Private equity firms – have you ever wondered what they are and what they do? Look no further! In this article, we will demystify the world of private equity firms and shed light on their inner workings. A private equity firm is a company that invests in privately-owned businesses or takes them private to help them grow, improve their operations, and ultimately achieve higher returns. These firms not only provide capital but also strategic guidance and management expertise to unlock the full potential of the businesses they invest in. Join us as we dive into the fascinating world of private equity and explore how they make it happen.

What Is a Private Equity Firm?

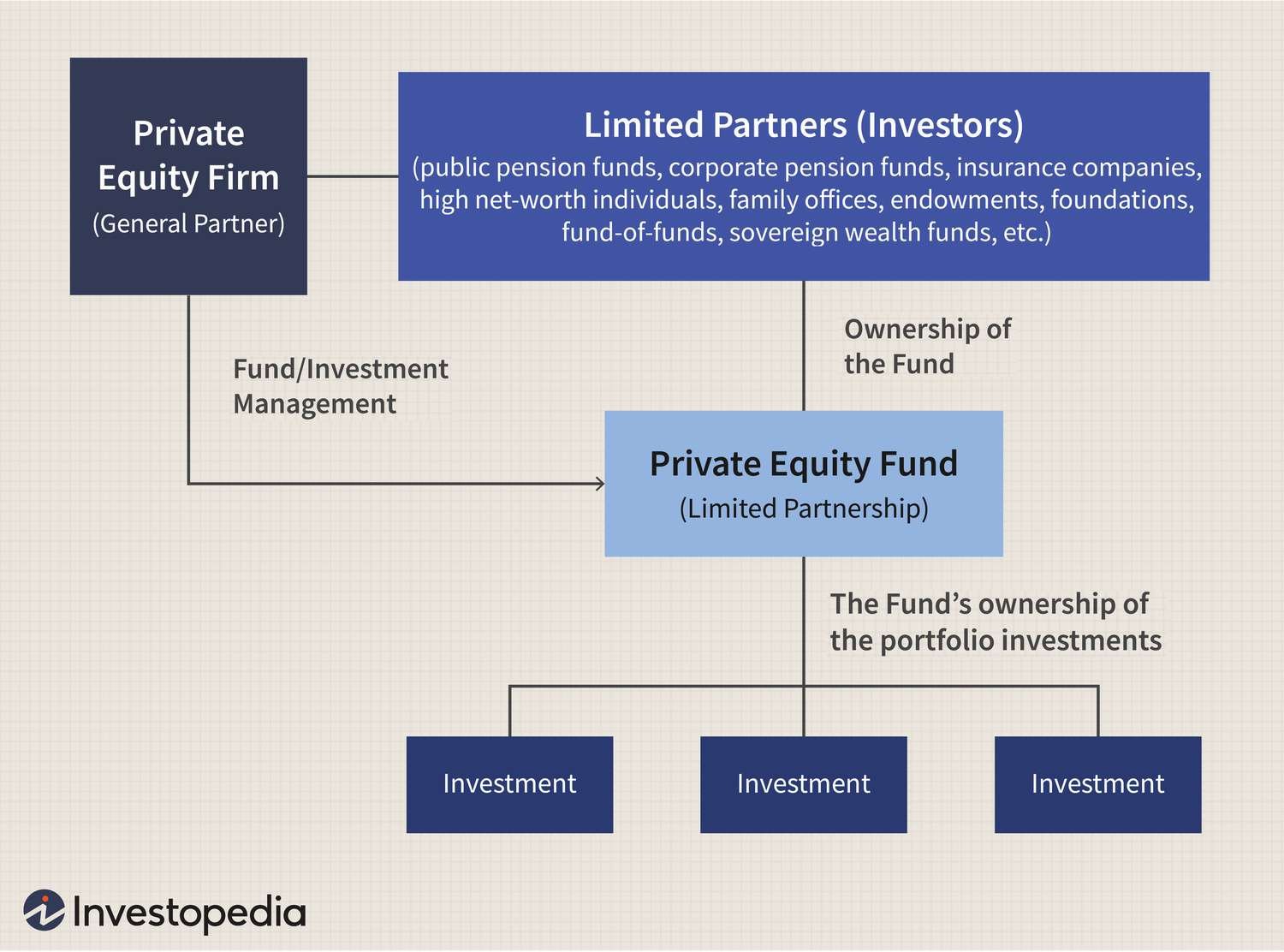

A private equity firm is a type of investment firm that specializes in investing in private companies. These firms raise capital from various sources, such as pension funds, endowments, and wealthy individuals, and use that capital to acquire ownership stakes in private companies. Private equity firms typically hold investments for a few years before selling them to generate a return on investment.

Private equity firms play a critical role in the financial ecosystem by providing capital and expertise to help businesses grow and thrive. They often target companies that have untapped potential but may be facing operational or financial challenges. By injecting capital and implementing strategic changes, private equity firms aim to transform these companies and create value for their investors.

Characteristics of Private Equity Firms

Private equity firms share several key characteristics that distinguish them from other types of investment firms:

- Long-term investment horizon: Unlike some other investment strategies, private equity firms typically have a long-term investment horizon. They are willing to commit capital to a company for several years, allowing sufficient time for strategic changes and operational improvements to be implemented.

- Active involvement: Private equity firms take an active role in the management of the companies they invest in. They provide not only financial resources but also strategic guidance and operational expertise to help drive growth and improve performance.

- Illiquid investments: Investments made by private equity firms are generally illiquid, meaning they cannot be easily bought or sold on a public exchange. This illiquidity is due to the nature of investing in privately held companies that are not listed on a stock exchange.

- High risk, high return: Private equity investments are generally considered to be higher risk compared to other types of investments. However, the potential for high returns is also greater if the investment is successful.

The Private Equity Investment Lifecycle

The investment lifecycle of a private equity firm typically consists of several stages:

