Are you ready to embark on the exciting journey of freelance work? Wondering how to transition financially into this new chapter of your professional life? Look no further! In this blog article, we will explore practical steps and valuable tips to help you smoothly navigate the financial aspects of freelancing. Whether you’re just starting out or seeking to optimize your existing freelance career, mastering the art of managing your finances is crucial for long-term success. So, tighten your seatbelt and let’s dive into understanding how to transition financially into freelance work.

How to Transition Financially into Freelance Work

Introduction

For many individuals, the prospect of transitioning from traditional employment to freelance work can be both exciting and daunting. While there are numerous benefits to freelancing such as flexibility, autonomy, and the potential for higher earnings, it is essential to consider the financial aspects of this career shift. Successfully navigating the transition requires careful planning and preparation to ensure a smooth financial journey as a freelancer. In this article, we will explore various strategies and tips on how to transition financially into freelance work.

Assessing Your Current Financial Situation

Before diving into the world of freelancing, it is crucial to assess your current financial situation. This evaluation will provide a solid foundation for planning and making informed decisions. Here are some key steps to take:

- Calculate your current income: Determine your monthly or annual income from your current job, considering any additional sources of revenue or benefits.

- Analyze your expenses: Review your monthly expenses, including bills, rent or mortgage payments, groceries, transportation costs, and any outstanding debts. Categorize expenses into fixed and variable to gain a better understanding of your financial obligations.

- Build an emergency fund: Freelancing often involves income fluctuations, making it essential to have an emergency fund. Aim to save at least three to six months’ worth of living expenses to provide a safety net during slower periods.

- Assess your debts: Take stock of any debts you currently have, such as credit card balances, student loans, or outstanding mortgage payments. Evaluating your debt situation will help you determine how to manage these financial obligations while transitioning to freelance work.

- Evaluate your savings: Review your savings accounts, retirement funds, and investments. Understanding your current savings will help you determine how long you can sustain yourself financially during the transition.

Creating a Realistic Budget

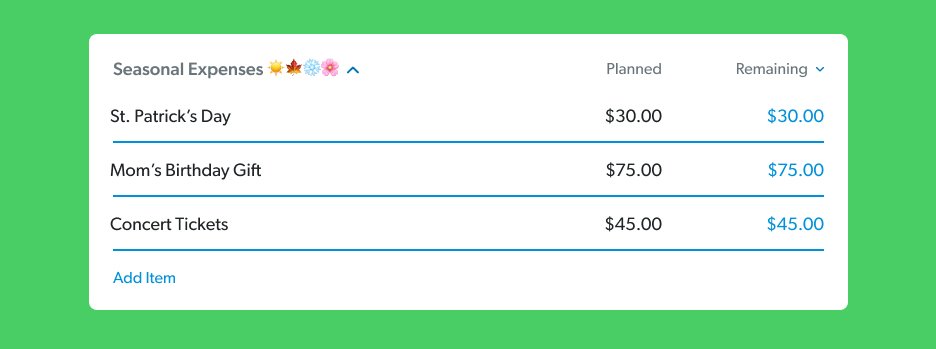

One of the most crucial aspects of transitioning into freelance work is creating a realistic budget that aligns with your new income streams. Follow these steps to create a comprehensive budget:

- Track your expenses: Monitor your spending for a few months to gain an accurate picture of your current financial habits. This will help identify areas where you can cut back or allocate more funds towards your freelancing journey.

- Identify essential and non-essential expenses: Categorize your expenses into essential (e.g., rent/mortgage, utilities) and non-essential (e.g., dining out, subscriptions). This will enable you to prioritize your expenditure and make necessary adjustments to accommodate your new income level.

- Set financial goals: Define your short-term and long-term financial goals. These may include paying off debts, saving for retirement, or investing in professional development. Incorporate these goals into your budget to ensure you are allocating funds accordingly.

- Consider irregular expenses: As a freelancer, you may encounter irregular expenses such as taxes, healthcare costs, and business-related expenditures. Factor in these expenses when creating your budget to avoid any financial surprises.

- Review and adjust regularly: Review your budget regularly to track your progress and make adjustments as needed. A budget is a dynamic tool that should evolve with your freelancing career.

