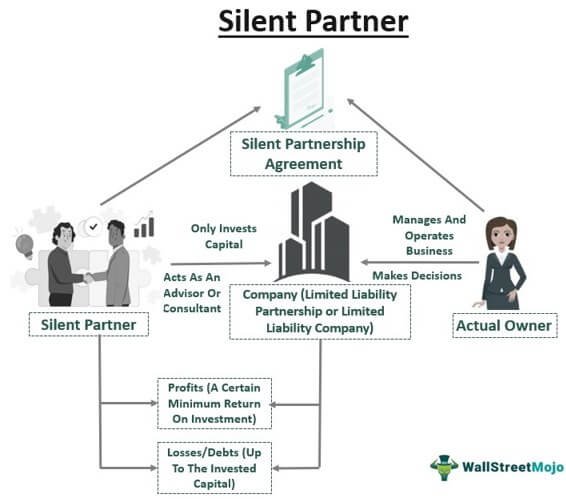

Curious about what a silent partner in business financing is? Well, you’ve come to the right place! In this article, we’ll shed light on the concept of a silent partner and how they play a vital role in funding businesses. So, what exactly is a silent partner in business financing? A silent partner, also known as a sleeping partner, is an individual or entity that invests capital into a business without actively participating in its day-to-day operations. They provide financial support while leaving the management and decision-making to the active partners or entrepreneurs. Let’s delve deeper into this intriguing aspect of business financing.

What is a Silent Partner in Business Financing?

Have you ever heard of a silent partner in business financing? If you’re new to the world of entrepreneurship or seeking funds for your business, understanding the concept of a silent partner can be highly beneficial. In this article, we’ll explore what a silent partner is, how they contribute to business financing, and the advantages and disadvantages of having one. So let’s dive in and learn more!

Understanding the Silent Partner Role

A silent partner, also known as a sleeping partner or an equity investor, is an individual or entity that provides capital to a business without actively participating in its day-to-day operations. Unlike an active partner, a silent partner typically remains in the background, offering financial support and sharing in the profits or losses.

Silent partners often invest in businesses to diversify their investment portfolios or capitalize on the potential growth of a business idea. They may not have the time, expertise, or interest to be actively involved in running a business, making them ideal for those seeking financial backing without additional management responsibilities.

How Does a Silent Partner Contribute to Business Financing?

Silent partners contribute to business financing by investing their capital in a company in exchange for an ownership stake. This capital infusion provides much-needed funds to cover various business expenses such as startup costs, operational expenses, marketing campaigns, or expansion plans.

Typically, silent partners provide funds as either debt or equity investments. In the case of equity financing, they become shareholders in the business and are entitled to a portion of the profits or losses. They may also have a say in major decisions that impact the company’s direction, although their level of involvement varies.

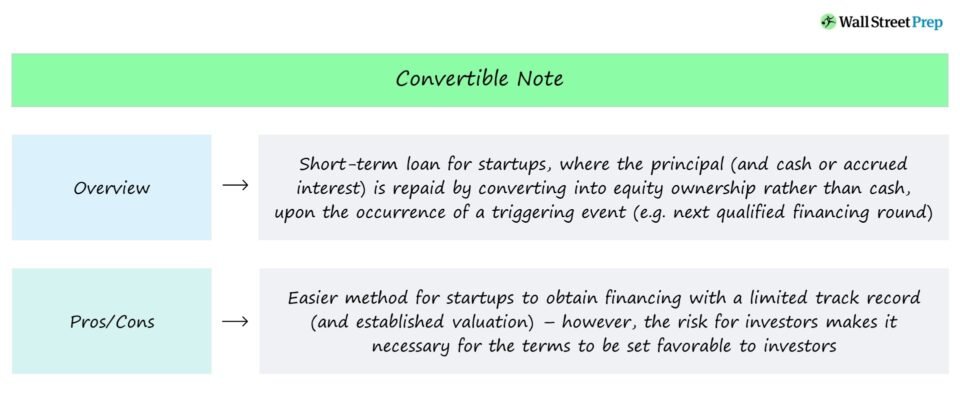

On the other hand, debt financing involves providing a loan to the business that must be repaid over time with interest. In this case, the silent partner acts as a lender, and their involvement is limited to receiving regular interest payments and ensuring the loan is repaid according to the agreed-upon terms.

The Advantages of Having a Silent Partner

Having a silent partner can offer several advantages for entrepreneurs and businesses seeking financing. Here are some key benefits:

1. Financial Support: Silent partners provide access to capital without the need for traditional loans or high-interest rates, allowing businesses to fund their operations and growth plans.

2. Shared Risk: Silent partners share the financial risks of the business. If the venture fails, they are prepared to lose their investment, easing the burden on the entrepreneur.

3. Expertise and Network: In some cases, silent partners may possess valuable industry expertise and a vast network of contacts that can benefit the business. They can offer guidance and connections, opening doors to new opportunities.

4. Less Operational Involvement: Unlike active partners, silent partners do not participate in day-to-day operations, alleviating the burden on the entrepreneur to constantly report or consult on business decisions.

