Are you tired of living paycheck to paycheck? Do you dream of financial freedom and independence? Well, look no further! In this blog article, we will show you exactly how to plan for financial independence. No more stressing over bills, debt, or living within tight means. With our simple yet effective strategies, you can take control of your finances and build the life you’ve always wanted. So, let’s dive in and discover the secrets to financial independence.

How to Plan for Financial Independence

Introduction

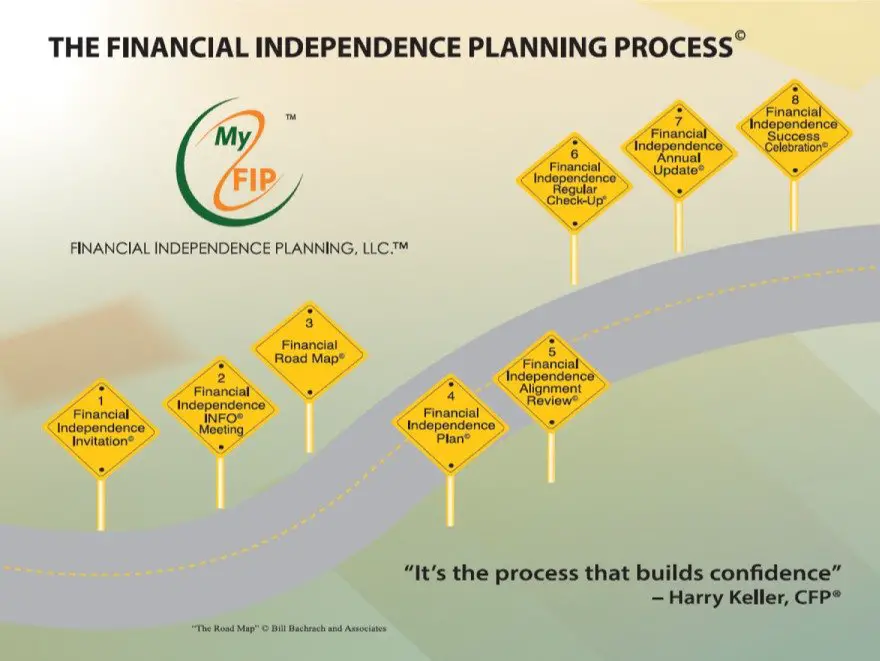

Welcome to our guide on how to plan for financial independence. Achieving financial independence is a goal that many people aspire to, and with the right plan in place, it is an attainable objective. In this comprehensive guide, we will explore various strategies, tips, and tools that can help you create a roadmap towards financial independence. Whether you are just starting your journey or looking to enhance your existing plan, this article will provide you with actionable steps and insights. So, let’s dive in and uncover the key components of a successful financial independence plan.

Understanding Financial Independence

Before we delve into the details of planning for financial independence, it’s important to have a clear understanding of what this concept entails. Financial independence refers to a state where you have accumulated enough wealth and financial resources to sustain your desired lifestyle without relying on active employment income. It means having the freedom to make choices without being limited by financial constraints.

Financial independence doesn’t necessarily mean retiring early, although it is a common goal for many individuals. It is about gaining control over your finances and having the ability to pursue your passions, spend quality time with loved ones, and achieve your long-term goals. It provides you with the flexibility to work on projects you are passionate about, take career breaks, travel, or engage in any activity that brings you fulfillment.

Determining Your Financial Independence Number

One of the first steps in planning for financial independence is to determine your financial independence number. This refers to the amount of money you will need to accumulate in order to sustain your desired lifestyle without relying on traditional employment income.

Calculating your financial independence number involves assessing your current expenses, estimating your future needs, and factoring in inflation and investment returns. It’s important to consider all aspects of your lifestyle, including housing, healthcare, education, travel, and any other expenses that you anticipate in the future.

Here’s a step-by-step process to help you determine your financial independence number:

- List down all your current monthly expenses, including fixed costs like rent or mortgage payments, utilities, transportation, groceries, and discretionary spending.

- Estimate any future expenses you anticipate, such as healthcare costs, education for you or your children, or other significant life events.

- Consider the impact of inflation on your expenses. Typically, it’s advisable to assume an average inflation rate of around 3%.

