Are you curious about the role of credit bureaus? Understanding the role of credit bureaus is crucial for anyone looking to navigate the world of finance. These institutions play a vital part in determining your creditworthiness, affecting your ability to secure loans, rent an apartment, or even land a job. In this blog article, we will delve into the inner workings of credit bureaus, shedding light on their significance and how they impact your financial life. So, whether you’re aiming to improve your credit score or simply seeking a deeper understanding of this system, this article is for you. Let’s dive in!

Understanding the Role of Credit Bureaus

Introduction

Credit bureaus play a crucial role in the financial landscape, yet many people may not fully understand what they do or how they impact their lives. These organizations collect and maintain vast amounts of data on consumer credit behavior, providing valuable information to lenders and businesses. In this article, we will delve into the intricacies of credit bureaus, exploring their functions, the data they gather, how they calculate credit scores, and why it all matters. By the end, you’ll have a comprehensive understanding of credit bureaus and their role in our financial lives.

The Basics of Credit Bureaus

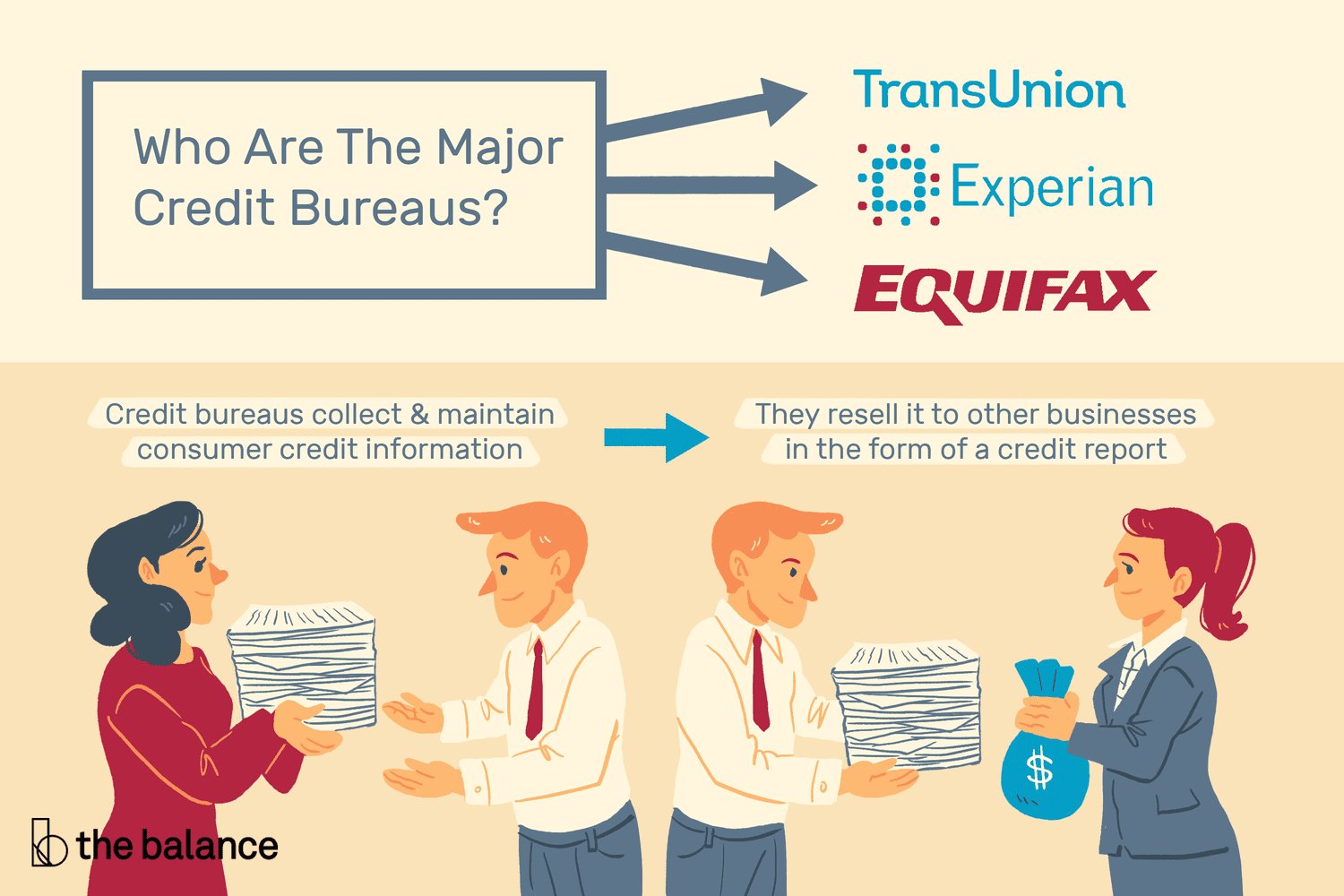

Credit bureaus, also known as credit reporting agencies, are companies that collect and store consumer credit information. They act as intermediaries between lenders and consumers, providing lenders with the necessary data to make informed lending decisions. The three major credit bureaus in the United States are Equifax, Experian, and TransUnion. These bureaus operate independently and compete with each other, but they all serve the same purpose – to assess and report on consumer creditworthiness.

