Are you dreaming of a retirement in a foreign land, savoring new cultures and experiences? If so, you’re probably wondering how to financially plan for overseas retirement. Well, worry not! In this article, we’ll guide you through the essential steps to ensure a secure and enjoyable retirement abroad. From understanding the cost of living to managing investment strategies, we’ll help you navigate the complexities of financial planning for your overseas retirement. So, if you’re ready to embark on this exciting journey, let’s dive in!

How to Financially Plan for Overseas Retirement

Introduction

Retirement is a time for relaxation, exploration, and enjoying the fruits of our labor. And what better way to spend your golden years than in a beautiful overseas destination? However, retiring abroad comes with its unique challenges, particularly in terms of financial planning. In this comprehensive guide, we will delve into the various aspects of financially planning for an overseas retirement. From evaluating cost of living to managing healthcare expenses, we will cover it all. So, let’s get started!

Evaluating Cost of Living in Your Chosen Destination

One of the first steps in planning for an overseas retirement is evaluating the cost of living in your chosen destination. This will help you determine how much money you’ll need to maintain your desired lifestyle. Consider the following factors when assessing the cost of living:

- Housing: Research the average cost of purchasing or renting a home in your desired location. Take into account property taxes, maintenance costs, and utilities.

- Food and groceries: Compare the prices of essential food items and groceries in your home country to those in your intended retirement destination.

- Transportation: Research the cost of public transportation, fuel, and car insurance. Determine if you’ll need a vehicle or if relying on public transportation is more cost-effective.

- Healthcare: Evaluate the cost of healthcare services, including insurance premiums, doctor visits, and medication expenses. Consider whether the country you plan to retire in has a reliable healthcare system or if you’ll need to purchase international health insurance.

- Entertainment and recreation: Research the prices of recreational activities, dining out, and cultural events. Consider the cost of hobbies and recreational facilities that you enjoy.

Investment and Retirement Savings

Retiring overseas requires careful management of your investment and retirement savings. Consider the following tips to ensure your financial stability:

Review and Adjust Your Investment Portfolio

- Meet with a financial advisor to review your investment portfolio. Discuss your plans for retiring abroad and any potential risks you may face.

- Consider diversifying your investments to reduce risk. Explore international investment opportunities that align with your retirement goals.

- Keep in mind the currency exchange rates and how they may impact the value of your investments in your chosen destination.

Understand Tax Implications

- Learn about the tax laws in your home country and the country you plan to retire in. Understanding the tax implications will help you optimize your financial strategy.

- Consult with a tax professional who specializes in international tax laws to ensure compliance and identify potential tax-saving opportunities.

Create a Realistic Budget

- Evaluate your current expenses and create a budget that reflects your anticipated retirement lifestyle.

- Consider the cost of healthcare, travel, leisure activities, and unexpected expenses.

- Factor in inflation and adjust your budget accordingly.

Managing Healthcare Expenses

Healthcare is a crucial consideration when planning for an overseas retirement. Here are some essential steps to manage healthcare expenses effectively:

Research Healthcare Systems in Your Chosen Destination

- Investigate the quality and accessibility of healthcare services in your intended retirement destination.

- Consider the availability of specialists, hospitals, and emergency services in the area.

- Understand the healthcare financing options available, such as public healthcare, private insurance, or a combination of both.

Consider International Health Insurance

- Research international health insurance options that provide comprehensive coverage in your destination country.

- Compare premiums, coverage limits, deductibles, and exclusions.

- Ensure that the insurance plan covers any pre-existing conditions you may have.

Explore Local Healthcare Assistance Programs

- Look into local healthcare assistance programs or government initiatives that may provide benefits or subsidies for retirees.

- Check if your prospective retirement destination offers any special healthcare programs for expatriates or foreign retirees.

Understanding Currency Exchange and Remittance Options

When retiring overseas, understanding currency exchange rates and having reliable remittance options is vital. Here’s what you need to know:

Monitor Currency Exchange Rates

- Keep an eye on currency exchange rates between your home country’s currency and the currency of your chosen retirement destination.

- Consider consulting with a foreign exchange specialist to optimize your currency exchange transactions.

- Plan your transfers strategically to take advantage of favorable exchange rates.

