As a freelance artist, managing your finances effectively is crucial for achieving long-term success. So, how can you manage your finances as a freelance artist? The answer lies in implementing practical strategies and developing healthy financial habits. In this blog article, we will delve into the world of financial management specifically tailored for freelance artists. From budgeting and tracking expenses to saving for taxes and planning for the future, we’ll explore the essential steps you need to take in order to maintain a stable and prosperous artistic career. So, let’s jump right in and uncover the secrets of how to manage finances as a freelance artist.

How to Manage Finances as a Freelance Artist

Being a freelance artist comes with many unique challenges, and managing finances is certainly one of them. As an artist, you have the freedom to pursue your creative passion, set your own rates, and choose the projects you work on. However, it’s essential to have a solid financial plan in place to ensure your success and stability. In this article, we will explore the various aspects of managing finances as a freelance artist and provide practical tips to help you navigate this journey.

1. Set Clear Financial Goals

Before diving into the nitty-gritty of financial management, it’s crucial to establish clear financial goals. What do you want to achieve with your freelance art career? Do you aim to pay off debts, save for a future project, or achieve a certain income level? By defining your financial goals, you can create a roadmap to guide your decision-making process.

- Identify short-term and long-term financial goals.

- Be specific and realistic about the amount of money you want to earn.

- Consider your current financial situation and how it aligns with your goals.

- Break down your goals into actionable steps.

2. Keep Personal and Business Finances Separate

As a freelance artist, it’s essential to keep your personal and business finances separate. This practice not only helps with organization but also ensures accurate accounting and tax reporting. Here’s what you can do:

- Open a separate bank account for your freelance income and expenses.

- Use accounting software or tools to track your business finances.

- Keep records of all your business-related transactions, including receipts and invoices.

- Consider consulting with a tax professional to ensure compliance with tax regulations.

3. Budgeting and Cash Flow Management

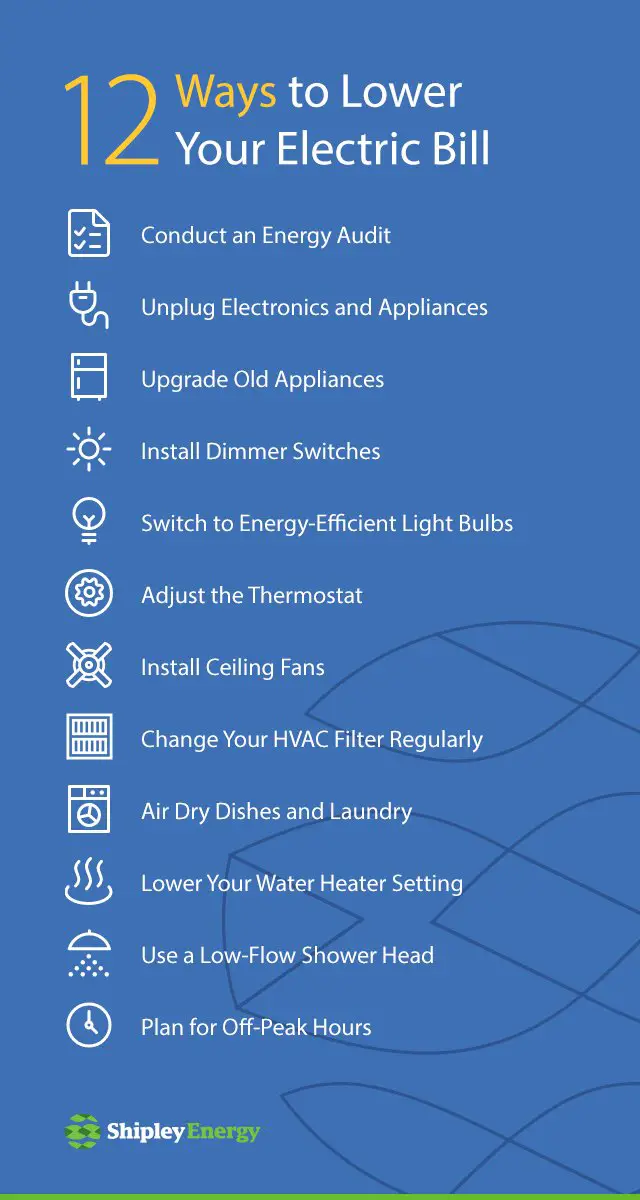

Budgeting is a fundamental aspect of managing finances as a freelance artist. By creating a budget, you can track your income, control expenses, and allocate funds for different purposes. Here are some steps to help you with budgeting:

- Analyze your income and expenses to determine your financial standing.

- Create a monthly budget that includes fixed expenses (rent, utilities) and variable expenses (materials, marketing).

- Set aside a portion of your income for taxes, savings, and emergencies.

- Regularly review and adjust your budget based on your changing financial circumstances.

Cash flow management is another critical aspect of financial management for freelance artists. Irregular income can pose challenges, so it’s crucial to plan and manage your cash flow effectively:

- Save a portion of your income during peak earning periods to cover slower periods.

- Consider setting up an emergency fund to handle unexpected expenses.

- Explore additional income streams or diversify your services to create a more stable cash flow.

- Invoice clients promptly and follow up on outstanding payments.

4. Pricing and Negotiation

Determining your pricing as a freelance artist can be complex. It’s important to strike a balance between charging what you’re worth and remaining competitive in the market. Consider the following tips:

- Research industry standards and market rates for your artistic services.