Data Collection

Credit bureaus are constantly collecting data from a variety of sources, such as lenders, credit card companies, and public records. They gather information on individual credit accounts, including credit cards, loans, and mortgages. Additionally, they collect information on public records like bankruptcies, liens, and judgments. This vast pool of data is then compiled and organized to create individual credit reports.

Credit Reports

A credit report is a detailed record of an individual’s credit history. It includes information on credit accounts, payment history, credit limits, outstanding balances, and public records. A credit report also lists inquiries made by lenders and businesses when checking an individual’s creditworthiness. Lenders and creditors rely on these reports to assess the risk of extending credit to potential borrowers. It’s essential for consumers to regularly review their credit reports to ensure the accuracy of the information.

Credit Scores

Credit bureaus use the data in credit reports to calculate credit scores, which provide a numerical representation of an individual’s creditworthiness. Credit scores help lenders quickly evaluate an applicant’s risk level and determine whether to approve a loan or credit application. The most widely used credit scoring model is the FICO score, developed by the Fair Isaac Corporation. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. Other scoring models, such as VantageScore, are also used in the industry.

Factors Affecting Credit Scores

Several key factors influence credit scores. Understanding these factors is important for individuals looking to improve their creditworthiness. The main factors affecting credit scores are:

- Payment History: This is the most significant factor, accounting for about 35% of a credit score. Lenders assess an individual’s payment history to see if they have a history of making payments on time.

- Utilization Ratio: The percentage of available credit being utilized is another important factor, contributing approximately 30% to a credit score. Keeping credit utilization below 30% is generally recommended.

- Length of Credit History: The length of time an individual has been using credit affects their score, with longer credit histories generally viewed more favorably.

- New Credit and Inquiries: Opening multiple new credit accounts within a short period or having too many inquiries can negatively impact a credit score, as it may suggest a higher level of risk.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively influence a credit score, as it demonstrates responsible credit management.

The Role of Credit Bureaus in Lending

Credit bureaus serve as vital tools for lenders in evaluating creditworthiness and managing risk. Lenders primarily use credit reports and credit scores to assess the likelihood of repayment and determine appropriate interest rates for loans. Let’s explore the role credit bureaus play in various aspects of lending:

Loan Approval

When individuals apply for loans, lenders pull their credit reports and scores from one or more credit bureaus. The information in these reports helps lenders decide whether to approve the loan application. Based on the applicant’s credit history, lenders can determine the level of risk involved and make informed decisions regarding loan terms and interest rates.

Interest Rates

Credit bureaus provide lenders with data that allows them to assess the level of risk associated with lending to a particular borrower. Individuals with higher credit scores are considered less risky and may qualify for lower interest rates, while those with lower scores may face higher interest rates to compensate for the perceived risk. The creditworthiness evaluation carried out by credit bureaus helps lenders determine the appropriate interest rates based on the borrower’s risk profile.

Collection Agencies

Credit bureaus also work closely with collection agencies. When a consumer defaults on payments, the lenders may eventually sell the debt to a collection agency. These agencies report the delinquency to the credit bureaus, which, in turn, update the consumer’s credit report. This reporting affects the individual’s credit score, potentially making it more challenging for them to secure future credit.

Identity Verification

In addition to assessing creditworthiness, credit bureaus play a crucial role in identity verification. Lenders rely on credit reports as a tool to confirm the identity of an applicant. By verifying an individual’s personal information, credit bureaus help prevent identity theft and fraudulent activities.

The Impact of Credit Bureaus on Consumers

Credit bureaus not only serve lenders but also have a significant impact on consumers. Understanding the effects of credit bureaus on individuals’ financial lives is essential for managing credit responsibly. Let’s explore how credit bureaus impact consumers:

Creditworthiness Assessment

Credit bureaus assess an individual’s creditworthiness based on their credit reports and scores. This assessment directly impacts an individual’s ability to access credit, such as loans and credit cards. Poor creditworthiness can result in limited borrowing options or higher interest rates, making it crucial for consumers to manage their credit responsibly.

Access to Credit

Credit bureaus enable consumers to access credit by providing lenders with reliable information on creditworthiness. As lenders rely on credit reports and scores, individuals with good credit histories have better chances of obtaining loans or credit cards with favorable terms and conditions. Positive credit behavior, such as making payments on time and maintaining low credit utilization, increases the likelihood of receiving credit offers.

Identity Theft Protection

Credit bureaus play a vital role in protecting consumers from identity theft. By monitoring individuals’ credit reports for any suspicious activity, such as unauthorized accounts or inquiries, credit bureaus help detect and prevent identity theft. Consumers can take advantage of credit monitoring services offered by credit bureaus to stay informed about potential fraudulent activities.