Building a Freelance Financial Safety Net

When transitioning to freelance work, it is essential to establish a robust financial safety net to protect yourself from unexpected financial challenges. Consider implementing the following strategies:

- Secure freelance clients before quitting your job: Before leaving your full-time employment, try to secure freelance clients or projects to ensure a smooth transition. Having a client base in place will provide immediate income once you start freelancing.

- Build an emergency fund: As mentioned earlier, having an emergency fund is crucial for freelancers. Set aside a portion of your income each month to gradually build up this fund.

- Invest in insurance: Freelancers often lack the benefits provided by traditional employment, such as health insurance or disability coverage. Explore insurance options tailored for freelancers to protect yourself and your business.

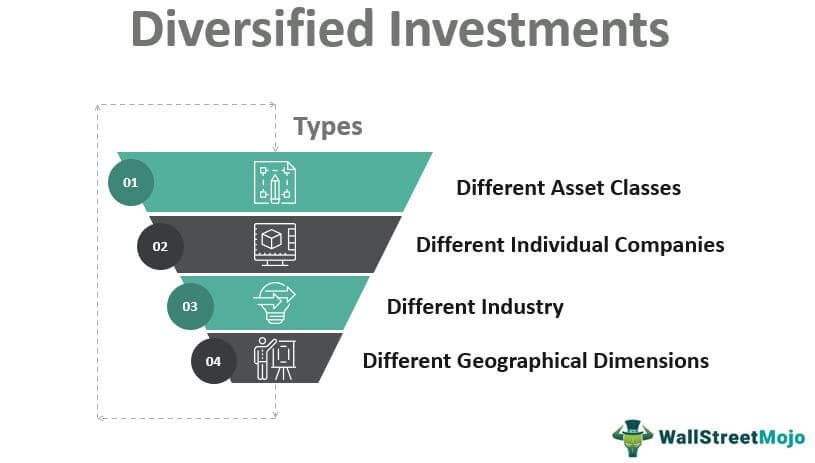

- Diversify your income streams: Relying solely on one client or income stream can be risky. Seek opportunities to diversify your income by exploring different projects or client niches to mitigate financial instability.

- Create a pipeline of work: Consistently market and network to maintain a steady flow of freelance projects. Building a pipeline of work will help reduce gaps between projects and ensure a more predictable income.

Managing Taxes and Financial Obligations

As a freelancer, managing taxes and financial obligations becomes your responsibility. Consider the following tips to navigate these aspects:

- Consult with a tax professional: Freelancers often have complex tax obligations. Seek guidance from a tax professional to understand the tax laws applicable to your freelance business and ensure you are compliant.

- Set aside money for taxes: Unlike traditional employment, freelancers must pay their taxes quarterly. Set aside a portion of each payment or income for future tax obligations to avoid any financial strain.

- Understand deductible expenses: Familiarize yourself with deductible expenses applicable to your freelance business. Keep detailed records of your business-related expenses to maximize your tax deductions.

- Invoice and track income: Implement a system to track your income and send professional invoices to clients in a timely manner. Properly recording your income will make tax filing more manageable.

- Pay attention to deadlines: Stay organized and be aware of tax deadlines, business license renewals, and other financial obligations associated with your freelance work. Missing deadlines can lead to penalties and unnecessary stress.

Investment and Retirement Planning

Transitioning into freelance work does not mean neglecting your financial future. Consider the following strategies for investment and retirement planning:

- Open a retirement account: As a freelancer, you are responsible for setting up your retirement savings. Consider opening an Individual Retirement Account (IRA) or a Simplified Employee Pension (SEP) IRA to save for your future.

- Work with a financial advisor: If you are unsure about investment strategies or retirement planning, consult with a financial advisor who specializes in working with freelancers. They can provide guidance tailored to your specific financial goals.

- Allocate funds towards investments: Once you have built a sufficient emergency fund, consider allocating a portion of your income towards investments. Diversify your investment portfolio to maximize potential returns.

- Stay informed about financial markets: Freelancers should stay updated on financial news and trends to make informed investment decisions. Attend webinars, read books, or follow reputable financial blogs to expand your financial knowledge.

Transitioning financially into freelance work requires careful consideration, planning, and ongoing evaluation. By assessing your current financial situation, creating a realistic budget, building a financial safety net, managing taxes and obligations, and investing for the future, you can set yourself up for a successful freelance career. Remember, freelancing offers unique financial opportunities, and with the right strategies in place, you can thrive both personally and financially in this new venture.