- Factor in your expected investment returns. This will depend on your risk tolerance and the types of investments you plan to make. A conservative estimate is often around 6%.

- Calculate how much wealth you would need to accumulate to generate the income required to cover your expenses.

Remember that the financial independence number is unique to each individual, as it depends on your desired lifestyle and goals. It is essential to periodically review and adjust your number as circumstances change over time.

Creating a Budget and Tracking Expenses

Once you have determined your financial independence number, the next step is to create a budget and track your expenses. A budget is a crucial tool that helps you understand where your money is coming from and where it is going. It allows you to make informed decisions about your finances and identify areas where you can save and invest.

Here are some steps to help you create and maintain an effective budget:

- List all your sources of income, including salaries, bonuses, investments, or any other sources of revenue.

- Identify and categorize your expenses, such as housing, transportation, groceries, entertainment, and savings.

- Assign a realistic amount to each category based on your past spending habits and financial goals.

- Track your expenses regularly, either manually or by using budgeting apps or software. This will help you stay accountable and make adjustments as needed.

- Review your budget periodically and make necessary revisions based on changes in your income, expenses, or financial goals.

By creating a budget and diligently tracking your expenses, you will gain a clearer understanding of your spending habits and identify areas where you can cut back or optimize. This will help you allocate more funds towards your financial independence goals and accelerate your progress.

Income Generation and Investment Strategies

To achieve financial independence, it’s essential to focus on both increasing your income and implementing sound investment strategies. By diversifying your income sources and making wise investment decisions, you can accelerate the growth of your wealth and reach your financial goals faster.

Here are some strategies to consider:

1. Increase Your Income

- Explore opportunities for career advancement or promotions within your current job.

- Consider acquiring new skills or certifications that can lead to higher-paying job opportunities.

- Start a side business or freelance gig to generate additional income.

- Invest in real estate properties to generate rental income.

- Invest in dividend-paying stocks or bonds that can provide regular income.

2. Implement Investment Strategies

- Work with a financial advisor to create a diversified investment portfolio tailored to your risk tolerance and financial goals.

- Consider investing in low-cost index funds or exchange-traded funds (ETFs) to achieve broad market exposure.

- Explore real estate investment trusts (REITs) as a way to gain exposure to the real estate market.

- Allocate a portion of your portfolio to alternative investments such as private equity or venture capital funds.

- Regularly review and rebalance your portfolio to ensure it aligns with your risk profile and financial objectives.

By combining efforts to increase your income and implementing smart investment strategies, you can accelerate your journey towards financial independence.

Debt Management and Elimination

Debt can be a significant obstacle to achieving financial independence. High-interest debt, such as credit card debt or personal loans, can drain your resources and impede your progress. Therefore, it is crucial to develop a debt management plan and work towards eliminating any outstanding debts.

Here are some steps to help you manage and eliminate debt:

- Create a list of all your debts, including outstanding balances, interest rates, and minimum monthly payments.

- Consider consolidating high-interest debts into a lower-interest loan or credit line.

- Develop a repayment strategy by prioritizing debts with the highest interest rates or the smallest balances.

- Allocate a portion of your budget towards debt repayment and commit to making consistent payments.

- Explore strategies to negotiate lower interest rates or settle debts for a reduced amount.

By actively managing and eliminating your debts, you can free up more funds to invest and accelerate your progress towards financial independence.

Emergency Fund and Insurance Coverage

Building an emergency fund and having adequate insurance coverage are crucial components of a comprehensive financial independence plan. They provide you with a safety net during unexpected events and ensure that your progress towards financial independence remains unimpeded.

1. Emergency Fund

An emergency fund is a savings account specifically designated to cover unforeseen expenses or financial emergencies. It acts as a buffer and helps you avoid dipping into your investments or accumulating debt during challenging times.

Here are some steps to build and maintain an emergency fund:

- Set a target amount for your emergency fund, typically around three to six months’ worth of living expenses.

- Automate regular contributions to your emergency fund to ensure consistent savings.

- Keep your emergency fund in a separate, easily accessible account, such as a high-yield savings account.

- Replenish your emergency fund whenever you withdraw from it to cover unexpected expenses.

