Are you confused about the differences between short-term and long-term investments? Look no further! Understanding short-term vs long-term investments is essential for anyone looking to make smart financial decisions. In this blog article, we will dive into the topic, providing you with valuable insights and guidance to help you navigate the investment landscape. Whether you’re a beginner or an experienced investor, this comprehensive guide will equip you with the knowledge you need to make informed decisions and achieve your financial goals. So, let’s start unraveling the secrets of short-term vs long-term investments!

Understanding Short-Term vs Long-Term Investments

Investing is a key aspect of financial planning that can help individuals grow their wealth and achieve their financial goals. When it comes to investing, one of the most important decisions is determining the time horizon for your investments. This decision sets the foundation for the type of investments you make and the strategies you employ. In this article, we will delve into the differences between short-term and long-term investments, exploring their characteristics, benefits, and considerations.

Defining Short-Term and Long-Term Investments

Before we examine the differences, let’s start by defining what short-term and long-term investments actually mean.

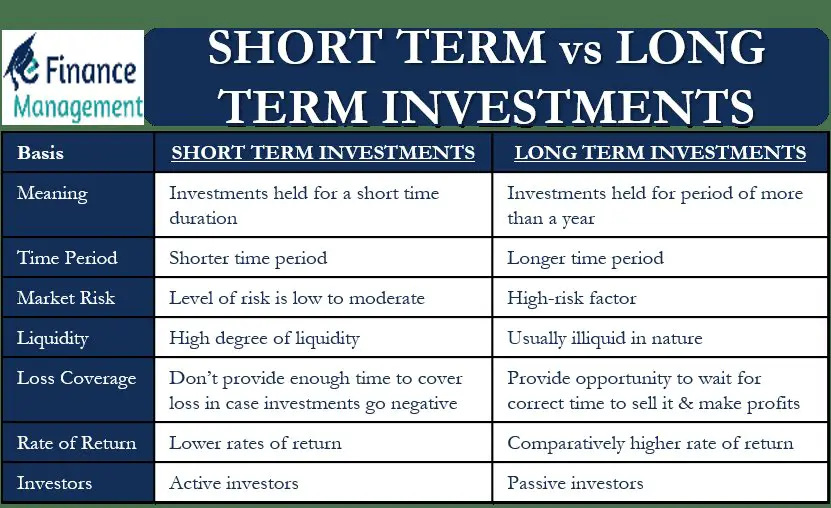

Short-term investments refer to assets or financial instruments that are held for a relatively brief period, usually within a year or less. These investments are typically characterized by their low risk and quick liquidity, meaning they can be easily converted into cash without significant losses.

On the other hand, long-term investments are assets or financial instruments held for an extended period, often exceeding one year. These investments are generally associated with higher risk levels but also offer the potential for higher returns over the long run.

The Purpose of Short-Term Investments

Short-term investments serve various purposes in an individual’s financial portfolio. Let’s take a closer look at some common reasons people opt for short-term investments:

- Liquidity: Short-term investments often offer quick access to cash, making them ideal for individuals who require immediate funds for emergencies or upcoming expenses.

- Preservation of capital: Since short-term investments are less exposed to market fluctuations, they allow individuals to protect their capital while earning modest returns.

- Opportunity funds: Short-term investments can act as a pool of funds for potential investment opportunities that may arise in the near future, such as a real estate deal or a promising business venture.

The Purpose of Long-Term Investments

While short-term investments offer immediate benefits, long-term investments are designed to provide lasting financial security and growth. Let’s explore some key reasons individuals opt for long-term investments:

- Capital appreciation: Long-term investments have the potential to generate significant returns over time as they benefit from the power of compounding. This makes them suitable for individuals with long-term financial goals, such as retirement planning or funding a child’s education.

- Beat inflation: Investing in long-term assets can help mitigate the impact of inflation by outpacing the rate of rising prices. By choosing investments that historically outperform inflation, individuals can maintain the purchasing power of their wealth over the long haul.

- Tax advantages: Certain long-term investments, such as retirement accounts or tax-efficient funds, offer tax advantages that can help individuals reduce their overall tax liability and potentially increase their net returns.

Differences in Risk and Return

One of the significant distinctions between short-term and long-term investments lies in their risk and return profiles. Understanding these differences is crucial for making informed investment decisions. Let’s explore this aspect in detail:

Risk Factors of Short-Term Investments

Short-term investments are generally considered less risky compared to their long-term counterparts due to the following reasons:

- Lower volatility: Short-term investments, such as money market funds or certificates of deposit (CDs), are often more stable and less prone to significant price fluctuations. This stability reduces the risk of losing capital.

- Shorter exposure to market conditions: Since short-term investments have a shorter time horizon, they are less affected by changes in economic conditions or market downturns.

- Greater liquidity: The ability to quickly convert short-term investments into cash provides a level of security, allowing individuals to access their funds promptly if needed.

Risk Factors of Long-Term Investments

Long-term investments, while potentially rewarding, come with higher levels of risk due to the following factors:

- Market volatility: Long-term investments are more susceptible to market fluctuations, and their values can vary significantly over time. This volatility exposes investors to potential losses, especially during economic downturns.

- Time commitment: Due to the extended time horizon, individuals investing in long-term assets must be prepared to weather short-term market volatility and fluctuations without panicking or making impulsive decisions.

- Less liquidity: Unlike short-term investments, long-term investments may have limited liquidity, making it more challenging to access funds quickly if an immediate need arises.

