Have you ever wondered how to save for an early retirement? Imagine waking up each morning without the worry of financial obligations, free to pursue your passions and live life on your own terms. Well, look no further! In this article, we will explore practical strategies and actionable steps to help you achieve your goal of retiring early. From smart savings strategies to making wise investments, we’ll guide you through the process of building a solid financial foundation for your future. So, let’s dive in and take control of your financial destiny!

How to Save for an Early Retirement

Introduction

Saving for an early retirement is a goal that many people aspire to. The idea of being able to enjoy your golden years without the constraints of work is incredibly appealing. However, achieving this goal requires careful planning and disciplined saving. In this article, we will explore various strategies and tips to help you save for an early retirement and ensure financial security. So, let’s get started on this exciting journey towards financial independence!

1. Assess Your Financial Situation

Before you can start saving for retirement, it’s important to assess your current financial situation. This involves taking a close look at your income, expenses, debts, and assets. By understanding your financial standing, you can determine how much you need to save and create an effective plan.

1.1 Calculate Your Retirement Needs

To determine how much you will need to save for retirement, it’s essential to calculate your retirement needs. Consider factors such as your desired lifestyle, estimated healthcare costs, and potential inflation. Online retirement calculators can help you estimate the amount required for a comfortable retirement.

1.2 Track Your Expenses

Tracking your expenses is crucial in identifying areas where you can reduce spending and save more for retirement. Create a budget and monitor your monthly expenses closely. Look for opportunities to cut unnecessary costs, such as eating out less or canceling unused subscriptions.

2. Start Early and Automate Your Savings

One of the most effective ways to save for an early retirement is to start as early as possible. The power of compounding can significantly impact your savings over time. Additionally, automating your savings ensures consistency and eliminates the temptation to spend the money elsewhere.

2.1 Take Advantage of Employer-Sponsored Retirement Accounts

If your employer offers a retirement savings plan, such as a 401(k) or a 403(b), make sure to take full advantage of it. Contribute the maximum amount allowed, especially if your employer offers a matching contribution. This is essentially free money that can accelerate your retirement savings.

2.2 Open a Personal Retirement Account

If you don’t have access to an employer-sponsored retirement account or want to supplement your savings further, consider opening a personal retirement account like an Individual Retirement Account (IRA). Both traditional and Roth IRAs offer tax advantages, so choose the option that aligns with your financial goals.

2.3 Set Up Automatic Transfers

To ensure regular contributions to your retirement savings, set up automatic transfers from your paycheck or bank account. This way, you won’t have to think about saving every month, as it will happen automatically. It’s a hassle-free method that helps you stay on track.

3. Reduce Debt and Cut Expenses

Reducing debt and cutting unnecessary expenses can free up extra money to allocate towards your retirement savings. By being mindful of your spending habits and making smart financial decisions, you can maximize your savings potential.

3.1 Prioritize Debt Repayment

High-interest debt, such as credit card debt, can hinder your progress towards saving for retirement. Focus on paying off these debts as quickly as possible to avoid accumulating more interest. Once your debt is under control, you can redirect those funds towards your retirement savings.

3.2 Minimize Housing Costs

Housing costs often make up a significant portion of our expenses. Consider downsizing to a smaller home or exploring alternatives like renting instead of owning. If suitable for your situation, house hacking, where you rent out a portion of your home, can help offset your mortgage expenses.

3.3 Cut Down on Non-Essential Expenses

Review your monthly spending and identify non-essential expenses that you can cut back on. These may include eating out, entertainment subscriptions, or excessive shopping. Adopting frugal habits can lead to substantial savings in the long run.

