Are skyrocketing prices and the increasing cost of living putting a strain on your financial well-being? Look no further! In this blog article, we will delve into strategies for coping with inflationary pressures and provide valuable insights on how to navigate these challenging economic times. Whether you’re an individual trying to stretch your budget or a business owner looking to combat rising costs, we’ve got you covered. So, without further ado, let’s explore practical solutions to help you weather the storms of inflation and secure your financial stability.

Strategies for Coping with Inflationary Pressures

Inflation is a persistent rise in the prices of goods and services in an economy over a period of time. It erodes the purchasing power of money and can have a significant impact on individuals, households, and businesses. Coping with inflationary pressures requires careful planning and the implementation of strategies that can help mitigate its effects. In this article, we will explore various strategies for coping with inflationary pressures and discuss how they can be effectively applied.

Create a Budget and Stick to It

One of the fundamental strategies for coping with inflation is to create a budget and stick to it. A budget helps you track your expenses, identify areas where you can cut back, and prioritize your spending. Here are some steps to create an effective budget:

- Start by listing all your sources of income.

- Identify your fixed expenses, such as rent or mortgage payments, utilities, and transportation costs.

- List your variable expenses, such as groceries, entertainment, and discretionary spending.

- Allocate a portion of your income for savings and investments.

- Regularly review and adjust your budget to reflect changes in your income or expenses.

By following a budget, you can better manage your finances and make informed decisions about where to allocate your money, even in the face of rising prices.

Diversify Your Investments

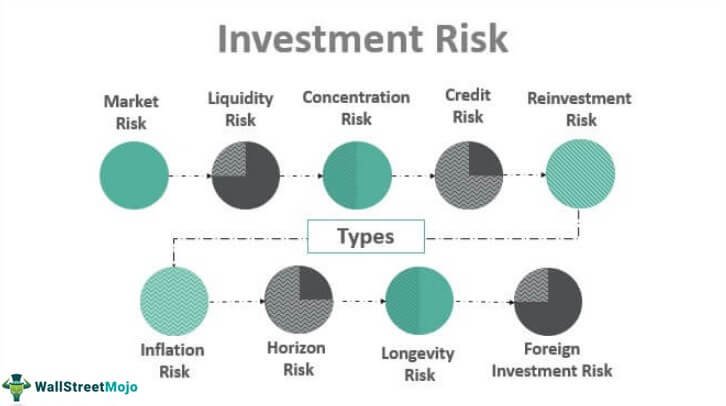

Another effective strategy for coping with inflation is to diversify your investments. Inflation typically erodes the value of money over time, making it important to invest in assets that can provide a hedge against inflation. Here are some investment options to consider:

- Stocks: Investing in stocks can offer potential long-term growth and returns that may outpace inflation.

- Bonds: Bonds can provide a steady income stream through interest payments.

- Real Estate: Owning real estate can provide a tangible asset that tends to appreciate over time.

- Commodities: Investing in commodities like gold or oil can serve as a hedge against inflation.

- Index Funds: Index funds allow for diversified investments across a broad range of assets, reducing risk.

By diversifying your investments across different asset classes, you can potentially minimize the impact of inflation on your overall portfolio and protect your purchasing power.

Explore Alternative Income Streams

Inflation can erode the value of your income, making it challenging to maintain your standard of living. To cope with inflationary pressures, it may be beneficial to explore alternative income streams. Here are some considerations:

- Freelancing: If you possess specialized skills or expertise in a particular field, freelancing can provide an additional source of income.

- Rental Income: If you have extra space in your home or own property, consider renting it out to generate additional income.

- Online Business: Starting an online business can open up opportunities for generating income from e-commerce, digital products, or online services.

- Investment Income: As mentioned earlier, diversifying your investments can help you earn income from various sources.

By diversifying your income streams, you can minimize the impact of inflation on your overall financial situation and maintain a certain level of stability.

Reduce Debt and Manage Interest Rates

Inflation can also affect the cost of borrowing, making it crucial to manage your debt and interest rates. Here are some strategies to consider:

- Pay off High-Interest Debt: Start by prioritizing and paying off high-interest debt, such as credit card debt or loans with high-interest rates.

