Are you wondering what a SEP IRA is and how it can benefit you? Look no further! In this article, we will explore the ins and outs of SEP IRAs and uncover the perks they bring to the table. Have you been searching for a retirement savings plan that offers flexibility and significant tax advantages? Well, you’ve come to the right place. A SEP IRA might just be the solution you’ve been seeking. Join us as we delve into what a SEP IRA entails and discover the benefits it can bring to your financial future. So, let’s dive right in!

What is a SEP IRA and Its Benefits

A SEP IRA, or Simplified Employee Pension Individual Retirement Account, is a retirement savings plan designed for self-employed individuals and small business owners. It allows employers to make tax-deductible contributions to individual retirement accounts (IRAs) on behalf of their employees, including themselves. SEP IRAs provide significant benefits and flexibility, making them a popular choice among businesses and individuals looking to save for retirement.

The Basics of a SEP IRA

To fully understand the benefits of a SEP IRA, let’s start by looking at how it works and who is eligible to establish one.

Who Can Establish a SEP IRA?

A SEP IRA is available to any self-employed individual or small business owner, regardless of the business’s legal structure. This includes sole proprietors, partnerships, limited liability companies (LLCs), and corporations. Even if you have no employees, you can still set up and contribute to a SEP IRA.

However, if you have employees, you must make contributions to their accounts proportional to their compensation. The requirements for eligible employees are:

- They are at least 21 years old

- They have worked for the business in at least three of the past five years

- They have earned at least $600 in the current year

How Does a SEP IRA Work?

Contributions to a SEP IRA are made solely by the employer and are tax-deductible. The employer determines the contribution amount each year, within certain limits. Contributions are not required every year, providing flexibility for businesses with fluctuating income.

Employees do not make contributions to their SEP IRAs; instead, they receive contributions from their employer. These contributions are considered part of the employee’s compensation and are subject to federal income tax withholding. However, SEP IRA contributions are exempt from Social Security and Medicare taxes.

