Are you curious about what an expense ratio in mutual funds actually means? Well, you’ve come to the right place! In this article, we will delve into the fascinating world of expense ratios and how they can impact your investments. So, let’s get started and unravel the mystery behind what is an expense ratio in mutual funds. Join us as we explore this topic and gain a better understanding of the financial dynamics at play. Get ready to dive into the world of mutual funds and discover how expense ratios play a vital role in your investment journey.

What is an Expense Ratio in Mutual Funds?

The expense ratio is a crucial factor to consider when investing in mutual funds. It represents the percentage of a fund’s total assets that are used to cover the operating expenses associated with managing the fund. These expenses include administrative fees, management fees, and other costs incurred by the fund. Put simply, the expense ratio is the annual cost of owning a mutual fund and is expressed as a percentage of the fund’s average net assets.

Understanding the expense ratio is essential because it directly impacts an investor’s returns. A high expense ratio can eat into the potential gains of a fund, while a low expense ratio allows investors to keep a larger portion of their returns. In this article, we’ll delve into the intricacies of mutual fund expense ratios, exploring different types of expenses, the significance of expense ratios, and factors investors should consider before investing.

Types of Expenses Included in the Expense Ratio

The expense ratio consists of various costs associated with managing a mutual fund. These expenses can be divided into two broad categories:

1. Management Fees: This portion of the expense ratio covers the costs of operating and managing the mutual fund. It includes fees paid to the fund manager, research analysts, and other professionals involved in making investment decisions for the fund. Management fees are typically the largest component of the expense ratio.

2. Other Expenses: In addition to management fees, there are other expenses incurred in running a mutual fund. These can include administrative costs, legal and compliance fees, custodial fees, shareholder servicing fees, marketing and distribution expenses, and audit fees. Other expenses can also include charges associated with brokerage commissions and transaction costs.

Significance of Expense Ratios

The expense ratio is an essential metric that allows investors to evaluate the cost-effectiveness of a mutual fund. Here are some key reasons why understanding expense ratios is significant:

1. Impact on Investment Returns: High expense ratios can significantly reduce investment returns over the long term. When expenses eat into a fund’s performance, investors receive a smaller share of the gains. It is crucial to find a balance between expenses and returns to maximize investment value.

2. Consistency of Performance: Funds with lower expense ratios tend to be more consistent in delivering returns. Since lower expenses mean the fund has less ground to make up, they can provide a more predictable performance.

3. Cost Comparison: Expense ratios allow investors to compare the costs of different mutual funds. By analyzing expense ratios, investors can make informed decisions about the most cost-effective funds for their investment goals.

4. Long-Term Impact: Over time, even minor differences in expense ratios can have a substantial impact on investment returns. Choosing a fund with a lower expense ratio can result in significant savings and higher overall returns over an extended period.

Factors to Consider When Evaluating Expense Ratios

While expense ratios are important, they should not be the sole factor considered when selecting mutual funds. Here are other key factors to evaluate alongside the expense ratio:

1. Fund Performance: Assessing a fund’s historical performance is crucial. A low expense ratio is favorable, but if a fund consistently underperforms its benchmark or peers, it may not be the best choice.

2. Fund Objectives: Understand the investment objectives and strategy of the fund. Ensure they align with your own investment goals.

3. Risk Level: Evaluate the risk level associated with the fund. High-risk funds may have higher expense ratios due to the expertise required to manage them effectively.

4. Fund Size: Consider the size of the mutual fund. Larger funds usually benefit from economies of scale, enabling them to negotiate lower expenses.

5. Fund Manager’s Experience: Evaluate the fund manager’s track record and experience in managing similar funds. A skilled fund manager can add value to the fund beyond the expense ratio.

6. Fund Turnover: Assess the fund’s turnover ratio, which measures how frequently the fund buys and sells securities. Frequent trading can lead to higher transaction costs and impact returns.

Comparing Different Expense Ratios

When comparing expense ratios, investors should consider the following:

1. Benchmark Comparison: Compare the expense ratio of a mutual fund with similar funds in the same category. This helps determine if the fund is charging a fair price relative to its peers.

2. Active vs. Passive Funds: Expense ratios tend to be lower for passive funds like index funds and ETFs. While active funds may have higher expense ratios due to the additional costs associated with active management, they may also offer the potential for higher returns.

3. Expense Ratio Trends: Look at the expense ratio trends over time. A fund with a consistent or decreasing expense ratio may provide a more attractive investment opportunity.

Understanding the Impact of Expense Ratios on Returns

The impact of expense ratios on returns can be significant over the long term. Consider the following example:

Assume you have two mutual funds, Fund A and Fund B, both with an initial investment of $10,000 and an average annual return of 8%. However, Fund A has an expense ratio of 1%, while Fund B’s expense ratio is 0.5%. After 20 years, the difference in returns becomes apparent:

– Fund A (1% expense ratio): $46,610

– Fund B (0.5% expense ratio): $50,863

The 0.5% difference in expense ratio results in a $4,253 higher return for Fund B. This demonstrates how expense ratios can impact the growth of investments over time, highlighting the importance of selecting funds with lower expense ratios.