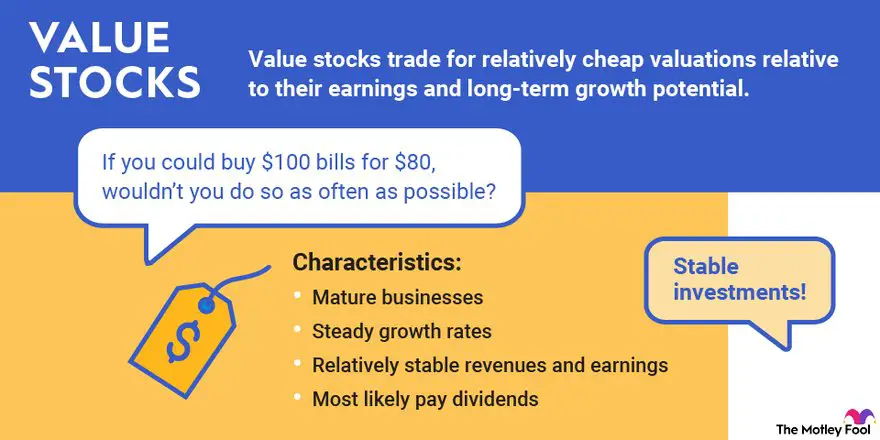

4. Invest Wisely for Growth

To make your money work for you and potentially achieve higher returns, investing wisely is paramount. While investing involves risks, it also offers the potential for significant growth over time.

4.1 Diversify Your Investment Portfolio

Diversification is a crucial strategy to mitigate risk. Spread your investments across different asset classes, such as stocks, bonds, and real estate investment trusts (REITs). This way, if one investment performs poorly, others can potentially compensate for the loss.

4.2 Consider Low-Cost Index Funds

Index funds are a popular investment option due to their low fees and broad market exposure. These funds mirror a market index, such as the S&P 500, providing diversification and eliminating the need to pick individual stocks. Over the long term, index funds have shown consistent growth.

4.3 Rebalance Your Portfolio Regularly

Regularly review and rebalance your investment portfolio to maintain your target asset allocation. Over time, some investments may outperform others, causing your portfolio to become unbalanced. By rebalancing, you ensure that your investments align with your risk tolerance and long-term goals.

5. Continuously Monitor and Adjust Your Plan

Saving for an early retirement is a long-term endeavor that requires ongoing monitoring and adjustments. Life circumstances, market conditions, and financial goals may change over time, necessitating modifications to your savings plan.

5.1 Review Your Plan Annually

Set aside time each year to review your retirement savings plan. Assess whether you are on track to meet your goals and make any necessary adjustments. This includes updating your retirement needs calculation, aligning your investments with your risk tolerance, and considering new opportunities for savings.

5.2 Seek Professional Financial Advice

If you’re unsure about managing your retirement savings or need expert guidance, consider consulting a financial advisor. An advisor can provide personalized recommendations based on your unique circumstances, ensuring you make informed decisions and stay on track towards your early retirement goals.

5.3 Stay Motivated and Celebrate Milestones

Saving for an early retirement can be a long and challenging journey. Stay motivated by celebrating milestones along the way. This could be reaching a certain savings target or achieving a specific investment return. Celebrating these achievements will help you stay focused and committed to your financial goals.

Saving for an early retirement requires discipline, careful planning, and a long-term mindset. By assessing your financial situation, starting early, reducing debt, cutting expenses, investing wisely, and continuously monitoring your progress, you can increase your chances of achieving financial independence and enjoying a comfortable retirement. Remember, every small step you take towards your retirement savings goal brings you one step closer to your dream of an early retirement. So, start today and secure a brighter future for yourself!

Best Way to Save For an Early Retirement?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I start saving for an early retirement?

To start saving for an early retirement, you can follow these steps:

- Evaluate your current financial situation and set a retirement goal.

- Create a budget to track your expenses and identify areas where you can save money.

- Establish an emergency fund to cover unexpected expenses.

- Maximize your retirement contributions, such as a 401(k) or IRA.

- Diversify your investments to minimize risk and maximize returns.

- Consider downsizing your lifestyle to reduce expenses and increase savings.

- Seek professional advice from financial advisors or planners.

- Regularly review and adjust your retirement savings strategy as needed.

What are some effective ways to increase my retirement savings?

