If you’ve ever wondered about the fascinating concept of the time value of money, you’re not alone. Understanding how it works can be a game changer when it comes to making financial decisions. So, what exactly do you need to know about the time value of money? In a nutshell, it refers to the idea that the value of money changes over time due to factors like inflation and the potential for earning interest. In this article, we’ll dive into the ins and outs of this concept, exploring its importance and practical applications. So, let’s get started on unraveling the mysteries of the time value of money!

What to Know About the Time Value of Money

Introduction

When it comes to personal finance, understanding the concept of the time value of money is crucial. The time value of money refers to the idea that a dollar today is worth more than a dollar in the future. This concept is based on the premise that money has the potential to grow over time through investments and earning interest. By comprehending the time value of money, individuals can make informed decisions about saving, investing, and borrowing.

The Basics of the Time Value of Money

The time value of money is rooted in the principle that money can be invested and earn returns over time. These returns can be in the form of interest, dividends, or capital appreciation. By considering the time value of money, individuals can determine the potential future value of their money and make more informed financial choices. Here are the key components to understand:

1. Future Value

Future value refers to the value of an investment or cash flow at a specific point in the future. When money is invested, it has the potential to grow due to compound interest or other investment returns. The future value is influenced by the length of time the money is invested and the rate of return it earns.

2. Present Value

Present value, on the other hand, is the current value of a future sum of money or cash flow. It takes into account the time value of money by discounting the future value to reflect its worth in today’s dollars. The present value is influenced by the length of time until the cash flow is expected and the discount rate used to calculate it.

3. Interest Rates

Interest rates play a significant role in determining the time value of money. When interest rates are high, money grows faster over time, increasing the future value. However, when interest rates are low, the growth potential of investments is reduced. Monitoring and understanding interest rates are crucial when considering the time value of money.

Applications of the Time Value of Money

Now that we understand the basic principles of the time value of money, let’s explore some practical applications in personal finance:

1. Investing for Retirement

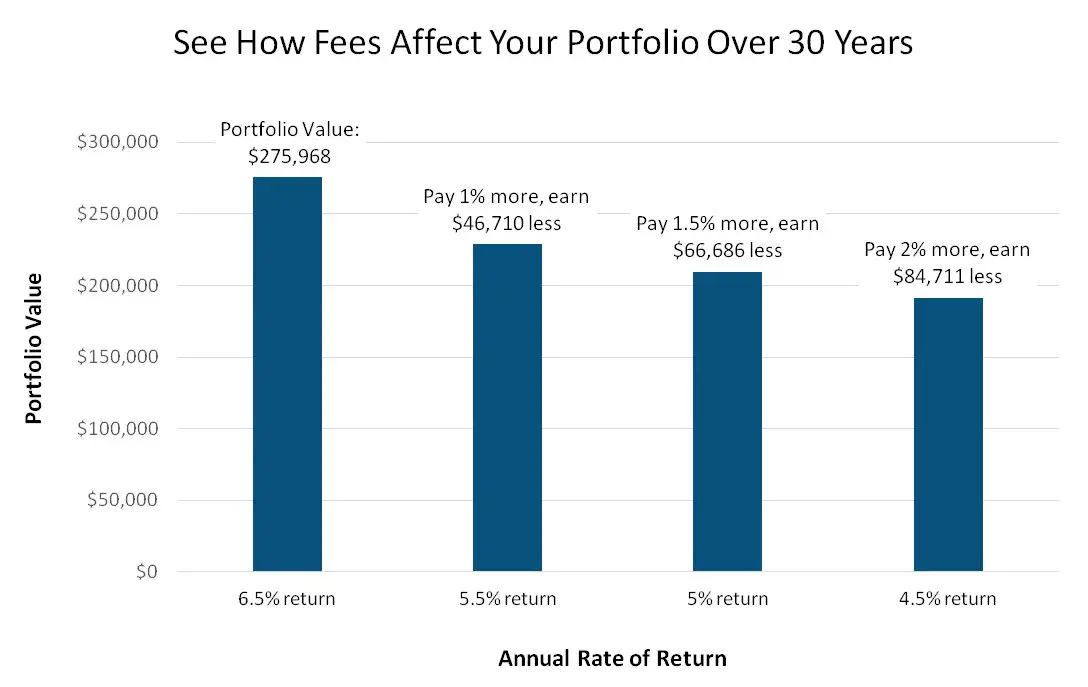

One of the most common applications of the time value of money is retirement planning. By starting to save and invest early, individuals can take advantage of compounding returns over a longer period. The earlier you start, the more time your money has to grow. Understanding the time value of money helps you make informed decisions about how much to save and what investment options to choose for a comfortable retirement.