In conclusion, the expense ratio is a vital component to consider when investing in mutual funds. It represents the annual cost of owning a fund and directly impacts an investor’s returns. By understanding the various types of expenses included in the expense ratio, evaluating its significance, and considering other important factors, investors can make informed decisions about the most suitable mutual funds for their portfolios.

How Does Expense Ratio 'Get Charged?'

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is an expense ratio in mutual funds?

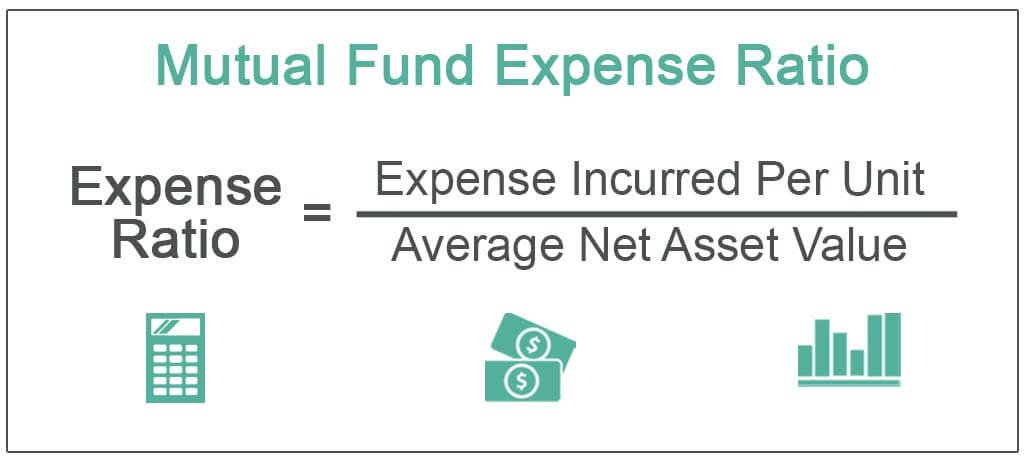

An expense ratio in mutual funds refers to the percentage of a fund’s assets that are used to cover the operating expenses of the fund. These expenses can include management fees, administrative costs, marketing expenses, and other operational costs. The ratio is calculated by dividing the total expenses of the fund by its average net assets. It is an important metric for investors to consider as it directly impacts the overall returns they can expect from their investments.

How is the expense ratio calculated?

The expense ratio is calculated by dividing the total expenses of a mutual fund by its average net assets. The result is then multiplied by 100 to express the ratio as a percentage. For example, if a mutual fund has total expenses of $10,000 and average net assets of $1 million, the expense ratio would be 1% ($10,000 / $1,000,000 x 100).

Why is the expense ratio important?

The expense ratio is important because it directly affects the returns earned by investors in a mutual fund. A lower expense ratio means more of the fund’s returns are retained by investors, while a higher expense ratio can eat into their overall returns. It is crucial for investors to compare expense ratios when choosing between different mutual funds, as it can significantly impact their long-term investment performance.

What factors contribute to the expense ratio?

Several factors contribute to the expense ratio of a mutual fund. These include management fees, administrative costs, legal and compliance expenses, marketing and distribution fees, and other operational expenses. The expense ratio may vary depending on the type of fund, its investment strategy, the size of the fund, and the management team’s expertise.

How does the expense ratio impact my investment returns?

The expense ratio directly impacts your investment returns. A higher expense ratio means a larger portion of the fund’s returns are deducted to cover expenses, reducing the net returns you receive. Conversely, a lower expense ratio allows more of the fund’s returns to be passed on to investors. Over time, even a small difference in expense ratios can significantly affect your investment’s growth.

What is a good expense ratio for a mutual fund?

There is no universal benchmark for a good expense ratio as it varies depending on factors such as the fund’s investment strategy, asset class, and historical performance. However, as a general rule, actively managed funds tend to have higher expense ratios compared to passively managed index funds. It is recommended to compare the expense ratios of similar funds within the same category to get an idea of what is considered competitive.

Are expense ratios the only costs associated with mutual funds?

No, expense ratios are not the only costs associated with mutual funds. Other costs may include transaction fees, front-end or back-end loads, redemption fees, and account fees. It is essential to understand the complete fee structure of a mutual fund before investing to evaluate the overall cost implications.

Can expense ratios change over time?

Yes, expense ratios can change over time. Mutual funds are required to disclose any changes in their expense ratios in their prospectus. Factors that may cause an expense ratio to change include fluctuations in operating costs, changes in management fees, shifts in the fund’s asset size, or adjustments to the fund’s investment strategy. It is important for investors to stay informed about any changes affecting the expense ratio of their chosen mutual funds.

Final Thoughts

The expense ratio is a crucial factor to consider when investing in mutual funds. It represents the percentage of a fund’s assets that are used to cover operating expenses. A lower expense ratio is generally preferred, as it implies lower costs and potentially higher returns for investors. By understanding the expense ratio, investors can assess the overall cost-effectiveness of a mutual fund and make informed decisions about their investments. Considering the expense ratio in mutual funds is essential for maximizing returns and minimizing unnecessary expenses.