Are you looking to invest in the stock market but unsure of the best strategy? Look no further! Dollar cost averaging in investing is a technique that can help you navigate the ups and downs of the market. By consistently investing a fixed amount at regular intervals, regardless of market conditions, you can take advantage of price fluctuations and potentially reduce the impact of market volatility on your investments. In this article, we will delve into what dollar cost averaging in investing is all about and how it can benefit your investment journey. Let’s get started!

What is Dollar Cost Averaging in Investing?

Investing in the stock market can be intimidating, especially if you’re new to the game. With all the market fluctuations and unpredictable nature of stock prices, it can be challenging to know when and how much to invest. This is where dollar cost averaging comes in. Dollar cost averaging is an investment strategy that can help mitigate some of the risks associated with market volatility and make investing more accessible for beginners.

Understanding Dollar Cost Averaging

Dollar cost averaging involves investing a fixed amount of money at regular intervals, regardless of the price of the investment. Instead of trying to time the market and make large lump sum investments, you spread out your investments over time. This strategy allows you to buy more shares when prices are low and fewer shares when prices are high. By consistently investing a fixed amount, you can take advantage of market fluctuations and potentially lower your average cost per share over time.

How Does Dollar Cost Averaging Work?

To illustrate how dollar cost averaging works, let’s consider an example. Suppose you decide to invest $500 a month in a specific stock. In month one, the stock price is $10 per share, so you buy 50 shares. In month two, the price increases to $12 per share, and you can only purchase 41.67 shares with your $500. In month three, the price drops to $8 per share, allowing you to buy 62.5 shares. Over time, your investment accumulates more shares when prices are lower and fewer shares when prices are higher.

The Benefits of Dollar Cost Averaging

Dollar cost averaging offers several advantages to investors:

1. Reduces the impact of market volatility: Since you’re investing the same amount consistently, you automatically buy fewer shares when prices are high and more shares when prices are low. This helps to smooth out the impact of market fluctuations over time.

2. Eliminates the need for market timing: Trying to time the market is notoriously difficult, even for seasoned investors. With dollar cost averaging, you don’t need to worry about buying at the perfect time. You’re continuously investing, regardless of market conditions.

3. Disciplined approach to investing: Dollar cost averaging helps instill discipline in your investment strategy. By committing to regular investments, you remove the temptation to make impulsive investment decisions based on short-term market movements.

4. Lower average cost per share: By consistently buying shares over time, you’ll accumulate more shares when prices are low, ultimately lowering your average cost per share. This can lead to higher potential returns in the long run.

5. Reduces emotional decision-making: Investing can be emotionally challenging, especially when markets are volatile. Dollar cost averaging helps to mitigate emotional decision-making by following a systematic investment plan.

Factors to Consider with Dollar Cost Averaging

While dollar cost averaging can be a useful strategy, it’s essential to consider a few factors:

1. Long-term commitment: Dollar cost averaging works best when you have a long-term investment horizon. It’s not a strategy suited for short-term traders or those looking for quick profits.

2. Regular contributions: Consistency is key with dollar cost averaging. Set up automatic contributions from your bank account to ensure regular investments.

3. Investment selection: Choose investments that align with your long-term goals and risk tolerance. Diversifying your investments across different asset classes and sectors can help manage risk.

4. Cost of transactions: Keep an eye on transaction costs, such as brokerage fees, as they can eat into your returns, especially when investing small amounts regularly. Look for low-cost investment options to maximize your returns.

Dollar cost averaging is a simple yet effective investment strategy that can help minimize the impact of market volatility and make investing more accessible for beginners. By committing to regular, fixed investments, regardless of market conditions, you can take advantage of market fluctuations and potentially lower your average cost per share over time. Remember, investing in the stock market carries inherent risks, and it’s crucial to do your research and consult with a financial advisor before making any investment decisions. Happy investing!

