Improving your financial literacy can be the key to a secure and prosperous future. Wondering how to improve your financial literacy? The solution lies in adopting simple yet effective strategies that empower you to make informed financial decisions. Understanding concepts like budgeting, saving, investing, and debt management are essential skills that can significantly impact your financial well-being. By equipping yourself with knowledge in these areas, you can navigate the complex world of personal finance with more confidence and control. So, let’s delve into some actionable tips on how to improve your financial literacy and pave the way for a brighter financial future.

How to Improve Your Financial Literacy

The Importance of Financial Literacy

Financial literacy refers to the knowledge and skills required to make informed and effective financial decisions. It is a crucial aspect of our lives as it empowers us to manage our money wisely, achieve our financial goals, and secure our future. Unfortunately, financial literacy is often overlooked, leading to poor financial decisions, debt, and financial stress. However, by taking proactive steps to improve your financial literacy, you can gain the necessary knowledge and skills to make better financial choices.

1. Start with the Basics

Building a strong foundation in financial literacy begins with understanding the basic concepts. Start by familiarizing yourself with essential terms and concepts such as budgeting, saving, investing, credit, interest rates, and debt management. Here are some key areas to focus on:

1.1 Budgeting

Creating a budget is the first step towards financial literacy. It helps you track your income and expenses, identify areas where you can save, and allocate your money effectively. Consider using budgeting tools or apps to simplify the process.

1.2 Saving

Saving money is a fundamental aspect of financial literacy. Start by setting specific savings goals and creating a plan to achieve them. Consider automating your savings by setting up automatic transfers from your paycheck to a savings account.

