Are you wondering how to manage your finances after experiencing a disability? The journey of adjusting to life after a disability can be challenging, especially when it comes to managing your finances. But fear not, because in this article, we will guide you through practical steps and valuable insights to help you navigate this new chapter with confidence. From budgeting tips to exploring financial assistance options, we’ll provide you with a comprehensive roadmap on how to manage your finances after disability. So let’s dive right in and empower you to take control of your financial well-being.

How to Manage Your Finances After Disability

Introduction

Dealing with a disability can have a significant impact on your life, including your financial situation. It may affect your ability to work, increase your medical expenses, and require modifications to your daily life. However, with proper planning and management, it is possible to navigate these challenges and maintain a stable financial footing. In this article, we will explore various strategies and resources to help you manage your finances after a disability.

1. Assess Your Current Financial Situation

Before diving into financial management after a disability, it’s important to assess your current financial situation. Take the following steps:

Gather Information

- Collect all relevant financial documents, including bank statements, bills, insurance policies, and investment account statements.

- Make a list of your income sources, including disability benefits, social security, pensions, and any other sources.

- Compile a list of your expenses, including fixed expenses (rent/mortgage, utilities) and variable expenses (groceries, transportation, entertainment).

- Obtain your credit report to evaluate your outstanding debts and credit history.

Evaluate Your Cash Flow

- Review your monthly income and compare it to your monthly expenses.

- Identify any gaps or areas where you might need to reduce expenses or look for additional income sources.

- Create a budget to allocate your income effectively.

2. Maximize Your Disability Benefits

Understand Your Disability Benefits

- Familiarize yourself with the specific benefits available to you, whether it’s through Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), or other programs.

- Review the eligibility criteria, payment amounts, and any limitations or requirements.

Explore Additional Assistance Programs

- Research local and national programs that provide financial assistance to individuals with disabilities, such as Medicaid, Medicare, housing assistance, and utility assistance programs.

- Seek assistance from disability advocacy organizations for guidance on available resources.

Work with a Benefits Counselor

- Consider consulting a benefits counselor to ensure you are maximizing your benefits and accessing all available assistance programs.

- They can help you navigate the complex system, provide personalized advice, and assist with the application process.

3. Manage Medical Expenses

Review Your Health Insurance

- Examine your health insurance policy to understand the coverage details, including deductibles, copayments, and out-of-pocket maximums.

- Ensure that your policy adequately covers your specific disability-related medical needs.

- Consider supplemental insurance plans if necessary.

Utilize Government Programs and Assistance

- Check if you qualify for government programs that can help with medical expenses, such as Medicaid, Medicare, or state-specific programs.

- Research prescription assistance programs that can help reduce the cost of medications.

Explore Medical Tax Deductions and Credits

- Consult with a tax professional to understand how you can benefit from available medical tax deductions and credits.

- Keep track of your medical expenses, including co-pays, transportation costs, and home modifications, to maximize your tax benefits.

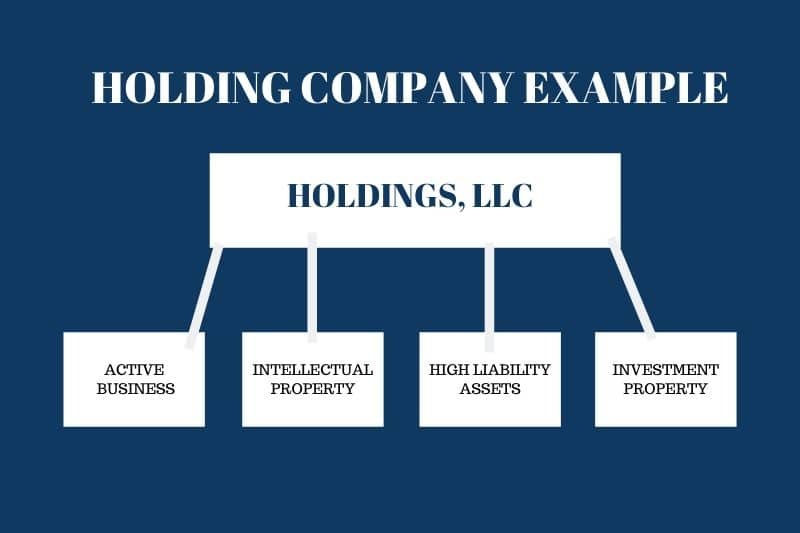

4. Protect Yourself Financially

Establish an Emergency Fund

- Build an emergency fund to cover unexpected expenses or income gaps.

- Save a portion of your income regularly and consider automating your savings to ensure consistency.

Review and Update Insurance Coverage

- Evaluate your existing insurance policies, such as life insurance, disability insurance, and long-term care insurance.

- Ensure your coverage is adequate to protect you and your family in case of unforeseen circumstances.

- Consider consulting an insurance professional to determine the appropriate coverage for your needs.

Create a Will and Establish Power of Attorney

- Prepare a will to outline your wishes regarding your assets and designate beneficiaries.

- Appoint a trusted person as your power of attorney to make financial decisions on your behalf, if necessary.

5. Seek Professional Financial Advice

Consult a Financial Planner

- Consider engaging a certified financial planner with experience in disability planning.

- They can help you create a long-term financial strategy, including investment planning, tax optimization, and retirement planning.

Work with an Accountant

- An accountant specializing in disability-related financial matters can provide guidance on tax planning and financial reporting.

- They can help maximize your eligible deductions and ensure compliance with tax regulations.

Join Support Groups and Networks

- Connect with other individuals who have gone through similar experiences.

- Join disability support groups or online communities where you can find advice, resources, and emotional support.

Managing your finances after a disability requires careful planning, resourcefulness, and access to information. By assessing your financial situation, maximizing your disability benefits, managing medical expenses, protecting yourself financially, and seeking professional advice, you can take control of your finances and secure a stable future. Remember, it’s essential to continually evaluate your situation, adapt as needed, and reach out for help when necessary. With the right strategies and support, you can overcome the challenges of disability and achieve financial stability.

How To Legally Earn Money And Keep Your Disability Benefits In 2022

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I manage my finances after becoming disabled?

Managing your finances after disability can be challenging, but with careful planning and these steps, you can regain control:

What government assistance programs are available to help manage finances after disability?

There are several government assistance programs you can consider, such as:

Are there any financial planning resources specifically for individuals with disabilities?

Yes, there are financial planning resources tailored to individuals with disabilities, including:

What steps can I take to budget effectively after becoming disabled?

To budget effectively after becoming disabled, follow these tips:

How can I protect myself from financial scams as a disabled individual?

To protect yourself from financial scams, keep in mind these guidelines:

Is it necessary to seek professional financial advice when managing finances after disability?

While seeking professional financial advice is not mandatory, it can be highly beneficial. Here are some reasons to consider it:

What should I do if I am unable to pay my bills after becoming disabled?

If you find yourself unable to pay your bills after becoming disabled, take these steps:

Are there any organizations or support groups that can assist in managing finances after disability?

Yes, there are organizations and support groups you can reach out to for assistance, such as:

Final Thoughts

Managing your finances after disability can be challenging, but with the right strategies, it is possible to regain control. Start by creating a budget that aligns with your new income and expenses. Prioritize your spending and consider seeking professional advice on managing debt and insurance coverage. Explore government benefits and support programs that you may be eligible for. Take advantage of technology tools and apps to track your expenses and savings. Stay informed about disability rights and laws to protect your financial interests. Remember, with careful planning and proactive steps, you can successfully manage your finances after disability.