Are you curious about understanding the basics of behavioral finance? Look no further! In this article, we will delve into the fascinating world of how our behaviors and emotions can affect our financial decisions. By gaining insights into the psychological factors that drive our financial choices, we can enhance our understanding of why we make certain investment decisions and learn to make more informed choices. So, let’s delve into the principles of behavioral finance and explore how they shape our financial lives.

Understanding the Basics of Behavioral Finance

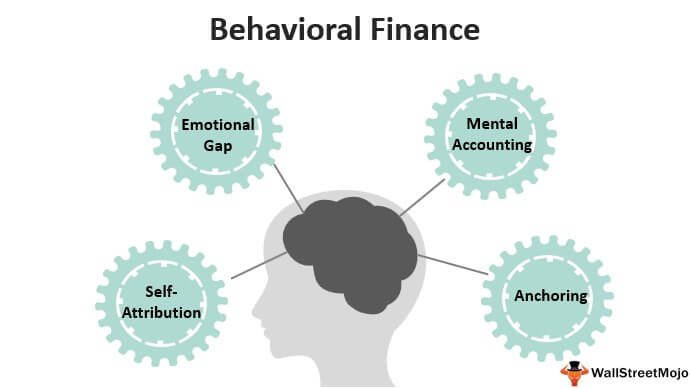

Behavioral finance is a fascinating field that seeks to understand how psychological factors and cognitive biases influence our financial decisions. By recognizing and studying these patterns of behavior, individuals can make better-informed investment choices and navigate the complexities of the financial markets. In this article, we will delve into the basics of behavioral finance, exploring various concepts and providing insights into how they impact our financial decision-making process.

I. What is Behavioral Finance?

Behavioral finance combines insights from psychology and traditional finance to explain why people often make irrational financial decisions. Unlike traditional finance theory, which assumes investors are perfectly rational and always act in their best interest, behavioral finance acknowledges that emotions, cognitive biases, and heuristics play a significant role in decision-making.

II. The Role of Cognitive Biases

Cognitive biases are systematic errors in thinking that lead to deviations from rational decision-making. These biases can impact our financial choices in various ways, including:

A. Loss Aversion Bias

Loss aversion bias refers to the tendency to feel the pain of losses more strongly than the pleasure of gains. This bias often leads individuals to avoid taking risks, even if the potential rewards outweigh the potential losses.

B. Anchoring Bias

Anchoring bias occurs when individuals rely too heavily on the initial piece of information they receive when making a decision. This bias can lead to inaccurate assessments of value or potential outcomes.

C. Confirmation Bias

Confirmation bias is the tendency to seek out information that confirms our existing beliefs or preconceptions while ignoring or downplaying conflicting evidence. This bias can prevent individuals from considering alternative viewpoints or conducting thorough research.

D. Overconfidence Bias

Overconfidence bias refers to the tendency to overestimate our own abilities and underestimate risks. This bias can lead to excessive risk-taking or suboptimal investment choices.

III. Prospect Theory and the Framing Effect

Prospect theory, developed by psychologists Daniel Kahneman and Amos Tversky, explains how individuals make decisions under uncertainty. The theory suggests that individuals evaluate potential gains and losses relative to a reference point and are more influenced by the potential for losses than gains.

A. Framing Effect

The framing effect occurs when individuals respond differently to the same information depending on how it is presented. For example, presenting an investment opportunity as having a 90% success rate is more appealing than presenting it as having a 10% failure rate, even though the information is essentially the same.

IV. Herd Mentality and Market Bubbles

Herd mentality refers to the tendency of individuals to follow the actions or decisions of a larger group, often without questioning or independently evaluating the information. In the context of financial markets, herd mentality can contribute to market bubbles and speculative manias.

A. Market Bubbles

Market bubbles occur when asset prices become detached from their intrinsic values, driven by irrational exuberance and excessive optimism. The dot-com bubble in the late 1990s and the housing bubble in the mid-2000s are prime examples of market bubbles fueled by herd mentality.

B. Speculative Manias

Speculative manias are periods of intense speculation and irrational behavior in financial markets. These manias often result in unsustainable price increases and eventually lead to market crashes. The South Sea Bubble in the 18th century and the tulip mania in the 17th century are notable historical examples.

