Fiduciary duty. It may sound like a complex term, but its importance cannot be overstated. So, what is a fiduciary and why is it important? In a nutshell, a fiduciary is a person or entity entrusted to act in the best interests of another. Whether it’s a financial advisor managing your investments or a trustee overseeing a family trust, fiduciaries play a vital role in safeguarding your interests. In this article, we will delve into the world of fiduciaries, uncovering their responsibilities, and exploring why they are crucial for ensuring trust and integrity in various areas of our lives. So, let’s dive in and demystify the concept of fiduciary duty!

What is a Fiduciary and Why is it Important?

An Introduction to Fiduciaries

Before we dive into the importance of fiduciaries, let’s first understand what exactly a fiduciary is. A fiduciary is someone who is legally obligated to act in the best interests of another person or entity. They are entrusted with managing assets, making financial decisions, and providing advice to their clients. By law, fiduciaries are required to prioritize their clients’ interests above their own and exercise a high level of care, loyalty, and prudence.

Fiduciaries can be found in various professions, including financial advisors, attorneys, trustees, and corporate directors. Their primary role is to ensure that their clients receive unbiased and competent guidance, with their clients’ best interests at heart. Now that we have a basic understanding of what a fiduciary is, let’s explore why they are important.

The Importance of Fiduciaries in Financial Planning

Financial planning is a critical aspect of our lives, and having a fiduciary by your side can significantly impact your financial well-being. Here are some reasons why fiduciaries are important in the realm of financial planning:

1. Fiduciaries Provide Objective and Unbiased Advice

When seeking financial advice, it’s crucial to have someone who prioritizes your interests over their own. Fiduciaries are legally bound to act in your best interest, ensuring that the advice and recommendations they provide are objective and unbiased. This level of trust is invaluable, enabling you to make informed decisions about your finances.

2. Fiduciaries Offer Expertise and Experience

Fiduciaries often possess specialized knowledge and expertise in their respective fields. Whether you’re managing investments, planning for retirement, or dealing with complex estate matters, fiduciaries can offer valuable insights and guidance. Their experience navigating financial challenges can help you avoid costly mistakes and achieve your goals in a more efficient manner.

3. Fiduciaries Help Minimize Conflicts of Interest

Conflicts of interest can arise when someone in a position of authority has personal interests that may interfere with their duty to act in the best interest of their clients. However, fiduciaries are legally obliged to minimize conflicts of interest and prioritize your needs above their own. This level of transparency and fiduciary duty helps build trust and ensures that your financial interests are protected.

4. Fiduciaries Promote Financial Transparency

Being transparent about financial matters is crucial for effective planning and decision-making. Fiduciaries are required to provide full disclosure of any potential conflicts of interest, fees, and charges associated with their services. This transparency allows you to make well-informed choices and gain a clear understanding of the costs and benefits involved.

The Legal Obligations of Fiduciaries

Fiduciaries operate under certain legal obligations that are designed to safeguard their clients’ interests. Here are some of the key legal obligations that fiduciaries must adhere to:

1. Duty of Loyalty

Fiduciaries must prioritize their clients’ interests above their own. They must avoid any conflicts of interest and act solely in the best interest of their clients. This duty of loyalty ensures that fiduciaries make decisions that are free from personal gain or bias.

2. Duty of Care

Fiduciaries are required to exercise a high level of care and diligence when managing their clients’ finances. They must possess the necessary expertise and skills to carry out their responsibilities competently. This duty of care ensures that fiduciaries make informed decisions based on thorough analysis and research.

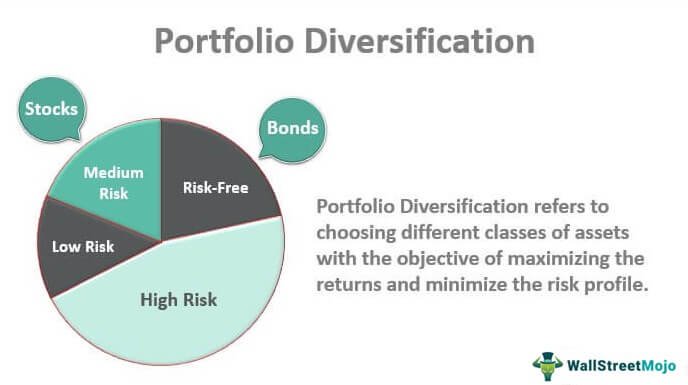

3. Duty of Prudence

Fiduciaries must act prudently when it comes to managing their clients’ assets and investments. They are expected to make informed decisions and avoid unnecessary risks that could jeopardize their clients’ financial well-being. This duty of prudence emphasizes the importance of careful and responsible financial management.

