Are you tired of falling prey to predatory lending practices? Look no further! In this blog article, we will discuss how to avoid these exploitative practices that can quickly turn your dream of financial stability into a nightmare. With our practical tips and insights, you can empower yourself and make informed decisions when it comes to borrowing money. From understanding the warning signs to conducting thorough research, we will equip you with the knowledge and tools necessary to protect yourself from predatory lending practices. So, let’s dive in and discover how to avoid predatory lending practices once and for all!

How to Avoid Predatory Lending Practices

When it comes to borrowing money, it’s essential to be aware of predatory lending practices. Predatory lenders take advantage of unsuspecting borrowers, often leading them into a cycle of debt and financial hardship. Fortunately, there are steps you can take to protect yourself and avoid falling victim to these deceptive practices. In this article, we will explore various strategies and tips to help you steer clear of predatory lending.

Understanding Predatory Lending

Predatory lending refers to unethical practices employed by certain lenders to exploit borrowers. These lenders often target individuals who may not have access to traditional banking services due to poor credit history or low income. They lure borrowers with false promises and misleading terms, trapping them in a debt spiral with exorbitant interest rates and hidden fees. By understanding the signs of predatory lending, you can make informed decisions and protect yourself from unscrupulous lenders.

The Warning Signs

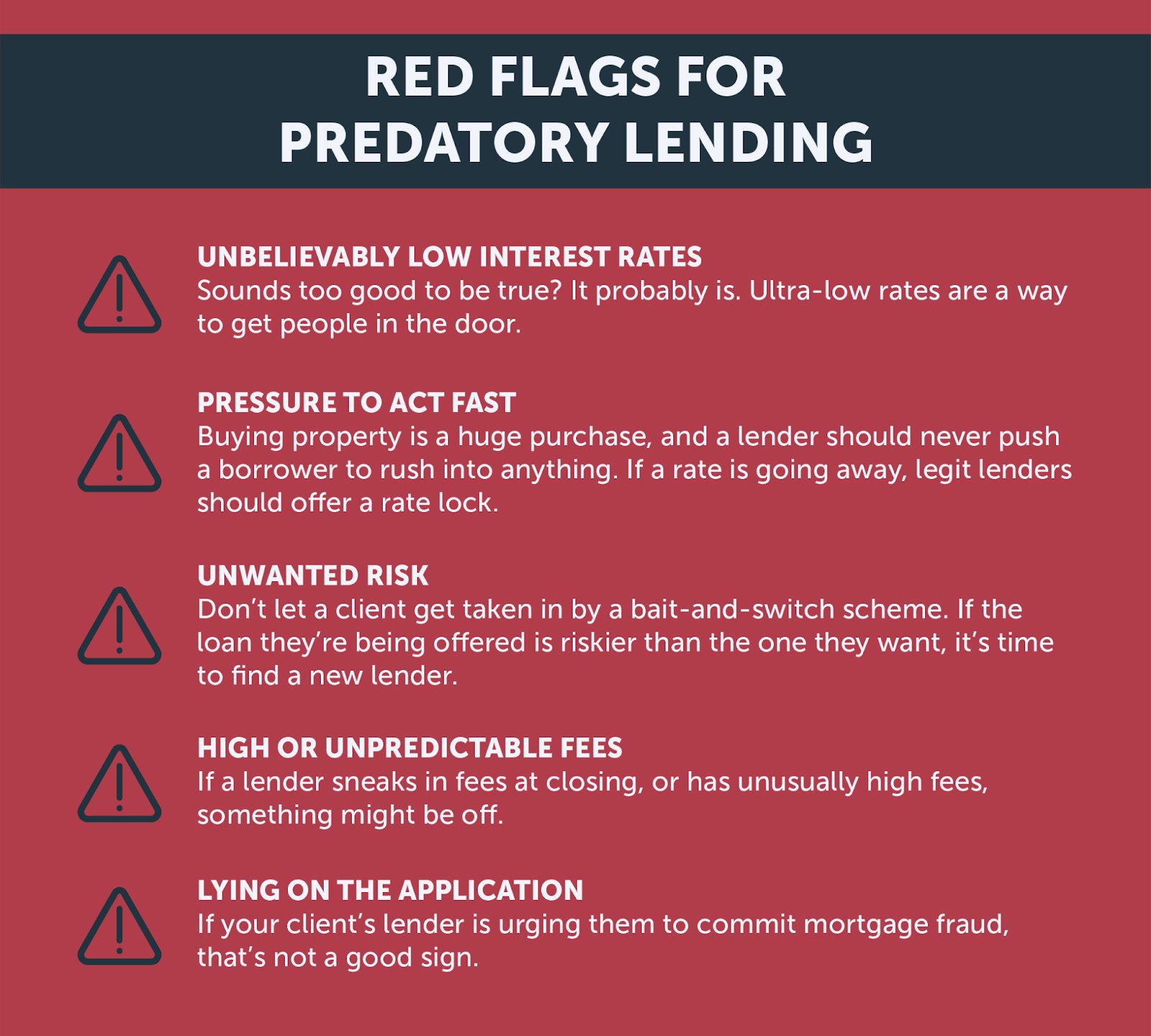

Recognizing the warning signs of predatory lending can help you identify and avoid potential traps. Here are some common red flags:

- High-pressure tactics: Predatory lenders may use aggressive sales tactics to rush you into making a decision without fully understanding the terms.

- Unrealistic promises: Be cautious of lenders who guarantee approval or promise incredibly low interest rates, especially if you have a poor credit history.

- Excessive fees: Watch out for lenders who impose high application fees, origination fees, or prepayment penalties. These fees can significantly increase the overall cost of your loan.

- Misleading terms: Predatory lenders may bury unfavorable terms deep within the loan agreement, making it difficult for borrowers to fully comprehend the risks involved.

- Unlicensed lenders: Verify that the lender is licensed and regulated by the appropriate authorities. Unlicensed lenders are more likely to engage in predatory practices.

Researching the Lender

Before entering into any loan agreement, it’s crucial to research the lender thoroughly. Here are some steps you can take to ensure the lender is reputable:

- Check online reviews: Look for reviews and testimonials from other borrowers to gauge their experiences with the lender. Pay attention to any negative patterns or complaints.