1. Fundraising

Private equity firms raise capital by establishing funds and seeking commitments from investors. These funds can range from a few million to several billion dollars. The fundraising process involves presenting the firm’s investment strategy, track record, and potential returns to potential limited partners.

2. Deal Sourcing and Due Diligence

Once a private equity firm has raised capital, it begins the process of sourcing potential investment opportunities. This involves evaluating hundreds or even thousands of companies to find those that align with the firm’s investment criteria. Due diligence is then conducted to assess the financial health, market position, and growth prospects of target companies.

3. Investment and Value Creation

If the due diligence process is successful, the private equity firm will negotiate and structure the investment deal with the target company. The firm will then work closely with the management team to implement strategic changes, streamline operations, and drive growth. The goal is to create value and position the company for a profitable exit in the future.

4. Monitoring and Exit

During the investment period, private equity firms actively monitor the performance of their portfolio companies. They provide ongoing support and guidance to ensure the implementation of their growth strategies. Once the company reaches a certain level of maturity or achieves predetermined financial goals, the private equity firm decides on the optimal exit strategy. This may involve an initial public offering (IPO), sale to another company, or a secondary buyout.

Benefits of Private Equity Firms

Private equity firms offer several benefits to both investors and the companies they invest in:

1. Capital Injection

Private equity firms provide much-needed capital to companies, particularly those that may struggle to access traditional forms of financing. This injection of capital can fuel growth, fund research and development, and support strategic initiatives.

2. Operational Expertise

Private equity firms bring a wealth of industry knowledge and operational expertise to the companies they invest in. Their involvement often leads to improvements in operational efficiency, strategic decision-making, and overall performance.

3. Access to Networks and Resources

Private equity firms have extensive networks of industry experts, potential business partners, and other portfolio companies. This access to networks and resources can provide valuable opportunities for collaboration, expansion, and market penetration.

4. Risk Mitigation

Private equity firms can help mitigate risk for investors by diversifying their portfolios across multiple companies, industries, and geographies. This diversification spreads the risk and reduces the potential impact of any single investment’s performance.

