When it comes to securing your financial future, choosing the right life insurance policy is crucial. But with so many options available, how do you decide between term life insurance and whole life insurance? Well, comparing term life insurance vs whole life insurance can seem overwhelming at first, but fret not! In this article, we’ll break down the key differences between these two popular insurance types, helping you make an informed decision that suits your needs and goals. Let’s dive right in!

Comparing Term Life Insurance vs Whole Life Insurance

Introduction

When it comes to protecting your loved ones financially, life insurance is an essential tool. It allows you to provide financial security and peace of mind for your family in the event of your death. However, choosing the right type of life insurance can be a daunting task. Two popular options to consider are term life insurance and whole life insurance. In this article, we will delve deep into the comparison of term life insurance versus whole life insurance. We will explore their features, benefits, drawbacks, and help you make an informed decision.

What is Term Life Insurance?

Term life insurance is a type of life insurance coverage that provides protection for a specific period, typically ranging from 10 to 30 years. If the insured person passes away during the term, the death benefit is paid out to the beneficiary. Unlike whole life insurance, term life insurance does not offer any cash value accumulation or investment component. It is a straightforward, pure life insurance coverage that focuses solely on providing a death benefit.

Features of Term Life Insurance

Term life insurance has several distinguishing features:

1. Fixed Premiums: The premiums for term life insurance remain level throughout the policy term, making it easier to budget for.

2. Temporary Coverage: Term life insurance provides coverage for a specific period or term, making it ideal for covering temporary needs such as mortgage payments, education expenses, or income replacement during the working years.

3. Flexible Policy Length: Term life insurance policies offer flexibility in choosing the policy term, allowing you to align coverage with specific financial obligations or milestones.

Benefits of Term Life Insurance

There are various benefits to consider when evaluating term life insurance:

1. Affordability: Term life insurance is typically more affordable than whole life insurance, especially for younger individuals or those in good health. The absence of cash value accumulation helps keep the premiums lower.

2. Simple and Easy to Understand: Term life insurance policies are straightforward, and their focus on providing death benefit coverage simplifies the decision-making process.

3. Financial Protection for a Specific Period: Term life insurance ensures that your loved ones are financially protected during the specific period of your choosing, such as until your children are grown, or until your mortgage is paid off.

Drawbacks of Term Life Insurance

It’s important to consider the potential drawbacks of term life insurance:

1. No Cash Value Accumulation: Unlike whole life insurance, term life insurance does not accumulate cash value over time. If you outlive your policy term, you will not receive any return on your premiums.

2. Renewal at Higher Premiums: When the policy term ends, you may have the option to renew the coverage, but at higher premiums due to your increased age or potential health issues.

3. No Lifetime Coverage: Term life insurance provides coverage for a specific period, which means that if you want coverage for your entire life, you will need to consider alternative options.

What is Whole Life Insurance?

Whole life insurance, also known as permanent life insurance, offers lifelong coverage as well as a cash value accumulation component. It provides a death benefit to the beneficiary upon the insured person’s death, but it also builds cash value over time. This accumulated cash value can be accessed during the insured person’s lifetime through loans or withdrawals, providing a source of liquidity and flexibility.

Features of Whole Life Insurance

Whole life insurance has several prominent features:

1. Lifetime Coverage: Whole life insurance provides coverage for the entire lifetime of the insured person, as long as the premiums are paid.

2. Cash Value Accumulation: A portion of the premiums paid goes toward building the policy’s cash value, which grows tax-deferred over time. This cash value can be used for various purposes, such as borrowing against it or surrendering the policy for its cash value.

3. Guaranteed Death Benefit: Whole life insurance offers a guaranteed death benefit, which means the beneficiary will receive a payout regardless of when the insured person passes away, as long as the policy is in force.

Benefits of Whole Life Insurance

Whole life insurance offers several noteworthy benefits:

1. Lifetime Coverage: Whole life insurance provides peace of mind to individuals who want to ensure their loved ones will receive a death benefit no matter when they pass away.

2. Cash Value Accumulation: The cash value component of whole life insurance allows for potential growth over time, providing additional financial security and flexibility.