- Verify their credentials: Check if the lender is registered with relevant regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB).

- Seek recommendations: Ask friends, family, or financial advisors for recommendations on reputable lenders. They may have had positive experiences with trusted institutions.

- Compare multiple lenders: Obtain loan quotes from multiple lenders and compare their terms, interest rates, and fees. This will help you identify any predatory practices or unusually high costs.

Maintain Healthy Credit

Your credit score plays a significant role in determining the terms and conditions of your loan. By maintaining a healthy credit profile, you can avoid falling prey to predatory lenders. Here are some steps you can take to improve and maintain your creditworthiness:

Regularly Monitor Your Credit Report

Reviewing your credit report on a regular basis is essential for detecting any errors or fraudulent activities. You can request a free copy of your credit report from each of the major credit bureaus (Equifax, Experian, and TransUnion) once a year. Check for inaccuracies and report any discrepancies immediately to the respective credit bureau for correction.

Pay Bills on Time

Consistently paying your bills, including credit card payments, loans, and utilities, on time demonstrates responsible financial behavior. Late payments can negatively impact your credit score, making you appear riskier to lenders. Setting up automatic payments or reminders can help ensure that you never miss a payment deadline.

Reduce Your Debt-to-Income Ratio

The debt-to-income ratio measures the amount of debt you owe compared to your income. Lenders consider a high debt-to-income ratio a risk factor when evaluating loan applications. To improve this ratio, focus on paying down your existing debts and avoid taking on new loans unless absolutely necessary.

Avoid Opening Multiple Lines of Credit Simultaneously

While having access to credit is essential, opening multiple lines of credit within a short period can raise concerns for lenders. Each new credit application triggers a “hard inquiry,” which temporarily lowers your credit score. Instead, selectively open new lines of credit when needed and maintain a reasonable number of accounts.

Read and Understand Loan Agreements

Before signing any loan agreement, it’s crucial to read and understand all the terms and conditions. Predatory lenders often bury unfavorable clauses in the fine print, leading borrowers into unfavorable agreements. Here are some key factors to consider when evaluating a loan agreement:

Interest Rates

Pay close attention to the interest rate charged on the loan. Predatory lenders may offer loans with significantly higher rates than average, driving up the overall cost of borrowing. Compare the interest rates with other lenders to ensure they are reasonable and competitive.

