Are you interested in building a sustainable investment portfolio? Look no further! In this blog article, we will provide you with a step-by-step guide on how to build a sustainable investment portfolio that will not only secure your financial future but also contribute to a better world. Whether you’re a seasoned investor or just starting out, this article will equip you with the knowledge and tools necessary to make informed decisions and maximize your returns. So, let’s dive right in and explore the key principles of building a sustainable investment portfolio that aligns with your values and goals.

How to Build a Sustainable Investment Portfolio

Introduction

Investing has always been an essential component of personal finance, providing opportunities for growth, wealth preservation, and financial security. However, as the world becomes more conscious of sustainable practices and the impact of investments on the environment and society, building a sustainable investment portfolio has gained considerable attention. A sustainable investment portfolio not only seeks financial returns but also aligns with the investor’s values and supports positive change. In this comprehensive guide, we will explore the steps to build a sustainable investment portfolio that combines financial goals with a purpose-driven approach.

The Benefits of Sustainable Investing

Before delving into the process, let’s understand why sustainable investing is gaining traction and the benefits it offers. Here are some key advantages of building a sustainable investment portfolio:

1. Positive Impact: Sustainable investing allows individuals to support companies that prioritize environmental sustainability, social responsibility, and good governance. By investing in such companies, you contribute to positive change and make a difference in the world.

2. Risk Mitigation: Companies with sustainable practices tend to be well-managed and better equipped to handle environmental and societal challenges. This resilience can reduce long-term investment risks, creating more stable returns.

3. Long-Term Performance: Numerous studies have shown that sustainable investments can deliver competitive financial returns over the long run. By integrating environmental, social, and governance (ESG) factors into investment decisions, you can tap into growth areas and capitalize on sustainable trends.

4. Alignment with Values: Building a sustainable investment portfolio allows you to invest in line with your personal values and beliefs. You can support causes you care about, such as renewable energy, human rights, or gender equality, while growing your wealth.

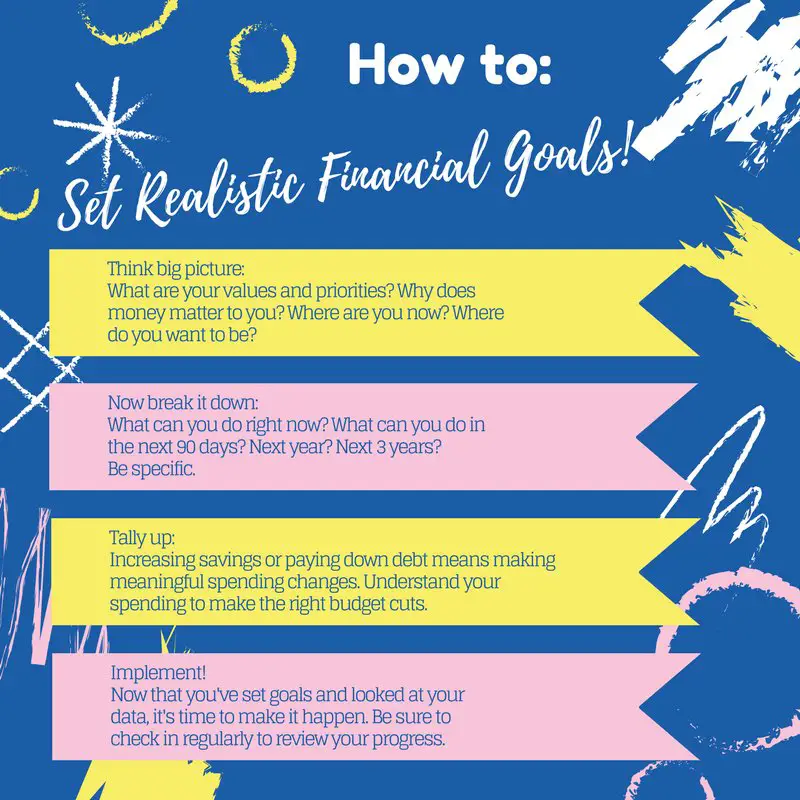

Step 1: Define Your Investment Goals and Values

The first step in building a sustainable investment portfolio is to clarify your investment goals and values. It is crucial to have a clear understanding of what you want to achieve and the causes you want to support. Consider the following questions:

1. Financial Goals: What are your short-term and long-term financial objectives? How much risk are you willing to take? Understanding your financial goals will help determine the asset allocation and investment strategies that align with your needs.