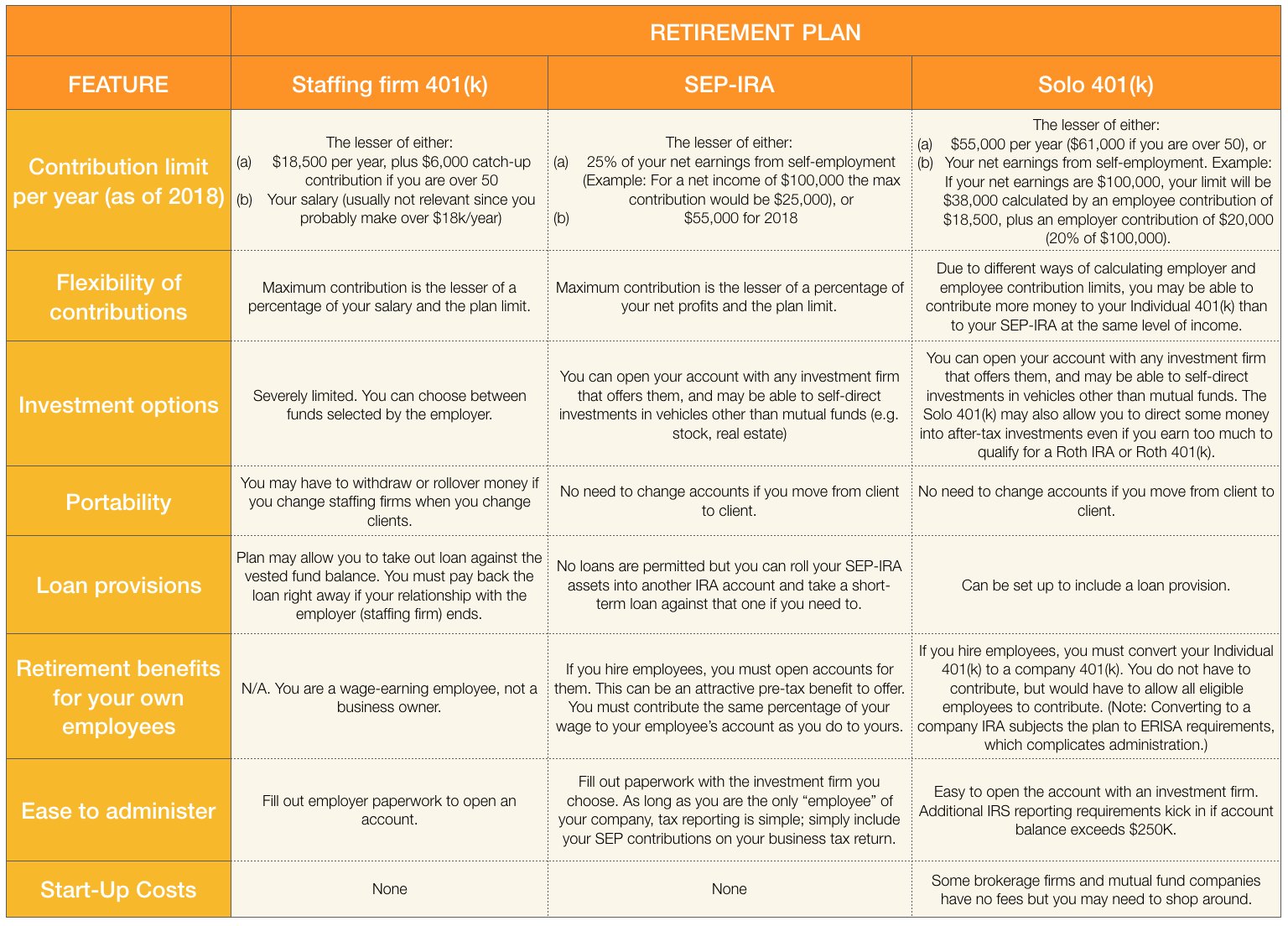

The maximum contribution limit for a SEP IRA is the lesser of 25% of compensation or $58,000 in 2021. This limit applies to both the employer’s contributions for employees and their own contributions if they are self-employed.

The Benefits of a SEP IRA

SEP IRAs offer several advantages that make them an attractive retirement savings option. Let’s explore some of the key benefits:

1. Simplified Administration

One of the primary advantages of a SEP IRA is its simplicity of administration. Unlike other retirement plans, such as 401(k)s or traditional pension plans, SEP IRAs have minimal reporting and administrative requirements. This makes them an excellent choice for small business owners who may not have dedicated HR or accounting departments.

With a SEP IRA, employers are not required to file annual reports with the IRS or submit complex plan documents. The simplicity of a SEP IRA allows business owners to focus on their core operations without spending excessive time on retirement plan administration.

2. Tax Advantages

SEP IRAs offer significant tax advantages for both employers and employees. Here’s how:

- Tax-Deductible Contributions: Employers can deduct their contributions to SEP IRAs as a business expense. This reduces their taxable income, resulting in potential tax savings.

- Tax-Deferred Growth: Contributions to SEP IRAs grow tax-deferred until withdrawals are made in retirement. This means the investments within the account can potentially grow faster compared to taxable accounts.

- Flexible Contributions: Employers have the flexibility to contribute different amounts each year, depending on their business’s profitability. If business is slow, they can reduce or skip contributions altogether, helping to lower their tax liability.

- No Taxes on Employer Contributions: Employer contributions to SEP IRAs are not subject to federal income tax or payroll taxes (Social Security and Medicare).

3. High Contribution Limits

SEP IRAs allow for substantial contributions, which can be advantageous for individuals looking to maximize their retirement savings. The maximum annual contribution limit for a SEP IRA is 25% of an employee’s compensation or $58,000, whichever is less, for 2021.

This higher contribution limit compared to traditional IRAs allows individuals to save more for retirement. Higher contribution limits are particularly beneficial for high-income earners who want to accelerate their retirement savings.

4. Flexibility for Self-Employed Individuals

For self-employed individuals, SEP IRAs offer unique advantages:

- Profit-Sharing: As a self-employed individual, you can contribute up to 25% of your net self-employment income into your SEP IRA. This flexibility allows you to save more when your business generates higher profits.

- Additional Benefits: If you have both self-employment income and a day job as an employee, you can still contribute to a SEP IRA for your self-employment income in addition to contributing to your employer-sponsored retirement plan. This enables you to save more for retirement using different retirement accounts.

5. Savings for Employees

Aside from the benefits for employers, SEP IRAs provide valuable retirement savings opportunities for employees. Here’s what employees can gain:

- Employer Contributions: Employees receive contributions from their employer, allowing them to build retirement savings without making their own contributions.

- Tax-Deferred Growth: Similar to employers, employees enjoy the tax-deferred growth of their SEP IRA investments until they start making withdrawals in retirement.

- Portability: If an employee leaves the company, they can take their SEP IRA with them. They have the option to roll it over to another retirement account without incurring taxes or penalties.

Considerations for SEP IRAs

While SEP IRAs offer numerous benefits, it is important to consider some key factors:

1. Limited Employee Eligibility

SEP IRAs have certain eligibility requirements for employees. As an employer, you must contribute to the SEP IRAs of all eligible employees. This includes part-time employees who meet the eligibility criteria. Therefore, if you have many employees who meet the eligibility requirements, the cost of contributions can add up.