3. Tax Advantages: The cash value growth in whole life insurance is tax-deferred, meaning you won’t have to pay taxes on it until you withdraw or surrender the policy.

Drawbacks of Whole Life Insurance

Here are some potential drawbacks to consider with whole life insurance:

1. Higher Premiums: Whole life insurance generally comes with higher premiums compared to term life insurance, primarily due to the cash value accumulation feature.

2. Complexity: The additional features and investment component of whole life insurance can make it more complex and harder to understand compared to term life insurance.

3. Lower Flexibility: Whole life insurance policies may have limited flexibility in terms of adjusting coverage or premiums once the policy is in force.

Comparing Term Life Insurance and Whole Life Insurance

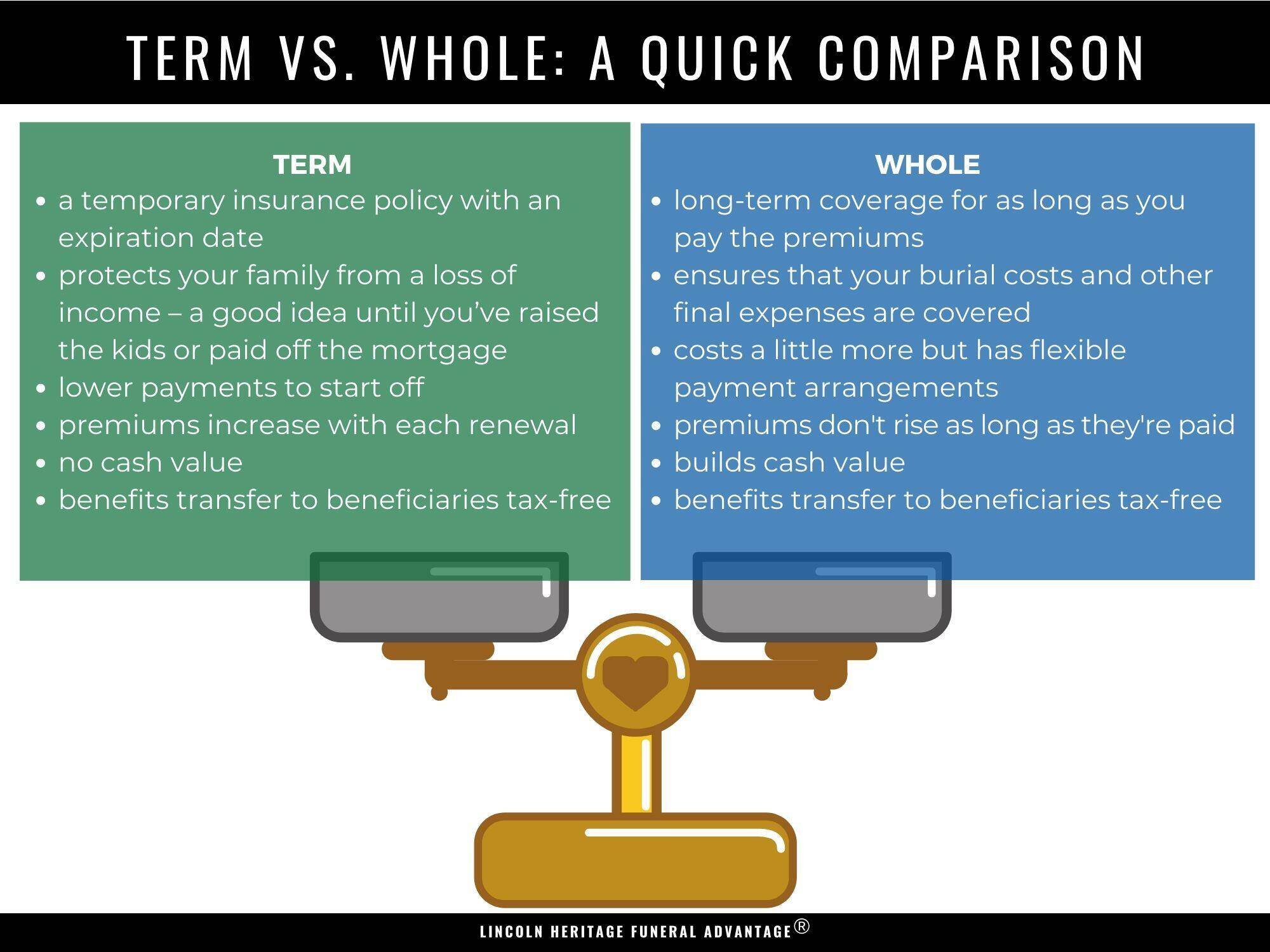

Now that we have examined the features, benefits, and drawbacks of both term life insurance and whole life insurance, let’s compare them side by side:

| Aspect | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Policy Duration | Specific term (e.g., 10, 20, or 30 years) | Lifetime coverage |

| Premiums | Lower compared to whole life insurance | Higher compared to term life insurance |

| Cash Value Accumulation | None | Accumulates over time |

| Flexibility | Flexible policy length | Less flexible once the policy is in force |

| Death Benefit | Paid out if the insured person passes away during the term | Paid out regardless of when the insured person passes away |

In conclusion, both term life insurance and whole life insurance serve different purposes and offer unique features. Term life insurance is suitable for individuals who require coverage for a specific period and prioritize affordability. On the other hand, whole life insurance provides lifelong coverage, cash value accumulation, and guarantees a death benefit. When choosing between term life insurance and whole life insurance, it’s essential to consider your specific needs, budget, and long-term financial goals. Consulting with a reputable insurance professional can help you make an informed decision based on your individual circumstances. Remember, the right life insurance policy is a crucial step in securing the financial future of your loved ones.

Why Is Term Insurance Better Than Whole Life Insurance?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years. If the insured person passes away during the term, their beneficiaries receive a death benefit. Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured, and it also includes a cash value component that grows over time.

Which is more affordable, term life insurance or whole life insurance?

Term life insurance tends to be more affordable than whole life insurance. Since term life insurance provides coverage for a fixed period, the premiums are generally lower. The cost of whole life insurance is higher because it covers the insured person for their entire lifetime and also accumulates cash value.