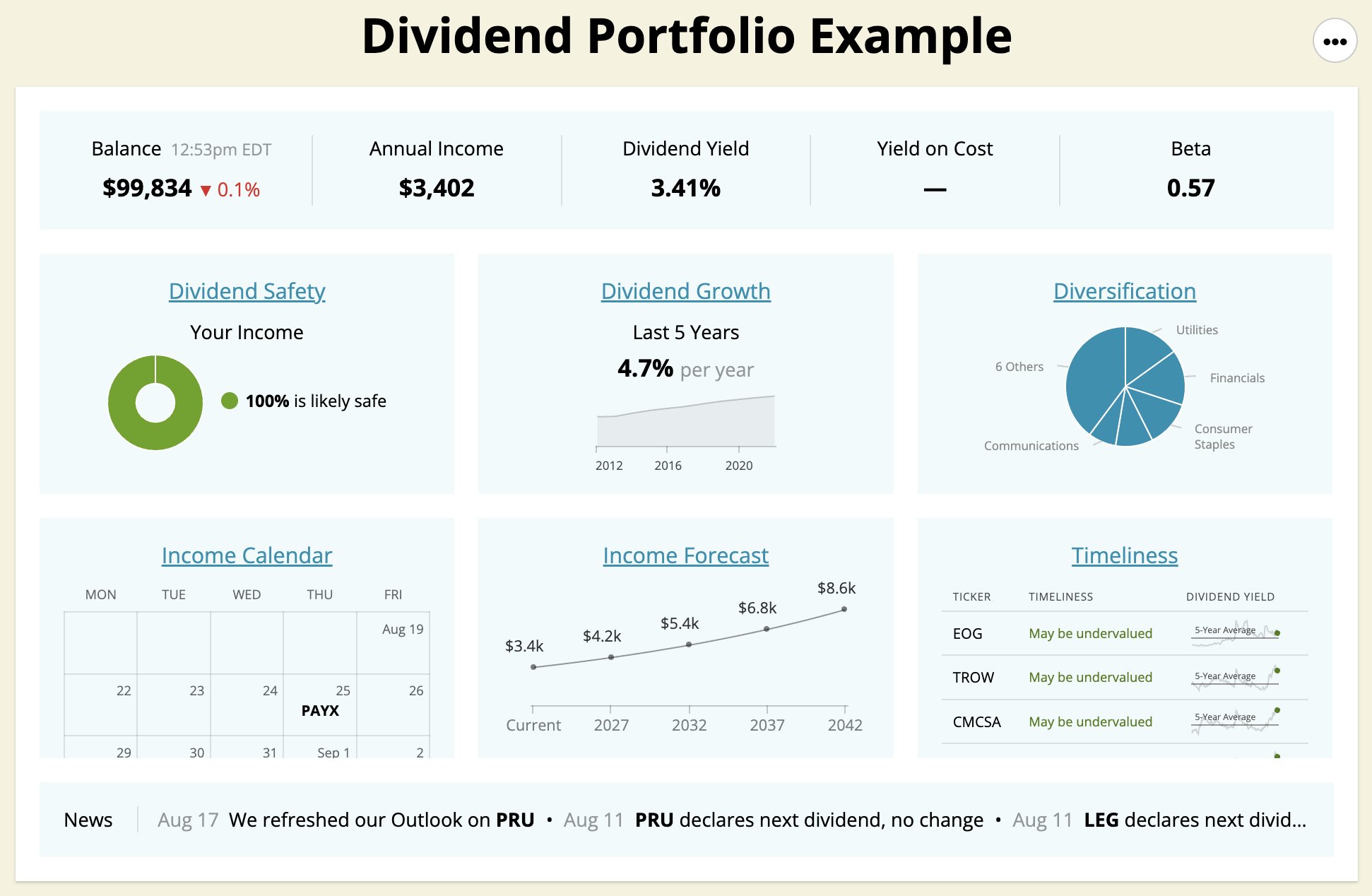

1.3 Investing

Learning about investing is essential for long-term financial success. Educate yourself about various investment options such as stocks, bonds, mutual funds, and real estate. Understand the risks and potential returns associated with each investment type.

1.4 Credit and Debt Management

Understanding how credit works and managing your debts responsibly is crucial. Learn about credit scores, interest rates, and repayment strategies. Practice responsible borrowing and avoid accumulating high-interest debt.

2. Educate Yourself

To improve your financial literacy, take advantage of the vast resources available. Here are some ways to educate yourself:

2.1 Read Books and Blogs

There are numerous books and blogs dedicated to personal finance and financial literacy. Look for reputable sources that provide practical advice on managing money, investing, and achieving financial independence.

2.2 Follow Personal Finance Experts

Follow personal finance experts and influencers on social media platforms. Many experts share valuable insights, tips, and advice on financial management. Engage with their content, ask questions, and learn from their experiences.

2.3 Enroll in Financial Courses

Consider enrolling in financial courses or workshops offered by reputable institutions or organizations. These courses cover a wide range of financial topics, including budgeting, investing, retirement planning, and tax strategies.

2.4 Attend Webinars and Seminars

Webinars and seminars are excellent opportunities to learn from industry professionals. Look for free or low-cost events that cover topics relevant to your financial goals. Take notes, ask questions, and engage with the speakers and other participants.

3. Seek Professional Advice

Financial advisors can provide personalized guidance based on your individual circumstances and goals. Consider consulting a financial advisor to get expert advice on areas such as retirement planning, investment strategies, tax planning, and estate planning. A professional can help you navigate complex financial matters and provide tailored solutions.

4. Practice Good Financial Habits

Improving your financial literacy goes hand in hand with adopting good financial habits. Here are some habits to cultivate:

4.1 Track Your Expenses

Keep track of your expenses to understand where your money is going. Use budgeting apps or spreadsheets to monitor your spending and identify areas where you can cut back.

4.2 Set Financial Goals

Define your long-term and short-term financial goals. Having clear goals can motivate you to save, invest, and make responsible financial decisions.

4.3 Automate Savings and Payments

Automating your savings and bill payments can ensure that you stay on track with your financial commitments. Set up automatic transfers to your savings account and schedule automatic bill payments to avoid late fees.

4.4 Regularly Review Your Financial Situation

Take time to review your financial situation periodically. Assess your progress towards your goals, review your investments, and make necessary adjustments. Regular evaluation will help you stay on top of your finances.

5. Practice Prudent Financial Decision-making

Developing the skills to make intelligent financial decisions is a key aspect of financial literacy. Here are some tips:

5.1 Conduct Research

Before making any significant financial decision, conduct thorough research. Compare different options, read reviews, and gather all the necessary information to make an informed choice.

5.2 Avoid Impulse Buying

Impulse buying can harm your finances. Before making a purchase, take a moment to consider if it aligns with your financial goals and budget. Avoid unnecessary expenses and prioritize your needs over wants.

5.3 Evaluate Financial Risks

When investing or taking on financial commitments, carefully evaluate the associated risks. Consider factors such as market volatility, interest rates, and potential returns. Diversify your investments to mitigate risks.