5. Extended Business Lifespan: With the injection of capital from a silent partner, businesses have a higher chance of surviving and thriving in the long run, as they can allocate funds strategically and weather any financial storms.

The Disadvantages of Having a Silent Partner

While there are advantages, it’s important to consider the potential downsides of having a silent partner as well:

1. Loss of Full Control: By bringing in a silent partner, entrepreneurs give up a portion of their ownership and decision-making power. They may need to consult with the partner on major business decisions, potentially leading to disagreements or conflicts.

2. Profit Sharing: Silent partners are entitled to a share of the business’s profits, which means the entrepreneur’s share may be reduced. This can impact the long-term financial benefits and the entrepreneur’s ability to reinvest profits back into the business.

3. Limited Involvement: While some entrepreneurs appreciate the freedom of decision-making, others may miss the expertise and active involvement of partners who can contribute ideas, strategies, and day-to-day support.

4. Lack of Flexibility: Silent partners may have restrictions on their involvement and withdrawal of funds, which can limit the entrepreneur’s ability to make changes or access additional capital when needed.

Choosing the Right Silent Partner

Now that we understand the pros and cons of having a silent partner, it’s crucial to choose the right one for your business. Here are a few key considerations when selecting a silent partner:

1. Shared Vision and Goals: Look for a silent partner who aligns with your business’s vision, values, and long-term goals. Their investment should go beyond just financial support and be driven by a genuine interest in your industry and the success of the venture.

2. Expertise and Connections: Consider the silent partner’s expertise, industry knowledge, and network. Having someone who understands your business and can provide guidance and support can be invaluable.

3. Financial Stability: Evaluate the financial stability and credibility of the potential silent partner. Ensure they have the capacity to invest the desired amount and sustain their commitment over the agreed-upon timeframe.

4. Clear Agreement: Establish a detailed agreement that outlines the expectations, rights, and responsibilities of both parties. Seek legal counsel to ensure all terms are fair, transparent, and protect the interests of everyone involved.

In summary, a silent partner in business financing refers to an individual or entity that invests capital in a business without actively participating in its operations. They can provide much-needed financial support, shared risk, and potential industry expertise. However, it’s essential to carefully consider the advantages and disadvantages of having a silent partner, ensuring their alignment with your business goals and selecting someone who can contribute positively to your venture’s success.

In Finance, what is a Silent Partner

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a silent partner in business financing?

A silent partner in business financing refers to an individual or entity that invests capital into a business but does not take an active role in the day-to-day operations or management of the company. They offer financial support and share in the profits or losses of the business without participating in its decision-making processes.

How does a silent partner differ from other types of business investors?

Unlike other types of investors, such as venture capitalists or angel investors, a silent partner does not have a say in the operations or management of the business. They provide financial resources but do not contribute to the strategic direction or decision-making of the company.

What are the benefits of having a silent partner in business financing?

Having a silent partner can provide several benefits, including access to additional capital without the burden of debt, sharing financial risks and losses, and the ability to tap into the expertise and network of the silent partner. Additionally, silent partners can help businesses maintain control and autonomy over their operations.

How is the role of a silent partner typically structured?

The specific structure of a silent partnership may vary depending on the agreement between the business owner and the silent partner. Typically, the silent partner provides capital in exchange for a share of the profits or losses. They may also participate in periodic financial reviews or receive reports on the performance of the business.

What is the level of involvement of a silent partner in the business?

A silent partner is typically not involved in the day-to-day operations or management of the business. They do not participate in decision-making processes, provide strategic input, or engage in any operational activities. Their involvement is primarily limited to the financial aspects of the partnership.

Are there any risks associated with having a silent partner?

While there are benefits to having a silent partner, there are also potential risks. One risk is the loss of autonomy and control over business decisions. Additionally, if the business does not perform well, the silent partner may share in the losses and could potentially withdraw their financial support.

How can a business owner find a potential silent partner?

Business owners can find potential silent partners through their personal and professional networks, attending networking events or industry conferences, reaching out to angel investor groups or venture capital firms, or utilizing online platforms that connect entrepreneurs with potential investors.

What should a business owner consider before entering into a silent partnership?

Before entering into a silent partnership, a business owner should consider the terms and conditions of the partnership agreement, such as the percentage of profits or losses the silent partner will receive, the duration of the partnership, the level of financial contribution, and any specific rights or obligations of the silent partner. It is also advisable to seek legal and financial advice to ensure a fair and mutually beneficial agreement.

Final Thoughts

A silent partner in business financing refers to an investor who provides capital to a business without actively participating in its daily operations. They contribute funds but do not have a say in decision-making or involvement in management. This type of partnership allows entrepreneurs to access the necessary funds while maintaining control and independence in running the business. Silent partners typically earn a share of the profits in return for their investment. Their role is to provide financial support and share in the success of the venture without actively participating in its day-to-day operations. Overall, a silent partner in business financing is an investor who provides capital without involvement in management.