In uncertain times like a recession, managing your finances becomes crucial. You might be wondering, “How can I effectively manage my finances during a recession?” The answer lies in developing smart strategies and making informed decisions. By taking control of your financial situation, you can navigate through these challenging times with confidence. In this article, we will explore practical tips and actionable advice on how to manage your finances during a recession. Let’s dive in and empower ourselves to secure a stable financial future.

How to Manage Your Finances During a Recession

Introduction

The global economic landscape is constantly evolving, and recessions are an unfortunate reality that many individuals and families have to face. During these challenging times, managing your finances becomes even more critical. Taking proactive steps to navigate the financial uncertainty can help you weather the storm and come out stronger on the other side. In this article, we will explore various strategies and tips on how to manage your finances during a recession.

Create a Budget and Stick to It

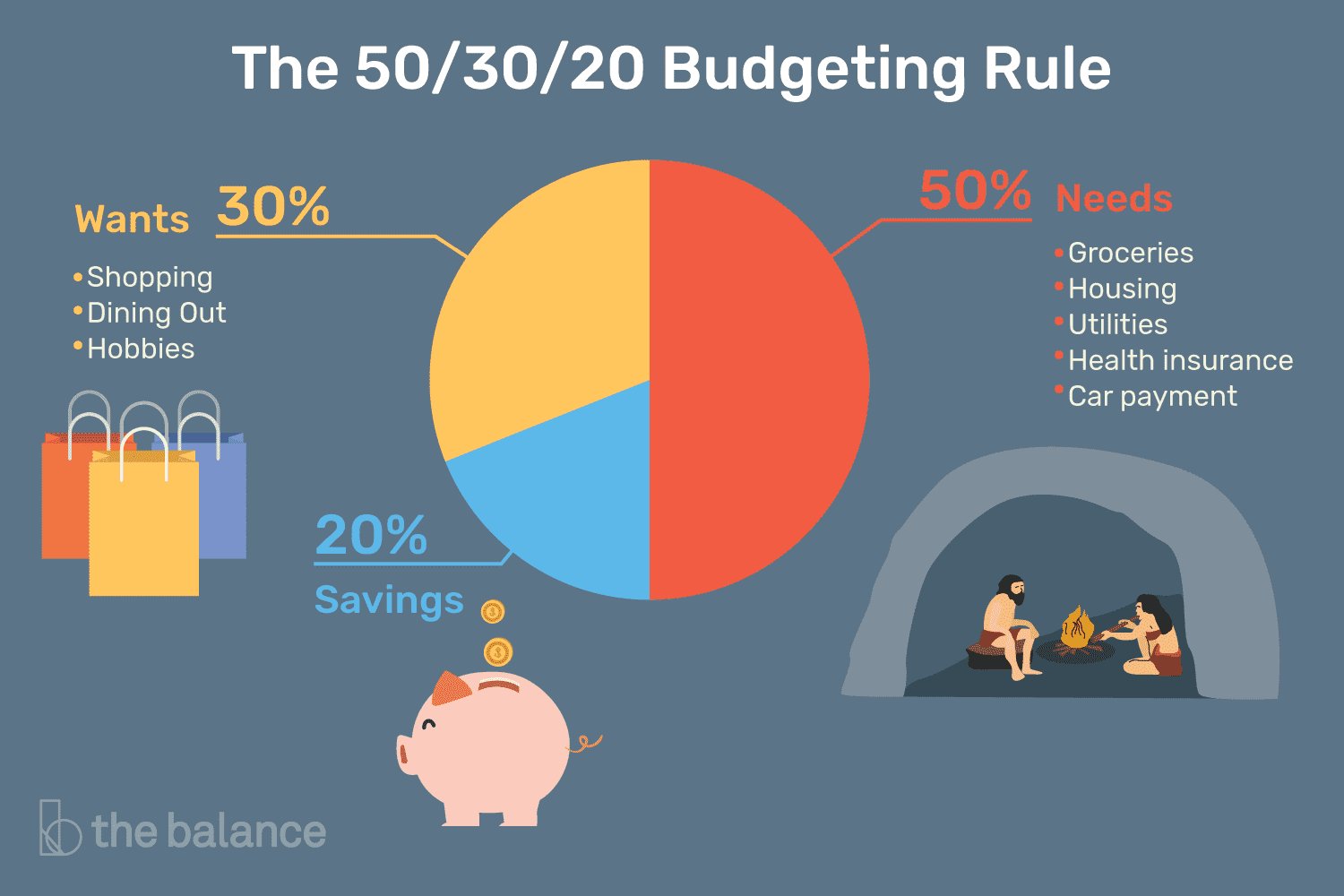

One of the first steps towards managing your finances effectively is to create a budget. A budget helps you gain a clear understanding of your income, expenses, and financial obligations. Here are some key points to consider when creating and sticking to your budget:

1. Evaluate your income: Begin by assessing your total monthly income from all sources. This includes your salary, freelance work, investment income, and any other sources of revenue.

2. Track your expenses: Keep a record of all your expenses for at least one month. Categorize them into essential (e.g., rent, utilities, groceries) and non-essential (e.g., dining out, entertainment). This exercise will help you identify areas where you can cut back.

3. Set financial goals: Determine your short-term and long-term financial goals. Whether it’s building an emergency fund, paying off debt, or saving for retirement, having clear goals will keep you motivated and focused.

4. Prioritize essential expenses: During a recession, it’s essential to prioritize your essential expenses. Ensure that your budget covers necessities such as housing, utilities, groceries, and healthcare costs.

5. Reduce discretionary spending: Look for ways to reduce non-essential spending. This might mean eating out less frequently, canceling subscriptions or memberships you no longer use, and finding more affordable entertainment options.