How To Make Money On Freelancer in 2023 (For Beginners)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What steps should I take to transition financially into freelance work?

To transition financially into freelance work, follow these steps:

- Assess your current financial situation, including your income, expenses, savings, and debts.

- Create a budget to manage your finances effectively and account for any fluctuations in income as a freelancer.

- Build an emergency fund to cover unexpected expenses and a potential gap in income during the transition period.

- Research and understand the market rates for your freelance services to determine competitive pricing.

- Establish a payment structure that works for both you and your clients, ensuring prompt and consistent payments.

- Consider obtaining freelancers’ insurance or liability coverage to protect yourself from potential risks.

- Explore different freelance platforms and networks to find clients and opportunities that align with your skills.

- Network and market yourself to potential clients through online platforms, social media, and professional connections.

How can I manage irregular income as a freelancer?

To manage irregular income as a freelancer:

- Create a realistic budget that accounts for fluctuations in income and prioritize essential expenses.

- Set aside a portion of your income during high-earning months to build financial stability during lean periods.

- Consider setting up separate savings accounts for taxes, emergencies, and long-term financial goals.

- Maintain a consistent record-keeping system to track income and expenses for accurate financial planning.

- Diversify your client base to reduce dependence on a single source of income and minimize financial risks.

Should I have a separate bank account for my freelance income?

Having a separate bank account for your freelance income is highly recommended. It provides several benefits:

- Allows you to easily track income and expenses related to your freelance work for accounting and tax purposes.

- Simplifies financial management by separating your personal and business finances.

- Helps establish a professional image and credibility with clients.

- Facilitates the identification of business-related deductions for tax purposes.

How do I determine my freelance rates?

To determine your freelance rates:

- Research the industry standards and rates for similar freelance services in your field.

- Evaluate your skills, experience, and expertise to assess your value in the market.

- Consider the time and effort required to complete projects and deliver quality work.

- Assess the level of demand for your services and factor in any specialized knowledge or niche expertise.

- Calculate your desired annual income, taking into account expenses, taxes, and business-related costs.

How can I ensure timely payment from clients as a freelancer?

To ensure timely payment from clients:

- Establish clear payment terms and policies upfront, including the preferred method of payment and payment schedule.

- Require clients to sign a contract or agreement that outlines the payment terms and protects both parties’ interests.

- Consider requesting an upfront deposit or partial payment before starting work on a project.

- Send professional and detailed invoices promptly, clearly specifying the services provided and the payment due date.

- Follow up politely but assertively on overdue payments, sending reminders and escalating if necessary.

What financial aspects should I consider before transitioning to freelance work?

Before transitioning to freelance work, consider these financial aspects:

- Evaluating your current financial stability and assessing your ability to sustain yourself during the transition period.

- Understanding the potential impact on your health insurance, retirement savings, and other employee benefits.

- Calculating the additional costs, such as business licenses, taxes, and self-employment taxes.

- Exploring the availability and requirements of freelancers’ insurance or liability coverage.

- Creating a backup plan or alternative income streams to mitigate the risks associated with freelancing.

Are there any tax considerations I should be aware of as a freelancer?

As a freelancer, you should be aware of the following tax considerations:

- Understanding your tax obligations, including self-employment taxes, estimated tax payments, and any applicable deductions.

- Keeping accurate records of income and expenses to facilitate tax preparation and minimize potential errors.

- Consulting with a tax professional or accountant to ensure compliance with tax laws and optimize your tax strategy.

- Researching deductible business expenses and taking advantage of potential tax deductions specific to freelancers.

- Setting aside a portion of your income for tax payments to avoid financial strain when the tax filing deadline approaches.

Final Thoughts

Transitioning financially into freelance work requires careful planning and a strategic approach. First, create a budget that accounts for both business and personal expenses. This will help you set realistic income goals and ensure that you can cover your essential costs. Second, consider establishing an emergency fund to handle unforeseen expenses or fluctuations in income. Third, diversify your income streams by finding multiple clients or projects. This will provide stability and minimize the risk of relying too heavily on a single source of income. Finally, as you make the leap into freelance work, continue to track your expenses, adjust your budget as necessary, and save for taxes. By following these steps and being proactive, you can successfully transition financially into freelance work.