Leveraged trading can be enticing, offering the potential for significant returns even with a small initial investment. However, it’s crucial to understand the risks involved before diving in. What is leveraged trading and its risks? Well, it involves borrowing funds to amplify your trading position, allowing you to potentially make more substantial profits. Yet, the same leverage that magnifies your gains can also amplify your losses. In this article, we’ll explore the ins and outs of leveraged trading, shedding light on its risks and precautions one should take before embarking on this financial adventure. So, let’s dive right in!

What is Leveraged Trading and its Risks

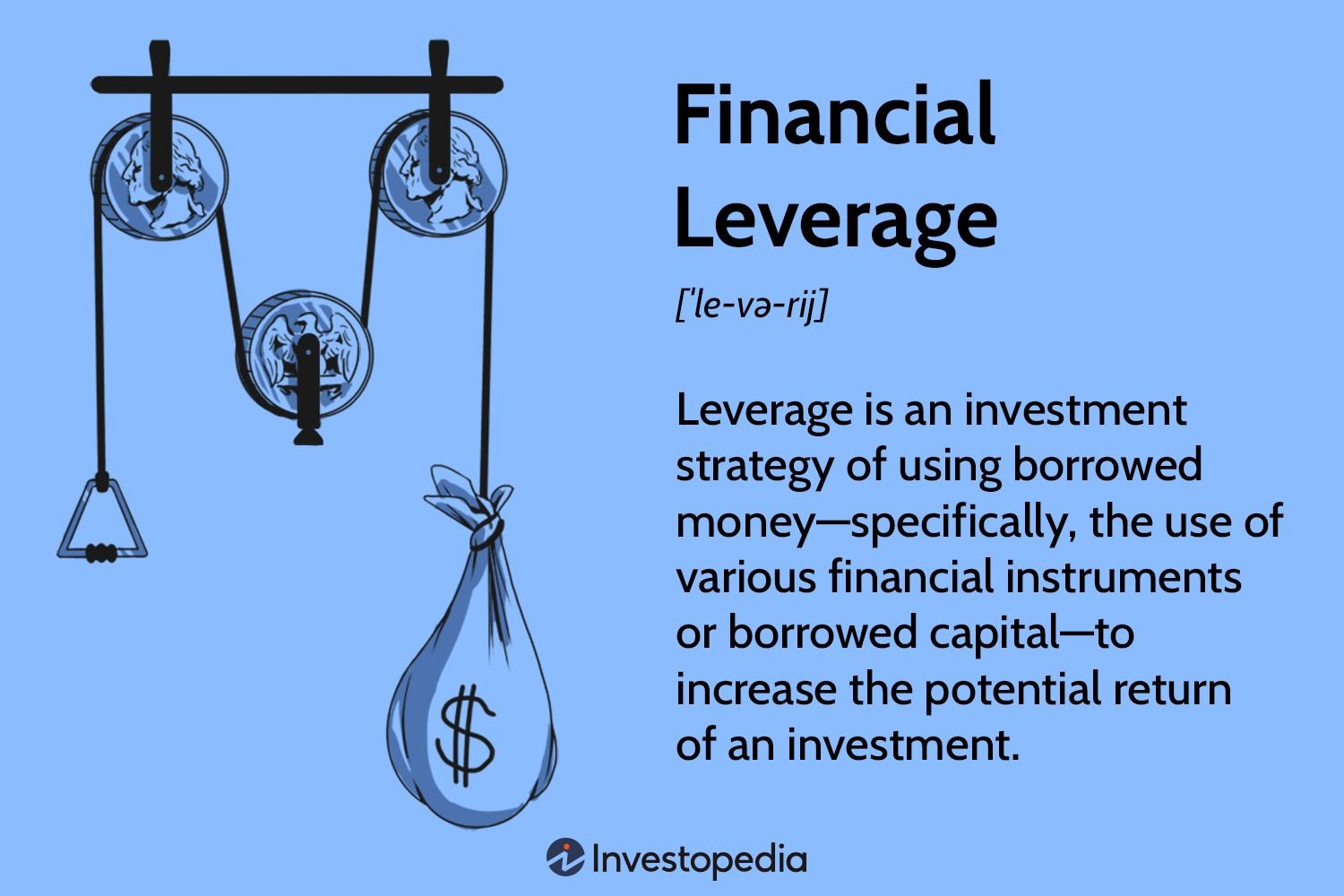

Leveraged trading is a popular strategy used by traders to amplify potential profits by borrowing additional capital from a broker. It allows traders to gain greater exposure to the financial markets using a smaller initial investment. While leveraged trading can be lucrative, it’s important to understand the risks involved.

How Does Leveraged Trading Work?

Leveraged trading involves using borrowed funds, often referred to as margin, to increase the potential return on investment. It allows traders to control a larger position in the market than their own capital would otherwise allow. The ratio of borrowed funds to the trader’s own capital is known as the leverage ratio.

For example, if a trader has $1,000 and uses 10x leverage, they can control a position worth $10,000. This means that any profits or losses on the trade will be magnified by a factor of 10.

The Benefits of Leveraged Trading

Leveraged trading offers several advantages for traders:

1. Increased Market Exposure: Leveraged trading allows traders to access markets and instruments they might not have been able to trade with their available capital.

2. Amplified Profits: By magnifying the position size, leveraged trading has the potential to generate higher returns if the trade moves in the trader’s favor.