V. Behavioral Biases and Investment Strategies

Understanding behavioral biases can help investors adopt strategies to mitigate their impact on decision-making. Here are some popular investment strategies influenced by behavioral finance:

A. Value Investing

Value investing involves identifying undervalued assets and investing in them with the expectation that their prices will eventually reflect their true value. This strategy capitalizes on market inefficiencies caused by cognitive biases like overreaction to negative news or unduly pessimistic sentiment.

B. Contrarian Investing

Contrarian investing involves going against the prevailing market sentiment and buying assets that are out of favor or selling assets that are overhyped. This strategy leverages the concept of herd mentality and aims to benefit from the eventual correction of market mispricing.

C. Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy in which an individual consistently invests a fixed amount of money in a particular asset at regular intervals, regardless of market conditions. This strategy helps mitigate the impact of emotional decision-making caused by short-term market fluctuations.

VI. Overcoming Behavioral Biases

While it’s impossible to completely eliminate behavioral biases, individuals can take steps to minimize their impact on financial decision-making:

A. Education and Awareness

Educating oneself about common cognitive biases and their impact on decision-making is the first step towards overcoming them. Being aware of our own biases allows us to pause, reflect, and make more rational decisions.

B. Establishing Investment Rules

Creating a set of predefined investment rules can help individuals avoid impulsive or emotional decision-making. By following a predetermined strategy, investors can reduce the influence of biases in their investment decisions.

C. Seeking Professional Guidance

Working with a financial advisor or investment professional can provide an objective perspective and help override cognitive biases. Advisors can offer guidance based on sound financial principles, ensuring investment decisions are well-informed and align with long-term goals.

In conclusion, understanding behavioral finance provides valuable insights into our financial decision-making process. By recognizing and mitigating cognitive biases, investors can make more rational choices, avoid costly mistakes, and achieve better long-term financial outcomes. Incorporating behavioral finance principles into investment strategies can ultimately lead to improved financial well-being and a more secure future.

What is Behavioral Finance?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is behavioral finance?

Behavioral finance is a field of study that analyzes how psychological factors and emotional biases influence individuals’ financial decisions and market outcomes.

How does behavioral finance differ from traditional finance?

Behavioral finance takes into account the impact of human behavior and psychology on financial decision-making, while traditional finance assumes rational behavior and efficient markets.

What are some common biases in behavioral finance?

There are several common biases in behavioral finance, including anchoring bias, confirmation bias, loss aversion, overconfidence bias, and herd mentality.

How does anchoring bias affect investment decisions?

Anchoring bias occurs when individuals rely heavily on one piece of information or an initial reference point when making investment decisions, often leading to irrational judgments and limited adjustments to new information.

What is loss aversion bias and how does it impact investors?

Loss aversion bias refers to the tendency of individuals to strongly prefer avoiding losses over acquiring gains. It leads investors to take unnecessary risks or hold onto losing investments for longer periods in order to avoid recognizing a loss.

Can behavioral finance help explain market bubbles and crashes?

Yes, behavioral finance provides insights into the formation and bursting of market bubbles, as well as the occurrence of market crashes. It highlights the role of investor sentiment, irrational exuberance, and herd behavior in these phenomena.

How can understanding behavioral finance benefit individual investors?

Understanding behavioral finance can help individual investors recognize and overcome their own biases, make more rational investment decisions, and avoid common pitfalls. It also provides insights into market trends and dynamics.

Are there any strategies to mitigate the impact of behavioral biases?

Yes, there are strategies to mitigate the impact of behavioral biases. These include diversification, setting clear investment goals, conducting thorough research, seeking feedback from trusted advisors, and maintaining discipline in sticking to a long-term investment plan.

Is it possible to entirely eliminate behavioral biases in financial decision-making?

While it is challenging to completely eliminate behavioral biases, awareness and understanding of these biases can help individuals minimize their impact. By practicing self-reflection, seeking diverse perspectives, and continuously learning, investors can make more informed and rational decisions.

Final Thoughts

Understanding the basics of behavioral finance is essential for any investor. By recognizing the impact of psychological biases on financial decision-making, individuals can make more informed choices. Behavioral finance helps explain why people often deviate from rationality and why markets may be subject to irrational behavior. It emphasizes the importance of emotions, cognitive biases, and social influences on financial outcomes. By incorporating these insights into their investment strategies, individuals can better navigate market fluctuations and improve their overall financial well-being. So, understanding the basics of behavioral finance is crucial for anyone looking to make informed investment decisions.