- Factor in your experience, expertise, and the value you bring to clients.

- Consider the time and effort required for each project when setting your rates.

- Be confident in negotiating with clients to ensure fair compensation.

5. Tax Planning and Financial Liabilities

Tax planning is a crucial part of managing finances as a freelance artist. Understanding your tax obligations and taking proactive steps can help you avoid financial liabilities. Here are some key points to consider:

- Consult with a tax professional to understand tax regulations specific to freelance artists.

- Track your business expenses and keep accurate records for tax deductions.

- Set aside a portion of your income for tax payments.

- Consider forming a legal business entity to optimize your tax situation.

6. Insurance and Protecting Your Finances

While pursuing your freelance art career, it’s essential to protect yourself and your finances from unforeseen circumstances. Consider the following steps to safeguard your financial well-being:

- Explore insurance options such as liability insurance to protect yourself from potential legal claims.

- Consider professional indemnity insurance, which covers you against claims of negligence or mistakes in your work.

- Review your health insurance options to ensure you have adequate coverage.

- Have an emergency fund to handle unexpected expenses and income gaps.

7. Seek Professional Assistance

Managing finances as a freelance artist can be challenging, especially if you’re not familiar with accounting and financial matters. Don’t hesitate to seek professional assistance to ensure you’re on the right track:

- Consult with a financial advisor or accountant who specializes in working with freelancers.

- Consider hiring a bookkeeper or using accounting software to streamline your financial management.

- Stay up to date with financial trends and seek educational resources to enhance your financial literacy.

By implementing these strategies and adopting sound financial practices, you can manage your finances effectively as a freelance artist. Remember, financial stability is crucial for your artistic journey, allowing you to focus on what you love most—creating remarkable art.

How I manage my time with full time job, freelance & side hustles ☕️

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Q: How can I manage my finances effectively as a freelance artist?

A: Managing finances as a freelance artist requires careful planning and organization. Start by creating a budget to track your income and expenses. Consider using accounting software or apps specifically designed for freelancers to simplify the process. Additionally, separate your personal and business finances by opening a dedicated bank account for your freelance income. Regularly review your finances, save for taxes, and set aside emergency funds for unexpected expenses.

Q: Should I set aside money for taxes as a freelance artist?

A: Yes, it is crucial to set aside money for taxes as a freelance artist. Unlike traditional employees, freelancers are responsible for paying their own taxes. Generally, it is recommended to save around 30% of your freelance income for taxes. Consult with a tax professional or use online resources to estimate your tax obligations based on your income and location.

Q: How can I ensure a steady income as a freelance artist?

A: Freelance artists can strive for a steady income by diversifying their client base and establishing long-term relationships with clients. Networking, marketing, and showcasing your work through online platforms and social media can help attract new clients. Additionally, consider offering different services or products related to your artistic skills to reach a wider audience and generate multiple income streams.

Q: How should I handle irregular income as a freelance artist?

A: Dealing with irregular income as a freelance artist requires careful financial planning. Start by creating a budget based on your average monthly income. Set aside a portion of your earnings during high-income months to cover expenses during low-income periods. Building an emergency fund can also provide a buffer during lean times. Consider taking on side gigs or part-time work to supplement your income if needed.

Q: What are some tips for tracking expenses as a freelance artist?

A: Tracking expenses is essential for managing finances as a freelance artist. Keep a record of all business-related expenses, including art supplies, studio rent, website hosting, marketing costs, and professional development expenses. Utilize expense tracking software or apps to streamline the process and categorize expenses. Regularly review your expenditures to identify areas where you can save money or cut unnecessary expenses.

Q: How can I handle invoicing and payment collection as a freelance artist?

A: To handle invoicing and payment collection efficiently, establish a clear invoicing system. Create professional invoices or use online invoicing platforms that allow you to track sent invoices and manage payment reminders. Clearly communicate your payment terms to clients upfront and set expectations regarding payment deadlines. Consider offering multiple payment options, such as bank transfers, PayPal, or credit cards, to accommodate clients’ preferences.

Q: Is it necessary to have a separate bank account for freelance income?

A: Yes, it is highly recommended to have a dedicated bank account for your freelance income. Separating personal and business finances helps with organization, makes tax preparation easier, and allows you to track your freelance earnings and expenses accurately. It also demonstrates professionalism when dealing with clients and can benefit you when applying for business loans or grants.

Q: How can I save for retirement as a freelance artist?

A: Saving for retirement is crucial for freelance artists since they don’t have the luxury of employer-sponsored retirement plans. Consider opening an individual retirement account (IRA) or a self-employed 401(k) plan. Contribute regularly to these accounts, preferably a percentage of your income, to ensure a secure retirement. Consult with a financial advisor to determine the best retirement savings strategy based on your goals and circumstances.

Final Thoughts

Managing finances as a freelance artist requires discipline and organization. Keep track of your income and expenses, creating a comprehensive budget. Set aside a portion of each payment for taxes and emergencies. Diversify your income streams to avoid reliance on a single source. Prioritize saving and investing to build a stable financial future. Stay on top of invoicing and follow up on late payments. Consider seeking professional advice to navigate complex financial matters. By implementing these strategies, freelance artists can effectively manage their finances, ensuring stability and success in their artistic careers.