Dollar Cost Averaging, explained

Frequently Asked Questions

#### Frequently Asked Questions (FAQs)

What is Dollar Cost Averaging in Investing?

How does dollar cost averaging work?

Dollar cost averaging is an investment strategy where an investor regularly invests a fixed amount of money into a specific investment, regardless of the asset’s price. By consistently investing the same amount at regular intervals, such as monthly or quarterly, investors can accumulate more shares when prices are low and fewer shares when prices are high.

Why is dollar cost averaging important?

Dollar cost averaging allows investors to mitigate the impact of market volatility. Since the investment is spread over time, it removes the need to perfectly time the market and reduces the risk of making poor investment decisions based on short-term market fluctuations.

Can dollar cost averaging be used for any type of investment?

Yes, dollar cost averaging can be used with a wide range of investments, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). It is particularly popular for long-term investing in the stock market.

What are the benefits of dollar cost averaging?

One of the main benefits of dollar cost averaging is that it helps to reduce the impact of market volatility on investment returns. It also makes investing more convenient as investors can set up automatic contributions and eliminate the need for constant monitoring and decision-making.

Does dollar cost averaging guarantee profit?

No, dollar cost averaging does not guarantee profit. It is an investment strategy that aims to reduce the overall risk of investing by spreading purchases over time. The returns will still depend on the performance of the underlying investment.

Are there any drawbacks to dollar cost averaging?

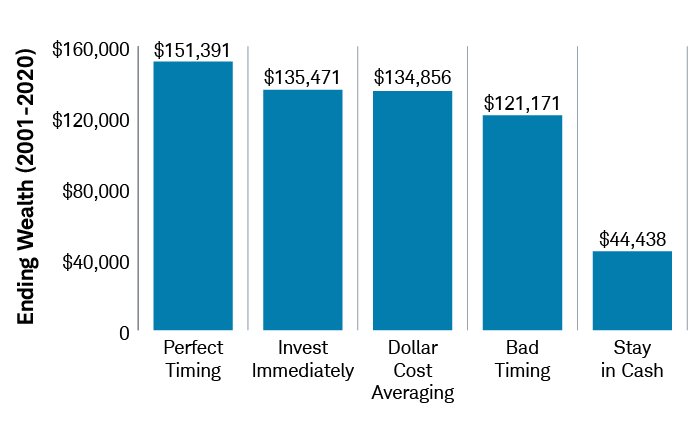

One potential drawback of dollar cost averaging is that it may result in missed opportunities for investors who are able to accurately time the market. Additionally, if the underlying investment consistently performs poorly, dollar cost averaging can lead to lower overall returns compared to a lump-sum investment.

Who should consider using dollar cost averaging?

Dollar cost averaging is a suitable strategy for investors who want to minimize their exposure to market volatility and prefer a disciplined approach to investing. It can be particularly beneficial for long-term investors who are focused on accumulating wealth over time.

Can dollar cost averaging be adjusted based on market conditions?

Yes, dollar cost averaging can be adjusted based on an investor’s assessment of market conditions. For example, during periods of market downturns, an investor may choose to increase their investment amount to take advantage of potentially lower prices. Conversely, during periods of market upswings, an investor may choose to decrease their investment amount.

Remember, dollar cost averaging is a long-term strategy, and any adjustments should be made based on careful analysis and consideration of individual investment goals.

Final Thoughts

Dollar cost averaging in investing is a strategy that involves regularly investing a fixed amount of money at regular intervals, regardless of the market conditions. This approach allows investors to take advantage of market fluctuations by buying more shares when prices are low and fewer shares when prices are high. By consistently investing over time, dollar cost averaging helps to mitigate the impact of short-term market volatility and allows investors to potentially benefit from long-term market growth. It is a prudent and straightforward investment strategy that can help individuals build wealth over time. So, what is dollar cost averaging in investing? It is a disciplined approach that can provide investors with a way to navigate the ups and downs of the market while working towards their financial goals.