- Refinance Loans: If interest rates are low, consider refinancing your loans to potentially secure a lower interest rate and reduce your monthly payments.

- Consider Fixed-Rate Loans: Opt for fixed-rate loans instead of variable-rate loans to protect yourself from potential interest rate hikes.

By reducing your debt burden and managing your interest rates effectively, you can minimize the impact of inflation on your financial obligations.

Invest in Education and Skill Development

Investing in education and skill development is another valuable strategy for coping with inflationary pressures. Upskilling or acquiring new skills can enhance your employability and potentially lead to higher income opportunities. Here are some ways to invest in education and skill development:

- Attend Workshops and Seminars: Participate in workshops and seminars relevant to your field of interest to stay up-to-date with industry trends and expand your knowledge.

- Enroll in Online Courses: Online platforms offer a wide range of courses that allow you to learn at your own pace and acquire new skills.

- Seek Professional Certifications: Professional certifications can provide a competitive edge and enhance your career prospects.

- Network and Collaborate: Networking with professionals in your field can expose you to new opportunities and help you stay ahead in a rapidly changing job market.

Investing in education and skill development not only helps you cope with inflation but also increases your long-term earning potential.

Stay Informed and Adjust your Strategies

Lastly, staying informed about economic trends and adjusting your strategies accordingly is crucial for coping with inflationary pressures. Keep track of inflation rates, consumer price indexes, and other economic indicators. Here are some tips to help you stay informed:

- Read Financial News and Analysis: Stay updated with financial news and analysis from reputable sources to understand how inflationary pressures may impact various sectors of the economy.

- Monitor Market Trends: Keep an eye on market trends and adjust your investment strategies accordingly. Consult with financial advisors if necessary.

- Review and Adjust your Budget Regularly: As inflation rates change, periodically review and adjust your budget to accommodate rising prices.

By staying informed and remaining flexible in your strategies, you can adapt to changing economic conditions and mitigate the impact of inflation on your financial well-being.

In conclusion, coping with inflationary pressures requires a proactive approach and the implementation of effective strategies. By creating a budget, diversifying investments, exploring alternative income streams, managing debt and interest rates, investing in education and skill development, and staying informed, individuals and households can better cope with inflation and protect their financial stability. Remember, it’s important to continually evaluate and adjust your strategies to ensure they align with your financial goals and the prevailing economic conditions.

Expert tips for coping with inflation

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are some effective strategies for coping with inflationary pressures?

One effective strategy for coping with inflationary pressures is diversifying your investments. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can mitigate the impact of inflation on your overall portfolio.

How can I protect my savings from the effects of inflation?

To protect your savings from the effects of inflation, you can consider investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS). These securities provide a return that is adjusted for inflation, helping to preserve the purchasing power of your savings.

Are there any specific industries or sectors that perform well during inflationary periods?

Historically, certain industries or sectors have performed well during inflationary periods. These include sectors such as commodities (e.g., oil, gold), energy, and healthcare. Investing in companies within these sectors may offer potential benefits during inflationary times.

