Are you bewildered by the various types of debt and unsure of where to begin? Understanding the different types of debt can be overwhelming, but fear not, as we are here to guide you through this financial maze. Debt is an integral part of many people’s lives, whether it be student loans, credit card debt, or mortgages. Each type of debt carries its own nuances, interest rates, and repayment terms. In this article, we will demystify the world of debt and provide you with the knowledge you need to navigate through your financial obligations confidently. Let’s embark on this journey of understanding the different types of debt together.

Understanding the Different Types of Debt

When it comes to managing our finances, understanding the different types of debt is crucial. Debt is a common aspect of modern life, but not all debts are created equal. From mortgages to student loans, credit cards to payday loans, each type of debt comes with its own characteristics and considerations. In this article, we will delve into the various types of debt and explore the key factors you need to know to make informed financial decisions. So, let’s get started!

1. Secured Debt

Secured debt refers to a loan that is backed by collateral. In other words, when you take out a secured loan, you provide an asset (such as a house, car, or savings account) as security against the loan. If you fail to repay the loan, the lender has the right to seize the collateral to recover their money. Common examples of secured debt include mortgages and auto loans.

Key characteristics of secured debt:

- The lender has a legal claim on the collateral until the loan is fully repaid.

- Secured debt typically allows for lower interest rates compared to unsecured debt, as it poses less risk to the lender.

- If you default on the loan, the lender can repossess the collateral.

- Secured debt is often considered a long-term commitment.

2. Unsecured Debt

Unsecured debt, as the name suggests, does not require any collateral. It is based on the borrower’s creditworthiness and ability to repay the loan. Since there is no collateral involved, unsecured loans usually come with higher interest rates. Examples of unsecured debt include credit cards, personal loans, and medical bills.

Key characteristics of unsecured debt:

- Unsecured debt relies primarily on the borrower’s credit score and income.

- Lenders may consider other factors such as employment history and debt-to-income ratio.

- If you default on unsecured debt, the lender cannot repossess any specific asset, but they can take legal action to recover the amount owed.

- Since there is no collateral, unsecured debt poses a higher risk for lenders, which results in higher interest rates.

3. Revolving Debt

Revolving debt is a type of debt that does not have a fixed end date. It allows borrowers to access a certain amount of credit, which can be used, repaid, and reused as needed. Credit cards are the most common example of revolving debt. With a credit limit, you can make purchases up to that limit and then make payments to reduce your balance. The cycle continues until the cardholder decides to close the account or until the lender revokes the credit.

Key characteristics of revolving debt:

- Revolving debt provides flexibility as it allows you to use and reuse credit as long as you make payments on time.

- Interest is charged on the outstanding balance, and the minimum payment may not be enough to pay off the debt quickly.

- Revolving debt often comes with higher interest rates compared to other types of debt.

- Managing revolving debt requires responsible budgeting and disciplined repayment strategies to avoid excessive interest charges.

4. Installment Debt

Installment debt involves borrowing a fixed amount of money and repaying it in regular installments over a specific period of time. Each payment consists of both principal and interest. Common examples of installment debt include auto loans, student loans, and personal loans.

Key characteristics of installment debt:

- Installment debt has a fixed repayment term, usually ranging from a few months to several years.

- Monthly payments remain the same throughout the loan term.

- Interest rates for installment debt vary depending on factors such as credit score, loan amount, and loan term.

- Borrowers have a clear repayment plan and know exactly when the debt will be fully paid off.

5. Payday Loans

Payday loans are short-term loans typically designed to help individuals bridge the gap between paychecks. These loans are usually small in amount and need to be repaid in full on the borrower’s next payday. Payday loans are notorious for their high interest rates and fees, often trapping borrowers in a cycle of debt.

Key characteristics of payday loans:

- Payday loans provide quick access to cash for immediate needs but come with extremely high interest rates and fees.

- The repayment period is typically very short, often ranging from a few days to a few weeks.

- Borrowers usually need to provide a post-dated check or give the lender access to their bank account as collateral.

- Payday loans should be approached with caution due to their exorbitant costs and potential for creating a debt spiral.

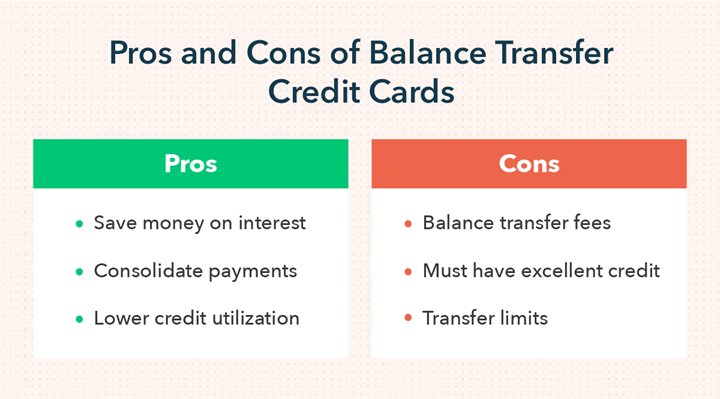

6. Consolidation Debt

Consolidation debt refers to combining multiple debts into a single loan, often with the aim of simplifying repayment and potentially obtaining a lower interest rate. Debt consolidation can be done through various means, such as taking out a personal loan to pay off credit card debt or using a home equity loan to consolidate multiple debts.