Choosing a Trusted Fiduciary

Selecting the right fiduciary is crucial for your financial success. Here are some tips to help you choose a trusted fiduciary:

1. Research and Credentials

Look for fiduciaries who hold relevant certifications and have a strong track record of experience and expertise. Research their qualifications and verify their credentials to ensure they are well-equipped to handle your specific financial needs.

2. Reputation and Reviews

Check for reviews and testimonials from other clients to gauge the fiduciary’s reputation. Positive feedback and recommendations from trusted sources can give you confidence in their abilities.

3. Clear Communication

Effective communication is essential when working with a fiduciary. Look for someone who can explain complex financial concepts in a clear and understandable manner. They should be responsive to your questions and concerns, ensuring that you feel comfortable and well-informed throughout the process.

4. Fee Structure and Transparency

Understand the fiduciary’s fee structure and ensure it aligns with your financial goals. Transparency in fees and charges is vital to avoid any surprises down the line. A trustworthy fiduciary will be upfront about their fees and provide a breakdown of the services they offer.

In a world where financial decisions can have a significant impact on our lives, having a fiduciary by your side can provide peace of mind and ensure that your best interests are protected. Fiduciaries offer objective advice, expertise, and transparency, while being legally obligated to prioritize your needs. By choosing a trusted fiduciary, you can navigate the complex world of finance with confidence, knowing that your financial well-being is in capable hands.

What is a Fiduciary? Why is Fiduciary Duty Important?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a fiduciary and why is it important?

A fiduciary is a person or entity that is legally bound to act in the best interests of another party. In the context of financial matters, a fiduciary is someone who manages and invests assets on behalf of clients. It is important because a fiduciary has a legal obligation to prioritize their clients’ interests above their own, providing unbiased advice and acting in a trustworthy manner.

How does a fiduciary differ from other financial advisors?

Unlike other financial advisors, a fiduciary is legally obligated to act in the best interests of their clients. This differs from advisors who may only need to provide suitable recommendations, which may not necessarily be the most advantageous for the client. Fiduciary duty brings a higher level of responsibility and accountability.

What are some examples of fiduciary relationships?

Fiduciary relationships can take various forms, including those between trustees and beneficiaries, attorneys and clients, corporate directors and shareholders, and investment advisors and clients. In all cases, the fiduciary has a legal duty to act in the best interests of the party they represent.

How can a fiduciary help with financial decision-making?

A fiduciary can provide expert guidance and advice when it comes to financial decision-making. By analyzing your financial situation, goals, and risk tolerance, a fiduciary can offer personalized recommendations and develop strategies to help you achieve your objectives while considering your best interests.

What are the benefits of working with a fiduciary?

Working with a fiduciary offers several benefits. Firstly, you can have confidence that their recommendations are based on your best interests, minimizing the risk of conflicts of interest. Additionally, fiduciaries typically have a higher level of expertise and are held to strict ethical standards.

How do fiduciaries charge for their services?

Fiduciaries may charge fees in various ways, including a percentage of assets under management, hourly rates, or a fixed fee. It is important to discuss and understand the fee structure upfront to ensure transparency and to evaluate if the cost aligns with the value provided.

Are all financial advisors fiduciaries?

No, not all financial advisors are fiduciaries. Some financial advisors operate under the suitability standard, where they are only required to make recommendations that are suitable for their clients’ needs. However, it is important to note that some financial advisors choose to adhere to a fiduciary standard voluntarily.

How can I verify if a financial advisor is a fiduciary?

To verify if a financial advisor is a fiduciary, you can ask them directly about their fiduciary status. Additionally, you can check their registration with regulatory bodies such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA), which can provide information about their obligations and any disciplinary history.

Final Thoughts

A fiduciary is a person or institution that is legally obligated to act in the best interest of another party. This role is crucial when it comes to managing and safeguarding someone else’s assets or investments. By serving as a fiduciary, individuals or organizations are required to prioritize their clients’ needs above their own, avoiding conflicts of interest. This responsibility ensures that the fiduciary acts with utmost honesty, integrity, and loyalty, instilling trust and confidence in the relationship. Understanding what a fiduciary is and why it is important can help individuals make informed decisions when entrusting others with their financial matters.