5.4 Learn from Mistakes

Financial education is an ongoing process, and mistakes can happen. If you make a financial blunder, don’t get discouraged. Instead, learn from your mistakes, seek guidance, and adjust your strategy moving forward.

6. Stay Informed about Current Financial Trends

Financial markets and trends are constantly evolving. Stay informed about the latest developments in the world of finance. Subscribe to financial news outlets, follow influential economists, and stay updated on regulatory changes that may affect your finances.

7. Teach Others

One of the best ways to solidify your own financial knowledge is by teaching others. Share what you’ve learned with friends, family, or even colleagues. Organize informal workshops or discussions to help others improve their financial literacy. By teaching others, you reinforce your own understanding and contribute to a financially literate society.

Remember, improving financial literacy is a journey that requires continuous effort and learning. By applying these strategies and dedicating time to enhance your financial knowledge and skills, you can take control of your finances and build a secure financial future.

Financial Education | The 4 Rules Of Being Financially Literate

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I improve my financial literacy?

To improve your financial literacy, you can start by educating yourself about basic financial concepts such as budgeting, saving, investing, and managing debt. You can read books, take online courses, attend workshops, or seek guidance from financial advisors to enhance your knowledge and understanding of personal finance.

2. Are there any useful online resources to improve financial literacy?

Yes, there are several reliable online resources available to enhance your financial literacy. Some popular ones include Investopedia, Khan Academy’s personal finance section, the National Endowment for Financial Education (NEFE) website, and the Financial Planning Association’s resource center. These platforms offer articles, videos, calculators, and interactive tools to help you expand your financial knowledge.

3. What are some practical ways to improve financial literacy?

You can improve your financial literacy by actively managing your own finances. Start by creating a budget, tracking your expenses, and setting financial goals. Additionally, you can analyze and understand your credit report, learn about different investment options, and seek professional advice when needed. Developing good financial habits and staying up-to-date with current financial news and trends also contribute to improving your financial literacy.

4. Is it necessary to hire a financial advisor to improve financial literacy?

Hiring a financial advisor is not mandatory for improving financial literacy, but it can be beneficial. A financial advisor can provide personalized guidance based on your specific financial situation and goals. However, if you prefer to learn on your own, there are plenty of resources available that can help you enhance your financial literacy without the need for a financial advisor.

5. Can improving financial literacy help me save more money?

Yes, improving your financial literacy can indeed help you save more money. By understanding personal finance concepts and strategies, you can make informed decisions regarding budgeting, saving, investing, and debt management. This knowledge can lead to better financial planning, reduced expenses, increased savings, and ultimately, greater financial security.

6. How long does it take to improve financial literacy?

The time it takes to improve financial literacy varies from person to person. It depends on factors such as your current knowledge level, the amount of time you dedicate to learning, and the complexity of the financial concepts you want to understand. Improving financial literacy is a continuous process, and it may take weeks, months, or even years to become confident in managing your finances effectively.

7. Are there any organizations offering financial literacy programs?

Yes, many organizations offer financial literacy programs to individuals seeking to improve their financial knowledge. Some well-known organizations include the Jump$tart Coalition for Personal Financial Literacy, the National Foundation for Credit Counseling (NFCC), and the Consumer Financial Protection Bureau (CFPB). These organizations offer various educational resources, workshops, and tools to enhance financial literacy.

8. Can improving financial literacy help me make better investment decisions?

Absolutely, improving your financial literacy can equip you with the knowledge and skills necessary to make better investment decisions. By understanding concepts like risk, diversification, asset allocation, and the different investment vehicles available, you can make informed choices that align with your financial goals and risk tolerance. It is essential to have a solid understanding of investing before making any investment decisions.

Final Thoughts

Improving your financial literacy is crucial for a secure and successful financial future. Start by understanding the basics of budgeting, saving, and investing. Educate yourself about different financial products and services to make informed decisions. Develop good money management habits, such as tracking your expenses and setting financial goals. Seek out resources like books, online courses, and workshops to enhance your knowledge. Practice wise spending habits and avoid unnecessary debt. Regularly review and assess your financial situation to make necessary adjustments. By taking these steps and consistently educating yourself, you can significantly improve your financial literacy and make informed financial decisions.