Which type of insurance is better for estate planning purposes?

Whole life insurance is often favored for estate planning purposes. It provides a death benefit that can be used to cover estate taxes or provide an inheritance to beneficiaries. Additionally, the cash value component can be utilized during the insured person’s lifetime for various financial needs.

Can I convert my term life insurance policy into a whole life insurance policy?

Many term life insurance policies offer a conversion option, allowing you to convert to a whole life insurance policy without undergoing medical underwriting. This conversion feature can be beneficial if your needs change and you want coverage for your entire life.

What happens if I outlive my term life insurance policy?

If you outlive your term life insurance policy, the coverage typically expires, and you will not receive any benefits. However, some term policies offer the option to renew or convert to a different policy, although the premiums may increase.

Can I borrow against the cash value of a whole life insurance policy?

Yes, one of the advantages of whole life insurance is that you can borrow against the accumulated cash value. This can be a useful source of funds for emergencies or other financial needs. Keep in mind that any outstanding loans will reduce the death benefit payable to your beneficiaries.

Which type of insurance is better for replacing income in the event of my death?

Term life insurance is often recommended for income replacement. It provides coverage for a specific period, which is typically the timeframe during which your dependents rely on your income. The death benefit can replace lost income and help support your loved ones financially.

Can I cancel my whole life insurance policy?

Yes, you can cancel your whole life insurance policy at any time. However, keep in mind that if you cancel early, you may receive only a portion of the cash value, as surrender charges and fees may apply. It’s important to carefully consider the implications before canceling a whole life policy.

Final Thoughts

Term life insurance and whole life insurance are two popular options for financial protection, each with their own advantages and considerations. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, while whole life insurance offers lifelong coverage with a cash value component. When comparing term life insurance vs whole life insurance, it’s important to consider factors such as affordability, flexibility, and long-term needs. Term life insurance is a cost-effective option for those seeking temporary coverage, whereas whole life insurance provides lifelong protection along with potential cash accumulation. Ultimately, the choice between these two types of insurance depends on individual circumstances, financial goals, and budget.