Challenges and Criticisms of Private Equity Firms

While private equity firms offer numerous benefits, they are not without their challenges and criticisms:

1. High Financial Barriers

Investing in private equity funds often requires a substantial financial commitment, making it inaccessible to many individual investors. The high minimum investment amounts can limit the pool of potential investors and contribute to the perception of private equity as an elite investment strategy.

2. Limited Liquidity

Private equity investments are illiquid by nature, meaning investors cannot easily sell their stakes in a company as they would with publicly traded stocks. This lack of liquidity makes it challenging for investors to exit their investments before the predetermined holding period.

3. Concentration of Power

Private equity firms can exert significant influence over the companies they invest in, potentially leading to concerns about concentrated power and decision-making authority. Critics argue that this concentration of power may not always align with the best interests of all stakeholders, including employees and communities.

4. Short-term Focus

Private equity firms typically have a relatively short investment horizon compared to other types of investors. Their focus on generating short-term returns may lead to decisions that prioritize immediate financial gains over long-term sustainable growth.

Private equity firms play a crucial role in the financial landscape by providing capital and expertise to help companies grow and succeed. They actively invest in and transform businesses, aiming to create value for their investors. While private equity offers benefits such as capital injection, operational expertise, and access to networks, it also faces challenges and criticisms, including high financial barriers, limited liquidity, concentration of power, and short-term focus. Understanding the role and characteristics of private equity firms is essential for anyone interested in the world of investment and entrepreneurship.

What REALLY is Private Equity? What do Private Equity Firms ACTUALLY do?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a private equity firm?

A private equity firm is an investment management company that provides financial backing and support to privately held companies. They raise capital from investors and use it to make investments in various companies with the aim of generating high returns.

How does a private equity firm operate?

Private equity firms usually buy a significant stake in a company and actively work with the management to improve its operations and increase its value. They may provide strategic guidance, bring in industry experts, or help with financial restructuring to enhance the company’s performance.

What types of companies do private equity firms invest in?

Private equity firms invest in a wide range of companies across different industries. They may invest in startups, small and medium-sized enterprises (SMEs), or even mature companies that need restructuring or growth capital.

What is the difference between private equity and venture capital?

While both private equity and venture capital involve investing in companies, they differ in terms of the stage of investment and the types of companies targeted. Private equity firms typically invest in more mature companies, while venture capital firms focus on early-stage startups with high growth potential.

How do private equity firms make money?

Private equity firms make money through a combination of capital appreciation and management fees. They aim to increase the value of the companies they invest in and generate returns when the companies are sold or go public. Additionally, private equity firms charge management fees to cover their operational costs.

What are the risks associated with investing in private equity?

Investing in private equity carries certain risks. These may include the potential for loss of capital, lack of liquidity, and reliance on the expertise and performance of the private equity firm. Additionally, the success of investments may depend on various external factors such as the overall economic conditions and market trends.

Who are the typical investors in private equity firms?

Typical investors in private equity firms include institutional investors such as pension funds, endowments, insurance companies, and high-net-worth individuals. These investors are attracted to the potential high returns that private equity investments can offer, despite the associated risks.

Can individuals invest in private equity firms?

In general, private equity investments are limited to accredited investors who meet specific income and/or net worth criteria. However, some private equity firms have started offering select opportunities for individual investors to participate indirectly through funds or other investment vehicles.

Please note that investing in private equity involves certain risks, and it is advisable to consult with a financial advisor before making any investment decisions.

Final Thoughts

A private equity firm is a financial institution that invests in privately held companies. With a focus on long-term investments, private equity firms provide capital to help businesses grow and expand. These firms typically acquire a significant stake in a company and actively participate in its management and strategic decisions. Private equity firms aim to generate substantial returns for their investors by improving the operational performance of the companies they invest in. They play a crucial role in fostering entrepreneurship and driving economic growth. If you want to understand what a private equity firm is, it is a key player in the world of finance and business.