Market timing in investing refers to the strategy of trying to predict the future movements of financial markets in order to make buy or sell decisions at the most opportune times. While it may seem enticing to stay ahead of the game by accurately predicting market trends, the reality is that market timing is incredibly challenging, if not impossible, to consistently get right. Many investors have fallen into the trap of attempting to time the market, only to suffer significant losses. In this article, we will delve into what market timing in investing truly entails and explore why it may not be the most reliable approach for long-term success. So, what is market timing in investing and why should we approach it with caution? Let’s find out.

What is Market Timing in Investing?

Market timing in investing refers to the strategy of buying and selling financial assets based on predictions or forecasts about future market movements. Investors who practice market timing attempt to enter the market when they believe prices are about to rise and exit before prices decline. Essentially, it involves making investment decisions by trying to predict short-term price movements in an attempt to maximize profits. However, it’s important to note that market timing is a highly debated and controversial strategy in the investment world.

The Basics of Market Timing

Market timing involves actively managing investment portfolios by making frequent trades based on short-term market predictions. This strategy relies heavily on trying to identify the optimal time to buy or sell assets, with the goal of capitalizing on anticipated market movements. Here are a few key points to understand about market timing:

- Market timing requires accurate predictions: Successful market timing relies on making accurate predictions about future market trends. Investors who try to time the market often rely on technical analysis, fundamental analysis, or a combination of both to predict market movements.

- Short-term perspective: Market timing focuses on short-term price movements rather than long-term investment goals. Traders who practice market timing typically hold assets for shorter durations, ranging from days to months, rather than years.

- Active portfolio management: Market timers actively manage their portfolios, frequently buying and selling assets in response to market conditions. This approach requires a high level of attention and market monitoring.

The Pros and Cons of Market Timing

While market timing may seem appealing to some investors, it’s important to consider the advantages and disadvantages of this strategy before implementing it.

Pros

- Potential for higher returns: Successful market timing can potentially lead to higher investment returns by capitalizing on short-term market movements. If timed correctly, investors can buy low and sell high, maximizing their profits.

- Flexibility: Market timing allows investors to react and adjust their investment strategy based on market conditions. This flexibility can be advantageous in volatile markets.

- Active engagement: Market timing requires active involvement in the investment process, which can be engaging and exciting for investors who enjoy monitoring the markets and making quick decisions.

Cons

- Difficulty in accurate predictions: Consistently predicting short-term market movements is notoriously challenging. Even seasoned investors and financial professionals struggle to consistently time the market accurately.

- Higher transaction costs: Frequent trading can lead to higher transaction costs such as broker commissions and taxes, which can eat into potential profits.

- Increased risk: Market timing can expose investors to increased risk, as mistimed trades can result in significant losses. This strategy requires precise timing, and even small errors in predictions can have adverse effects.

- Emotional biases: Market timing may tempt investors to make decisions based on emotions rather than sound investment principles. Fear and greed can significantly impact decision-making, potentially leading to poor investment choices.

The Impact of Market Timing on Investment Performance

Market timing has long been a subject of debate among investors, academics, and financial professionals. Numerous studies have analyzed the impact of market timing on investment performance, and the findings are mixed.

Some studies suggest that successfully timing the market consistently is extremely challenging and that the average investor is unlikely to achieve superior results using this strategy. These studies often point to the difficulty of accurately predicting short-term market movements.

On the other hand, proponents of market timing argue that it can be a valuable tool in certain market conditions or for specific types of investments. They claim that by avoiding market downturns or taking advantage of short-term trends, market timers can potentially outperform the market.

Despite the ongoing debate, it’s crucial to recognize that market timing can be highly risky and should be approached with caution. It requires a significant amount of skill, knowledge, and disciplined decision-making.

The Alternatives to Market Timing

For investors who are skeptical of market timing or prefer a more passive approach, there are alternative strategies to consider:

1. Buy and Hold

Buy and hold is a long-term investment strategy that involves purchasing assets and holding onto them for an extended period, regardless of short-term market fluctuations. This strategy aims to benefit from the long-term growth of the market and is often associated with lower costs and reduced trading activity.