6. Consider renegotiating bills: Contact your service providers and negotiate lower rates or ask for discounts. Many companies are willing to work with customers during challenging times.

Build an Emergency Fund

Having an emergency fund is crucial, especially during a recession. An emergency fund acts as a financial safety net and provides a buffer in case of unexpected expenses or a loss of income. Here are some tips for building and maintaining an emergency fund:

1. Set a savings goal: Aim to save at least three to six months’ worth of living expenses. This amount will vary depending on your circumstances and the stability of your income.

2. Automate your savings: Set up automatic transfers from your checking account to a separate savings account designated for emergencies. This will make saving easier and ensure consistency.

3. Reduce unnecessary expenses: Review your budget again and identify areas where you can cut back further. Redirect the money saved towards your emergency fund.

4. Increase your income: Look for opportunities to increase your income. You could take on a part-time job, start a side business, or freelance in your area of expertise. Channel the extra income towards your emergency fund.

5. Resist the temptation to dip into your emergency fund for non-emergencies. Use it only for genuine emergencies, such as unexpected medical expenses or major home repairs.

Manage Debt Wisely

Debt can become a burden during tough economic times. It’s essential to manage your debt wisely to stay financially stable. Consider the following strategies:

1. Prioritize debt payments: Focus on paying off high-interest debts first. This might include credit card debt or payday loans. Make minimum payments on other debts while directing additional funds towards the highest interest debt.

2. Explore refinancing options: If you have a mortgage or other long-term loans, consider refinancing to take advantage of lower interest rates. This could potentially lower your monthly payments and save you money in the long run.

3. Communicate with lenders: If you’re struggling to make debt payments, reach out to your lenders and explain your situation. They may be willing to offer leniency, such as reduced interest rates or a temporary payment plan.

4. Consolidate debt: If you have multiple debts with varying interest rates, consolidating them into a single loan can simplify your payments and potentially lower your overall interest rate.

5. Avoid taking on new debt: During a recession, it’s wise to avoid accumulating new debt unless absolutely necessary. Focus on paying off existing debts instead.

