Are you looking to understand the basics of Roth IRA conversions? Look no further! In this article, we will dive into the world of Roth IRA conversions and shed light on the essential knowledge you need. Converting a traditional IRA into a Roth IRA can have significant benefits, but it’s crucial to understand the process and its implications. So, let’s explore the ins and outs of Roth IRA conversions, demystify any confusion, and help you make informed decisions for your financial future. Let’s get started!

Understanding the Basics of Roth IRA Conversions

Retirement planning is an essential aspect of financial security, and one popular option is a Roth Individual Retirement Account (IRA). A Roth IRA offers numerous advantages, including tax-free growth and tax-free withdrawals during retirement. However, there are instances when individuals may want to consider converting their traditional IRA or employer-sponsored retirement plans to a Roth IRA. This process is known as a Roth IRA conversion.

What is a Roth IRA Conversion?

A Roth IRA conversion involves moving funds from a traditional IRA or a qualified employer-sponsored retirement plan, such as a 401(k), into a Roth IRA. This means that any pre-tax dollars in the traditional account are subject to income tax when converted to a Roth IRA. However, once the funds are in the Roth IRA, they can grow tax-free, and any qualified withdrawals made during retirement are also tax-free.

Why Consider a Roth IRA Conversion?

There are several reasons why individuals may choose to convert their retirement savings to a Roth IRA:

- Tax-Free Growth and Withdrawals: Roth IRAs offer the advantage of tax-free growth and qualified withdrawals during retirement. By converting to a Roth IRA, individuals can potentially benefit from tax-free earnings in the long run.

- Tax Diversification: By having retirement savings in both traditional and Roth accounts, individuals can create tax diversification. This can provide flexibility during retirement, allowing individuals to strategically withdraw funds from different accounts based on their tax situation.

- Reducing Future Tax Liability: Converting to a Roth IRA can be advantageous for individuals who anticipate being in a higher tax bracket during retirement. By paying taxes on the converted amount now, they can potentially reduce their future tax liability when they withdraw the funds tax-free during retirement.

- Eliminating Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have required minimum distributions (RMDs) during the owner’s lifetime. By converting to a Roth IRA, individuals can eliminate future RMDs and have more control over their retirement income.

Understanding the Tax Implications

It’s important to consider the tax implications of a Roth IRA conversion. When converting from a traditional IRA or employer-sponsored retirement plan to a Roth IRA, the amount converted is generally treated as taxable income in the year of the conversion. This means that individuals will owe income tax on the converted amount, which could potentially push them into a higher tax bracket. However, once the funds are in the Roth IRA, they can grow tax-free, and qualified withdrawals are tax-free during retirement.

It’s essential to consult with a financial advisor or tax professional before proceeding with a Roth IRA conversion to fully understand the tax implications based on individual circumstances.

Eligibility for Roth IRA Conversions

Not everyone is eligible to directly contribute to a Roth IRA, but there are no income limits for Roth IRA conversions. This means that individuals at any income level can convert their eligible retirement accounts to a Roth IRA. However, it’s important to note that income limits may still apply for individuals who wish to make future contributions directly to a Roth IRA.

It’s also worth considering the “pro-rata rule” when converting funds from a traditional IRA to a Roth IRA. If an individual has both pre-tax and after-tax money in their traditional IRA, the pro-rata rule applies. This rule calculates the tax liability on the converted amount based on the overall percentage of pre-tax funds in all traditional IRAs. It’s essential to consider this rule when evaluating the tax consequences of a Roth IRA conversion.

