Looking for a smart way to boost your retirement savings? The benefits of contributing to a traditional IRA are just what you need. With tax advantages and potential growth over time, contributing to a traditional IRA allows you to take control of your financial future. Say goodbye to worrying about whether you’ll have enough for your golden years. In this article, we’ll explore the many benefits of contributing to a traditional IRA and why it should be a vital part of your retirement strategy. So, let’s dive in and uncover the advantages that this investment option has to offer!

Benefits of Contributing to a Traditional IRA

Tax Advantages

One of the key benefits of contributing to a traditional Individual Retirement Account (IRA) is the potential for significant tax advantages. Here’s a closer look at how a traditional IRA can help you save on taxes:

- Tax Deductibility: When you contribute to a traditional IRA, the amount you contribute may be tax-deductible, meaning it can reduce your taxable income for the year. This can result in immediate tax savings, especially if you’re in a higher tax bracket.

- Tax-Deferred Growth: Another advantage of a traditional IRA is that your contributions grow tax-deferred until you withdraw them in retirement. This means you won’t owe taxes on any investment gains or dividends earned within the account, allowing your savings to potentially compound faster over time.

- Tax Bracket Flexibility: One additional benefit of a traditional IRA is that it offers flexibility in managing your tax liability in retirement. When you withdraw funds from your traditional IRA during retirement, you’ll likely be in a lower tax bracket compared to your working years. This can result in significant tax savings.

Higher Contribution Limits

Another advantage of contributing to a traditional IRA is the higher contribution limits compared to other retirement savings options. As of 2021, the annual contribution limit for a traditional IRA is $6,000 for individuals under 50 years of age, and $7,000 for individuals aged 50 and above. This higher limit allows you to potentially save more money towards your retirement goals and take advantage of the tax benefits mentioned earlier.

Immediate Tax Savings

One of the immediate benefits of contributing to a traditional IRA is the potential for immediate tax savings. By deducting your contributions from your taxable income, you can lower the amount of taxes you owe in the current tax year. This can be particularly advantageous if you’re in a higher tax bracket and are looking for ways to reduce your tax liability.

Income Limitations for Tax Deductibility

While the tax deductibility of traditional IRA contributions offers significant advantages, it’s important to note that there are income limitations to consider. If you have access to an employer-sponsored retirement plan, such as a 401(k) or a 403(b), and your modified adjusted gross income (MAGI) exceeds a certain threshold, you may not be eligible to deduct your traditional IRA contributions. However, you can still make non-deductible contributions to a traditional IRA, which can still provide tax-deferred growth benefits.

Flexibility in Retirement

One of the lesser-known benefits of contributing to a traditional IRA is the flexibility it provides in retirement. Here are a few ways a traditional IRA can offer financial flexibility during your golden years:

- Delaying Required Minimum Distributions (RMDs): Unlike certain employer-sponsored retirement plans, such as a 401(k), a traditional IRA allows you to delay taking required minimum distributions (RMDs) until age 72. This gives you more control over your retirement income strategy and allows your savings to potentially grow for a longer period.

- Early Withdrawal Options: While it’s generally recommended to leave your funds in a traditional IRA until retirement, certain circumstances may require early access to your savings. With a traditional IRA, you have the option to withdraw funds penalty-free for specific reasons, such as higher education expenses or a first-time home purchase (up to certain limits).

Estate Planning Benefits

Contributing to a traditional IRA can also offer estate planning benefits. Here’s how:

- Passing Down Wealth: With a traditional IRA, you have the ability to name beneficiaries who will inherit your savings upon your passing. By designating beneficiaries, you can ensure a smooth transfer of your assets to your loved ones, potentially avoiding probate and allowing your beneficiaries to benefit from the tax-deferred growth.

- Stretch IRA Strategy: If you have a younger beneficiary, they can take advantage of the “stretch IRA” strategy. This allows them to stretch out the tax-deferred growth over their lifetime, potentially creating a lasting legacy.

In conclusion, contributing to a traditional IRA offers numerous benefits, including tax advantages, higher contribution limits, immediate tax savings, flexibility in retirement, and estate planning benefits. By taking advantage of these benefits, you can enhance your retirement savings and secure a financially comfortable future. Remember to consult with a financial advisor to determine the best retirement saving strategy for your individual needs and goals.

Traditional IRA explained | A quick explanation of the Traditional IRA and rules

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are the benefits of contributing to a traditional IRA?

Contributing to a traditional IRA offers several benefits, including:

– Potential tax deductions: Contributions to a traditional IRA may be tax-deductible, reducing your taxable income for the year.

– Tax-deferred growth: Any earnings within the traditional IRA are not subject to immediate taxation, allowing your investments to potentially grow faster.

