Living abroad can be an exciting adventure, but it can also present unique challenges, especially when it comes to managing your finances. If you find yourself wondering how to manage your finances while living abroad, you’re not alone. Thankfully, there are practical steps you can take to navigate this new financial landscape with confidence. In this article, we will explore effective strategies for ensuring your financial well-being while abroad, from budgeting and banking to taxes and investments. So, whether you’re a seasoned expat or just starting your international journey, this guide will provide you with valuable insights and actionable tips for managing your finances while living abroad. Let’s dive in!

How to Manage Your Finances While Living Abroad

Living abroad can be an exciting and enriching experience, but it also comes with its fair share of challenges, especially when it comes to managing your finances. Whether you’re moving abroad for work, study, or adventure, it’s crucial to have a solid plan in place to ensure your financial stability and peace of mind. In this article, we will explore various strategies and tips on how to effectively manage your finances while living abroad.

1. Establish a Budget

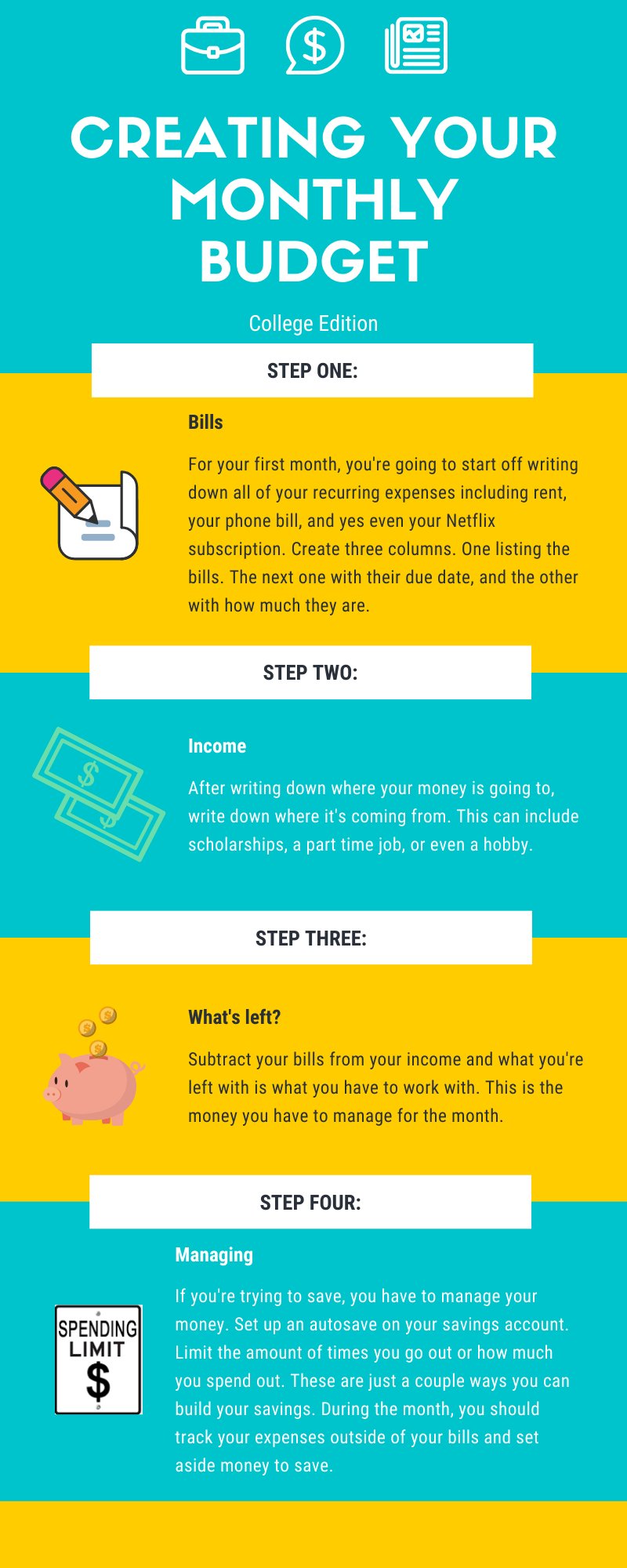

Creating a budget is the first step towards managing your finances anywhere, and it becomes even more important when you’re living in a foreign country. A budget helps you track your income, expenses, and savings, providing a clear overview of where your money is going.

Here are some key steps to consider when establishing a budget while living abroad:

– Determine your income: Calculate your monthly income from all sources. This may include your salary, allowances, scholarships, or any other funds you receive regularly.

