Looking to invest in green bonds? You’ve come to the right place! In this article, we will explore strategies for investing in green bonds – a sustainable investment option that not only promises financial returns but also contributes to a greener future. Green bonds have been gaining popularity among environmentally conscious investors, offering an opportunity to support projects focused on renewable energy, clean transportation, and other eco-friendly initiatives. So, if you’re interested in aligning your investment portfolio with your sustainability goals, keep reading for valuable insights on strategies for investing in green bonds.

Strategies for Investing in Green Bonds

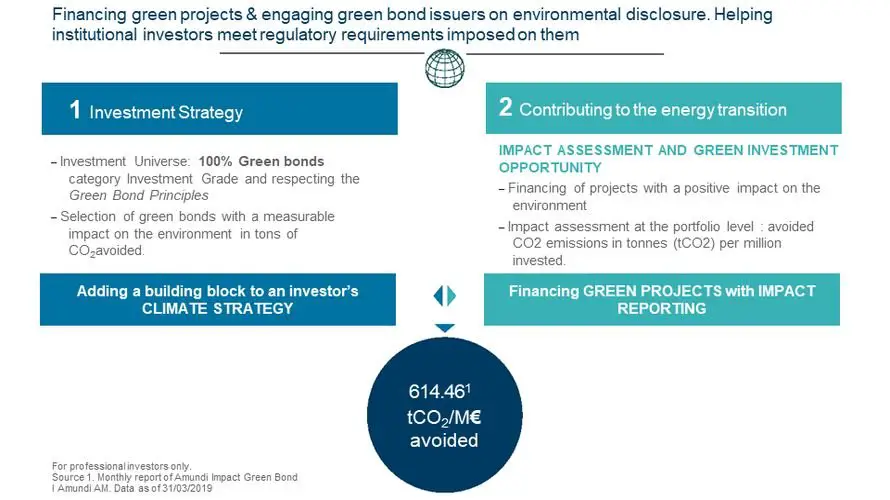

Investing in green bonds has gained significant traction in recent years as individuals and organizations seek to align their investments with environmental sustainability. Green bonds are financial instruments that are specifically earmarked for financing environmentally friendly projects or initiatives. If you are considering investing in green bonds, it is important to understand the strategies that can help you navigate this growing market. In this article, we will explore various strategies for investing in green bonds and provide you with the knowledge to make informed decisions.

Educate Yourself on Green Bonds

Before diving into the world of green bonds, it’s crucial to educate yourself about the basics, benefits, and risks associated with this investment vehicle. Here are some key points to consider:

- Definition: Green bonds are debt securities issued by governments, municipalities, or corporations to fund projects with environmental benefits.

- Environmental Impact: These bonds finance initiatives such as renewable energy projects, sustainable agriculture, energy-efficient buildings, clean transportation, and more.

- Market Growth: The green bond market has experienced rapid growth, with issuances reaching record highs in recent years.

- Transparency and Certification: Many green bonds are certified by independent third parties to ensure the funds are used for environmentally friendly projects.

- Risks: As with any investment, green bonds carry risks, including interest rate fluctuations, credit risk, and regulatory changes.

By familiarizing yourself with these fundamentals, you can make informed decisions when selecting green bonds for investment.

Define Your Investment Goals and Risk Tolerance

As with any investment strategy, it’s important to define your goals and assess your risk tolerance before investing in green bonds. Consider the following:

- Financial Objectives: Determine whether you are investing for capital preservation, income generation, or long-term capital appreciation.

- Time Horizon: Assess how long you are willing to hold your investments to achieve your financial objectives.

- Risk Appetite: Evaluate your tolerance for market volatility and potential fluctuations in the value of your investments.

Defining your investment goals and risk tolerance will help you shape your green bond investment strategy and select the most suitable bonds.

Select the Right Issuers

When investing in green bonds, it is vital to carefully evaluate the issuers. Here are some factors to consider:

- Issuer’s Track Record: Assess the issuer’s reputation, financial stability, and commitment to sustainability.

- Adequate Disclosure: Look for issuers that provide transparent and comprehensive information about the use of proceeds from their green bond offerings.

- Certification: Consider investing in green bonds certified by recognized organizations such as the Climate Bonds Initiative or the International Capital Market Association.

Choosing reputable issuers with a strong track record of environmental responsibility can enhance the likelihood of positive environmental impact and financial returns.

Perform Thorough Due Diligence

Conducting thorough due diligence is crucial when investing in green bonds. Here are some steps to follow:

- Review Official Statements: Read the official statements and offering documents to understand the issuer’s financial health, project details, and use of proceeds.

- Evaluate the Green Project: Assess the environmental impact, feasibility, and long-term sustainability of the project being financed by the green bond.

- Assess Creditworthiness: Analyze the issuer’s creditworthiness and credit rating to gauge the likelihood of timely interest and principal payments.

- Engage with Experts: Seek guidance from financial advisors or sustainable investment experts who can provide insights into the green bond market.

Thorough due diligence is essential to mitigate risks and ensure your investments align with your sustainability goals.

Diversify Your Green Bond Portfolio

Diversification is a key strategy in any investment portfolio, including green bonds. By spreading your investments across different issuers and sectors, you can reduce the impact of potential single-issuer or sector-specific risks. Consider diversifying across:

- Geographies: Invest in green bonds issued in different countries or regions to minimize exposure to local economic or regulatory factors.