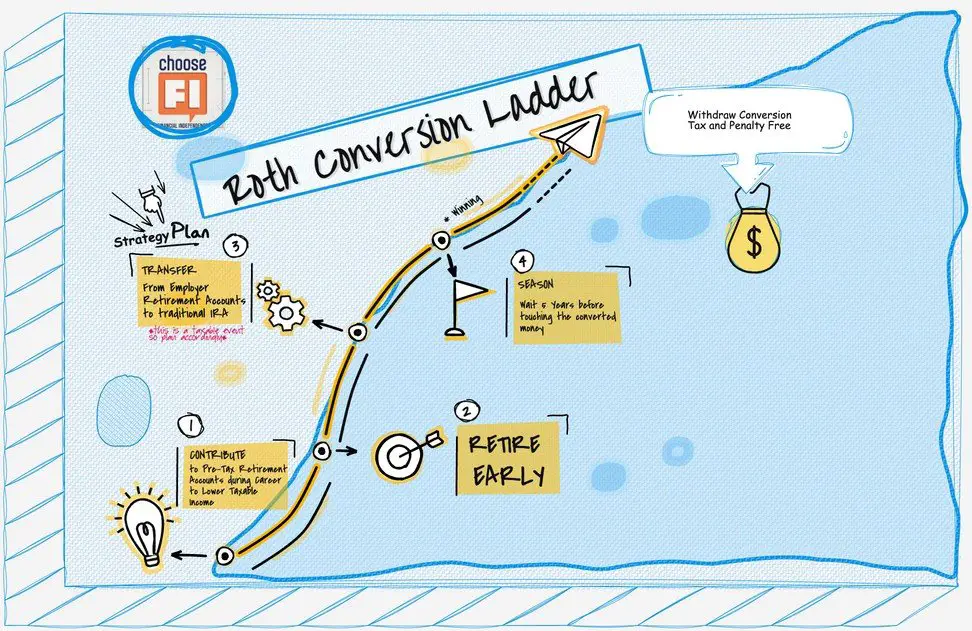

The Roth IRA Conversion Process

Converting to a Roth IRA involves several steps:

- Evaluate Eligibility: Ensure that you are eligible for a Roth IRA conversion and understand the potential tax implications.

- Review Retirement Accounts: Assess your existing retirement accounts, such as traditional IRAs and employer-sponsored plans, to determine which funds you want to convert.

- Calculate the Conversion Amount: Determine the amount you want to convert to a Roth IRA, keeping in mind potential tax consequences.

- Pay Taxes: Prepare to pay income taxes on the converted amount in the year of the conversion.

- Complete the Conversion: Contact your financial institution or retirement plan custodian to initiate the Roth IRA conversion process. They will guide you through the necessary paperwork and processes.

- Consider Timing: Evaluate the timing of your conversion carefully, taking into account your current and anticipated future tax bracket.

Factors to Consider Before Converting

Before proceeding with a Roth IRA conversion, it’s essential to consider the following factors:

- Current and Future Tax Situation: Assess your current tax bracket and evaluate whether converting to a Roth IRA would be beneficial based on potential future tax liability.

- Source of Funds to Pay Taxes: Determine how you will pay the income taxes on the converted amount. It’s generally recommended to use funds outside the retirement account to cover the tax liability to maximize tax-free growth within the Roth IRA.

- Retirement Timeline: Consider your retirement timeline and whether the tax advantages of a Roth IRA outweigh the potential short-term tax consequences of the conversion.

- Investment Strategy: Evaluate your investment strategy and the potential investment options available within a Roth IRA. Ensure that the investment choices align with your long-term financial goals.

- Estate Planning: Roth IRAs offer potential estate planning benefits, such as tax-free transfers to beneficiaries. Consider how a Roth IRA conversion aligns with your estate planning objectives.

Maximizing the Benefits of a Roth IRA Conversion

To maximize the benefits of a Roth IRA conversion, consider the following strategies:

- Partial Conversions: Instead of converting all funds at once, consider spreading the conversions over several years to manage the tax impact.

- Tax Planning: Consult with a tax professional to develop a strategic plan for the conversion based on your individual circumstances and long-term financial goals.

- Utilize Non-Deductible Contributions: If you have made non-deductible contributions to a traditional IRA, consider converting those contributions to a Roth IRA tax-free, as they have already been taxed.

