If you’ve ever found yourself scratching your head when it comes to mortgage amortization, you’re not alone. Understanding the ins and outs of this complex process can feel like deciphering a secret code. But fear not! This guide to understanding mortgage amortization is here to demystify the subject and empower you with the knowledge you need to navigate the world of home financing with confidence. So, let’s dive in and unravel the mysteries of mortgage amortization together.

Guide to Understanding Mortgage Amortization

Introduction

Understanding mortgage amortization is crucial for anyone looking to purchase a home or refinance their current mortgage. When you take out a mortgage loan, it’s important to comprehend how the repayment structure works, including how much of your monthly payment goes towards principal and interest. This comprehensive guide will break down the complexities of mortgage amortization, providing you with the knowledge you need to make informed decisions about your home financing.

What is Mortgage Amortization?

Mortgage amortization refers to the process of repaying a loan, particularly a mortgage, through regular payments over a specified period of time. It involves dividing the total loan amount into equal installments, which are paid over the term of the loan. Each payment consists of both principal and interest, with the proportion of each varying throughout the life of the loan.

Principal and Interest

In mortgage amortization, the principal refers to the original loan amount borrowed from the lender. Each monthly payment you make contributes towards reducing the principal balance. On the other hand, the interest is the cost of borrowing money and represents the fee charged by the lender for providing the loan. The interest portion of your payment decreases over time as you pay down the principal.

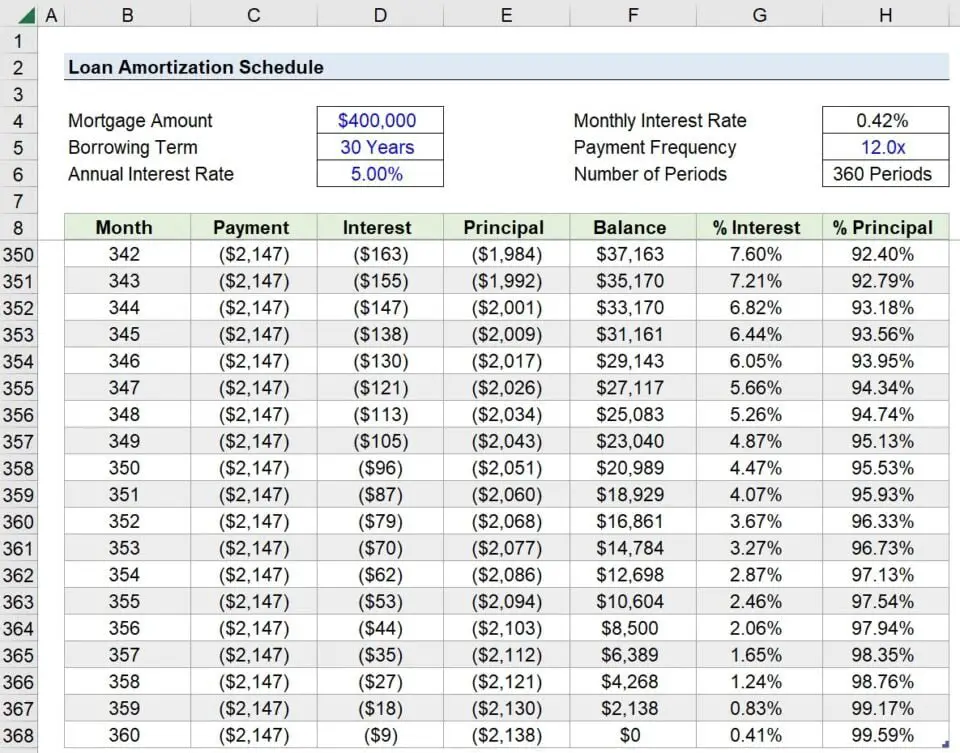

Amortization Schedule

An amortization schedule is a table that outlines the repayment plan for your mortgage loan. It provides a clear breakdown of each monthly payment, illustrating the amount allocated to principal and interest. The schedule typically covers the entire loan term, allowing you to see how your loan balance decreases over time. Analyzing the amortization schedule can help you understand the financial implications of your mortgage and make informed decisions.

Loan Term

The loan term refers to the length of time you have to repay your mortgage loan. Common loan terms include 15, 20, and 30 years, although other options may be available. Shorter loan terms typically result in higher monthly payments but lower interest costs over time. Longer loan terms, on the other hand, may have lower monthly payments but higher overall interest expenses. Understanding the trade-offs can help you choose the loan term that aligns with your financial goals.

How Mortgage Amortization Works

Now that we understand the basic components of mortgage amortization, let’s dive into how it works in practice. We’ll discuss the gradual reduction of the loan balance, the changing proportion of principal and interest in each payment, and the impact of early payments.

Gradual Reduction of Loan Balance

With each monthly payment you make, a portion of the payment goes towards reducing the principal balance of your loan. As the principal balance decreases, the amount of interest charged on the remaining balance also decreases. This means that over time, a larger portion of your payment goes towards reducing the principal rather than paying interest. As a result, your loan balance gradually decreases until it is fully repaid at the end of the loan term.

Changing Proportion of Principal and Interest

One of the essential aspects of mortgage amortization is understanding how the proportion of principal and interest in each payment changes over time. Initially, a significant portion of your monthly payment goes towards paying interest, while only a small fraction goes towards reducing the principal. However, as you continue making payments, the proportion shifts in favor of the principal reduction. This shift occurs because the interest is calculated based on the remaining loan balance, which decreases over time.