3. Diversification: Leveraged trading enables traders to diversify their portfolio by gaining exposure to different asset classes and markets.

The Risks of Leveraged Trading

While leveraged trading can be enticing, it also comes with inherent risks that traders should be aware of:

1. Increased Losses: While leveraged trading can amplify profits, it can also magnify losses. If a trade moves against the trader, the losses will be larger than if they were trading with their own capital alone.

2. Margin Calls: When trading on margin, traders must maintain a minimum level of funds in their account known as the maintenance margin. If the account value falls below this level, traders may receive a margin call, requiring them to either deposit additional funds or close their positions.

3. Volatility: Leveraged trading is particularly sensitive to market volatility. Rapid price movements can result in significant losses or gains, making it crucial for traders to closely monitor their positions.

4. Overtrading and Impulsive Decisions: The ease of leveraged trading can tempt traders to overtrade or make impulsive decisions, increasing the risk of losses. It is important to have a well-thought-out trading plan and stick to it.

5. Counterparty Risk: Leveraged trading involves borrowing funds from a broker. Traders should be mindful of the counterparty risk associated with their chosen broker, ensuring they select a reputable and regulated provider.

Managing the Risks of Leveraged Trading

While leveraged trading carries risks, there are certain measures traders can take to manage and minimize these risks:

1. Risk Management Strategies

Implementing risk management strategies can help traders protect their capital and minimize potential losses:

- Stop Loss Orders: Placing stop-loss orders can automatically close a position if the market moves against the trader beyond a specified threshold, limiting potential losses.

- Take Profit Orders: Take profit orders can automatically close a position when the market reaches a predetermined profit level, ensuring traders lock in profits.

- Position Sizing: Properly sizing positions based on risk tolerance can help traders avoid overexposure and manage potential losses.

2. Education and Research

Becoming knowledgeable about the financial markets and the instruments being traded is essential. Traders should invest time in understanding the factors that can influence market movements and conduct thorough research before entering any leveraged trade.

3. Demo Trading

Using a demo trading account can be beneficial for new traders who want to practice leveraged trading without risking real money. It provides an opportunity to gain experience and test various strategies in a risk-free environment.

4. Proper Capital Allocation

Allocating capital wisely is crucial for managing risk. Traders should avoid risking too much on a single trade and diversify their portfolio to spread the risk across different instruments and markets.

5. Regular Monitoring

Monitoring positions regularly allows traders to stay updated on market conditions and potential risks. Keeping a close eye on trades enables timely decisions to be made, such as adjusting stop-loss levels or taking profits.

Leveraged trading can be a powerful tool for traders, offering increased market exposure and the potential for amplified profits. However, it is important to be aware of the risks involved and to implement appropriate risk management strategies. By understanding these risks and taking necessary precautions, traders can participate in leveraged trading with confidence and increase their chances of success.

This IS WHY Most BEGINNERS Lose Their ACCOUNTS (What Is Leverage?)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is leveraged trading?

Leveraged trading refers to the practice of using borrowed funds (leverage) to amplify potential returns when trading financial instruments such as stocks, currencies, or commodities. It allows traders to control a larger position in the market with a smaller amount of invested capital.

What are the risks associated with leveraged trading?

Leveraged trading involves significant risks that traders should be aware of. Some of the common risks include:

How does leverage increase the risk in trading?

Leverage increases the risk in trading by amplifying both potential gains and losses. While it allows traders to magnify their profits, even small price movements in the market can lead to significant losses as leveraged positions are exposed to a higher degree of market volatility.

What is margin call and how does it relate to leveraged trading?

A margin call is a demand by the broker or exchange to deposit additional funds into the trading account to maintain the required margin level. In leveraged trading, margin calls occur when losses on a trade deplete the available margin to an insufficient level. Failure to meet the margin call may result in the liquidation of positions.

What is the difference between leverage and margin?

Leverage refers to the ratio of borrowed funds to the trader’s invested capital, while margin is the amount of funds that the trader must deposit as collateral to open and maintain a leveraged position. Leverage is the amplification factor, while margin is the actual amount required to control the leveraged position.

Is leveraged trading suitable for everyone?

Leveraged trading is not suitable for everyone and carries a higher level of risk. It is more appropriate for experienced traders who understand the risks involved and have the necessary knowledge and expertise to manage their positions effectively.

What are some risk management strategies for leveraged trading?

To manage the risks associated with leveraged trading, traders can employ various strategies such as setting stop-loss orders, diversifying their portfolio, using proper position sizing, and staying updated with market news and analysis. Proper risk management is crucial to mitigate potential losses.

Are there any regulations or restrictions on leveraged trading?

Regulations and restrictions on leveraged trading vary across different jurisdictions. It is important for traders to understand the applicable laws and regulations in their country or region to ensure compliance and protect their interests while engaging in leveraged trading activities.

Final Thoughts

Leveraged trading involves borrowing funds to amplify potential gains in the financial markets. However, it also carries significant risks that traders need to be aware of. One major risk is the potential for substantial losses, as leveraged trading magnifies both profits and losses. Additionally, market volatility can lead to rapid and unpredictable price fluctuations, further increasing the risk exposure. Furthermore, traders will often face margin calls, which require additional funds to maintain open positions. Understanding the risks associated with leveraged trading is crucial, as it can help traders make informed decisions and manage their risk effectively.