– Track your expenses: Keep a record of all your expenses, including rent, utilities, groceries, transportation, healthcare, entertainment, and any other recurring or one-time costs. Be thorough to ensure accurate tracking.

– Differentiate between needs and wants: Understand your priorities and distinguish between necessary expenses (needs) and discretionary spending (wants). This will help you make informed decisions and avoid unnecessary financial strain.

– Consider local cost of living: Research and understand the cost of living in your host country. Take into account currency conversions, taxes, healthcare costs, and any specific local expenses.

– Allocate savings: Set aside a portion of your income for savings, emergencies, and future financial goals. Aim to save at least 20% of your monthly income, if possible.

2. Understand Currency Exchange and Banking System

Dealing with foreign currencies and navigating a new banking system can be overwhelming at first. However, a good understanding of currency exchange rates, banking fees, and local financial services is crucial for effectively managing your finances while living abroad.

Consider the following:

– Exchange rates: Stay updated on currency exchange rates to make informed decisions when transferring money between your home country and the host country. Online platforms, financial news websites, and mobile apps can provide real-time exchange rate information.

– Banking options: Research local banks and their offerings to find the most suitable option for your needs. Look for banks that provide convenient online banking services, international money transfers, low fees, and favorable exchange rates.

– International transactions: Understand the fees associated with international transactions, such as wire transfers, ATM withdrawals, and currency conversions. Compare the fees charged by different banks to minimize transaction costs.

– Consider local banking services: Explore local banking services that may offer advantages over international banks. Some countries have specialized financial institutions that cater specifically to expatriates and may provide benefits such as multi-currency accounts, tax assistance, or easier access to credit.

– Online banking and mobile apps: Take advantage of online banking services and mobile apps offered by your bank. These tools can help you track your transactions, set up notifications for account activity, and manage your finances conveniently.

3. Manage Taxes Effectively

Tax obligations can be complex, especially when you’re living and working abroad. Understanding the tax system in your host country and considering any tax obligations in your home country is crucial to avoid legal issues and optimize your financial situation.

Consider the following tax management strategies:

– Research tax residency rules: Consult with a tax advisor or research the tax residency rules in your host country. Depending on the duration of your stay and other factors, you may be required to pay taxes locally or enjoy specific tax benefits.

– Double taxation treaties: Investigate if there are any double taxation treaties between your home country and the host country. These treaties aim to prevent individuals from being taxed twice on the same income. Understanding and utilizing these treaties can help you minimize your tax liabilities.

– File tax returns: Fulfill your tax obligations by filing tax returns in both your home country (if required) and your host country. You may be eligible for tax exemptions, deductions, or credits, so ensure you are aware of the relevant forms and deadlines.

– Seek professional advice: Engage a tax professional who specializes in international tax matters. They can assist you in optimizing your tax situation, ensuring compliance, and taking advantage of any available tax benefits.

4. Explore Health Insurance Options

Healthcare costs can vary significantly from country to country, making it vital to have appropriate health insurance coverage while living abroad. Unexpected medical emergencies can have a severe impact on your finances, so it’s crucial to explore your health insurance options.

Consider the following:

– International health insurance: Investigate international health insurance plans that provide coverage in both your home country and the host country. These plans often offer comprehensive coverage, including emergency medical treatment, hospitalization, and repatriation.

– Local health insurance: Research the local healthcare system in your host country and consider obtaining local health insurance if it offers reliable coverage at an affordable cost. Some countries may have mandatory health insurance requirements for residents.

– Travel insurance: If you frequently travel between your home country and the host country, consider purchasing travel insurance that covers emergencies, trip cancellation, and loss of personal belongings. This can provide an extra layer of protection and peace of mind.

– Emergency funds: Regardless of your insurance coverage, it’s advisable to maintain emergency funds to cover unexpected medical costs, deductibles, or any medical expenses not covered by your insurance.

5. Plan for Retirement and Investments

Managing your finances while living abroad should also involve planning for your long-term financial goals, such as retirement and investments. Taking proactive steps towards securing your financial future will contribute to your overall financial well-being.

Consider the following:

– Retirement plans: Investigate retirement options available in your host country, such as employer-sponsored pension plans or individual retirement accounts. Determine whether you’re eligible to contribute and whether the plans are portable if you decide to return to your home country.

– Investment opportunities: Explore investment opportunities in your host country that align with your risk tolerance and financial goals. Consider real estate, local stocks, bonds, or other investment instruments available in the local market. Consult with a financial advisor to ensure you make well-informed investment decisions.

– Cross-border investments: If you prefer to invest in your home country or other international markets, research cross-border investment options that allow you to manage your investments while living abroad. Online investment platforms and brokerage accounts can facilitate these transactions.