- Consider Recharacterization: If your converted Roth IRA value decreases significantly after the conversion, you have the option to undo the conversion through a process called recharacterization. This can help you avoid unnecessary tax liability.

Monitoring and Adjusting Your Strategy

Once you have completed a Roth IRA conversion, it’s important to monitor your strategy and make adjustments as needed. Factors such as changes in income, tax laws, and personal circumstances may warrant a review of your retirement savings plan. Regularly reassess your financial goals and consult with a financial advisor to ensure your strategy aligns with your evolving needs.

A Roth IRA conversion can be a valuable financial strategy for individuals looking to maximize their retirement savings and potentially reduce future tax liability. By understanding the basics of Roth IRA conversions, including eligibility, tax implications, and factors to consider, individuals can make informed decisions to enhance their long-term financial security. It is important to consult with a qualified financial advisor or tax professional to evaluate the suitability of a Roth IRA conversion based on individual circumstances.

Roth IRA Conversion EXPLAINED (Roth Conversion Strategies for tax free growth)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a Roth IRA conversion?

A Roth IRA conversion is the process of transferring funds from a traditional IRA or employer-sponsored retirement plan into a Roth IRA. This conversion allows you to pay taxes on the converted amount upfront and enjoy tax-free growth and qualified withdrawals in the future.

Who is eligible for a Roth IRA conversion?

Anyone can convert a traditional IRA or eligible retirement plan to a Roth IRA, regardless of income level or age. However, keep in mind that there are income limits for making direct contributions to a Roth IRA, but those limits do not apply to conversions.

What are the benefits of a Roth IRA conversion?

Converting to a Roth IRA provides several advantages. Firstly, it allows for tax-free growth and tax-free qualified withdrawals in retirement. Additionally, Roth IRAs are not subject to required minimum distributions (RMDs) during the account owner’s lifetime, providing more flexibility for estate planning purposes.

When is the best time to do a Roth IRA conversion?

The optimal time to convert to a Roth IRA depends on your individual financial situation. It is generally recommended to consider a conversion when you are in a lower tax bracket or have the ability to pay the taxes on the converted amount without significant financial strain.

Can I undo a Roth IRA conversion?

Yes, you can reverse a Roth IRA conversion through a process called recharacterization. However, the Tax Cuts and Jobs Act of 2017 eliminated the ability to recharacterize conversions made after December 31, 2017. Therefore, conversions made after that date are not reversible.

Are there any tax implications when doing a Roth IRA conversion?

Yes, converting to a Roth IRA triggers a taxable event, as you must pay income taxes on the amount converted. It is important to consult with a tax professional to understand the potential tax implications and determine the most suitable approach for your financial situation.

Can I convert a Roth 401(k) to a Roth IRA?

Yes, in most cases, you can convert a Roth 401(k) to a Roth IRA. However, similar to traditional IRA conversions, you would need to pay taxes on the converted amount. It is advisable to review the specific rules and regulations regarding rollovers and conversions with your plan administrator or financial advisor.

What happens to my beneficiaries after a Roth IRA conversion?

After a Roth IRA conversion, your beneficiaries can inherit the account tax-free, as long as the Roth IRA has been open for at least five years. This can provide significant tax advantages to your heirs compared to a traditional IRA, where they would be subject to income taxes on distributions.

Final Thoughts

Understanding the basics of Roth IRA conversions is crucial for individuals looking to maximize their retirement savings. By converting a traditional IRA to a Roth IRA, investors can benefit from tax-free growth and withdrawals in the future. The process involves paying taxes on the converted amount upfront, but it can be advantageous for those expecting higher tax rates in the future or seeking to leave a tax-free inheritance. Roth IRA conversions offer flexibility and potential long-term advantages, making them a valuable strategy for retirement planning and wealth preservation. Plan your conversion wisely to optimize your retirement savings.