Hidden Fees and Penalties

Thoroughly review the loan agreement for any hidden fees or penalties. Predatory lenders often impose excessive fees for services such as loan origination, document preparation, or late payments. Additionally, they may include prepayment penalties that discourage early repayment of the loan.

Loan Term and Repayment Schedule

Understand the duration of the loan and the repayment schedule. Predatory lenders may structure loans with short repayment terms and large balloon payments, making it difficult for borrowers to meet their obligations. Ensure that the loan term and repayment schedule are manageable based on your financial situation.

Consider Alternatives

If you suspect that a loan offer might involve predatory practices or the terms are unfavorable, explore alternative options. Here are some alternatives to consider:

- Traditional banks and credit unions: Banks and credit unions are regulated financial institutions that offer a range of loan products. They typically have more transparent lending practices and offer competitive interest rates.

- Peer-to-peer lending: Peer-to-peer lending platforms connect borrowers with individual investors. These platforms often offer competitive rates and more flexible terms.

- Nonprofit organizations: Some nonprofit organizations provide low-cost loans or financial assistance programs specifically designed for individuals facing financial hardship.

- Family and friends: If possible, consider borrowing money from trusted family or friends who may be willing to provide a loan with more favorable terms.

Seek Professional Financial Advice

If you are unsure about the terms or legitimacy of a loan offer, it’s always a good idea to seek professional financial advice. A certified financial planner or credit counselor can help you navigate through the complexities of borrowing and provide guidance on alternative solutions. They can review loan agreements, assess your financial situation, and offer recommendations based on your specific needs.

By being vigilant and well-informed, you can protect yourself from predatory lending practices. Remember to research lenders, maintain a healthy credit profile, read loan agreements carefully, and seek professional advice when necessary. Taking these steps will help you make informed decisions and avoid falling into the trap of predatory lending.

Predatory Lending Practices & How to Avoid Them

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What are predatory lending practices?

Predatory lending practices refer to the unethical and deceptive tactics used by some lenders to exploit borrowers, often leading to financial harm or loss.

2. How can I identify predatory lenders?

To identify predatory lenders, watch out for warning signs such as high interest rates, excessive fees, pressure to borrow more than you need, and lack of transparency in loan terms and conditions.

3. What steps can I take to avoid predatory lending practices?

To avoid predatory lending practices, it is important to research and compare lenders, read and understand loan documents, ask questions about any unclear terms, and seek advice from trusted financial professionals.

4. Is it important to review my credit report before applying for a loan?

Yes, reviewing your credit report before applying for a loan is crucial. It allows you to identify and rectify any errors or inaccuracies that may negatively impact your loan terms or eligibility. This can help you secure better loan options and avoid predatory lenders who take advantage of borrowers with poor credit.

5. How can I determine if a loan offer is predatory?

You can determine if a loan offer is predatory by carefully reviewing the interest rates, fees, repayment terms, and any hidden charges. Compare the offer with other loans available in the market to ensure fairness and transparency.

6. Are there any government resources or agencies that can help me avoid predatory lending?

Yes, there are government resources and agencies that can help you avoid predatory lending practices. For example, in the United States, the Consumer Financial Protection Bureau (CFPB) provides information and resources to empower consumers and protect them from predatory lending practices.

7. What are some alternative borrowing options to consider instead of predatory loans?

Instead of turning to predatory loans, consider alternative borrowing options such as credit unions, community development financial institutions (CDFIs), or peer-to-peer lending platforms. These alternatives often offer more affordable and transparent loan options.

8. What should I do if I believe I have been a victim of predatory lending?

If you believe you have been a victim of predatory lending, you should gather all relevant documentation, including loan agreements and communication records. Contact a consumer protection agency or a lawyer specializing in consumer rights to explore your options for legal recourse or assistance in resolving the matter.

Final Thoughts

In order to avoid predatory lending practices, there are several steps you can take to protect yourself and make informed decisions. Firstly, always thoroughly research and compare lenders to ensure they have a reputable track record. Secondly, carefully review all loan terms and conditions before signing any agreements, paying attention to hidden fees or excessive rates. Additionally, it is crucial to understand your own financial situation and only borrow what you can comfortably afford to repay. Lastly, seek guidance from certified financial professionals who can provide valuable advice and insights. By following these proactive steps, you can safeguard yourself from falling victim to predatory lending practices.