– Income tax flexibility: With a traditional IRA, you have the option to withdraw funds during retirement when you may be in a lower tax bracket, potentially reducing your overall tax burden.

Can I contribute to a traditional IRA if I have a retirement plan at work?

Yes, you can contribute to a traditional IRA even if you have a retirement plan at work. However, depending on your income level, your traditional IRA contributions might not be fully tax-deductible.

What is the maximum contribution limit for a traditional IRA?

For the tax year 2021, the maximum contribution limit for a traditional IRA is $6,000 for individuals under the age of 50. If you are 50 years or older, you may be eligible for catch-up contributions of an additional $1,000, making the total limit $7,000.

Are there income restrictions for contributing to a traditional IRA?

No, there are no income restrictions for contributing to a traditional IRA. However, depending on your income and whether you have a retirement plan at work, the deductibility of your contributions may be limited.

What are the tax implications when withdrawing funds from a traditional IRA?

When you withdraw funds from a traditional IRA, the amount you withdraw is subject to ordinary income tax. The tax rate will depend on your tax bracket at the time of withdrawal.

Can I convert funds from a traditional IRA to a Roth IRA?

Yes, you can convert funds from a traditional IRA to a Roth IRA. However, you will be required to pay income tax on the amount converted in the year of the conversion.

At what age can I start making withdrawals from a traditional IRA without penalty?

You can start making penalty-free withdrawals from a traditional IRA at the age of 59½. However, keep in mind that any withdrawals will be subject to ordinary income tax.

Do I have to start taking required minimum distributions (RMDs) from a traditional IRA?

Yes, once you reach the age of 72, you are required to start taking annual required minimum distributions (RMDs) from your traditional IRA. These distributions are subject to income tax and failure to take RMDs may result in penalties.

Final Thoughts

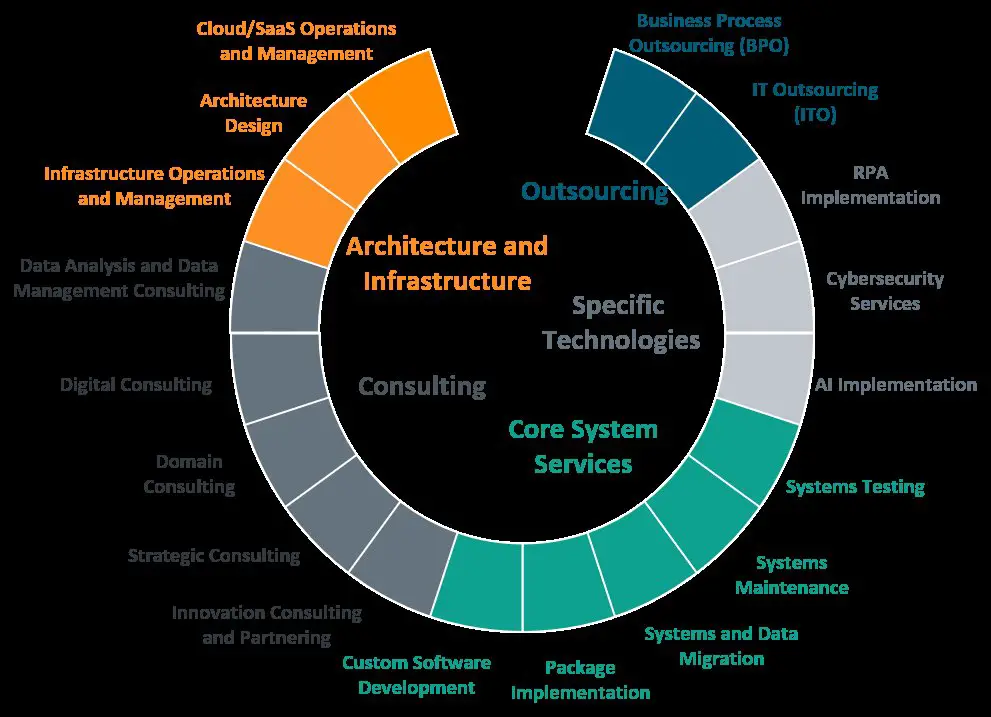

Contributing to a traditional IRA offers several benefits. Firstly, it allows for tax-deferred growth, meaning you won’t pay taxes on your earnings until you withdraw them during retirement. This can potentially lower your tax liability both now and in the future. Secondly, contributions to a traditional IRA are often tax-deductible, providing immediate tax advantages. Additionally, traditional IRAs offer a wide range of investment options, giving you the flexibility to tailor your portfolio to meet your financial goals. Lastly, contributing to a traditional IRA can help you build a substantial nest egg for retirement, ensuring financial security in your golden years. Don’t overlook the benefits of contributing to a traditional IRA when planning for your future.