Investing in renewable energy stocks is a smart move for those looking to make a positive impact on the environment while potentially earning substantial returns. If you’re wondering how to navigate this exciting sector and tap into its vast potential, look no further! In this comprehensive guide to investing in renewable energy stocks, we will walk you through everything you need to know to make informed decisions and seize the opportunities that lie ahead. From understanding the market dynamics to identifying promising companies and evaluating risks and returns, this guide will equip you with the knowledge and confidence to navigate the renewable energy stock market with ease. So, let’s dive in and explore the world of renewable energy investing together!

Guide to Investing in Renewable Energy Stocks

Renewable energy stocks have gained significant popularity in recent years as more investors recognize the potential for profit and environmental impact of clean energy. With increasing concerns about climate change and the transition towards sustainable energy sources, investing in renewable energy stocks can be a lucrative and socially responsible choice. This comprehensive guide will walk you through the basics of investing in renewable energy stocks, including key concepts, strategies, and important factors to consider.

Understanding Renewable Energy Stocks

Renewable energy stocks represent companies involved in the production, distribution, and development of clean and sustainable energy sources. These companies operate in various sectors such as solar power, wind energy, hydroelectricity, geothermal energy, and bioenergy. Investing in renewable energy stocks allows you to support the shift towards cleaner energy alternatives while potentially earning substantial returns.

The Benefits of Investing in Renewable Energy Stocks

Investing in renewable energy stocks can offer several advantages, including:

1. **Sustainability**: Renewable energy stocks align with societal and environmental goals aimed at reducing carbon emissions and combating climate change.

2. **Growth Potential**: The renewable energy sector is experiencing rapid growth, driven by government incentives, technological advancements, and increasing demand for clean energy sources.

3. **Diversification**: Including renewable energy stocks in your investment portfolio provides diversification beyond traditional sectors and can help mitigate risks associated with fossil fuel investments.

4. **Long-Term Stability**: Renewable energy companies often have long-term contracts in place, ensuring stable revenue streams and predictable cash flows.

Key Considerations in Renewable Energy Investing

Before diving into the world of renewable energy stocks, it’s crucial to consider the following factors:

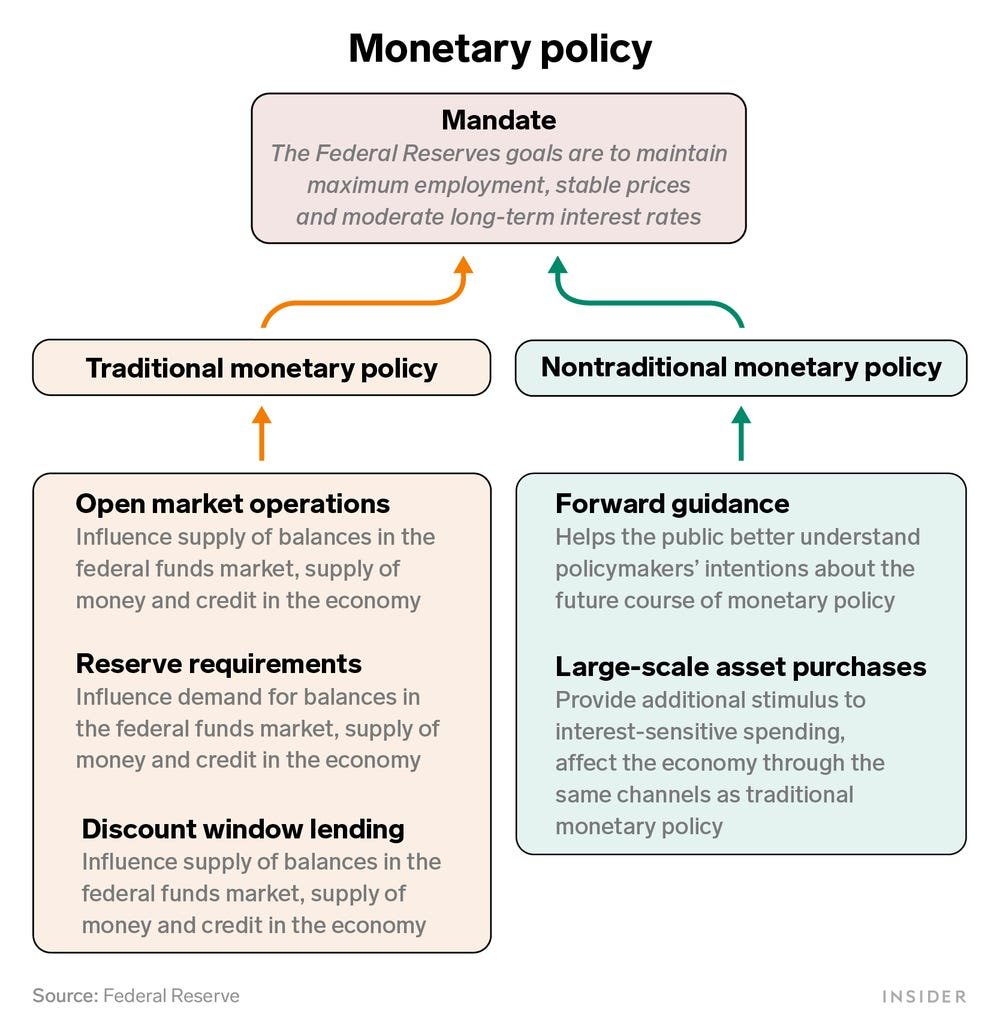

Government Policies and Incentives

Government policies and incentives play a vital role in the growth and profitability of renewable energy companies. Keep an eye on state and federal regulations, tax credits, grants, and subsidies that support renewable energy development. Changes in government policies can significantly impact the financial performance of renewable energy stocks.

Technological Advancements and Innovations

The renewable energy sector is characterized by rapid technological advancements. Stay informed about the latest innovations in solar panels, wind turbines, battery storage, and other clean energy technologies. Companies that can effectively harness these advancements may have a competitive edge and offer promising investment opportunities.

Market Demand and Growth Potential

Assess the market demand for renewable energy and the growth potential of different sectors within the industry. Evaluate factors such as population growth, energy consumption patterns, and the need to reduce carbon emissions. Investing in sectors with high growth potential can maximize your investment returns.

Financial Performance and Metrics

When considering individual renewable energy stocks, analyze their financial performance, including revenue growth, profitability, debt levels, and cash flow generation. Compare key financial metrics with industry peers to gain insights into a company’s competitive position and financial health.

Risk Factors

Like any investment, renewable energy stocks carry specific risks that investors should be aware of:

1. **Regulatory Changes**: Changes in government policies or a reduction in subsidies can adversely affect the profitability of renewable energy companies.

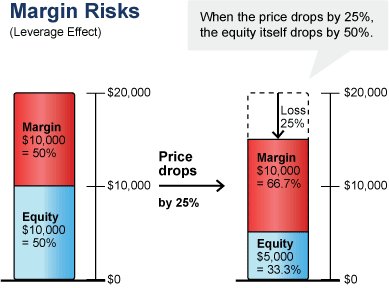

2. **Volatility**: Renewable energy stocks can be subject to market volatility, especially during economic downturns or changes in investor sentiment towards the sector.

3. **Competition**: The renewable energy industry is becoming increasingly competitive as more companies enter the market. Evaluate a company’s competitive advantages, such as proprietary technologies or strategic partnerships.

Strategies for Investing in Renewable Energy Stocks

When investing in renewable energy stocks, consider the following strategies to optimize your investment approach:

1. Diversify Your Portfolio

Diversification is essential in any investment strategy. Allocate a portion of your portfolio to various renewable energy sectors to spread the risk across different technologies and companies. This approach can help capture the growth potential of the entire industry while minimizing the impact of individual stock performance.

2. Research and Select Companies Carefully

Thoroughly research and analyze individual renewable energy companies before making investment decisions. Consider factors such as financial stability, technological advancements, competitive advantages, and growth prospects. Look for companies with a proven track record and a clear vision for the future.

3. Evaluate Cost Structures

Examine a company’s production costs, including expenses related to manufacturing, operations, and maintenance. Lower production costs can lead to higher profit margins and increased competitiveness. Understanding cost structures can help identify companies with efficient operations and potential for long-term profitability.