2. Sustainable Values: Which environmental, social, or governance issues are important to you? Do you want to prioritize clean energy, gender diversity, or community development? Identifying your sustainable values will guide your investment decisions.

3. Time Horizon: How long do you plan to invest? Sustainable investing can be focused on both short-term and long-term goals. Your time horizon may influence the choice of investments and strategies.

Step 2: Educate Yourself on Sustainable Investing

To build a sustainable investment portfolio effectively, it is essential to understand the landscape of sustainable investing. Educate yourself on various sustainable investment strategies, financial products, and industry trends. Consider the following resources for self-education:

1. Sustainable Investing Books: Explore books that delve into the concepts and strategies of sustainable investing. Some recommended titles include “The Sustainable Investing Guide” by Stephanie T. Yonker and “The Green Investing Handbook” by Nick Silver.

2. Online Courses and Webinars: Take advantage of online courses and webinars offered by reputable organizations in the sustainable investing field. These educational platforms can provide in-depth knowledge and insights.

3. Industry Reports and Publications: Stay up-to-date with industry reports, publications, and white papers on sustainable investing. These resources offer valuable information on current trends, market performance, and emerging opportunities.

Step 3: Assess Your Risk Tolerance

Understanding your risk tolerance is a crucial factor in building an investment portfolio that aligns with your financial goals and sustainable values. Risk tolerance refers to your ability to endure fluctuations in investment returns without panicking or making hasty decisions. Consider the following factors:

1. Time Horizon: Investors with longer time horizons can typically afford to take on more risk, as they have a greater opportunity to recover from short-term market downturns.

2. Financial Stability: Evaluate your financial situation, including income, savings, and debts. A stable financial foundation may provide greater risk tolerance compared to a more precarious situation.

3. Emotional Response: Reflect on your emotional response to investment fluctuations. If market volatility significantly affects your well-being, you may have a lower risk tolerance.

4. Investment Knowledge: Consider your level of investment knowledge and experience. Investors with a solid understanding of market dynamics may have a higher risk tolerance.

Step 4: Asset Allocation for Sustainable Investing

Asset allocation is a critical aspect of building an investment portfolio. It involves dividing your investments across different asset classes, such as stocks, bonds, and alternative investments. When it comes to sustainable investing, asset allocation takes into account both financial goals and sustainable values. Here are some considerations:

1. Sustainable Equity Investments: Allocate a portion of your portfolio to sustainable companies or funds that prioritize ESG factors. These investments can provide exposure to companies working towards positive change.

2. Fixed-Income Investments: Consider investing in green bonds or social impact bonds. These bonds fund projects with environmental or social benefits and can add stability to your portfolio.

3. Alternative Investments: Explore alternative investment options like renewable energy projects, sustainable infrastructure funds, or impact investing funds. These investments offer diversification and the potential for high returns.

4. Diversification: Ensure your portfolio is well-diversified across different asset classes, geographies, and industries. Diversification helps manage risk and increases the potential for consistent returns.

Step 5: Selecting Sustainable Investments

With your asset allocation strategy in place, it’s time to select specific sustainable investments that align with your goals and values. Consider the following factors:

1. ESG Integration: Look for companies or funds that consider ESG factors in their investment decision-making processes. These investments prioritize sustainable practices and demonstrate a commitment to positive change.

2. Performance Track Record: Assess the historical performance of potential investments. Look for investments that have delivered competitive returns compared to their peers or benchmarks.

3. Transparency and Reporting: Research the transparency and reporting practices of companies or funds. Transparent reporting on ESG practices and outcomes demonstrates a commitment to accountability.