– Seek professional advice: Engage the services of a financial advisor who specializes in international investments and retirement planning. They can provide guidance based on your specific circumstances and help you optimize your investment portfolio.

6. Monitor and Adjust Your Financial Strategy

Managing your finances while living abroad is an ongoing process that requires monitoring, evaluation, and adjustment. Your financial situation and goals may evolve over time, and it’s essential to adapt your strategy accordingly.

Consider the following:

– Regularly review your budget: Periodically review your budget to ensure it reflects your current income, expenses, and financial goals. Make adjustments as necessary to stay on track and accommodate any changes in your circumstances.

– Track your spending habits: Continuously monitor your spending habits to identify areas where you can save money or redirect funds towards your financial goals. Use personal finance apps or spreadsheets to track your expenses easily.

– Stay informed about local regulations: Stay updated on any changes in local financial regulations, tax laws, or banking requirements. This will ensure compliance and help you make educated decisions regarding your finances.

– Stay connected with professionals: Maintain relationships with professionals such as tax advisors, financial advisors, or local experts who can provide guidance and support when needed. Regular consultations can help you stay informed and make well-informed financial decisions.

In conclusion, managing your finances while living abroad requires careful planning, research, and adaptability. By establishing a budget, understanding the local banking system, managing taxes effectively, exploring health insurance options, planning for retirement and investments, and regularly monitoring your financial strategy, you can maintain financial stability and make the most of your international experience. Remember to seek professional advice when needed and be open to adjusting your approach as circumstances change. With the right mindset and financial management skills, you can navigate the challenges and thrive financially while living abroad.

Navigating Finances Overseas | How To Manage Your Money While Living Abroad | Expat Money Advice

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I open a bank account while living abroad?

Opening a bank account while living abroad may vary depending on the country you are in. Contact local banks to inquire about the necessary documentation, such as your identification, proof of residency, and employment status. Some banks also offer online account opening services that can be convenient if you don’t have access to a physical branch.

2. What should I consider when choosing a currency for my bank account?

When selecting a currency for your bank account while living abroad, consider the currency that aligns with your income, expenses, and financial goals. Evaluate exchange rates, transaction fees, and accessibility. If you receive income in a specific currency or frequently transfer funds back to your home country, it may be beneficial to open an account in that currency.

3. How can I manage currency exchange rates effectively?

To manage currency exchange rates effectively while living abroad, you can consider utilizing services such as foreign exchange brokers or specialized money transfer companies. These options may offer better rates and lower fees compared to traditional banks. Additionally, monitoring exchange rates and transferring larger sums when rates are favorable can help maximize your funds.

4. What are some tips for budgeting while living abroad?

When budgeting while living abroad, start by calculating your income and fixed expenses, such as rent, utilities, and insurance. Consider local costs of living, including groceries, transportation, and entertainment. It’s crucial to track your expenses regularly, prioritize saving, and adjust your budget as needed to maintain financial stability.

5. How can I minimize bank fees and charges while living abroad?

To minimize bank fees and charges while living abroad, research and compare different banks’ fee structures. Look for accounts that offer waived or reduced fees for international transactions, ATM withdrawals, and currency conversions. Opting for online banking and electronic transfers can also help reduce transaction fees.

6. Are there any tax considerations I need to be aware of while living abroad?

While living abroad, tax obligations may still apply depending on your country of citizenship and residency. It’s advisable to consult with a tax professional or seek guidance from the respective tax authorities to understand your tax responsibilities, potential deductions, and any applicable treaties between your home country and the country you reside in.

7. How can I protect my finances from fraud and identity theft while living abroad?

To protect your finances from fraud and identity theft while living abroad, follow these best practices: regularly monitor your bank accounts and credit reports, avoid sharing sensitive information over unsecure networks, use strong and unique passwords for your financial accounts, and be cautious when providing personal information to unfamiliar entities.

8. Can I still maintain financial ties with my home country while living abroad?

Yes, it is possible to maintain financial ties with your home country while living abroad. You can consider keeping a bank account in your home country for various purposes, such as receiving payments, managing investments, or paying bills back home. However, be mindful of any tax implications and potential currency exchange fees when transferring funds between countries.

Final Thoughts

Managing your finances while living abroad can be a challenging task, but with the right strategies, it is certainly possible. Start by creating a budget that takes into account your unique circumstances and prioritize your expenses accordingly. Research local banking options and find one that offers convenient and cost-effective services for international transactions. Consider using online tools and apps to track your expenses and stay organized. Make sure to stay informed about exchange rates and explore ways to minimize transaction fees. By being proactive and mindful, you can effectively manage your finances and ensure a smooth financial journey while living abroad.