2. Buying a Home

When purchasing a home, the time value of money plays a crucial role in determining the affordability. Mortgages allow buyers to spread their payments over time, but the interest accrued over the loan term affects the total amount paid. By evaluating different mortgage options and interest rates, individuals can make financially sound decisions and save substantial amounts of money.

3. Assessing Investment Opportunities

When considering investment opportunities, understanding the time value of money helps assess the potential returns. By comparing the expected future value of different investment options, individuals can identify the most profitable choices. Additionally, it allows for the evaluation of risk versus returns, helping to make informed decisions based on personal financial goals and risk tolerance.

Factors Affecting the Time Value of Money

Several factors influence the time value of money. It’s essential to be aware of these variables when making financial decisions:

1. Inflation

Inflation is the rate at which prices rise over time, eroding the purchasing power of money. It affects the time value of money by decreasing the future value relative to the present value. Taking inflation into account is crucial when estimating future costs or determining investment returns.

2. Risk

Risk is another factor that affects the time value of money. Investments with higher risk typically offer the potential for higher returns. However, they also come with greater uncertainty. Understanding the relationship between risk and returns is essential for evaluating investment options and considering the time value of money.

3. Opportunity Cost

Opportunity cost refers to the potential benefits an individual gives up by choosing one option over another. When considering the time value of money, it’s essential to weigh the potential returns against the opportunity cost of alternative investments or financial decisions. By understanding the opportunity cost, individuals can make more informed choices that maximize their financial well-being.

Time Value of Money Formulas and Calculations

Various formulas and calculations can help individuals quantify the time value of money. These calculations provide insights into future value, present value, and the length of time required to achieve specific financial goals. Here are some commonly used formulas:

1. Future Value of a Lump Sum

The future value of a lump sum calculation determines how much an investment will grow over a specific time period. The formula is:

FV = PV * (1 + r)^n

Where:

– FV is the future value

– PV is the present value or initial investment

– r is the interest rate or rate of return

– n is the number of periods or years

2. Present Value of a Lump Sum

The present value of a lump sum calculation determines the current value of a future sum of money. The formula is:

PV = FV / (1 + r)^n

Where:

– PV is the present value

– FV is the future value

– r is the interest rate or rate of return

– n is the number of periods or years

3. Time Required to Reach a Financial Goal

Calculating the time required to reach a financial goal helps individuals understand how long they need to save or invest to achieve specific targets. The formula is:

n = log(FV / PV) / log(1 + r)

Where:

– n is the number of periods or years

– FV is the future value

– PV is the present value or initial investment

– r is the interest rate or rate of return

The Importance of Understanding the Time Value of Money

Understanding the time value of money is crucial for several reasons:

1. Informed Financial Decision-Making

By comprehending the time value of money, individuals can make informed decisions about saving, investing, and borrowing. It helps evaluate different financial options and compare their long-term implications.