4. Monitor Market and Industry Trends

Stay up-to-date with the latest market and industry trends. Keep an eye on technological breakthroughs, policy changes, regulatory developments, and international market conditions. Regularly assess how these factors may impact the financial performance of renewable energy stocks in your portfolio.

5. Consider Exchange-Traded Funds (ETFs)

For investors looking for broader exposure to the renewable energy sector, consider investing in exchange-traded funds (ETFs) focused on renewable energy stocks. These funds provide diversified exposure to a basket of renewable energy companies, reducing the risk associated with holding individual stocks.

Investing in renewable energy stocks offers an opportunity to align your financial goals with the pursuit of a more sustainable future. By understanding the key considerations, risks, and strategies involved, you can make informed investment decisions in the renewable energy sector. Remember to diversify your portfolio, stay informed about market trends, and evaluate individual companies based on financial performance and growth potential. With careful research and analysis, investing in renewable energy stocks can be a rewarding way to contribute to a greener world while potentially generating attractive investment returns.

HOW TO INVEST SUSTAINABLY // green stocks guide

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are renewable energy stocks?

Renewable energy stocks refer to shares of companies involved in the production, distribution, and implementation of renewable energy sources. These sources include solar, wind, hydro, geothermal, and biomass energy. Investing in renewable energy stocks allows individuals to support and profit from the transition to cleaner and more sustainable energy alternatives.

Why should I consider investing in renewable energy stocks?

Investing in renewable energy stocks offers several potential benefits. Firstly, it allows you to contribute to the fight against climate change by supporting sustainable energy solutions. Additionally, renewable energy stocks have the potential for long-term growth as the demand for clean energy continues to rise. Moreover, investing in this sector can provide diversification to your investment portfolio.

What factors should I consider before investing in renewable energy stocks?

Before investing in renewable energy stocks, it is important to consider various factors. These include understanding the company’s financial health, evaluating the management team’s expertise and experience, assessing the potential growth prospects of the company, and analyzing industry trends and regulations. Additionally, it is advisable to diversify your investments and consult with a financial advisor.

How can I research renewable energy stocks?

To research renewable energy stocks, you can start by gathering information from reliable sources such as financial news websites, industry reports, and company filings. It is also recommended to analyze the company’s financial statements, examine their competitive position in the market, evaluate their track record, and consider any potential risks associated with their operations. Additionally, staying updated on industry trends and attending investor conferences can provide valuable insights.

What are the potential risks of investing in renewable energy stocks?

Like any investment, there are potential risks associated with investing in renewable energy stocks. These risks include regulatory changes, technological advancements that could render certain technologies obsolete, fluctuating commodity prices, and even weather conditions that may impact energy production. It is crucial to carefully assess these risks and diversify your portfolio to mitigate potential losses.

Are renewable energy stocks suitable for all investors?

While renewable energy stocks can offer compelling investment opportunities, they may not be suitable for all investors. As with any investment, it is important to consider your individual financial goals, risk tolerance, and investment timeline. If you are unsure about investing in renewable energy stocks, seeking advice from a qualified financial advisor can help you make an informed decision.

How do I purchase renewable energy stocks?

To purchase renewable energy stocks, you will need to open a brokerage account with an online or traditional brokerage firm. Once your account is set up, you can conduct research on renewable energy companies, select the stocks you want to invest in, and place an order through your brokerage platform. It is essential to understand the associated fees and commissions before making any investment.

Can investing in renewable energy stocks guarantee profits?

Investing in renewable energy stocks, like any other investment, does not guarantee profits. The stock market is subject to fluctuations, and individual stocks can experience volatility. It is crucial to conduct thorough research, diversify your portfolio, and consider a long-term investment approach to improve the chances of achieving favorable returns.

Final Thoughts

Investing in renewable energy stocks offers an exciting opportunity to support sustainability while potentially earning substantial returns. By providing a guide to investing in renewable energy stocks, this article aimed to inform readers about the benefits and strategies involved in this market. Understanding the renewable energy sector’s growth potential and selecting promising companies are key aspects highlighted. Thorough due diligence, diversification, and long-term thinking were emphasized to mitigate risks and maximize returns. While investing in renewable energy stocks may not be without challenges, those seeking to align their investments with their values and capitalize on the renewable energy industry’s growth should explore this guide to investing in renewable energy stocks.