Financial risk is an inevitable part of any business or investment venture. But what exactly is financial risk and how can it be mitigated? In simple terms, financial risk refers to the potential for loss or uncertainty in achieving financial goals. It encompasses various factors such as market volatility, credit risks, and economic changes. Understanding and effectively managing financial risk is crucial to safeguarding your financial well-being. In this article, we will explore the concept of financial risk and provide practical strategies to mitigate it. So, whether you are an individual investor or a business owner, this guide will help you navigate the complex world of financial risk and protect your assets. Let’s get started!

What is Financial Risk and How to Mitigate It

Financial risk is an inherent part of any economic activity, and it refers to the potential loss or uncertainty associated with financial investments and decisions. In the world of finance, risk is a crucial concept that every individual and organization should understand and manage effectively. Whether you are an investor, business owner, or simply managing your personal finances, understanding financial risk and taking appropriate measures to mitigate it is vital for long-term success.

Understanding Financial Risk

Financial risk can arise from various factors and events that affect the value of investments and financial decisions. It is essential to have a clear understanding of the different types of financial risk before delving into the strategies for mitigating them. Let’s explore some common types of financial risk:

Market Risk

Market risk, also known as systematic risk, refers to the potential losses incurred due to changes in the overall market conditions. This type of risk is beyond an individual’s control and is driven by external factors such as economic fluctuations, interest rate changes, political instability, or market crashes. Market risk affects all investments to some degree and cannot be eliminated entirely.

Credit Risk

Credit risk arises from the possibility of borrowers failing to repay their debts or fulfill their financial obligations. It primarily affects lenders and investors who provide credit to individuals, businesses, or governments. Credit risk can lead to financial losses and is influenced by factors such as the borrower’s creditworthiness, economic conditions, and market dynamics.

Liquidity Risk

Liquidity risk refers to the possibility of not being able to buy or sell a particular asset quickly without incurring significant losses. It typically arises when there is a lack of market participants or when there is insufficient demand for a particular asset. Liquidity risk can be detrimental, especially during financial crises or when dealing with illiquid investments.

Operational Risk

Operational risk arises from internal factors within an organization and encompasses the potential losses resulting from inadequate internal processes, systems, or human errors. It includes risks associated with fraud, technological failures, legal issues, and regulatory compliance. Operational risk affects businesses of all sizes and can impact their financial performance and reputation.

Foreign Exchange Risk

Foreign exchange risk, also known as currency risk, occurs when investments or financial transactions involve different currencies. Fluctuations in exchange rates can lead to significant gains or losses, impacting the overall profitability of investments or international business operations. Foreign exchange risk is particularly relevant for businesses engaged in global trade or investors with international portfolios.

Strategies to Mitigate Financial Risk

While it is impossible to completely eliminate financial risk, several strategies can help individuals and organizations mitigate their exposure to potential losses. Implementing effective risk management practices can enhance financial stability and protect investments. Here are some strategies to consider:

Diversification

Diversification is a fundamental principle in risk management and involves spreading investments across different assets, sectors, or geographical regions. By diversifying, you can reduce the impact of any single investment or market condition on your overall portfolio. Diversification helps balance risk and potential returns, aiming to minimize losses when certain investments underperform.

Asset Allocation

Asset allocation refers to the distribution of investments across different asset classes, such as stocks, bonds, real estate, and commodities. It involves determining the optimal mix of assets based on individual risk tolerance, financial goals, and market conditions. A well-diversified asset allocation strategy can reduce the impact of market volatility and provide more stable long-term returns.

Risk Assessment and Evaluation

Before making any financial decision, it is essential to assess and evaluate the associated risks thoroughly. Conducting a comprehensive risk analysis helps identify potential risks and their potential impact on investments or financial goals. This assessment enables informed decision-making and helps allocate resources effectively to manage and mitigate identified risks.