Choose the Right Remittance Option

- Research and compare remittance options to transfer your funds between countries.

- Consider factors such as fees, exchange rates, transfer speed, and reliability.

- Explore services offered by banks, specialized foreign exchange providers, or online remittance platforms.

Manage Foreign Bank Accounts

- Open a bank account in your chosen retirement destination to facilitate local transactions and simplify money management.

- Research the banking regulations, fees, and services provided by local banks.

- Consider the convenience of accessing your funds through online banking or international ATM networks.

Insurance Considerations

Insurance coverage is essential for a worry-free retirement abroad. Consider the following insurance options:

Health Insurance

- Ensure you have comprehensive health insurance that covers your medical needs in your chosen retirement destination.

- Check if your current health insurance plan offers coverage abroad. If not, explore international health insurance options.

Property and Liability Insurance

- If you own property overseas, make sure you have adequate property and liability insurance coverage.

- Research insurance providers in your retirement destination and compare coverage options.

Travel Insurance

- Consider travel insurance to cover unexpected events, such as trip cancellations, lost luggage, or medical emergencies during your travels.

- Research different travel insurance policies and select one that suits your needs and travel frequency.

Considerations for Estate Planning

Estate planning is crucial, regardless of where you retire. Here are some key considerations:

Update your Will and Estate Documents

- Review your Will and other estate planning documents to ensure they align with the laws and regulations of your retirement destination.

- Consult with an attorney who specializes in international estate planning to navigate any legal complexities.

Understand Inheritance Laws

- Research the inheritance laws in your chosen country to understand the distribution of assets upon your passing.

- Consider consulting with a legal professional to ensure your assets are distributed according to your wishes.

Appoint a Power of Attorney

- Consider appointing a trusted individual, either in your home country or your retirement destination, as your power of attorney.

- Ensure they have the legal authority to manage your affairs and make decisions on your behalf, if necessary.

Planning for an overseas retirement can be an exciting and fulfilling journey. By thoroughly evaluating the cost of living, managing your investment and retirement savings, and addressing healthcare, currency exchange, insurance, and estate planning considerations, you can achieve financial security and peace of mind. Remember to consult with professionals who specialize in international retirement planning to maximize the benefits and minimize potential pitfalls. Cheers to a blissful and financially sound overseas retirement!