Here are a few effective ways to increase your retirement savings:

- Contribute the maximum amount to your employer-sponsored retirement plan like a 401(k).

- Consider opening an Individual Retirement Account (IRA) and make regular contributions.

- Take advantage of catch-up contributions if you’re over 50 years old.

- Invest in tax-efficient retirement accounts to minimize your tax liability.

- Automate your savings by setting up automatic contributions from your paycheck.

- Reduce unnecessary expenses and redirect the saved money towards your retirement funds.

- Utilize employer matching contributions if available.

- Consider delaying your retirement age to allow for more years of savings.

Is it better to save for retirement in a traditional or Roth IRA?

The decision to save for retirement in a traditional or Roth IRA depends on your individual circumstances. Here’s a comparison:

- Traditional IRA: Contributions are tax-deductible, potentially lowering your current tax bill. However, withdrawals during retirement are taxed as income.

- Roth IRA: Contributions are made with after-tax dollars, so withdrawals during retirement are tax-free. It may be more beneficial if you expect to be in a higher tax bracket in the future.

It is advised to consult with a financial advisor to determine which option aligns best with your retirement goals and financial situation.

Can I use my retirement savings before reaching retirement age?

Withdrawing funds from your retirement savings before reaching retirement age may result in penalties and taxes. However, there are certain circumstances where you may be able to access your funds early without penalties:

- Hardship withdrawals for immediate and heavy financial needs.

- Substantially equal periodic payments under IRS rules.

- Qualified distributions for first-time homebuyers or specific education expenses.

- Rollovers to another qualified retirement account.

It’s important to understand the rules and consult with a financial advisor or tax professional before making early withdrawals to avoid any unnecessary penalties or taxes.

Should I invest in stocks for my retirement savings?

Investing in stocks for retirement savings can potentially provide higher returns, but it also carries higher risks. Consider the following points:

- Stocks have historically outperformed other investment options in the long run.

- Investing in a diversified portfolio can help mitigate risks.

- Investing in stocks is ideal for long-term goals, such as retirement.

- Consider your risk tolerance, time horizon, and goals before investing in stocks.

- Consult with a financial advisor to create a suitable investment strategy.

How much should I save each month for an early retirement?

The amount you should save each month for an early retirement depends on various factors, including your retirement goal, desired lifestyle, current age, and expected investment returns. It’s recommended to save at least 15-20% of your income, but this may vary on an individual basis.

Creating a budget and evaluating your financial situation can help determine a realistic savings goal. Consulting with a financial advisor can also provide personalized guidance based on your specific circumstances.

What if I have existing debt while saving for an early retirement?

If you have existing debt while saving for an early retirement, it’s important to strike a balance between debt repayment and retirement savings. Some steps you can take include:

- Priority debt repayment: Focus on high-interest debts first to minimize interest payments.

- Consider debt consolidation to lower interest rates and simplify payments.

- Create a budget to allocate a portion of your income towards both debt repayment and retirement savings.

- Consult with a financial advisor to evaluate the best approach in managing your debt and retirement savings simultaneously.

When should I start saving for an early retirement?

The sooner you start saving for an early retirement, the better. It’s never too early to begin planning and setting aside money for your future. The power of compounding allows your savings to grow over time, so starting early can significantly boost your retirement funds.

Even if you’re not able to save a substantial amount initially, regular and consistent contributions can make a significant difference in the long run. Take advantage of any employer-sponsored retirement plans and maximize your contributions as early as possible.

Final Thoughts

Saving for an early retirement is attainable with careful planning and disciplined financial habits. Start by setting clear retirement goals and determining the amount you need to save each month. Create a budget that allows for consistent savings and consider cutting back on non-essential expenses. Maximize your savings by taking advantage of employer-matched retirement plans and contributing regularly. Invest strategically to generate long-term growth and review your portfolio periodically. Stay committed to your savings plan, even during challenging times, and seek professional advice if needed. By following these steps, you can pave the way towards a financially secure and early retirement.