4. Engagement and Advocacy: Consider investments that actively engage with companies to promote positive change. Some funds take an active role in shareholder advocacy, influencing companies to improve their ESG practices.

Step 6: Monitor and Rebalance Your Portfolio

Building a sustainable investment portfolio is an ongoing process that requires regular monitoring and rebalancing. As market conditions and investment performance change, it is crucial to review and adjust your portfolio. Consider the following actions:

1. Monitor Performance: Regularly review the performance of your investments and compare them against your financial goals. This assessment will help you identify underperforming investments or areas that require adjustment.

2. Rebalance: As asset values change, your portfolio’s asset allocation may deviate from your target allocation. Rebalancing involves selling or buying assets to bring your portfolio back in line with your desired asset allocation.

3. Stay Informed: Stay updated on sustainable investing trends, industry developments, and emerging opportunities. The sustainable investing landscape continues to evolve, and being well-informed will help you make strategic investment decisions.

Building a sustainable investment portfolio requires careful consideration of your financial goals, sustainable values, risk tolerance, and investment choices. By aligning your investments with your values, you can make a positive impact while pursuing financial growth. Remember, sustainable investing is a long-term endeavor that requires ongoing monitoring and adjustment. With the right knowledge, patience, and commitment, you can build a sustainable investment portfolio that aligns with your values and helps create a more sustainable future.

4 Steps to Building a Sustainable Portfolio

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a sustainable investment portfolio?

A sustainable investment portfolio consists of investments that consider environmental, social, and governance (ESG) factors. It aims to generate positive financial returns while promoting sustainability and responsible business practices.

Why is building a sustainable investment portfolio important?

Building a sustainable investment portfolio is important because it allows investors to align their financial goals with their values. It promotes long-term sustainability and contributes to a more environmentally and socially conscious investment landscape.

How can I identify sustainable investment opportunities?

To identify sustainable investment opportunities, you can research companies that prioritize ESG factors. Look for companies with strong environmental initiatives, social responsibility programs, and transparent governance practices. ESG ratings and sustainability indexes can also help identify sustainable investment options.

What are some key considerations when building a sustainable investment portfolio?

Some key considerations when building a sustainable investment portfolio include defining your investment goals, diversifying your investments, analyzing ESG data, evaluating risk and return trade-offs, and staying informed about sustainability trends and regulations.

Can sustainable investing yield competitive financial returns?

Yes, sustainable investing can yield competitive financial returns. Studies have shown that companies that integrate ESG factors into their business practices can outperform their non-sustainable counterparts. By investing in sustainable companies, you can potentially achieve both financial and social returns.

Are there any risks associated with sustainable investing?

Like any investment strategy, sustainable investing also carries certain risks. These risks can include factors such as regulatory changes, market volatility, and potential greenwashing. However, by conducting thorough research and diversifying your investments, you can mitigate these risks.

How can I measure the impact of my sustainable investment portfolio?

Measuring the impact of a sustainable investment portfolio can be challenging, but there are tools and metrics available to help. Some common impact measurement tools include carbon footprint analysis, social impact assessments, and ESG ratings. These tools provide insights into the environmental and social impacts of your investments.

Can I customize my sustainable investment portfolio based on my values?

Yes, you can customize your sustainable investment portfolio based on your values. By considering specific sustainability themes or issues that align with your values, you can select investments that have a positive impact in those areas. Working with a financial advisor who specializes in sustainable investing can also help tailor your portfolio to your values.

Final Thoughts

Building a sustainable investment portfolio requires careful consideration and strategic planning. By diversifying your investments across different asset classes and industries, you can mitigate risks and enhance potential returns. It is important to conduct thorough research, analyze financial data, and stay updated with market trends. Furthermore, incorporating ESG (environmental, social, and governance) factors into your investment decisions can promote long-term sustainable growth. Keep an eye on the performance of your investments and regularly adjust your portfolio to align with your financial goals. With these steps, you can create a sustainable investment portfolio that balances financial returns with responsible investing.