Are you tired of constantly stressing about your financial situation? Do you wish there was a simple, effective way to improve your financial habits and gain control over your money? Look no further! In this blog article, we will show you how to improve your financial habits in just 30 days. No need to worry about complex strategies or overwhelming tasks – we’ve got you covered. With our practical tips and actionable advice, you’ll be well on your way to financial success in no time. So, let’s dive in and discover how to improve your financial habits in 30 days!

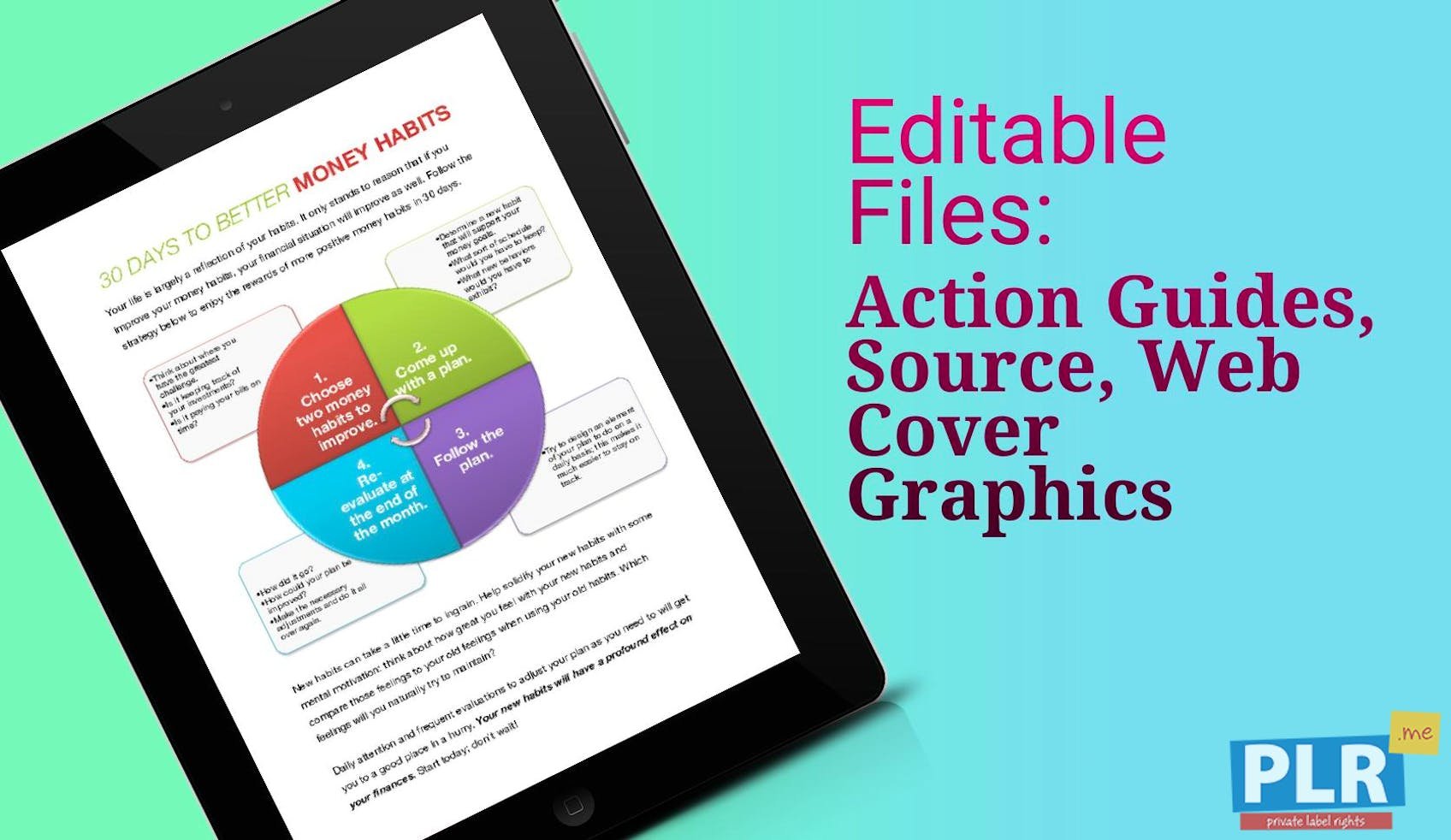

How to Improve Financial Habits in 30 Days

Managing your finances effectively is essential for achieving financial stability and reaching your long-term goals. However, it’s not always easy to develop good financial habits. The good news is that with determination and the right strategies, you can improve your financial habits in just 30 days. In this article, we will explore various approaches and practical tips to help you take control of your finances and build a solid foundation for a secure financial future.

1. Create a Budget

A budget serves as a roadmap for your financial journey. It allows you to track your income and expenses, identify areas where you can cut back, and ensure you are allocating your money wisely. Here’s how to create an effective budget:

- List your sources of income.

- Track your expenses for a month to understand where your money is going.

- Categorize your expenses into fixed (rent, utilities) and variable (entertainment, dining out).

- Set realistic spending limits for each category.

- Review and adjust your budget regularly.

2. Track Your Expenses

Keeping track of your expenses is crucial for gaining a clear understanding of your spending habits and identifying areas where you can save money. Here are some tips for effective expense tracking:

- Use mobile apps or budgeting software to record your expenses.

- Save receipts and review them regularly.

- Categorize your expenses to identify trends and areas of overspending.

- Consider using cash for discretionary spending to develop better awareness of your spending habits.