Investment Considerations: Short-Term vs Long-Term

When deciding between short-term and long-term investments, it’s essential to consider several factors to align your investment strategy with your financial goals. Let’s examine these considerations:

Time Horizon

The time horizon is a critical factor in determining whether short-term or long-term investments are more suitable for your needs. Consider the following:

- Short-term goals: If you have specific financial objectives that need to be met in the near future, such as buying a car or going on a vacation, short-term investments with quick liquidity may be the better option.

- Long-term goals: On the other hand, for goals like retirement planning or saving for your child’s education, long-term investments offer the potential to accumulate wealth gradually over an extended period.

Risk Tolerance

Understanding and assessing your risk tolerance is crucial before embarking on any investment strategy. Consider the following:

- Conservative risk tolerance: If you are risk-averse and prefer stability over potentially high returns, short-term investments with lower risk levels may align better with your risk tolerance.

- Tolerant of market fluctuations: If you can accept short-term volatility and have a higher risk tolerance, long-term investments have the potential to generate higher returns in exchange for the increased risk.

Liquidity Needs

Consider your current and future liquidity needs when determining your investment horizon:

- Immediate cash needs: If you anticipate requiring immediate access to a significant portion of your funds, short-term investments offer the advantage of quick liquidity without significant penalties.

- Reduced liquidity needs: If you have a stable financial situation and do not foresee an immediate need for cash, long-term investments can provide higher potential returns without sacrificing liquidity completely.

Financial Goals and Objectives

Aligning your investments with your financial goals is crucial in ensuring you make progress towards achieving them:

- Short-term financial goals: If you have specific short-term financial goals, such as saving for a down payment on a house or paying off high-interest debt, short-term investments can help you achieve these goals within a shorter timeframe.

- Long-term financial goals: For long-term financial goals like building a retirement nest egg or leaving a legacy for future generations, long-term investments provide the opportunity for wealth accumulation over an extended period.

Combining Short-Term and Long-Term Investments

In many cases, striking a balance between short-term and long-term investments can offer a well-rounded investment strategy. Here are some ways in which you can combine the two:

- Emergency fund: Building a short-term emergency fund in easily accessible, low-risk investments ensures you have a financial cushion for unexpected expenses while your long-term investments continue to grow.

- Dollar-cost averaging: Investing a fixed amount regularly in long-term assets, such as index funds or mutual funds, allows you to take advantage of market volatility and potentially reduce the impact of short-term fluctuations.

- Asset allocation: Diversifying your investments across various asset classes and time horizons can provide a balanced risk-return profile. Allocating a portion of your portfolio to short-term investments provides liquidity and stability, while long-term investments have the potential for growth.

In conclusion, understanding the differences between short-term and long-term investments is crucial for making informed investment decisions. Short-term investments offer liquidity, capital preservation, and opportunity funds, making them suitable for immediate financial needs. Long-term investments, on the other hand, provide the potential for capital appreciation, inflation protection, and tax advantages, making them ideal for long-term financial goals. By considering factors such as time horizon, risk tolerance, liquidity needs, and financial goals, individuals can create a well-rounded investment strategy that combines both short-term and long-term investments to maximize their wealth and financial security.

Short-Term Investing vs Long-Term Investing Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the difference between short-term and long-term investments?

Short-term investments are typically held for a shorter period, usually less than a year, and are aimed at preserving capital or generating quick gains. On the other hand, long-term investments are held for an extended period, often several years or more, with the goal of achieving significant growth or income generation.

What are some examples of short-term investments?

Examples of short-term investments include savings accounts, money market funds, certificates of deposit (CDs), and Treasury bills. These investments are considered relatively low risk and offer more liquidity.

Can you give examples of long-term investments?

Examples of long-term investments include stocks, real estate, bonds, mutual funds, and retirement accounts like 401(k)s or IRAs. These investments are generally subject to market fluctuations and may require a longer time horizon to achieve substantial returns.

What are the potential risks associated with short-term investments?

Short-term investments typically have lower risk compared to long-term investments. However, the potential risks include inflation risk, low returns compared to long-term investments, and the risk of not keeping pace with inflation.

What are the potential benefits of long-term investments?

Long-term investments have the potential for higher returns compared to short-term investments. They allow for compounding growth over time and can help individuals achieve their long-term financial goals, such as retirement savings.

How can I determine whether to choose short-term or long-term investments?

Your investment choice depends on your financial goals, risk tolerance, and time horizon. If you have specific short-term financial needs or prefer lower-risk options, short-term investments may be more suitable. Long-term investments are ideal for individuals with longer time horizons and higher risk tolerance.

What are some strategies for managing short-term investments?

To manage short-term investments effectively, it is important to diversify your portfolio, regularly review and adjust your investments based on market conditions, and consider factors such as liquidity needs and potential tax implications.

Are short-term investments more or less volatile than long-term investments?

Generally, short-term investments are less volatile compared to long-term investments. However, the level of volatility can vary depending on the specific investment instrument chosen and the overall market conditions.

Final Thoughts

Understanding short-term vs long-term investments is crucial for making informed financial decisions. Short-term investments are typically characterized by a shorter time horizon, ranging from a few months to a few years. These investments are often less risky and provide quicker returns. On the other hand, long-term investments require a longer holding period, usually spanning several years or even decades. They tend to offer potential for higher returns but also carry more market volatility. Ultimately, it’s essential to consider your financial goals, risk tolerance, and timeline when determining the most suitable investment strategy for your needs. By grasping the differences between short-term and long-term investments, you can make better choices to maximize your financial growth.