Protect Your Investments

During a recession, financial markets can be volatile, impacting the value of your investments. To protect your investments and secure your financial future, consider these strategies:

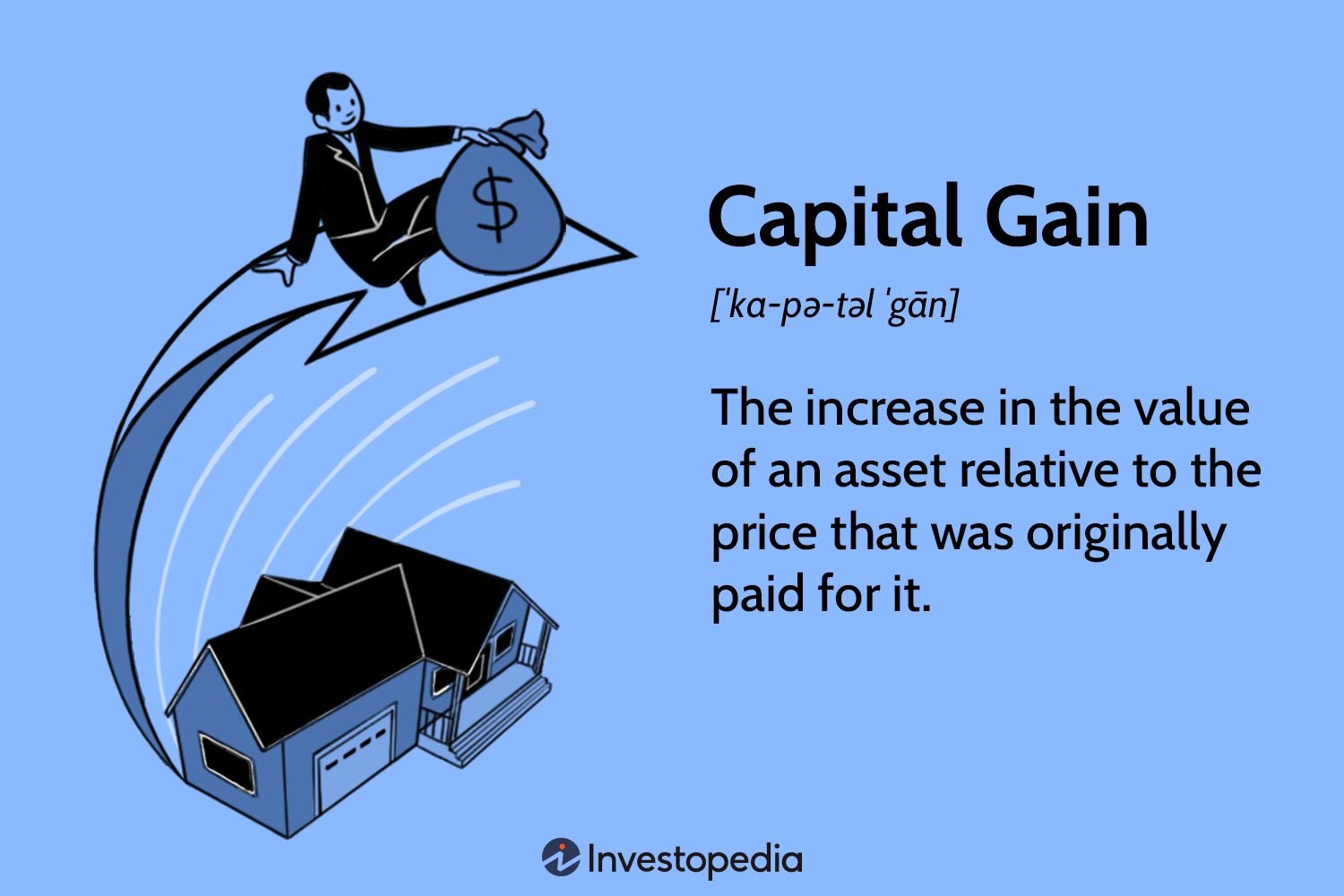

1. Diversify your portfolio: Spread your investments across various asset classes, such as stocks, bonds, and real estate. Diversification can help mitigate risk and reduce the impact of market fluctuations.

2. Review and adjust your investment strategy: Regularly review your investment portfolio and make adjustments based on your risk tolerance and financial goals. Consult with a financial advisor if needed.

3. Avoid making impulsive investment decisions: During times of market volatility, it’s crucial to avoid making impulsive decisions based on short-term fluctuations. Stick to your long-term investment plan and avoid panic selling.

4. Take advantage of market opportunities: Recessions can present buying opportunities for long-term investors. If you have the financial means, consider investing in undervalued assets or stocks.