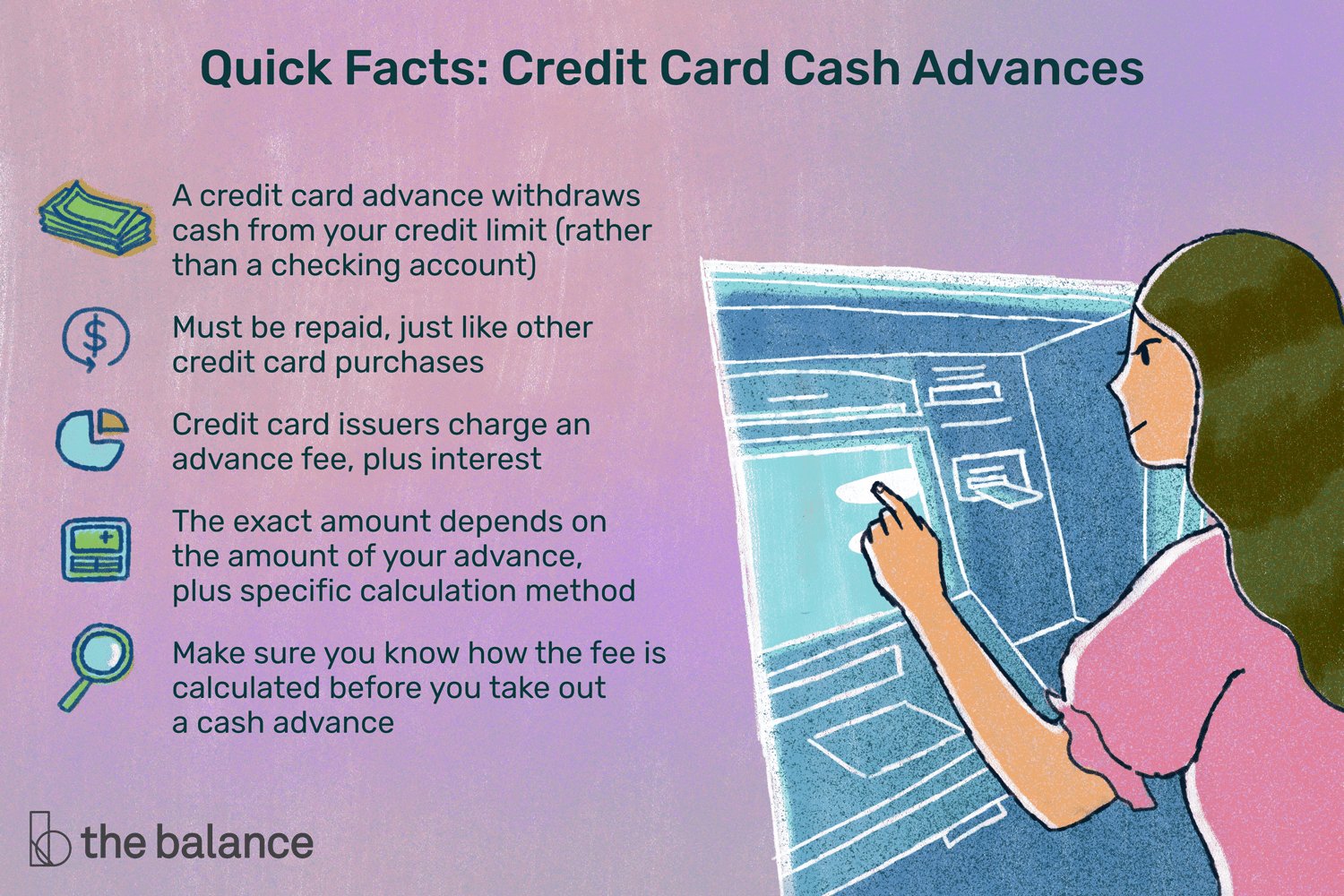

3. Prioritize Debt Repayment

If you have outstanding debt, prioritizing debt repayment is essential for improving your financial situation. Focus on paying off high-interest debts first, such as credit card debt. Here’s how to tackle your debt efficiently:

- Create a debt repayment plan by listing all your debts, their interest rates, and minimum monthly payments.

- Allocate extra funds towards paying off the debt with the highest interest rate while making minimum payments on others.

- Once the first debt is paid off, move on to the next one and continue this process until all your debts are gone.

4. Set Financial Goals

Setting clear financial goals provides you with a sense of purpose and motivation to improve your financial habits. Here’s how to set effective financial goals:

- Identify both short-term and long-term financial goals.

- Ensure your goals are specific, measurable, achievable, relevant, and time-bound (SMART).

- Break down your long-term goals into smaller milestones.

- Track your progress regularly and celebrate your achievements along the way.