2. Dollar-Cost Averaging (DCA)

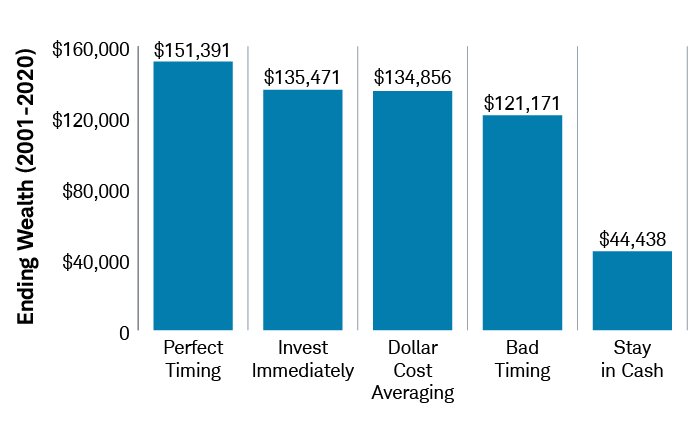

Dollar-cost averaging is a strategy where an investor regularly invests a fixed amount of money into a particular asset, regardless of its price. By investing a fixed amount consistently over time, investors automatically buy more shares when prices are low and fewer shares when prices are high. DCA helps mitigate the impact of short-term price volatility.

3. Asset Allocation

Asset allocation involves diversifying investments across different asset classes, such as stocks, bonds, and cash equivalents. By spreading investments across various assets, investors aim to reduce risk and potentially improve long-term returns. Asset allocation typically follows a long-term investment horizon and minimizes the need for frequent trades based on short-term market predictions.

Market timing in investing is a strategy that involves making investment decisions based on short-term market predictions. While it may seem appealing, market timing is highly debated and carries significant risks. Successfully timing the market consistently is challenging, and mistimed trades can lead to substantial losses. It is important for investors to carefully consider their goals, risk tolerance, and investment horizon before deciding to implement market timing. Alternative strategies such as buy and hold, dollar-cost averaging, and asset allocation provide more passive approaches to investing that may better suit long-term investment objectives.

Does Market Timing Ever Work?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is market timing in investing?

Market timing in investing refers to the strategy of trying to predict the future movements in the stock market or other financial markets in order to make investment decisions. It involves attempting to buy stocks or other securities when their prices are expected to rise and sell them before they decline.

How does market timing work?

Market timing involves analyzing various factors such as market trends, economic indicators, and company-specific news to make predictions about future market movements. Investors using market timing may try to identify the best time to enter or exit the market, aiming to maximize gains and minimize losses.

Is market timing an effective investment strategy?

Market timing is a highly debated topic in the investment community, with conflicting opinions on its effectiveness. While some investors believe that successfully timing the market can lead to enhanced returns, many studies have shown that consistently predicting market movements is extremely difficult. In fact, attempts to time the market often result in missing out on potential gains and can increase transaction costs.

What are the risks of market timing?

Market timing carries several risks. Firstly, accurately predicting the timing of market movements is challenging and can lead to missed opportunities or losses if predictions are incorrect. Secondly, frequent buying and selling of securities can result in higher transaction costs and taxes, reducing overall returns. Additionally, market timing often requires making emotional decisions, which can be influenced by short-term market volatility and lead to impulsive actions.

Are there any alternatives to market timing?

Instead of trying to time the market, many investment professionals advocate for a long-term, diversified investment strategy. This strategy involves holding a mix of different investments across various asset classes and maintaining a consistent approach regardless of short-term market fluctuations. Diversification helps to spread risk and aligns investments with long-term financial goals rather than short-term market predictions.

Can market timing be profitable in certain situations?

While it is difficult to consistently time the market, some investors claim to have achieved success in specific situations. However, it’s important to note that these instances are often attributed to luck or temporary market anomalies rather than genuine market-timing skill. Additionally, even if profitability is achieved in certain situations, it may not be replicable over the long term.

What are the potential drawbacks of market timing?

Market timing can lead to several potential drawbacks. Firstly, it can result in missed opportunities for gains if an investor exits the market during periods of growth. Secondly, timing the market requires active monitoring and analysis, which can be time-consuming and stressful. Lastly, relying on market timing can detract investors from focusing on long-term financial goals and adopting a disciplined investment approach.

What are some common misconceptions about market timing?

One common misconception about market timing is that it can consistently beat the market and generate significant returns. However, numerous studies have shown that even professional investors struggle to consistently time the market. Another misconception is that market timing is necessary for successful investing. In reality, a patient and disciplined long-term investment strategy often outperforms attempts to time the market.

Final Thoughts

Market timing in investing refers to the practice of trying to predict and take advantage of future market movements to maximize profits. However, it is important to note that market timing is highly challenging, if not impossible, to consistently achieve. Attempting to time the market requires accurate predictions of both the market’s direction and timing, which is often hindered by unpredictable factors and market volatility. Furthermore, studies have shown that frequent trading and market timing strategies often result in lower returns compared to a long-term, buy-and-hold approach. Therefore, investors should be cautious when considering market timing strategies and focus on building a diversified portfolio based on their long-term financial goals.