Looking to use a credit card responsibly? We’ve got you covered! The key lies in understanding how to manage your spending and repayments wisely, all while taking advantage of the benefits credit cards have to offer. By following a few simple guidelines, you can enjoy the convenience and security that credit cards provide, without falling into a financial trap. So, let’s dive into the world of responsible credit card usage and explore how you can make the most of your plastic companion.

How to Use a Credit Card Responsibly

Introduction

In today’s world, credit cards have become an essential financial tool for many people. From making online purchases to booking flights and hotels, credit cards offer convenience and security. However, with this convenience comes the responsibility to use them wisely. It’s important to understand how to use a credit card responsibly to avoid falling into debt and damaging your financial health. This article will guide you through the various aspects of responsible credit card usage, empowering you to make informed decisions.

Understanding Credit Cards

Before we dive into using credit cards responsibly, let’s begin by understanding what a credit card is and how it works.

What is a Credit Card?

A credit card is a plastic card issued by a financial institution that allows you to borrow money to make purchases. Unlike a debit card that uses funds from your bank account, a credit card provides you with a line of credit, which you can use to make purchases up to a certain limit. You are then required to pay back the borrowed amount to the credit card issuer, typically on a monthly basis, along with any accrued interest and fees.

How Do Credit Cards Work?

When you make a purchase using a credit card, the card issuer pays the merchant on your behalf. The amount spent is added to your outstanding balance, and you are responsible for repaying it. If you pay off the full balance by the due date, you won’t incur any interest charges. However, if you carry a balance from month to month, interest will be charged on the remaining amount.

The Importance of Using Credit Cards Responsibly

Using a credit card responsibly has numerous benefits, including:

Building a Good Credit History

One of the primary reasons to use a credit card responsibly is to establish and maintain a good credit history. Your credit history plays a crucial role when you apply for loans, mortgages, or even future credit cards. By using your credit card responsibly, making timely payments, and keeping your credit utilization low, you can demonstrate your creditworthiness to lenders. This can lead to better interest rates and higher credit limits in the future.

Earning Rewards and Benefits

Many credit cards offer rewards programs that allow you to earn points, cashback, airline miles, or other benefits for every dollar you spend. Responsible credit card usage gives you the opportunity to take advantage of these rewards. By paying off your balance in full each month, you can enjoy the perks of credit card rewards without paying any interest.

Emergency Fund and Payment Flexibility

Credit cards can provide a safety net in case of emergencies or unexpected expenses. By using your credit card responsibly and having it available for emergencies, you can avoid financial stress and have the flexibility to handle unexpected situations. However, it’s important to have a plan for paying off these expenses promptly to avoid unnecessary interest charges.

Using Credit Cards Responsibly

To ensure responsible credit card usage, consider the following guidelines:

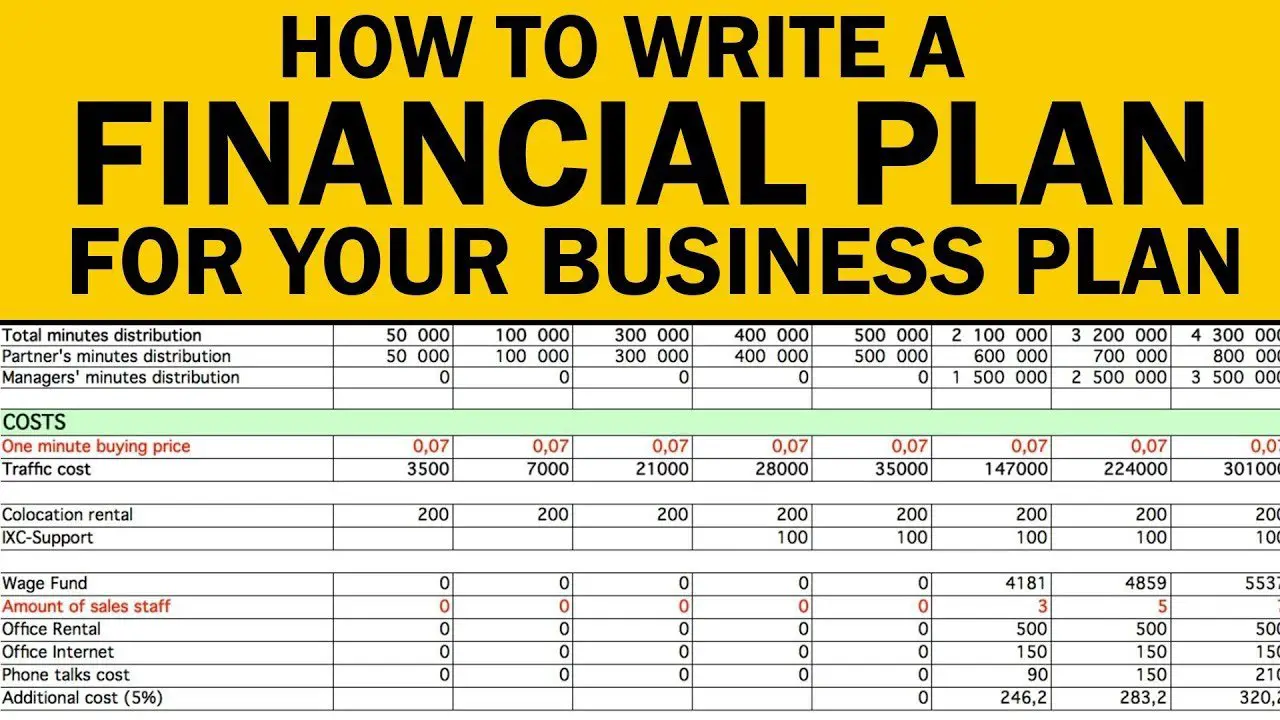

Create a Budget

Before using a credit card, it’s crucial to have a budget in place. Determine your monthly income and expenses, including bills, groceries, and other necessary payments. This will help you understand how much you can afford to spend using your credit card and avoid overspending.

Pay Your Balance in Full

Paying off your credit card balance in full every month is the best way to avoid accumulating interest charges. By doing so, you can enjoy the benefits of a credit card without falling into debt. Make it a habit to pay your credit card bill on time to avoid late fees and negative impacts on your credit score.

Monitor Your Credit Card Statements

Regularly reviewing your credit card statements is essential to ensure accuracy and identify any unauthorized transactions. Reporting any discrepancies or fraudulent charges to your credit card issuer as soon as possible can help protect your finances and credit standing.

Avoid Using Your Credit Card for Cash Advances

Cash advances on credit cards often come with high interest rates and additional fees. It’s best to avoid using your credit card for cash advances unless absolutely necessary. Instead, plan ahead and use your debit card or withdrawal funds from your bank to avoid unnecessary costs.

Keep Your Credit Utilization Low

Credit utilization refers to the percentage of your credit limit that you are using at any given time. It’s recommended to keep your credit utilization below 30% to maintain a healthy credit score. Using your credit card responsibly and keeping your balances low can positively impact your creditworthiness and financial well-being.

Be Mindful of Introductory Offers and Promotions

Credit card issuers often entice new customers with attractive introductory offers and promotions. While these can be tempting, it’s important to carefully read the terms and conditions. Understand the duration of the promotional period, any fees associated with the offer, and how it may impact your finances in the long run. Make sure the offer aligns with your financial goals before taking advantage of it.

Avoid Opening Too Many Credit Card Accounts

While having multiple credit cards can provide some benefits, it’s important to strike a balance. Opening too many credit card accounts within a short period can negatively impact your credit score and financial standing. It’s best to start with one or two credit cards and gradually build your credit profile over time.

Using a credit card responsibly is essential for maintaining a healthy financial life. By understanding the fundamentals of credit cards, the importance of responsible usage, and following the guidelines provided, you can confidently navigate the world of credit cards. Remember to use your credit card as a tool, not as a source of free money, and always prioritize timely payments and maintaining a positive credit history. By doing so, you can enjoy the benefits and convenience of credit cards while avoiding the pitfalls of debt and financial stress.

How to Use Credit Cards Wisely

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I use a credit card responsibly?

Using a credit card responsibly involves following some key guidelines. Here are some tips:

What are the benefits of responsible credit card usage?

Responsible credit card usage offers several benefits, including:

How can I avoid overspending with my credit card?

To avoid overspending with your credit card, you can:

What should be my credit card spending limit?

Determining your credit card spending limit depends on various factors, such as:

Can I use my credit card for cash withdrawals?

Yes, you can use your credit card for cash withdrawals, but it is generally not recommended due to:

What are the consequences of not paying my credit card bill on time?

Not paying your credit card bill on time can result in:

How should I handle credit card fraud or unauthorized transactions?

If you encounter credit card fraud or unauthorized transactions, take the following steps:

What happens if I exceed my credit card limit?

Exceeding your credit card limit can lead to the following consequences:

Please note that the information provided here is for general guidance only. It is important to check with your credit card provider for specific terms and conditions related to responsible credit card usage.

Final Thoughts

Using a credit card responsibly is crucial for maintaining financial stability. To begin, it is essential to pay your credit card bill on time each month to avoid interest charges. Additionally, keeping your credit utilization low, ideally below 30%, shows lenders that you are a responsible borrower. Be mindful of your spending habits, distinguishing between essential and discretionary purchases. By tracking your expenses and setting a budget, you can ensure you are not overspending. Finally, regularly reviewing your credit card statements for any errors or fraudulent activities is imperative. By following these guidelines, you can confidently use a credit card responsibly.