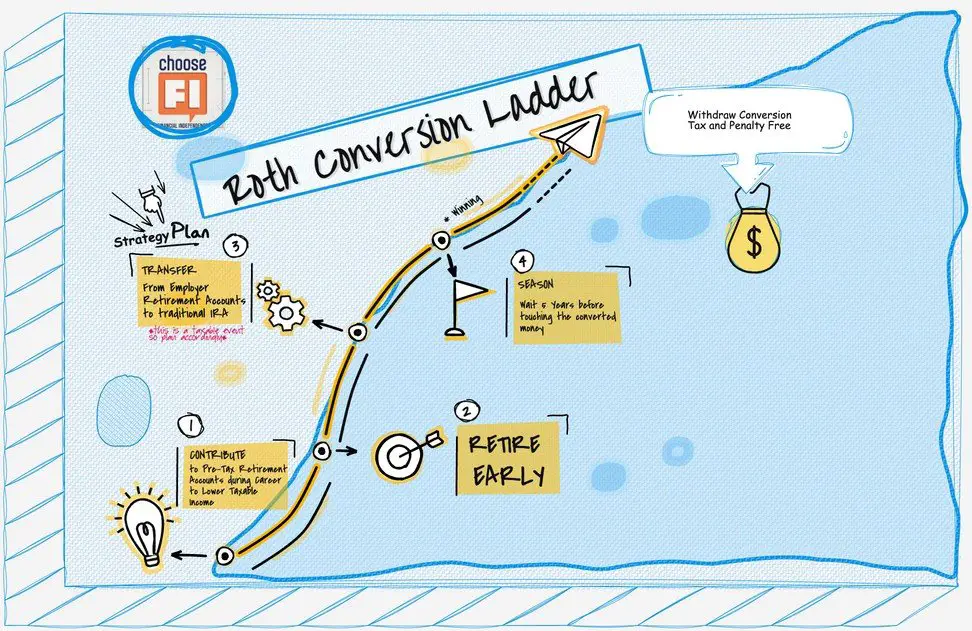

5. Automate Savings

Automating your savings is a powerful tool to build your wealth and improve your financial habits. Here’s how to make saving a breeze:

- Set up automatic transfers from your checking account to a savings account.

- Start small and gradually increase the amount you save.

- Consider opening separate savings accounts for different goals, such as an emergency fund or a vacation fund.

- Take advantage of employer-sponsored retirement plans, such as a 401(k), and contribute regularly.

6. Educate Yourself

Improving your financial habits requires knowledge and understanding of personal finance concepts. Educate yourself on various financial topics to make informed decisions. Here are some resources you can explore:

- Read books on personal finance and budgeting.

- Follow reputable personal finance blogs or websites.

- Listen to podcasts or watch videos on financial topics.

- Consider attending personal finance workshops or webinars.

7. Cut Back on Expenses

Reducing unnecessary expenses is an effective way to improve your financial habits and free up money for savings and debt repayment. Here are some tips to help you cut back:

- Identify discretionary expenses that can be reduced or eliminated.

- Look for alternative ways to save money, such as meal planning, shopping for deals, or negotiating bills.

- Consider downsizing or finding more affordable housing options.

- Avoid impulsive purchases and give yourself time to think before buying.

8. Review and Adjust Regularly

Improving your financial habits is an ongoing process. It’s important to regularly review and adjust your approach as needed. Here’s how to stay on track:

- Review your budget and expenses monthly to identify any deviations.

- Make adjustments based on changes in income, expenses, or financial goals.

- Seek feedback from a financial advisor or trusted friend.

- Celebrate milestones and use setbacks as learning opportunities.

By following these strategies and committing to making positive changes, you can improve your financial habits in just 30 days. Remember, it’s important to stay consistent, be patient, and continuously strive for financial well-being. Take control of your finances today and pave the way for a secure future.

Develop new habits in 30 days

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I improve my financial habits in 30 days?

By following these simple steps:

2. What are some effective strategies for improving financial habits within a month?

Consider implementing the following strategies:

3. Is it possible to see significant improvements in my finances within 30 days?

While individual results may vary, it is definitely possible to make notable progress in just one month by:

4. How can I create a budget to improve my financial habits within 30 days?

Here’s a step-by-step guide on creating a budget to enhance your financial habits:

5. What is the importance of tracking expenses when trying to improve financial habits in 30 days?

Tracking expenses is crucial in improving financial habits within a month because:

6. How can I reduce unnecessary expenses and save money within 30 days?

You can take the following actions to reduce unnecessary expenses and save money in a month:

7. Are there any recommended resources or tools that can help me improve my financial habits within 30 days?

Yes, there are several resources and tools available that can assist you in improving your financial habits within a month:

8. What should I do if I encounter financial setbacks while trying to improve my financial habits in 30 days?

If you encounter financial setbacks during the 30-day period, here’s what you can do:

Final Thoughts

Improving financial habits in 30 days is an achievable goal that can lead to long-term financial stability. Start by setting clear financial goals and creating a budget to track your expenses. Cut unnecessary expenses and prioritize saving money. Automate your savings and set up automatic bill payments to avoid late fees. Keep track of your spending and review your progress regularly. Seek out resources and educate yourself on personal finance to make informed decisions. By taking small, consistent steps and staying committed, you can improve your financial habits in just 30 days. It’s time to take control of your finances and make the necessary changes for a better financial future.