Implement Risk Management Tools

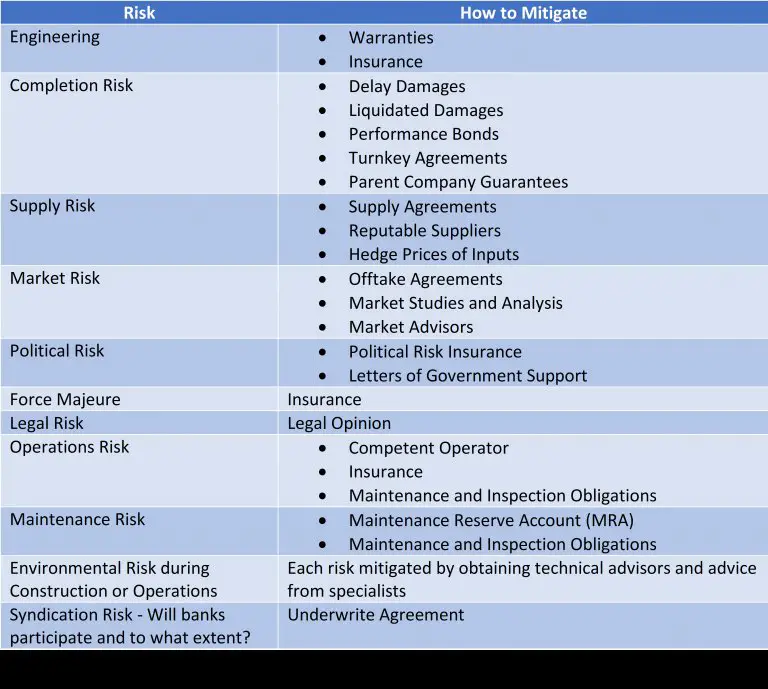

Various risk management tools and instruments are available to help individuals and organizations mitigate financial risk. These tools can provide protection against specific risks and help manage uncertainty. Some common risk management tools include insurance policies, derivatives, hedging strategies, and stop-loss orders. Understanding and utilizing the appropriate risk management tools can enhance financial stability and reduce potential losses.

Stay Informed and Seek Professional Advice

Keeping oneself updated with the latest financial news, market trends, and economic developments is crucial for effective risk management. Regularly monitoring investment portfolios, analyzing financial statements, and seeking professional advice from financial advisors or experts can provide valuable insights and guidance in managing financial risk. Professional advice can help identify potential risks, discover suitable risk mitigation strategies, and optimize investment performance.

Maintain Adequate Emergency Funds

Creating and maintaining an emergency fund is a prudent strategy to mitigate financial risk. An emergency fund acts as a safety net during unexpected events or financial hardships, providing financial support without relying on high-interest debt or selling investments at inopportune times. Having a reserve of liquid funds helps navigate financial uncertainties and reduces the potential impact of liquidity risk.

Financial risk is an unavoidable aspect of any financial endeavor, but it can be managed effectively through various strategies. By understanding the different types of financial risk, such as market risk, credit risk, liquidity risk, operational risk, and foreign exchange risk, individuals and organizations can implement appropriate risk mitigation measures. From diversification and asset allocation to risk assessments, implementing risk management tools, staying informed, and maintaining emergency funds, proactive risk management is crucial for long-term financial stability and success. By integrating these strategies into financial decision-making processes, individuals and organizations can minimize potential losses, optimize returns, and navigate through uncertain economic environments with confidence.

Financial Risk Explained in 3 Minutes in Basic English

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is financial risk and how to mitigate it?

Financial risk refers to the potential for loss or negative impact on the financial health of an individual or organization. It encompasses various factors, including market volatility, credit risk, liquidity risk, and operational risk. To mitigate financial risk, consider the following strategies:

How can diversification help mitigate financial risk?

Diversification involves spreading investments across different asset classes, industries, and geographical regions. By doing so, you reduce the impact of a single investment or market event, as losses in one area may be offset by gains in another.

What role does insurance play in mitigating financial risk?

Insurance can provide protection against unforeseen events that may lead to financial losses. It allows individuals and businesses to transfer some of the risk to an insurance company in exchange for payment of premiums.

How does risk assessment contribute to financial risk mitigation?

Risk assessment involves identifying, analyzing, and evaluating potential risks. By understanding the risks involved, you can implement appropriate risk management strategies and controls to minimize their impact.

What are hedging strategies and how do they mitigate financial risk?

Hedging involves taking positions that offset the potential losses from adverse price movements. For example, using derivatives, such as options or futures contracts, can help protect against fluctuations in commodity prices, interest rates, or foreign exchange rates.

What is the role of financial planning in mitigating risk?

Financial planning involves setting specific goals, creating a budget, and developing strategies to achieve those goals. By having a well-defined plan in place, individuals and businesses can better manage financial risks and make informed decisions.

How can proper cash flow management mitigate financial risk?

Effective cash flow management ensures that you have enough liquidity to meet your financial obligations. By closely monitoring and managing your cash flow, you can reduce the risk of financial distress or the need for costly borrowing in adverse situations.

What impact does regulatory compliance have on mitigating financial risk?

Compliance with applicable regulations and laws is crucial in mitigating financial risk. By adhering to regulatory requirements, organizations can avoid penalties, lawsuits, reputational damage, and potential financial losses resulting from non-compliance.

How can ongoing monitoring and review help mitigate financial risk?

Ongoing monitoring and review of financial activities and investments allow you to identify potential risks or deviations from your risk management strategies. By promptly addressing any issues identified, you can take corrective actions and reduce the impact of financial risks.

Final Thoughts

Financial risk refers to the potential loss or negative impact on financial well-being that individuals or businesses may face in their investment or financial activities. Mitigating financial risk is crucial for safeguarding wealth and ensuring sustainable financial growth. To mitigate financial risk, one must first identify and evaluate potential risks, such as market volatility, credit default, or liquidity issues. Implementing diversification strategies, maintaining an emergency fund, and having proper insurance coverage can help in mitigating financial risk. Additionally, staying informed, regularly reviewing and adjusting investment portfolios, and seeking professional advice are essential in successfully managing financial risk. By understanding what financial risk entails and taking proactive measures to mitigate it, individuals and businesses can protect their financial stability and achieve their long-term financial goals.