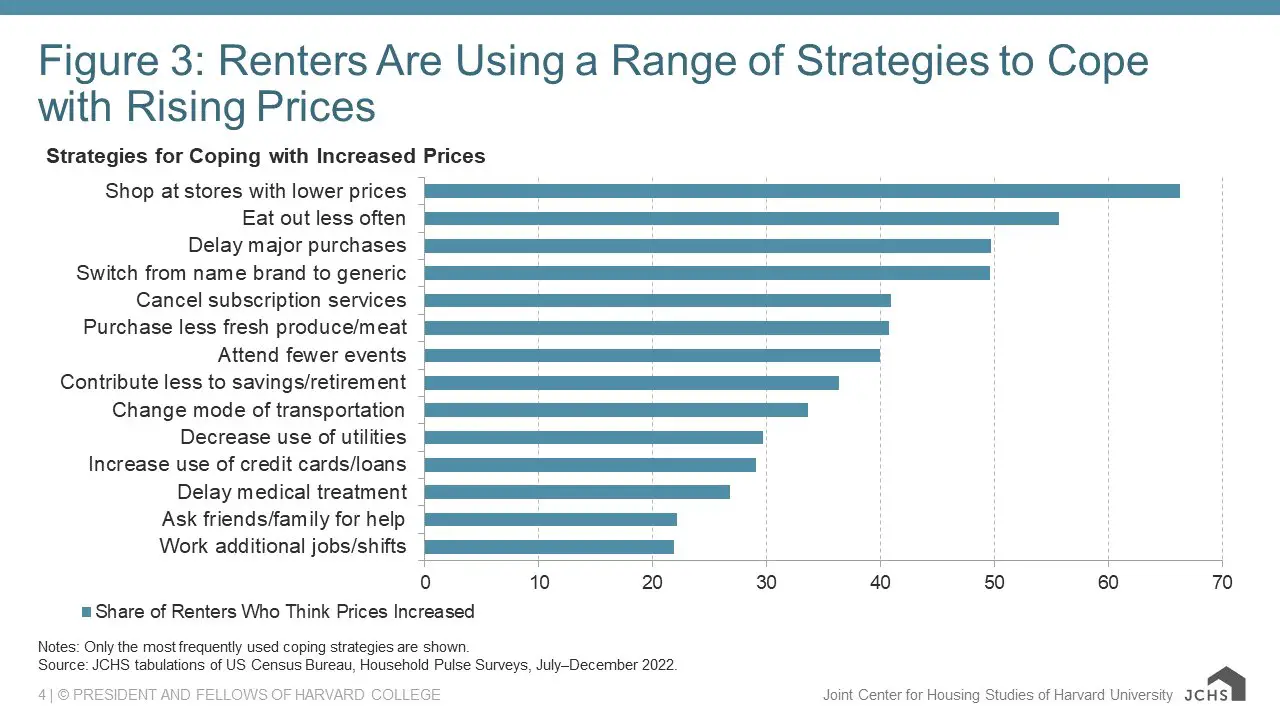

What steps can individuals take to adjust their budgets during inflationary periods?

During inflationary periods, individuals can adjust their budgets by cutting down on non-essential expenses. This can involve reducing discretionary spending, finding ways to save on utilities and transportation costs, and exploring more cost-effective alternatives for everyday items.

Is it advisable to consider salary negotiations or seeking alternative income sources during times of inflation?

Yes, considering salary negotiations or seeking alternative income sources can be advisable during times of inflation. By negotiating a higher salary or exploring additional income streams, individuals can better keep up with the rising cost of living.

How can business owners adjust their pricing strategies to cope with inflation?

Business owners can adjust their pricing strategies by carefully analyzing their costs and profit margins. They can consider passing on some of the increased costs to customers through moderate price increases. Additionally, exploring ways to increase operational efficiency and reduce waste can help offset inflationary pressures.

Are there any government programs or initiatives aimed at helping individuals and businesses cope with inflationary pressures?

The government may implement various programs or initiatives to help individuals and businesses cope with inflationary pressures. These can include measures such as tax incentives, subsidies, or grants targeted towards sectors impacted by inflation. Staying informed about such programs can provide opportunities for assistance.

What are the potential long-term effects of inflation on the economy?

Potential long-term effects of inflation on the economy can include a decrease in purchasing power, reduced consumer spending, higher interest rates, and decreased investment. Additionally, inflation can adversely impact the value of currency, making imports more expensive and potentially leading to trade imbalances.

Final Thoughts

Inflationary pressures can have a significant impact on individuals, businesses, and nations as a whole. To cope with these challenges, it is essential to employ effective strategies. Firstly, individuals can focus on saving more and reducing unnecessary expenses to mitigate the effects of rising prices. Secondly, diversifying investments and considering safe-haven assets, such as gold or real estate, can provide a hedge against inflation. Additionally, businesses should evaluate pricing strategies, streamline operations, and explore alternative suppliers to mitigate cost increases. Lastly, governments can implement prudent fiscal and monetary policies to control inflation, such as reducing excessive government spending and tightening monetary supply. By adopting these strategies, individuals, businesses, and governments can better manage the impact of inflationary pressures. Strategies for coping with inflationary pressures are vital for economic stability and prosperity.