Impact of Early Payments

Making additional payments towards your mortgage principal can have a significant impact on your loan amortization. By paying extra towards your principal balance, you can reduce the total interest paid over the life of the loan and potentially shorten the loan term. Even making small additional payments can add up over time and lead to substantial savings. However, it’s important to check with your lender about any prepayment penalties or specific instructions for applying extra payments to the principal balance.

Understanding Mortgage Amortization Methods

Various methods are used to calculate mortgage amortization, with the most common ones being the constant payment method and the constant amortization method. Let’s explore each method in detail.

Constant Payment Method (Fully Amortizing Loans)

The constant payment method, also known as fully amortizing loans, is the most common type of mortgage. Under this method, the borrower makes equal monthly payments throughout the loan term. These payments include both principal and interest, with the interest portion gradually decreasing over time. The principal reduction portion increases to compensate, ensuring that the loan is fully repaid by the end of the loan term.

Constant Amortization Method (Partially Amortizing Loans)

The constant amortization method, also referred to as partially amortizing loans, is less common than the constant payment method. In this method, the borrower pays a fixed amount towards the principal balance each month, while the interest portion fluctuates based on the remaining loan balance. As a result, the monthly payments decrease over time since the outstanding loan balance decreases. While this method offers lower initial payments, it does not fully amortize the loan, leaving a final balloon payment at the end of the term.

Advantages and Disadvantages of Mortgage Amortization

Like any financial tool, mortgage amortization comes with its advantages and disadvantages. Understanding these can help you evaluate whether it aligns with your financial goals.

Advantages

– Predictable payments: With mortgage amortization, you have fixed monthly payments, making it easier to budget and plan your finances.

– Equity build-up: By gradually reducing the principal balance through regular payments, you build equity in your home, which can be beneficial for future financial needs.

– Potential tax benefits: In many countries, mortgage interest payments are tax-deductible, providing potential tax benefits to homeowners.

Disadvantages

– Paying more interest over the long term: Due to the gradual repayment structure, you end up paying more interest over the life of the loan compared to if you were to pay off the loan quickly.

– Limited flexibility: Once you commit to a mortgage with a specific amortization schedule, it can be challenging to change the terms or pay off the loan earlier without incurring penalties.

– Risk of foreclosure: Failing to make regular mortgage payments can put your home at risk of foreclosure, so it’s crucial to ensure you can comfortably afford the monthly payments.

Understanding mortgage amortization is essential for making informed decisions about your home financing. By grasping the principles behind mortgage amortization, including how the loan balance decreases over time, the changing proportion of principal and interest in each payment, and the impact of early payments, you can navigate the mortgage landscape with confidence. Remember to carefully evaluate the advantages and disadvantages of mortgage amortization to determine if it aligns with your financial goals.

How To Calculate Your Mortgage Payment

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is mortgage amortization?

Mortgage amortization refers to the process of paying off a mortgage loan through regular payments over a set period of time. These payments typically consist of both principal (the original amount borrowed) and interest.

How does mortgage amortization work?

When you make a mortgage payment, a portion of it goes towards reducing the principal balance while the remaining amount covers the interest charges. Over time, the proportion of the payment applied to the principal gradually increases, leading to a reduction in the outstanding loan balance.

What is an amortization schedule?

An amortization schedule is a table that outlines the specific details of your mortgage loan. It shows each payment, the amount applied to principal and interest, the remaining principal balance, and the total interest paid over the life of the loan. It helps you understand the progress of your mortgage and plan for future payments.

Can I change the amortization schedule of my mortgage?

In most cases, the amortization schedule is predetermined and set based on the terms of your mortgage agreement. However, it may be possible to make changes to the schedule by refinancing your loan or making extra principal payments. It’s best to consult with your lender to explore available options.

What is the impact of a longer or shorter amortization period?

A longer amortization period results in lower monthly payments but higher overall interest costs. On the other hand, a shorter amortization period leads to higher monthly payments but helps you pay off the loan faster and save on interest expenses. Consider your financial goals and capabilities when choosing an amortization period.

Can I make additional principal payments towards my mortgage?

Yes, making additional principal payments can help you pay off your mortgage faster and reduce the total interest paid over time. It’s important to check with your lender beforehand to understand any prepayment penalties or restrictions that may apply.

What is the difference between a fixed-rate mortgage and an adjustable-rate mortgage in terms of amortization?

A fixed-rate mortgage maintains the same interest rate throughout the entire loan term, resulting in consistent monthly payments and a predictable amortization schedule. On the other hand, an adjustable-rate mortgage (ARM) has an interest rate that can fluctuate periodically, potentially leading to changes in the monthly payment amount and amortization schedule.

How can I calculate mortgage amortization?

You can use an online mortgage amortization calculator or a spreadsheet to calculate your mortgage amortization. By entering the loan amount, interest rate, and term, the calculator can generate an amortization schedule and show you the breakdown of principal and interest payments over time.

Final Thoughts

Understanding mortgage amortization is crucial for anyone considering purchasing a home. It enables borrowers to comprehend how their mortgage payments are allocated between principal and interest over time. By grasping this concept, individuals can make informed decisions about their finances and potentially save money in the long run. This guide has provided a comprehensive overview of mortgage amortization, explaining key terms, illustrating payment schedules, and highlighting the impact of extra principal payments. Armed with this knowledge, prospective homeowners can navigate the mortgage process with confidence and make choices that align with their financial goals.