Improving Credit Score

Credit bureaus provide individuals with credit reports that contain valuable information on their credit history. Reviewing these reports allows individuals to identify areas for improvement and take steps to enhance their creditworthiness. By understanding the factors affecting credit scores, consumers can implement strategies to improve their financial standing over time.

The Importance of Credit Bureaus in the Financial System

Credit bureaus are integral to the smooth functioning of the financial system. Their existence and operation enable lenders to make informed decisions, manage risk, and provide credit to consumers. The importance of credit bureaus in the financial system can be summarized as follows:

Facilitating Lending

Credit bureaus facilitate lending by providing lenders with reliable information on an individual’s creditworthiness. This information allows lenders to evaluate the risk associated with granting credit and make decisions accordingly. Without credit bureaus, lenders would face significant challenges in assessing borrowers’ creditworthiness, resulting in limited access to credit for individuals.

Reducing Risk

By assessing creditworthiness, credit bureaus help reduce the risk faced by lenders. Lenders can use credit reports and scores to estimate the likelihood of repayment, allowing them to make informed decisions about extending credit. This risk assessment process minimizes the chances of loans defaulting, thereby contributing to the overall stability of the financial system.

Promoting Fairness

Credit bureaus promote fairness in lending by providing a standardized evaluation system. The use of credit reports and scores allows lenders to assess individuals based on objective criteria rather than relying solely on subjective judgments. This standardized approach ensures that individuals are evaluated fairly and objectively, regardless of personal biases or discrimination.

Encouraging Responsible Borrowing

The existence of credit bureaus encourages responsible borrowing and credit management. Individuals are aware that their credit behavior is being monitored and recorded, incentivizing them to make timely payments, maintain low credit utilization, and manage their debts responsibly. This focus on responsible borrowing creates a healthier credit environment for both lenders and consumers.

Credit bureaus play a crucial role in our financial lives, influencing lending decisions, interest rates, and overall creditworthiness. Understanding their functions, data collection processes, and the factors they consider when calculating credit scores empowers individuals to make informed financial decisions. By managing credit responsibly and regularly monitoring credit reports, consumers can improve their creditworthiness, access better borrowing opportunities, and protect themselves from identity theft. The role of credit bureaus in the financial system ensures fairness, stability, and responsible borrowing practices, benefiting both lenders and consumers alike.

Credit Scores and Credit Reports Explained in One Minute

Frequently Asked Questions

Understanding the Role of Credit Bureaus (FAQs)

Understanding the Role of Credit Bureaus

1.

How do credit bureaus collect information about my credit history?

Credit bureaus collect information about your credit history from various sources such as banks, lenders, credit card companies, and other financial institutions. They gather data on your payment history, loan balances, credit limits, and any negative information like late payments or defaults.

2.

What is the purpose of credit bureaus?

Credit bureaus play a crucial role in managing credit information and providing credit reports to lenders. Their primary purpose is to help lenders assess the creditworthiness of individuals and businesses before approving loans or extending credit.

3.

How do credit bureaus calculate credit scores?

Credit bureaus use complex algorithms to calculate credit scores. They consider several factors, including payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. These factors are weighted differently, and the resulting score provides an overview of your creditworthiness.

4.

Do credit bureaus make lending decisions?

No, credit bureaus do not make lending decisions. They simply provide credit reports and scores to lenders, who then use this information along with their own lending criteria to determine whether to approve a loan or credit application.

5.

How often should I check my credit report?

It is recommended to check your credit report at least once a year to ensure the accuracy of the information it contains. Regularly reviewing your credit report allows you to identify any errors, fraudulent activity, or potential issues that may affect your creditworthiness.

6.

Can I dispute incorrect information on my credit report?

Yes, if you notice incorrect information on your credit report, you have the right to dispute it. Credit bureaus have a process in place for handling disputes and correcting any inaccuracies. You can initiate a dispute by contacting the credit bureau and providing supporting documentation to substantiate your claim.

7.

How long does negative information stay on a credit report?

Most negative information, such as late payments, defaults, or bankruptcies, stays on your credit report for a certain period. For example, late payments typically remain on your report for seven years, while bankruptcies may remain for up to ten years. However, positive information, like on-time payments, can also remain on your report for an extended period.

8.

Can I improve my credit score?

Yes, it is possible to improve your credit score over time. By paying bills on time, reducing credit card balances, and maintaining a healthy credit utilization ratio, you can positively impact your credit score. Regularly reviewing your credit report and addressing any negative factors can also help improve your creditworthiness.

Please note that the information provided is general and may vary depending on your specific credit bureau and jurisdiction.

Final Thoughts

Credit bureaus play a crucial role in the financial ecosystem. By collecting and analyzing data on borrowers, they provide lenders with valuable insights into an individual’s creditworthiness. Understanding the role of credit bureaus is essential for consumers as well. It empowers them to take control of their financial health, make informed decisions, and take steps towards improving their credit scores. With credit bureaus, lenders can assess the risk associated with extending credit, while borrowers can access credit on fair terms. Therefore, understanding the role of credit bureaus is vital for both borrowers and lenders in fostering a healthy and sustainable financial landscape.