Key characteristics of consolidation debt:

- Debt consolidation allows you to merge multiple debts into one, making it easier to manage and potentially saving on interest charges.

- Consolidation loans can be secured or unsecured, depending on the chosen method.

- The interest rate on a consolidation loan depends on factors such as credit score, collateral, and loan term.

- Debt consolidation should be accompanied by a sound financial plan to avoid falling back into debt.

7. Mortgage Debt

Mortgage debt is a loan taken out to purchase a property, typically a home. It is one of the largest financial commitments most people will make in their lifetime. Mortgages generally have longer terms, ranging from 15 to 30 years, and require regular payments consisting of principal and interest.

Key characteristics of mortgage debt:

- Mortgages are secured loans, with the property serving as collateral. If you default on your mortgage, the lender can initiate foreclosure proceedings to recover the money.

- Interest rates for mortgages can be fixed or adjustable, depending on the terms of the loan.

- The down payment, credit score, and debt-to-income ratio play a significant role in mortgage approval and determining the interest rate.

- Proper budgeting and financial planning are essential to ensure comfortable and sustainable mortgage payments.

Understanding the different types of debt empowers you to make informed financial decisions. It allows you to assess the risk, interest rates, and repayment terms associated with each type of debt. By understanding these nuances, you can develop a comprehensive plan to manage your debts effectively and work towards a more secure financial future. Remember, debt is not inherently bad, but it requires responsible handling to avoid financial pitfalls.

Everything You Need To Know About Debt

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are the different types of debt?

There are several types of debt that individuals and businesses may encounter, including:

- Credit card debt

- Student loan debt

- Mortgage debt

- Auto loan debt

- Personal loan debt

- Business loan debt

How does credit card debt work?

Credit card debt is a type of borrowing that occurs when you use a credit card to make purchases. The amount you charge on the card is added to your outstanding balance, and you are required to make minimum monthly payments. If you don’t pay off the full balance, interest is charged on the remaining amount.

What is student loan debt?

Student loan debt is money borrowed to pay for education expenses. It is specifically used to cover tuition fees, books, and living costs while attending college or university. Student loans usually have fixed interest rates and must be repaid after a grace period following graduation or leaving school.

How does mortgage debt work?

Mortgage debt is a loan used to finance the purchase of a home or property. The borrower makes regular monthly payments towards the loan, which includes both the principal amount borrowed and interest. The property acts as collateral, and if the borrower fails to make payments, the lender may foreclose on the property.

What is auto loan debt?

Auto loan debt refers to the money borrowed to purchase a vehicle. Like mortgage debt, auto loans also have regular monthly payments that include both the principal and interest. The vehicle itself serves as collateral, and if the borrower defaults on payments, the lender can repossess the vehicle.

What are personal loans?

Personal loans are unsecured loans that individuals can borrow for various purposes, such as debt consolidation, home improvements, or unexpected expenses. Unlike credit cards, personal loans have a fixed repayment term and interest rate.

What is business loan debt?

Business loan debt is money borrowed by a company to finance its operations, expand, or invest in assets. Business loans can be secured or unsecured, and the terms and interest rates vary depending on the lender and the purpose of the loan.

How do I manage my debt effectively?

To manage debt effectively, consider the following strategies:

- Create a budget and track your expenses

- Prioritize debt repayment and make timely payments

- Consider debt consolidation to simplify multiple debts

- Explore options for refinancing to potentially lower interest rates

- Seek professional assistance if needed, such as credit counseling

Can I get rid of all my debt?

While it may be challenging, it is possible to become debt-free with discipline and proper financial planning. By following a consistent debt repayment strategy and making wise financial decisions, you can gradually eliminate your debts over time.

Final Thoughts

Understanding the different types of debt is crucial for managing your financial well-being. From mortgages and student loans to credit card debt and personal loans, each type of debt comes with its own terms, interest rates, and repayment options. By being aware of these distinctions, you can make informed decisions about borrowing and develop a plan to pay off debt efficiently. Whether it’s prioritizing high-interest debt or seeking consolidation options, understanding the different types of debt empowers you to take control of your financial future. So, educate yourself about the various types of debt and tailor your debt management strategies accordingly.