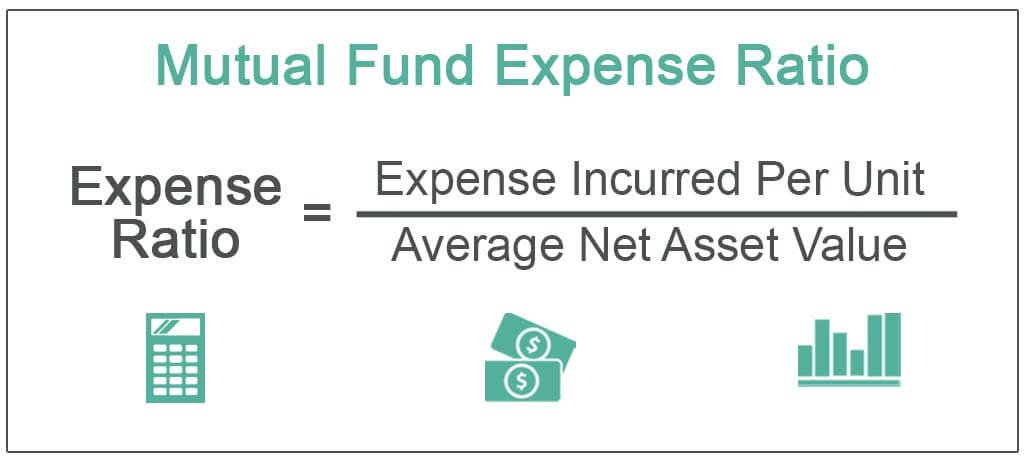

2. Maximizing Investment Returns

Understanding the time value of money helps individuals make educated investment decisions. By considering the growth potential over time, one can identify investments that align with their financial goals, risk tolerance, and time horizon.

3. Retirement Planning

The time value of money is particularly important in retirement planning. By starting early and taking advantage of compounding returns, individuals can ensure a comfortable retirement lifestyle. Understanding how the time value of money affects retirement savings can guide individuals in making appropriate contributions and investment choices.

In conclusion, the time value of money is a fundamental concept in personal finance. By understanding this concept, individuals can make more informed financial decisions, whether it is investing for retirement, purchasing a home, or evaluating investment opportunities. Factors such as inflation, risk, and opportunity cost impact the time value of money, and various formulas and calculations help quantify its effects. The ability to consider the time value of money empowers individuals to plan for their financial future effectively.

Time value of money | Interest and debt | Finance & Capital Markets | Khan Academy

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the concept of time value of money?

The concept of time value of money refers to the idea that money in the present is worth more than the same amount of money in the future. This is due to the potential to earn interest or investment returns over time.

How does time value of money affect financial decision-making?

The time value of money is a fundamental concept in finance and plays a crucial role in financial decision-making. It helps individuals and businesses assess the value of future cash flows, determine investment opportunities, evaluate borrowing costs, and make informed choices regarding saving and investing.

What are the factors that influence the time value of money?

Several factors influence the time value of money, including the interest rate, inflation rate, risk, opportunity cost, and the length of time involved. These factors affect the present value and future value of money.

What is the difference between present value and future value?

Present value refers to the current worth of a future sum of money, discounted back to today’s value using an appropriate interest rate. Future value, on the other hand, represents the value of an investment or cash flow at a specific point in the future, assuming a certain rate of return.

How can I calculate the present value of money?

To calculate the present value of money, you need three key inputs: the future value of the amount, the interest rate or discount rate, and the time period involved. The present value can be determined using various financial formulas or through the use of financial calculators or software.

What is the importance of considering the time value of money in investment decisions?

Considering the time value of money in investment decisions is crucial as it helps in assessing the profitability and feasibility of investment opportunities. By factoring in the time value of money, investors can compare the potential returns of different investments, evaluate risk and reward, and make more informed investment choices.

How does inflation impact the time value of money?

Inflation erodes the purchasing power of money over time. Therefore, it is important to consider the inflation rate when assessing the time value of money. Inflation reduces the future value of money and increases the cost of goods and services, emphasizing the need to account for inflation in financial calculations.

What is compounding and how does it relate to the time value of money?

Compounding refers to the process of earning interest on both the initial principal and the accumulated interest of an investment. It relates to the time value of money by allowing investments to grow over time through the reinvestment of earnings. Compounding enhances the impact of the time value of money and can significantly increase investment returns.

How can the time value of money be applied in personal finance?

The time value of money is applicable in various personal finance aspects, such as budgeting, saving, retirement planning, and debt management. It helps individuals make informed decisions by considering the potential future value of their money and the impact of interest rates and inflation on their financial goals.

Final Thoughts

Understanding the time value of money is crucial when it comes to making informed financial decisions. By comprehending this concept, individuals can assess the worth of money in different time periods and evaluate the potential returns of investments. The time value of money recognizes that money today holds greater value than the same amount in the future due to factors such as inflation and the opportunity for earning interest. By considering this principle, individuals can make better decisions regarding saving, investing, and borrowing. Overall, grasping the time value of money is essential for effective financial planning and decision-making.