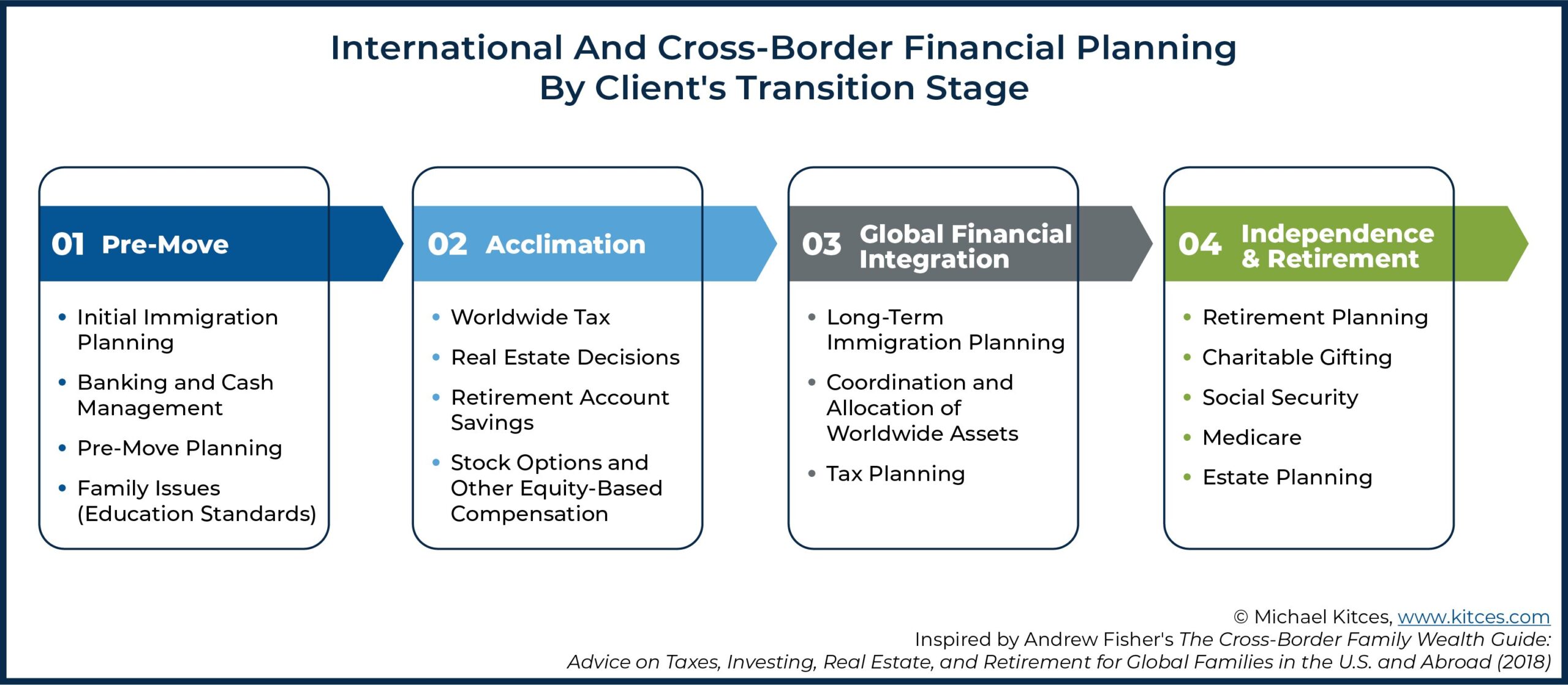

Complete Guide to Retirement Planning as a US Expat

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the importance of financially planning for overseas retirement?

Financially planning for overseas retirement is important because it allows you to secure a comfortable lifestyle in another country, ensuring that you have enough funds to cover your living expenses, healthcare, and other necessities.

How early should I start planning for my overseas retirement?

It is recommended to start planning for your overseas retirement as early as possible. Ideally, you should begin at least five to ten years before your anticipated retirement date. This will give you ample time to save, invest, and make any necessary adjustments to your financial strategy.

What factors should I consider when financially planning for overseas retirement?

When financially planning for overseas retirement, you should consider factors such as the cost of living in your desired destination, healthcare expenses, taxes, currency exchange rates, and any potential cultural differences that may affect your finances.

How can I estimate my retirement expenses for overseas living?

To estimate your retirement expenses for overseas living, you should research the cost of housing, transportation, healthcare, utilities, food, entertainment, and other daily expenses in your chosen country. Additionally, consider inflation and any unexpected expenses that may arise.

What are some investment options that can help me financially plan for overseas retirement?

Some investment options that can help you financially plan for overseas retirement include stocks, bonds, mutual funds, real estate investments, annuities, and retirement accounts like IRAs or 401(k)s. It’s advisable to consult with a financial advisor who specializes in international investments and retirement planning.

Should I consider purchasing international health insurance for my overseas retirement?

Yes, it is strongly recommended to consider purchasing international health insurance for your overseas retirement. This will provide coverage for medical expenses and ensure that you have access to quality healthcare services in your new country of residence.

What are some potential challenges I might face when financially planning for overseas retirement?

Some potential challenges when financially planning for overseas retirement may include navigating complex tax regulations, understanding foreign currency exchange rates, adapting to different cultural norms regarding money and personal finance, and managing potential language barriers when dealing with financial institutions.

How can I protect my retirement savings from currency fluctuations?

To protect your retirement savings from currency fluctuations, you can consider strategies such as diversifying your investments across different currencies, utilizing currency hedging options, or consulting with a financial advisor who can provide guidance on managing currency risk.

Final Thoughts

In conclusion, financially planning for overseas retirement requires careful consideration and proactive steps. Start by assessing your current financial situation, including savings, investments, and potential sources of income in retirement. Research the cost of living and healthcare expenses in your desired destination, and factor in currency exchange rates. Develop a comprehensive budget and explore diverse investment options for long-term growth. Seek guidance from financial advisors who specialize in international retirement planning. Regularly review and adjust your plans as needed to ensure a secure and comfortable retirement abroad. By following these steps, you can effectively prepare for overseas retirement and take control of your financial future.