- Sectors: Allocate investments across various sectors such as renewable energy, transportation, sustainable agriculture, and green buildings.

- Issuer Types: Include bonds issued by governments, municipalities, and corporations to diversify both credit and sector risks.

Diversification can help smooth out potential volatility and enhance the overall risk-adjusted returns of your green bond investments.

Monitor and Engage with Issuers

Actively monitoring your green bond investments and engaging with issuers is crucial to stay informed and influence positive change. Here’s how:

- Monitor Environmental Impact: Regularly assess the environmental performance and progress of the projects funded by the green bonds you hold.

- Stay Up-to-Date: Stay informed about any changes in the issuer’s financial health, sustainability initiatives, or regulatory environment that may impact your investments.

- Engage in Shareholder Activities: Participate in shareholder meetings, ask questions, and voice your concerns or support for sustainable practices.

- Support for Transition Bonds: Consider supporting transition bonds issued by companies or sectors in the process of transitioning to greener practices, as they play a vital role in the overall sustainability journey.

By actively monitoring and engaging with issuers, you can contribute to the ongoing improvement of green bond practices and foster positive environmental impact.

Stay Informed and Adapt

The world of green bonds is continually evolving, and staying informed is essential for successful investing. Here are some strategies:

- Follow Market Trends: Stay updated on the latest green bond market trends, new issuances, and regulatory developments.

- Continuous Learning: Engage in ongoing education about sustainable investing, green bond frameworks, and emerging impact assessment methodologies.

- Adapt to Changing Market Conditions: Adjust your investment strategy as market conditions change, seizing new opportunities and managing potential risks.

Remaining knowledgeable and adaptable will ensure you can make informed decisions and navigate the dynamic landscape of green bond investing.

Investing in green bonds can be a rewarding way to align your financial goals with your commitment to environmental sustainability. By educating yourself, defining your investment goals, conducting due diligence, diversifying your portfolio, and actively monitoring your investments, you can create a strategy that maximizes both environmental impact and financial returns. Remember to stay informed, adapt to market conditions, and engage with issuers to contribute to the growth of the green bond market and the transition to a more sustainable future.

Green Bonds Series – What you need to know about investing in sustainable bonds?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are green bonds?

Green bonds are fixed-income financial instruments that provide funds for projects with environmental benefits, such as renewable energy, energy efficiency, sustainable agriculture, and clean transportation.

How do green bonds work?

Green bonds work similarly to traditional bonds, where investors provide capital to issuers in exchange for regular interest payments and the return of principal. The difference lies in the use of these funds, which must be dedicated to environmentally friendly projects.

Why should I consider investing in green bonds?

Investing in green bonds allows you to support projects that contribute to a more sustainable future and address pressing environmental challenges. It can also be seen as a way to align your investments with your personal values and contribute to positive change.

What strategies can I use when investing in green bonds?

1. Diversification: Spread your investments across different types of green bonds and issuers to reduce risk.

2. Research: Conduct due diligence on the issuer’s track record, project details, and the green bond framework to ensure transparency and credibility.

3. Yield evaluation: Compare the yields of green bonds with similar traditional bonds to assess their financial attractiveness.

4. Impact assessment: Evaluate the environmental impact of the projects funded by green bonds to ensure alignment with your sustainability goals.

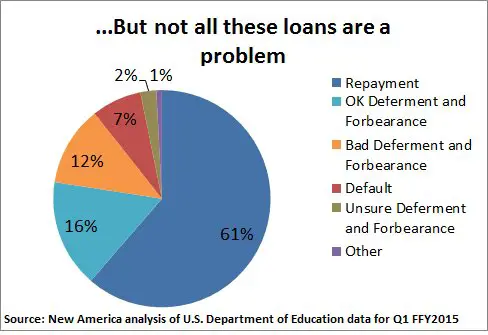

Are green bonds considered low-risk investments?

While green bonds can offer similar risk levels as traditional bonds, it is important to note that risk ultimately depends on the issuer’s financial strength and the specific terms of the bond. Conducting thorough research and diversifying your portfolio can help manage risk effectively.

Where can I buy green bonds?

Green bonds can be purchased through various channels such as banks, brokerage firms, and online platforms. It is advisable to consult with a financial advisor or explore reputable investment platforms to gain access to a diverse range of green bond options.

How can I track the performance of my green bond investments?

You can track the performance of your green bond investments by reviewing periodic statements provided by your financial institution or online investment platforms. These statements typically provide information on interest payments received and the current value of your investments.

What are the potential financial returns of investing in green bonds?

The potential financial returns of green bonds are influenced by factors such as market conditions, interest rates, and the creditworthiness of the issuer. While green bonds may not always offer higher returns than traditional bonds, they can still provide competitive financial rewards while making a positive impact.

Note: This content is for informational purposes only and should not be considered financial advice. Consult with a professional financial advisor before making any investment decisions.

Final Thoughts

In conclusion, strategies for investing in green bonds involve considering both financial and environmental factors. Investors should research and select bonds that align with their sustainability goals and offer attractive returns. Diversifying the portfolio by investing in a variety of green bonds can help mitigate risks. Additionally, staying updated on market trends, regulatory changes, and reporting standards is essential for making informed investment decisions. By actively engaging with issuers and seeking transparency, investors can contribute to the growth of the green bond market while generating positive environmental impact and financial returns.