Debt Consolidation: If you have multiple high-interest debts, such as credit card balances or personal loans, you can use a personal line of credit to consolidate them into a single payment. This can simplify your finances and potentially lower your interest rate.

4. Education Expenses: Whether you’re pursuing higher education or enrolling in courses to enhance your skills, a personal line of credit can help cover the costs of tuition, books, or other educational expenses.

5. Business Funding: Small business owners or entrepreneurs can utilize a personal line of credit to fund their business needs. It provides a convenient way to access funds for inventory, equipment, or operational expenses.

Key Considerations for a Personal Line of Credit

Before applying for a personal line of credit, it’s essential to consider the following factors:

1. Creditworthiness: Lenders evaluate your creditworthiness, including credit score, credit history, and income, before approving a line of credit. Maintaining a good credit score and a positive credit history increases your chances of approval and better terms.

2. Interest Rates and Fees: Compare interest rates and fees offered by different lenders before choosing a personal line of credit. Look for competitive rates and fees that align with your financial goals.

3. Repayment Terms: Understand the repayment terms and options offered by the lender. Ensure they are suitable for your financial situation, and you can comfortably make the required payments.

4. Credit Limit: Consider your borrowing needs and the credit limit offered by the lender. Ensure the credit limit is sufficient to cover your expected expenses.

5. Responsible Borrowing: A personal line of credit should be used responsibly. Borrow only what you need and make timely payments to maintain a good credit score.

In conclusion, a personal line of credit is a flexible borrowing option that offers convenience, lower interest rates, and customization. It provides financial flexibility for various purposes, and its revolving nature allows you to reuse the funds as you repay the borrowed amount. However, it’s crucial to understand the terms, fees, and repayment requirements before applying for a personal line of credit.

What's a Line of Credit?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a personal line of credit?

A personal line of credit is a revolving loan product that allows individuals to borrow money as needed up to a predetermined credit limit. It provides flexibility in managing personal finances and can be used for various purposes such as home improvements, debt consolidation, or unexpected expenses.

How does a personal line of credit work?

A personal line of credit works similarly to a credit card. Once approved, you are given access to a certain amount of funds that you can borrow from. You can borrow any amount up to your credit limit and only pay interest on the amount you borrow. As you repay the borrowed amount, the credit becomes available again for future use.

What are the advantages of a personal line of credit?

– Flexibility: You have the freedom to borrow only the amount you need when you need it.

– Lower interest rates: Personal lines of credit typically have lower interest rates compared to credit cards or payday loans.

– Easy access to funds: Once approved, you can access funds through checks, online transfers, or debit cards, making it convenient for immediate cash needs.

– Improves credit score: Responsible usage and timely repayments can help improve your credit score over time.

How do I qualify for a personal line of credit?

Qualification criteria may vary depending on the lender, but generally, factors such as credit score, income, employment history, and existing debts are considered. Lenders would want to ensure that you have the ability to repay the borrowed funds.

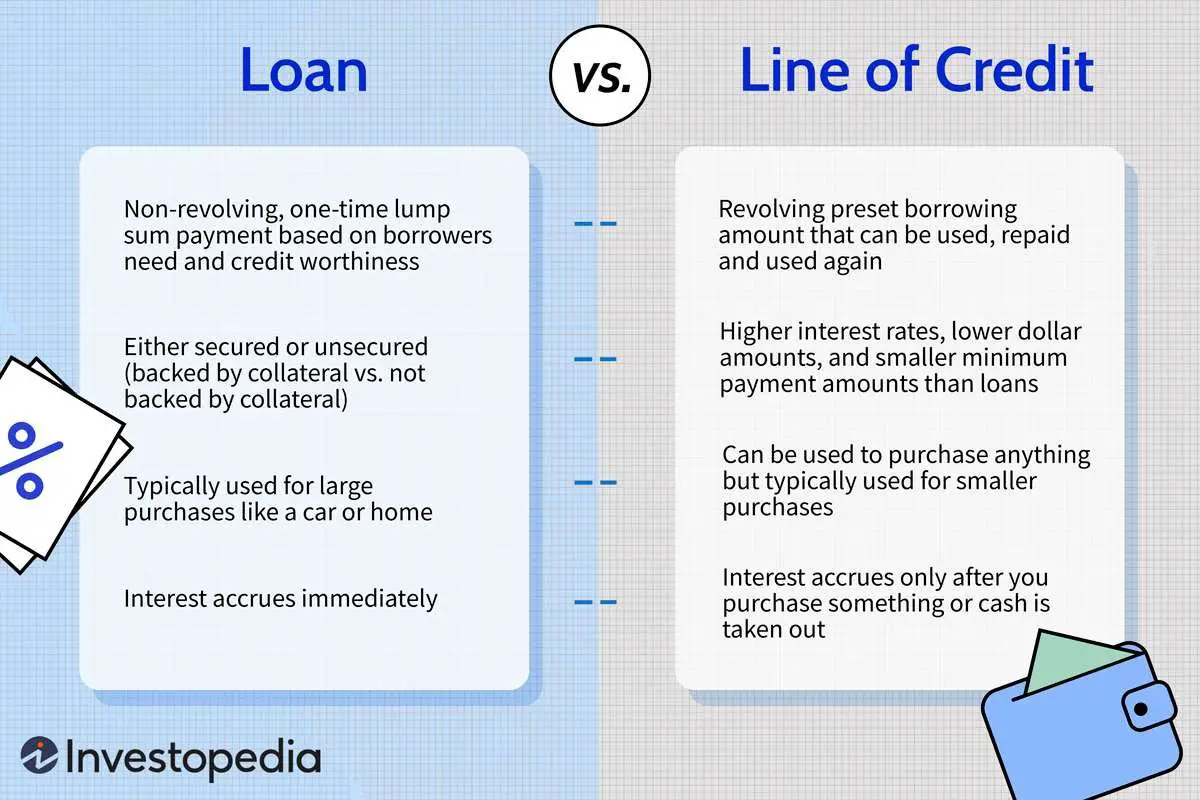

What is the difference between a personal line of credit and a personal loan?

A personal line of credit is a revolving credit product that allows you to borrow funds as needed up to a preset limit. You only pay interest on the amount borrowed. On the other hand, a personal loan provides a lump sum payment and requires fixed monthly repayments over a set term.

Can I use a personal line of credit for any purpose?

Yes, you can use a personal line of credit for various purposes such as home improvements, education expenses, medical bills, debt consolidation, or even as a financial safety net for unexpected emergencies. However, it is important to use the funds responsibly and within your means.

How is the interest calculated on a personal line of credit?

Interest on a personal line of credit is typically calculated based on the outstanding balance that you borrow. The interest rate is expressed as an annual percentage rate (APR), which is divided by the number of billing cycles in a year to determine the periodic interest rate charged on the outstanding balance.

Are there any fees associated with a personal line of credit?

Yes, there may be fees associated with a personal line of credit. Common fees include an annual fee, cash advance fee, and late payment fee. It is important to review the terms and conditions of the specific personal line of credit before applying to understand any applicable fees.

Final Thoughts

A personal line of credit is a flexible borrowing option that allows individuals to access funds as needed. Unlike a traditional loan, a personal line of credit provides a revolving credit limit that can be used repeatedly. It offers convenience and financial flexibility, allowing borrowers to manage unexpected expenses, pay for home renovations, or consolidate debt. With a personal line of credit, individuals have the freedom to borrow only what they need and repay it at their own pace. This financial tool is a valuable resource for those seeking convenient and adaptable borrowing options. So, what is a personal line of credit? It is a versatile financial tool that provides individuals with convenient access to funds whenever they need it.