2. No Roth Option

Unlike some other retirement plans, such as a Roth IRA or Roth 401(k), contributions to a SEP IRA are made on a pre-tax basis. This means that contributions and investment earnings are taxed when withdrawn in retirement. If you prefer the tax advantages of a Roth account or want to have a mix of pre-tax and Roth savings, a SEP IRA may not be the best choice.

3. Required Contributions

When an employer establishes a SEP IRA, they are required to contribute to their own account and the accounts of eligible employees. While the flexibility to vary contribution amounts each year is an advantage, it is important to budget for contributions and ensure they align with your business’s financial situation.

4. Other Retirement Plan Options

SEP IRAs may not be the most suitable retirement plan for every business. Depending on factors such as the number of employees, income levels, and desired contribution flexibility, other retirement plan options like a Solo 401(k) or SIMPLE IRA may be more advantageous. It is essential to evaluate different plans and consider guidance from a financial advisor or tax professional before making a decision.

A SEP IRA is a powerful retirement savings tool for self-employed individuals and small business owners. It offers simplicity, tax advantages, high contribution limits, and flexibility. SEP IRAs provide an opportunity to build a substantial retirement nest egg while enjoying tax benefits along the way.

However, it is crucial to consider the specific needs and circumstances of your business before choosing a SEP IRA. Exploring other retirement plan options and seeking professional advice can help you make an informed decision and maximize your retirement savings potential.

SEP IRA Pros and Cons

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a SEP IRA and how does it work?

A SEP IRA, or Simplified Employee Pension Individual Retirement Account, is a retirement plan that allows self-employed individuals and small business owners to make tax-deductible contributions on behalf of themselves and their eligible employees. These contributions are invested in a variety of investment options, such as stocks, bonds, and mutual funds, and grow tax-deferred until retirement.

What are the benefits of a SEP IRA?

1. Simplified Administration: SEP IRAs offer simple and flexible administrative requirements, making them easy to set up and maintain.

2. Higher Contribution Limits: You can contribute more to a SEP IRA compared to traditional IRAs, which allows for greater retirement savings potential.

3. Tax-Deductible Contributions: Contributions made to a SEP IRA are tax-deductible for both the employer and the employee, reducing taxable income.

4. Employer Flexibility: As an employer, you have the flexibility to vary the contribution amounts each year, depending on your business’s performance.

5. Potential Tax-Deferred Growth: The earnings on investments within a SEP IRA grow tax-deferred until withdrawals are made during retirement.

6. Employee Participation: SEP IRAs offer a retirement savings vehicle to employees, helping attract and retain talent in your business.

Who is eligible for a SEP IRA?

Eligibility for a SEP IRA is based on two criteria:

1. The individual must be at least 21 years old.

2. The individual must have worked for the employer in at least three of the past five years and received at least $600 in compensation during the year.

Can I contribute to a SEP IRA if I have no employees or am self-employed?

Yes, SEP IRAs are designed to be used by self-employed individuals, including freelancers and independent contractors, even if they have no employees. Contributions are made by the individual and are based on a percentage of their net self-employment income.

Are SEP IRA contributions tax-deductible?

Yes, contributions made by both the employer and the employee to a SEP IRA are tax-deductible. These contributions help reduce the taxable income during the year they are made.

Is there a maximum limit to SEP IRA contributions?

Yes, there are annual limits to SEP IRA contributions. The maximum contribution limit for 2021 is the lesser of 25% of compensation or $58,000.

Can I combine a SEP IRA with other retirement plans?

Yes, you can have a SEP IRA along with other retirement plans. However, the total contribution limit across all plans should not exceed the annual limits set by the IRS.

When can I withdraw funds from a SEP IRA?

Withdrawals from a SEP IRA can begin penalty-free after reaching the age of 59½. However, distributions are subject to income tax based on your tax bracket at the time of withdrawal. Withdrawals made before the age of 59½ may incur an early withdrawal penalty, unless certain exceptions apply.

Final Thoughts

A SEP IRA, or Simplified Employee Pension Individual Retirement Account, is a retirement savings plan for self-employed individuals and small business owners. It offers several benefits, including tax advantages and flexibility. Contributions are tax-deductible and can be made by both the employer and the employee. The funds can be invested to grow over time, and withdrawals can be made after the age of 59 ½ without penalty. SEP IRAs provide a way for individuals to save for retirement while also enjoying potential tax savings and investment growth. Consider a SEP IRA for your retirement planning needs.