2. Insurance Coverage

Having adequate insurance coverage is essential to protect yourself and your assets. It provides financial security in the face of unexpected events such as accidents, illnesses, or natural disasters.

Consider the following types of insurance to ensure comprehensive coverage:

- Health insurance to cover medical expenses.

- Life insurance to provide for your loved ones in the event of your passing.

- Homeowners or renters insurance to protect your property against damages or theft.

- Auto insurance to cover accidents and damages related to your vehicle.

Review your insurance policies regularly to ensure that they align with your current needs and provide adequate coverage.

Regular Evaluation and Adjustments

Finally, it’s crucial to regularly evaluate and adjust your financial independence plan as circumstances change. Life events, economic conditions, and personal goals may evolve over time, requiring you to adapt your strategy accordingly.

Here are some factors to consider when reviewing your plan:

- Changes in your income, expenses, or financial goals.

- Market conditions and the performance of your investments.

- Personal or family-related events, such as marriage, the birth of a child, or retirement.

- Legal or tax-related changes that may impact your financial situation.

By regularly evaluating your plan and making necessary adjustments, you can ensure that you stay on track towards achieving financial independence.

Planning for financial independence requires a combination of disciplined saving, smart investing, and strategic decision-making. It is a journey that will take time and effort, but the rewards are well worth it. By following the steps outlined in this guide and staying committed to your financial goals, you can unlock the path to financial independence and enjoy a life of freedom and abundance. Remember, financial independence is attainable for anyone willing to plan, adapt, and take action. Start today and pave your way to a brighter financial future.

Please note that the information provided in this guide is for educational purposes only and should not be construed as financial advice. Consult with a qualified financial advisor or planner before making any financial decisions.

How to Retire in 10 Years (starting with $0)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I start planning for financial independence?

To start planning for financial independence, you should first evaluate your current financial situation, set clear goals, create a budget, and develop a savings plan. It’s essential to educate yourself about personal finance and consider seeking professional advice if needed.

2. What is the importance of creating a budget for financial independence?

Creating a budget is crucial for financial independence as it helps you track your income and expenses, identify areas where you can cut back on spending, and prioritize your financial goals. A budget provides a clear roadmap for managing your money effectively.

3. How much should I save for financial independence?

The amount you should save for financial independence depends on your individual circumstances and goals. A general rule of thumb is to aim for saving at least 15-20% of your income. However, it’s always beneficial to save as much as you comfortably can to accelerate your progress towards financial independence.

4. Is it necessary to invest for financial independence?

Investing is an essential aspect of planning for financial independence. By investing, you can potentially grow your wealth faster and generate passive income. It’s important to diversify your investments, understand different asset classes, consider your risk tolerance, and seek professional advice if needed.

5. How do I prioritize my financial goals?

Prioritizing your financial goals involves determining what is most important to you and aligning your resources accordingly. Start by identifying your short-term, mid-term, and long-term goals and allocate your money and time towards achieving them. It’s essential to regularly review and adjust your priorities as circumstances change.

6. What are some strategies to reduce debt and achieve financial independence?

To reduce debt and work towards financial independence, you can employ strategies such as creating a debt repayment plan, consolidating high-interest debts, negotiating with creditors, and avoiding unnecessary debt. It’s important to make consistent payments towards your debts and avoid accumulating new ones.

7. How can I increase my income for better financial stability?

To increase your income, you can explore various options such as seeking a higher-paying job, acquiring new skills to enhance your career prospects, starting a side business or freelancing, or investing in income-generating assets. It’s important to evaluate different opportunities and find the best fit for your skills and interests.

8. How long does it take to achieve financial independence?

The time required to achieve financial independence varies for each individual and depends on factors like your current financial situation, income level, savings rate, and investment returns. It can take several years or even decades to reach financial independence, but with careful planning and discipline, you can steadily work towards your goal.

Final Thoughts

To plan for financial independence, start by setting clear and measurable goals. Determine how much money you need to save or earn, and establish a realistic timeline for achieving those goals. Create a budget to track your expenses and ensure you are living within your means. Consider diversifying your income streams and investing wisely to grow your wealth. Stay disciplined and stick to your plan, making adjustments as necessary. Prioritize saving and investing for the long term, and always be mindful of your financial goals. With careful planning and a proactive approach, achieving financial independence is within reach.