5. Stay informed and educate yourself: Stay updated on financial news and market trends. Educate yourself about investment strategies and seek professional advice if necessary.

Seek Additional Sources of Income

During a recession, finding additional sources of income can provide much-needed financial stability. Consider the following options:

1. Freelancing or consulting: Leverage your skills and expertise by offering freelance services or consulting in your field. Websites such as Upwork and Freelancer can connect you with potential clients.

2. Rent out unused space: If you have spare rooms or property, consider renting them out for extra income. Platforms like Airbnb make it easy to find short-term renters.

3. Start a side business: Turn your hobbies or passions into a source of income by starting a small business. It could be selling handmade crafts, baking, or offering tutoring services.

4. Monetize your talents: If you have a talent or skill, such as writing, designing, or photography, explore ways to monetize it. Sell your work online or offer your services to clients.

5. Explore gig economy opportunities: Companies like Uber, Lyft, and TaskRabbit offer flexible earning opportunities. You can work on your terms and earn extra income.

Conclusion

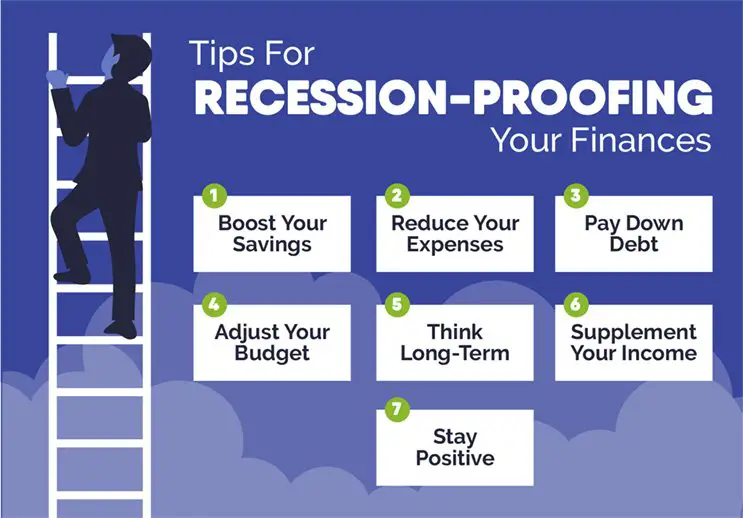

Managing your finances during a recession requires careful planning, discipline, and adaptability. By creating a budget, building an emergency fund, managing debt, protecting your investments, and seeking additional sources of income, you can navigate through financial uncertainties with greater confidence. Remember, a recession is temporary, and with the right strategies in place, you can safeguard your financial well-being and come out stronger on the other side.

How To Manage Your Finances During A Recession + Tips If You Are Unemployed | Clever Girl Finance

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I manage my finances during a recession?

During a recession, it becomes crucial to be proactive and make smart financial decisions. Here are some strategies to manage your finances:

What are some ways to reduce expenses during a recession?

To reduce expenses during a recession, consider these steps:

How can I prioritize my spending during a recession?

Prioritizing your spending during a recession is essential in order to manage your finances effectively. Here’s how:

What should I do if I lose my job during a recession?

If you lose your job during a recession, it’s important to take these actions:

What are some ways to increase income during a recession?

Increasing your income during a recession can provide some relief to your financial situation. Here are a few strategies:

Should I continue investing during a recession?

Investing during a recession requires careful consideration. Here’s what you should keep in mind:

How can I build an emergency fund during a recession?

Building an emergency fund during a recession is essential for your financial stability. Here’s how you can do it:

What steps should I take to manage my debt during a recession?

Managing debt during a recession is crucial to avoid any financial setbacks. Consider these steps:

Final Thoughts

In conclusion, managing your finances during a recession requires careful planning and smart decision-making. Start by creating a budget that prioritizes essential expenses and reduces non-essential ones. Look for ways to cut back on unnecessary spending and find creative ways to save money. Consider diversifying your income sources to protect yourself from any potential job loss. Additionally, explore opportunities to increase your savings and investments. Stay informed about the economic situation and adjust your financial strategies accordingly. By implementing these strategies and staying proactive, you can effectively manage your finances during a recession.